Recent tax changes mean that more businesses are receiving Form 1099-Ks than before. Here’s what to expect when you get one.

So you just received a copy of Form 1099-K for the first time, and the question you’re asking yourself is, “Why?”

You’re not alone. Thousands of farms and ranches that use third-party payment processors are receiving Form 1099-K for the first time this year. Form 1099-K is used to report income paid out to your business by these payment processors.

Recent tax changes mean that more businesses qualify to receive Form 1099-K. That’s why you’re seeing this form for the first time.

Some good news: Form 1099-K has minimal impact on your overall tax filing. Mostly, you need to concern yourself with confirming the information on it is correct.

That being said, if you’ve received it this year, there’s a chance you’ll be getting Form 1099-K in years to come. So here’s everything you need to know about Form 1099-K and what to do after you receive it.

What is Form 1099-K?

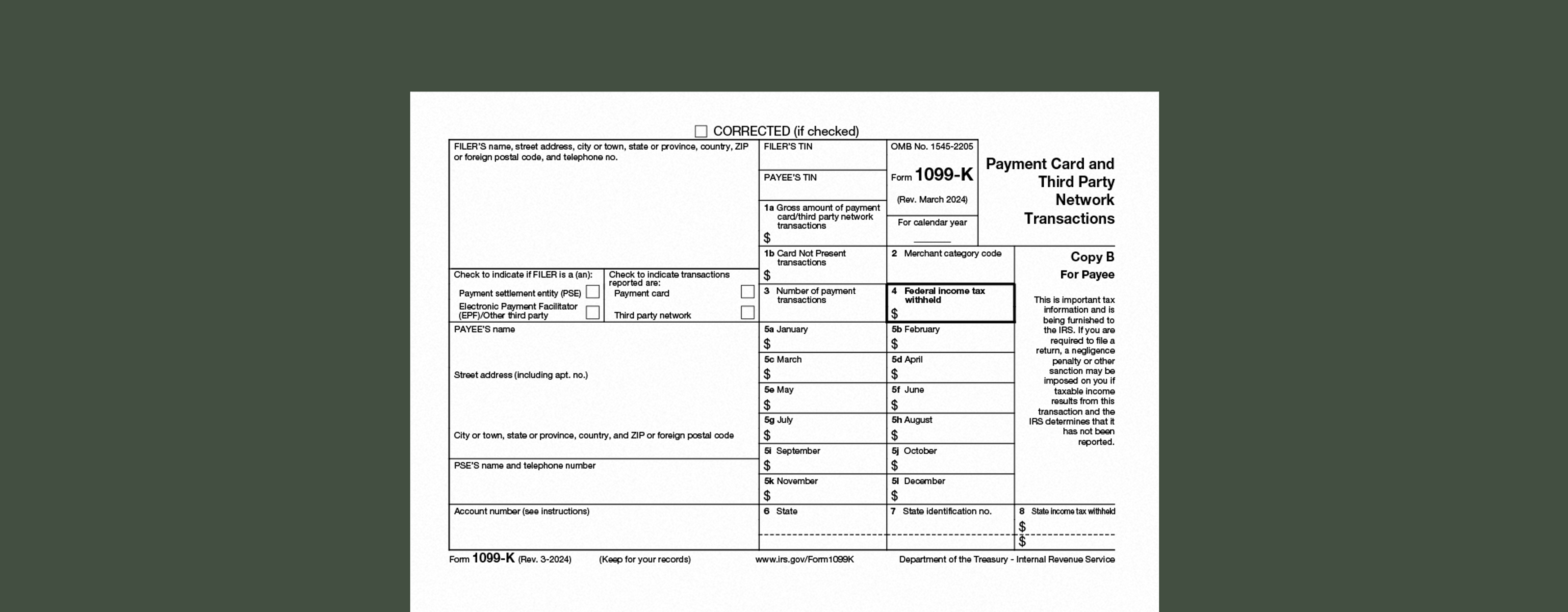

Payment processors use Form 1099-K (Payment Card and Third Party Network Transactions) to report to the IRS the amount they paid out to their clients and users over the course of the year.

As with Form 1099-NEC, one copy of Form 1099-K (Copy A) goes to the IRS. A second copy (Copy B) goes to your business, which received the payments.

These payment processors are referred to as third party settlement organizations (TPSOs). When a customer uses a TPSO to pay you, what really happens is that they pay the TPSO. Then, the TPSO pays you the full amount, minus any processing fees.

Typical TPSOs include:

Point of sale (POS) payment processors (i.e., credit and debit card terminals)

App-based payment processors like Stripe and Square

Online payment processors like Venmo or PayPal

Online storefronts like Shopify, Squarespace, and Wix

For instance, if you…

Use Square to accept payments at the local farmer’s market

Have a POS system in your farm store

Accept payments for farm gate sales via Venmo

Sell merchandise or secondary products in an online store

…then you use a TPSO service, and you may receive a Form 1099-K at the end of the year.

What does Form 1099-K include?

Every Form 1099-K you receive includes:

The name and contact information of the TPSO

Your business’s name and contact information

The total amount before taxes or deductions (gross income) paid out to you over the course of the year

If your bookkeeping is organized and up to date, you should be able to compare the amount reported on Form 1099-K with the amount reported on your books and find they match.

Keep in mind that this only works if revenue you’ve recorded on the books is categorized according to source (e.g., cash, check, payment processor) with each payment processor in its own category.

Otherwise, you can collect your receipts from the payment processor and add up the total amount to confirm that the revenue reported on Form 1099-K is accurate.

What are the Form 1099-K reporting thresholds?

You only receive a Form 1099-K from a TPSO if your total payments reach above a certain threshold.

Up to and including the 2023 tax year, that threshold was $20,000 and 200 transactions. Starting in 2024, the IRS removed the transaction volume threshold, and the dollar threshold began to decrease, with further decreases planned for 2025 and 2026.

Then in July of 2025, the One Big Beautiful Bill Act changed the thresholds for 2026 and future years back to $20,000 and 200 transactions.

Here’s the resulting 1099-K threshold schedule:

| Tax year | Threshold |

|---|---|

| 2024 | $5,000 |

| 2025 | $2,500 |

| 2026 and onward | $20,000 and 200 transactions |

Keep in mind, this is only the threshold at which a TPSO is required by law to send you Form 1099-K. The TPSO may choose to send you a Form 1099-K even if you fall below the threshold.

What do you do with a Form 1099-K?

By the time you’ve received your copy of Form 1099-K, the IRS has already received theirs. There’s no need to report to the IRS that you received a certain amount from a payment processor; they already know.

That being said, the information reported on your Form 1099-K should be reflected on your tax return. It’s part of your gross income, a total which includes payments you received by other means (e.g., cash, check, bank transfer, or direct deposit).

Once you have a Form 1099-K in your hands, here are the steps to take:

1. Compare Form 1099-K with your records

First, make sure the gross income reported on the form matches that reported on the books. Also, confirm that your business information on the form—including your tax identification number (TIN)—is accurate.

If any of this information is inaccurate, there are steps you can follow to fix the problem (covered below).

Then review expenses that you’re able to deduct from the gross income reported on Form 1099-K. These include added processing fees, credits, refunds, shipping, cash equivalents or discounts.

2. Report the gross income on your tax return

Include the income reported on Form 1099-K in the gross income you report on your tax return. You may report revenue on different forms depending on what type it is:

Farm-related sales and other income are reported on Schedule F (Form 1040)

Gross sales of farm equipment or breeding stock are reported on Form 4797

Rent is reported on Schedule E (Form 1040)

Business income from a non-farm business is reported on Schedule C

3. Report your deductible expenses elsewhere

This is important: do not deduct expenses like processing fees, refunds, etc. from your Form 1099-K income before you include it on your tax return. Only report the total amount reported on the form.

Form 1099-K expenses should be reported alongside other business expenses. (For individual filers, that’s Schedule F of Form 1040.)

You’ll subtract these expenses from your gross income to calculate your net income.

4. Contact the TPSO if Form 1099-K is inaccurate

If any of the information on a Form 1099-K is inaccurate, contact the TPSO that issued it ASAP and request a new, corrected form.

The issuer of the form should appear at the top left corner of Form 1099-K. If you don’t recognize the name of the issuer, check the bottom left corner. That’s where the payment statement entity (PSE) is listed, above your account number.

Keep copies of any correspondence with the TPSO, along with copies of the corrected Form 1099-K, in your files.

Don’t contact the IRS about an inaccurate Form 1099-K; they can’t do anything about it. Only the issuer can make the appropriate corrections.

If you can’t get a corrected Form 1099-K before the tax deadline:

If the TIN on the original form is incorrect, go ahead and file your taxes normally, including the income on your return

If the gross income is incorrect, report it in the designated space at the top of Schedule 1, Form 1040, and file your taxes normally

The IRS prefers you to file your taxes on time with inaccurate Form 1099-K information rather than filing them late with corrected Form 1099-K information. Remember, the IRS will receive a copy of any corrected Form 1099-K the TPSO issues you.

5. Keep records of expenses

For all deductible Form 1099-K expenses, make sure you have records backing up your claims.

For instance, if a TPSO issued a refund to one of your customers, you can claim it as a deductible expense. But you should ensure you have a copy of the receipt for the refund in your records.

Like all records of deductible expenses, these ones will support your claims in the event of an IRS audit.

Do you need to report income even if you don’t get a Form 1099-K?

The IRS requires your business to report all income earned in the course of the tax year. Even if you don’t receive a Form 1099-K, you need to report the money paid out to you by a payment processor as part of your income. Failure to include it could lead to serious IRS penalties, up to and including charges of fraud.

Do you need to fill out a Form W-9 to get a Form 1099-K?

When you sign up for a TPSO service, they should send you a Form W-9 to complete. You use Form W-9 to report your tax information to the TPSO, so they have everything they need to issue you a Form 1099-K (if necessary) later on.

If you don’t fill out Form W-9, the TPSO is permitted to withhold up to 24% of your payments. They’ll send this backup withholding to the IRS on your behalf. Depending on the terms and conditions, they may also shut down your payment processor account.

If you sign up for a TPSO service and you don’t receive a Form W-9, check the service’s documentation to see whether you should have received one, or reach out to a customer support representative.

Does Form 1099-K report payments from families or friends?

If you use online payment processors like Venmo both to receive payments from customers and to receive money from friends and family, you should have two separate accounts: one for your business, and another for personal use.

Payments from friends or family sent to your business account could show up on your Form 1099-K. That money is not business income, and you aren’t required to pay income tax on it—but if you include it in your calculation of gross income for the year, you’ll end up owing extra taxes.

Besides that, it will complicate your bookkeeping: you’ll have personal gift payments showing up on the books as business income, muddying the waters and making your financial reports inaccurate.

If you do receive a personal payment through your business’s TPSO service, you may be able to use the service’s app to designate it as such. That ensures it isn’t included in the total calculation of your gross income on Form 1099-K.

But if there is no way to designate the payment as personal using the app, you will need to reach out to the TPSO directly to make sure the payment is not included.

And if you fail to contact the TPSO, you may find personal payments included in your Form 1099-K income—in which case you will need to request an amended form from the TPSO.

Both can be complicated, time-consuming processes; you may need to provide documentation proving certain payments were personal, and not for business. So it’s in your best interest to make sure your business and personal payments go to different accounts right from the start.

Make sure your 1099-Ks are A-OK with Ambrook

When you use Ambrook for your farm or ranch’s accounting, income from payment processors is automatically categorized according to which TPSO it comes from. That makes it easy to compare Form 1099-K with your records, confirm that the amounts match up, and file your taxes accurately on time.

Plus, with time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make revenue tracking simple: it takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

Want to learn more about Ambrook?

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.