If you sold any business property last year like equipment, vehicles or livestock, you’ll have to file Form 4797 to report any gains on your taxes.

If you sell used farm equipment or livestock, you will probably need to complete Form 4797 and submit it as part of your tax filing. Form 4797 reports earnings or losses on the sale of depreciable property you use in the operation of your business.

Form 4797 may look complicated at first glance, but once you break it down it’s fairly straightforward. Best of all, if you do it right, you’ll likely pay less in taxes than you would otherwise.

What is Form 4797?

When you sell an asset your business uses to earn an income—like a piece of farm equipment, or breeding or dairy stock—it’s taxed differently than the products of your business.

For instance, if you sell silage as a farm product, it’s taxed as business income. If you sell the baler you use to bale your silage, it’s taxed differently (typically at your income tax and/or capital gains tax rate, but minus self-employment tax). The first is a farm product, the second is a depreciable asset.

What is a depreciable asset?

A depreciable asset is any asset (aka property) whose cash value you depreciate over multiple years.

When you purchase an asset for your business—like a baler—you deduct the cost from your income on your tax return. As a result, you pay less in taxes.

What’s more, you depreciate any large asset that will benefit your business over multiple years (or, technically, for any period longer than 12 months). That is, you deduct a portion of its value from your taxes each year until the asset has reached the end of its useful life.

The useful life or recovery period of different types of property—the period over which you can depreciate them—is determined by the IRS. And there are multiple methods for calculating how much to deduct each year.

For each year you own a depreciable asset, its cash basis decreases. Cash basis is the original amount you paid for an asset, minus depreciation. There are different ways of calculating depreciation, and the rate at which an asset depreciates (at which its cash basis decreases) will depend upon which method you use.

If you’re brand new to the concept of depreciable assets, check out our Simple Guide to Depreciation and MACRS before reading the rest of this article. It will make Form 4797 much easier to understand.

Who needs to file Form 4797?

If you sold any depreciable asset used in the operation of your business over the course of the year, you need to report the sale with Form 4797.

And, due to changes introduced by the Tax Cuts and Job Act (TCJA) of 2017, if you trade a depreciable asset for another asset—or for credit (for instance, at an equipment dealership)—you must report it as a sale on Form 4797.

Each year, many farmers and other business owners make the mistake of reporting the sale of depreciable property as business income on their tax returns, rather than filing Form 4797. Not only does that misrepresent their income to the IRS, but it often means they end up paying more in taxes than they would otherwise.

So it’s in your best interest to file Form 4797 correctly and on time.

What do you report on Form 4797?

When you report the sale of property on Form 4797, you must include:

A description of the asset

The date you originally purchased the asset

The date you sold the asset, and the price for which you sold it

The asset’s cash basis (its original sale price, minus depreciation and any expenses of the sale)

You use this information to calculate:

The difference between the asset’s cash basis and its resale price

Your gain (aka profit), if any, on the resale of the property

Depreciation recapture, which affects how any gain is taxed

That last item—depreciation recapture—is where Form 4797 gets tricky.

Depreciation recapture on Form 4797

If you depreciate the value of an asset—writing off its value over multiple tax years—and then sell it for a gain, the IRS requires you to pay back the tax deductions you’ve claimed. (The IRS is “recapturing” the depreciation.)

They do this by taxing the gain at your regular income tax rate up to the point where the total depreciation has been recaptured. Any cash you earn beyond that point is taxed at the long-term capital gains rate (typically less than your income tax rate).

So, if you sell a piece of depreciable property and your gain is less than the total amount you have deducted via depreciation, 100% of the gain is taxed at your income tax rate.

Some Form 4797 examples when it comes to depreciation recapture:

Example #1: Form 4797 gain greater than depreciation deductions. You buy a piece of farm equipment for $15,000. Over the course of two years, you claim deprecation of $7,800. Its cash basis is now $7,200 ($15,000 - $7,800). You then sell the equipment for $16,000, earning a gain of $8,800 ($16,000 - $7,200). Of that $8,800, the IRS taxes $7,800 at your income tax rate (recapturing the depreciation you have claimed). The remaining $1,000 is taxed as long-term capital gains.

Example #2: Form 4797 gain less than depreciation deductions. You buy a piece of farm equipment for $15,000. Over the course of two years, you claim deprecation of $7,800. Its cash basis is now $7,200 ($15,000 - $7,800). You then sell the equipment for $13,000, earning a gain of $5,800. Since your gain is less than the total amount you have claimed in depreciation ($7,800), 100% of your gain is taxed at your income tax rate.

Types of assets reported on Form 4797

For the sake of determining how sales of depreciable assets should be taxed, the IRS identifies different types of property according to internal revenue code (IRC) sections.

It’s good to familiarize yourself with these sections. They work as shorthand for how different assets and their sale are taxed, and understanding them makes it easier to understand Form 4797 and IRS Form 4797 Instructions.

The relevant classifications of property and sales:

Section 1231: Personal property taxed as capital gains at sale.

Section 1245: Personal property used in the operation of your business.

Section 1250: Real property (buildings and other permanent structures)

Section 1252: Farmland held for 1 - 10 years before sale for which you have deducted the cost of watering, levelling, tillage, etc.

To make things even more interesting, when you sell a depreciable asset, different portions of your gain are treated as different types of sales under these section codes.

So, if you sell a piece of property for gain, the portion of that gain taxed at your normal income tax rate—for the purpose of recapturing depreciation—is considered a section 1245, 1250, or 1252 sale (according to the type of property). The remaining gain is considered a section 1231 sale, and taxed at the long-term capital gains rate.

For instance, jumping back to Example #1 in the previous section: Of the $8,800 gain earned in the sale of farm equipment, $7,800 counts as a section 1245 sale and $1,000 counts as section 1231.

Section code examples

To get a better sense of which types of depreciable assets fall under which codes, some examples:

Section 1231: Property sold and taxed and the capital gains rate, including sales taxed as both ordinary income and capital gains. When you sell section 1245, 1250, or 1252 property, some portion of the sale may be classified as section 1231, while the property itself is classified by its own code.

Section 1245: Farm equipment, vehicles, livestock, grain silos, fruit trees, moveable irrigation equipment, fencing, dairy facilities, etc.

Section 1250: Barns, stables, greenhouses, worker accommodations, leasehold land (but not fee simple land), etc.

Section 1252: If you have had possession of a piece of land for 1 - 10 years and you have claimed deductions for watering, levelling, tillage etc. expenses, you report its sale as a Section 1252 sale. A portion of your gain will be taxed at normal income tax rates.

If you’re unsure which category an asset falls under, consult with a qualified accountant.

Special considerations for farmers

Some types of tangible property have special exceptions when it comes to Form 4797.

Livestock and capital gains

Cattle and horses used for breeding, dairy, and draft purposes must be held for at least 24 months from purchase (or birth, if you raise them yourself) before their sale can be reported as capital gains on Form 4797.

Other livestock—including goats and swine—only need to be held for 12 months.

Poultry are not considered depreciable assets.

Section 1252 property

Special rules apply to Section 1252 property, which is any farmland you have owned for one to 10 years, and for which you have claimed the cost of soil and water conservation expenses (watering, tillage, etc.) as business expenses.

Farmland you have owned for over 10 years and which you sell for a gain is taxed as capital gains under Section 1231.

Also, farmland you give as a gift, or which an inheritor inherits from you when you pass away, is not treated as 1252 property.

For everything else, if you sell your farmland for a gain, the lesser of the following two amounts is taxed as ordinary income:

Your gain (the amount for which you sold the property, minus its cash basis)

A percentage of the total allowable deduction for soil and water conservation expenses

The percentage for #2 above is based on how long you have held the property. If you have owned it for longer than five years, the total allowable deduction is reduced by a certain percentage each year.

| Length of ownership | Percentage of expenses incurred you may deduct |

|---|---|

| 1 - 5 years | 100% |

| 6 years | 80% |

| 7 years | 60% |

| 8 years | 40% |

| 9 years | 20% |

| 10+ years | 0% |

These rates apply for partial years. So, for example, if you own the property for seven years and one month, the total allowable deduction is 40% rather than 60 percent.

Some Form 4797 examples when it comes to Section 1252 sales:

Example #1: Form 4797 gain greater than the allowable soil and water conservation expenses deducted. You buy a piece of farmland in 2018. You sell it in 2025 for a $40,000 gain. While you owned the property, you incurred $10,000 in fully deductible expenses for soil and water conservation. Since you owned the property for seven years, the applicable percentage is 60 percent. You treat $6,000 ($10,000 x 0.60) of the sale as ordinary income. The remaining $34,000 ($40,000 - $6,000) is taxed as Section 1231 property at the capital gains rate.

Example #2: Form 4797 gain less than the allowable soil and water conservation expenses deducted. You buy a piece of farmland in 2023. You sell it in 2025 for a $2,000 gain. While you owned the property you incurred $5,000 in fully deductible soil and water conservation expenses. The total allowable amount is $5,000, or 100% of those expenses, because you owned the property for less than five years. Since the allowable amount ($5,000) is greater than your gain ($2,000), the entirety of the gain is taxed as ordinary income.

How to fill out Form 4797

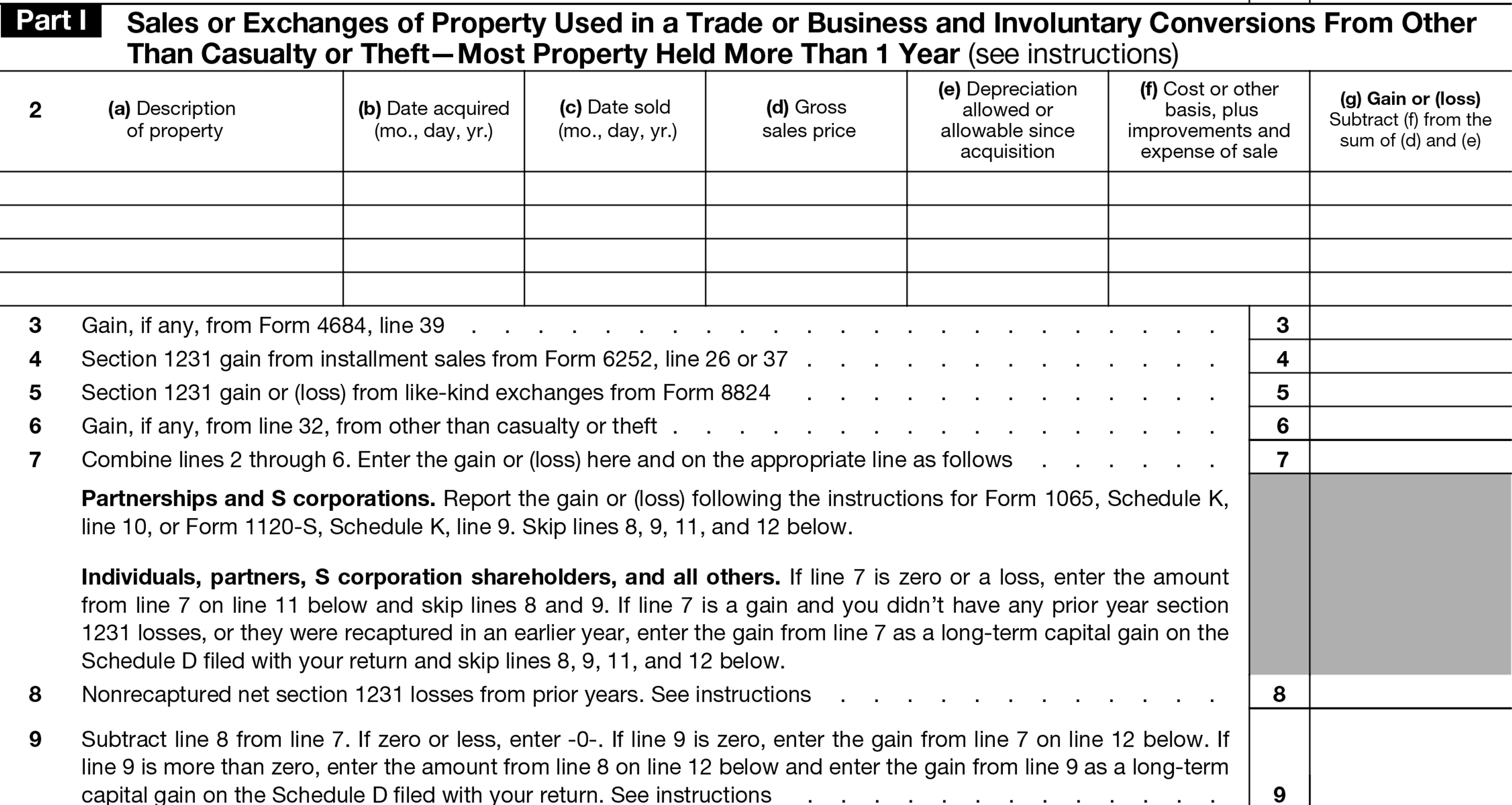

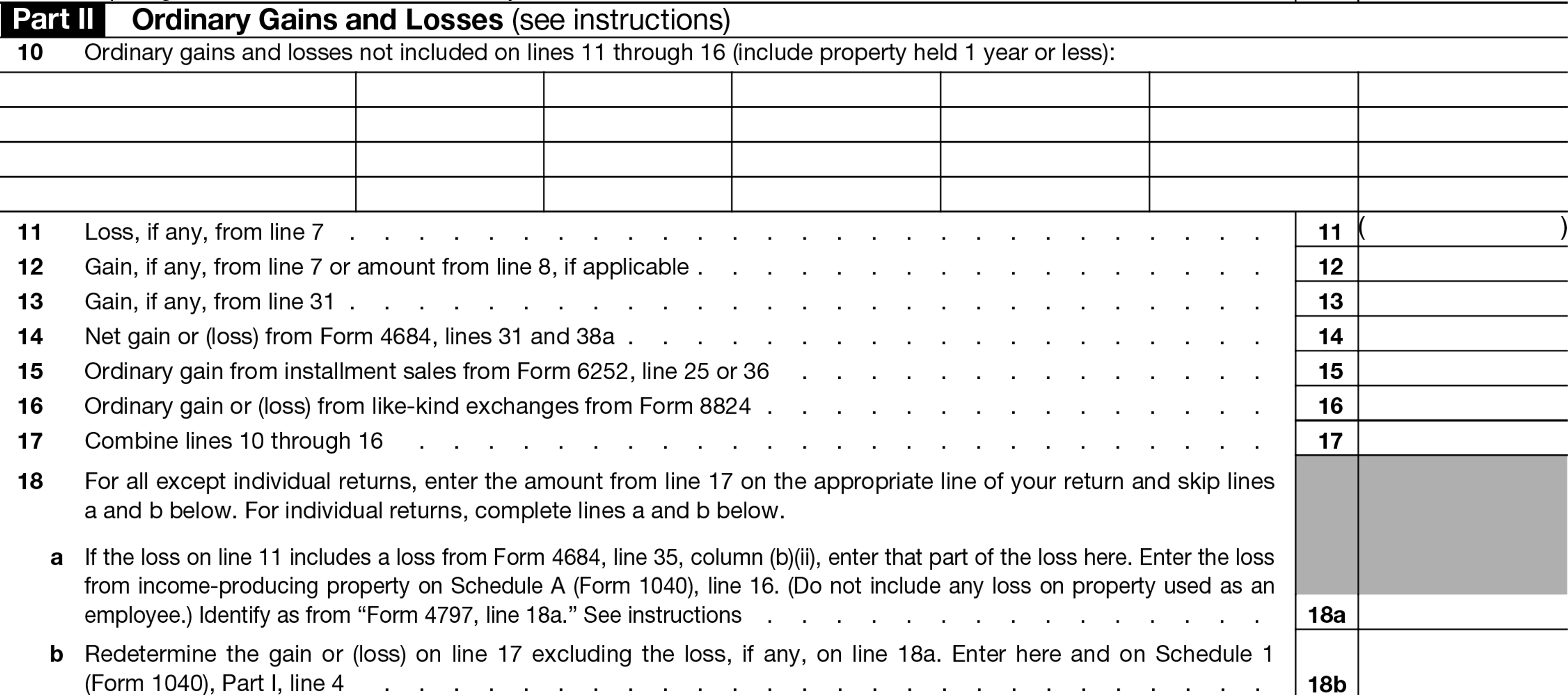

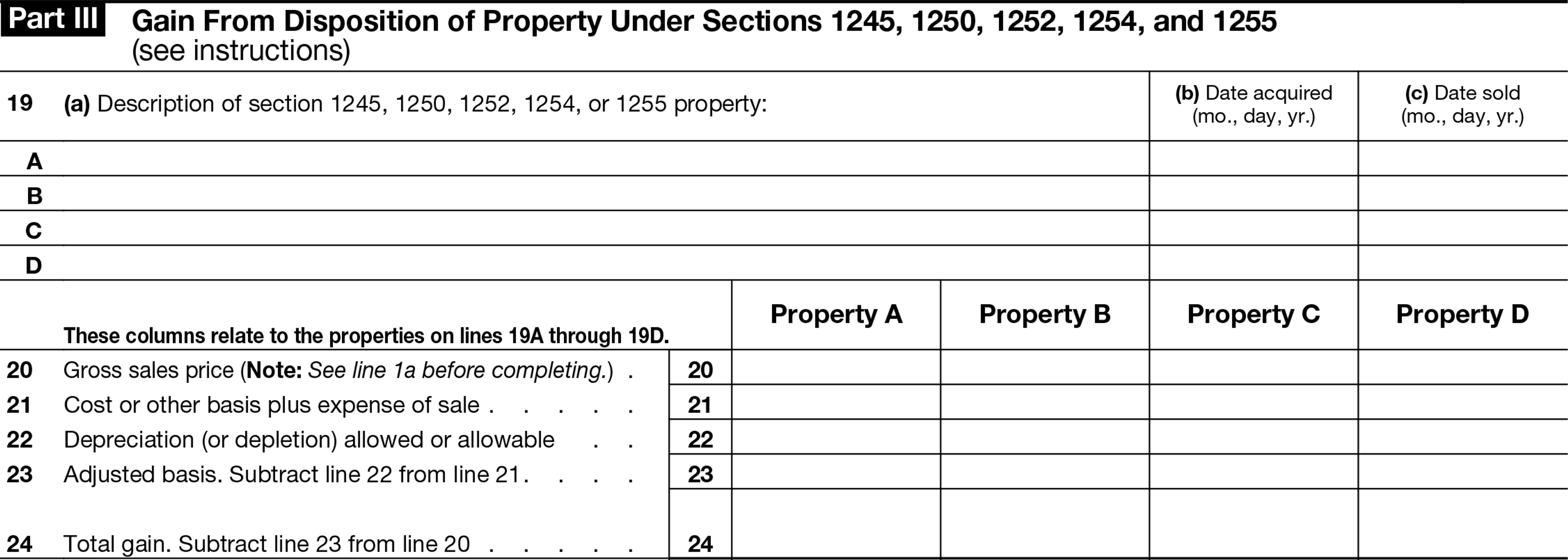

Form 4797 is broken up into four parts:

Form 4797 Part I: The sale of any property you have held for more than one year, but which doesn’t fall under any of the sections covered in Part III. (In terms of Form 4797 Part I vs. Part III, the most relevant example would be farmland you have held for more than ten years.)

Form 4797 Part II: The sale of property held for less than one year.

Form 4797 Part III: This covers the sale of section 1245, 1250, and 1252 property.

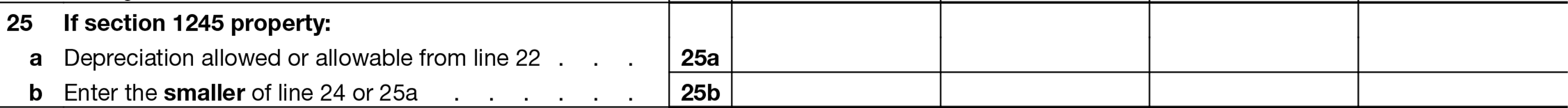

Form 4797 Part III, Section 1245 (line 25): The sale of depreciable personal property used in the operations of your business.

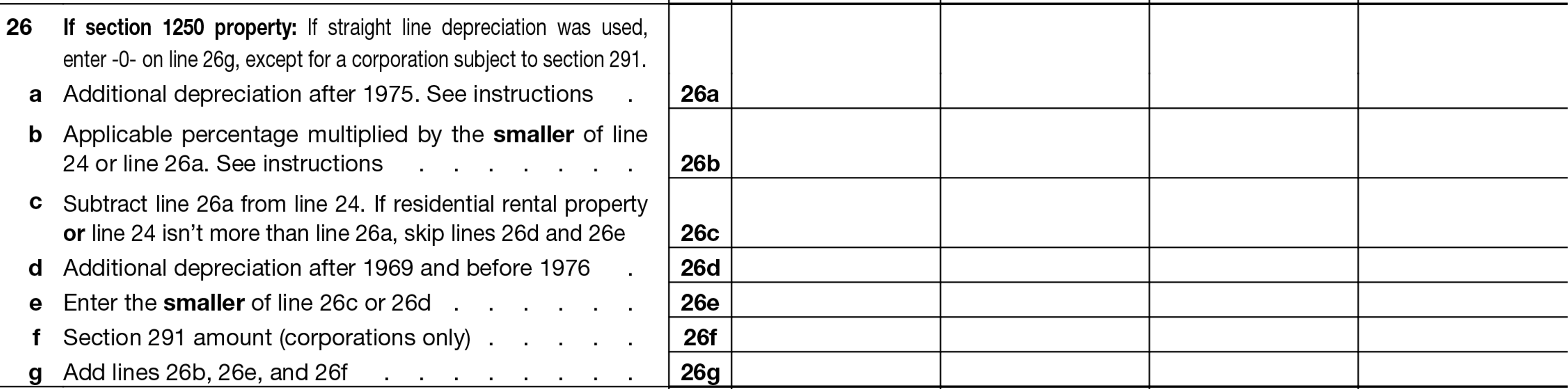

Form 4797 Part III, Section 1250 (line 26): The sale of depreciable real property used in the operations of your business.

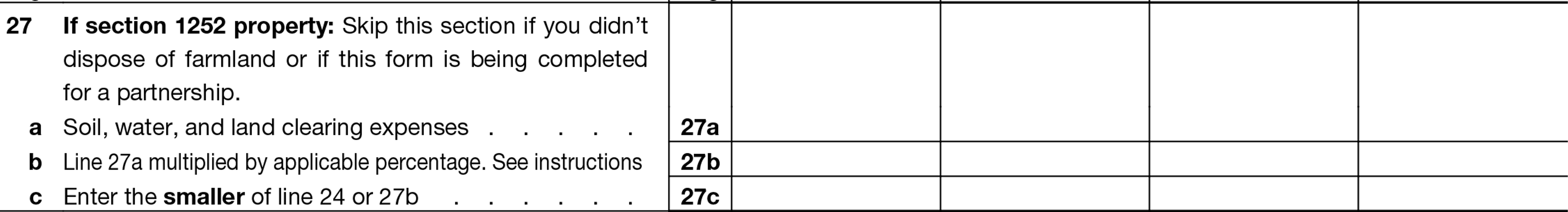

Form 4797 Part III, Section 1252 (line 27): The sale of farmland held for one to 10 years for which you have deducted soil and water conservation expenses.

Form 4797 Part III, Section 1254 (line 28): Property that could have been subject to depreciation and amortization and includes intangible drilling, exploration, and mining costs.

Form 4797 Part III, Section 1255 (line 29): Cost-sharing earnings you do not report as part of your business income, which must be partially taxed as ordinary income. (Covered in IRC Section 126.)

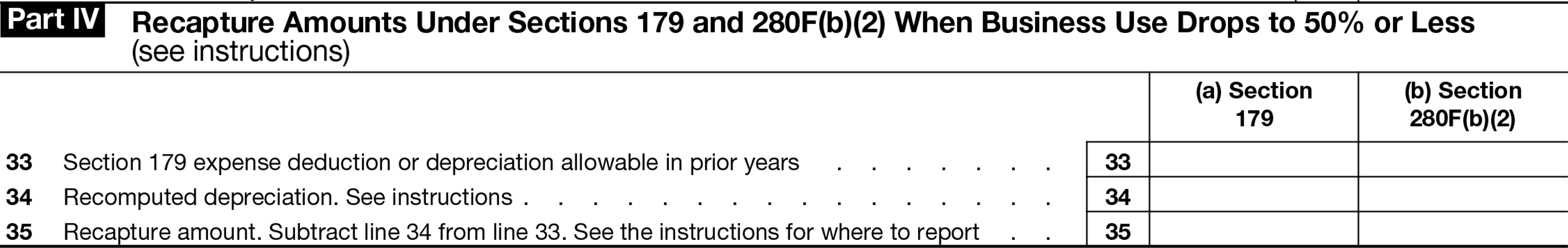

Form 4797 Part IV: Property for which you claimed a Section 179 deduction, but which no longer qualifies as business use property (business use has dropped below 50%). For more on Section 179, see A Simple Guide to Depreciation and MACRS.

Note: Portions of Part III applicable to Section 1254 and Section 1255 are not typically applicable to farmers, and aren’t covered in this article.

On a line-by-line level, each of these parts includes explanations for entering information about your sales and calculating gains, recaptured depreciation, and other information. With the information in this article, you should be able to follow those instructions and calculate how your income from sales is taxed

For clarification on any particular point not covered by this article, refer to Chapter 8, Gains and Losses, of IRS Publication 255, Farmer’s Tax Guide. You can also find a highly detailed breakdown in the IRS Form 4797 Instructions

Form 4797 and Schedule D

Schedule D of Form 1040 is used to report the sale of personal property. That includes homes, automobiles, stocks and bonds, cryptocurrency, and collectibles.

Importantly, Schedule D is for personal property not used in your business. If you’re only reporting the sale of business property, you do not need to file Schedule D.

However, if some of your business property is also used in a personal capacity, you may need to file both Schedule D (reporting a percentage of the sale based on personal use) and Form 4797 (a percentage of the sale based on business use).

In that case, since it can be tricky determining how much of a piece of property’s use is personal rather than business, and since this can have wider ramifications for your tax return, consult with an accountant for help splitting a sale between Schedule D and Form 4797.

Form 4797 and Form 8949

Form 8949 is used to provide information relevant to Schedule D, such as when assets were bought and sold, their sale price, and their cost basis.

As long as the sales you’re reporting on Form 4797 are not also being reported on Schedule D (i.e., in the case of mixed-use property), you do not need to file Form 8949 to report sales of business property.

How to file Form 4797

You file Form 4797 as part of your regular tax return. The same deadlines that apply to your personal tax return apply to Form 4797.

You can access relevant documents here:

Keep records for the sale of any business property for up to six years after filing. In the event of an audit, the IRS may require records related to your tax filing going back up to three years. If they suspect fraud, they may go back up to six years. It’s always better to have extra records on file than to risk running into trouble later on.

Simplify Tax Season with Ambrook

Ambrook’s category tags correspond directly to each line on Schedule F, making it easy to compare your tax return to your records and saving you hours of work during tax season.

With time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make filing your taxes easy: it takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.