Ambrook for Equestrian Operations

Track every horse and every dollar

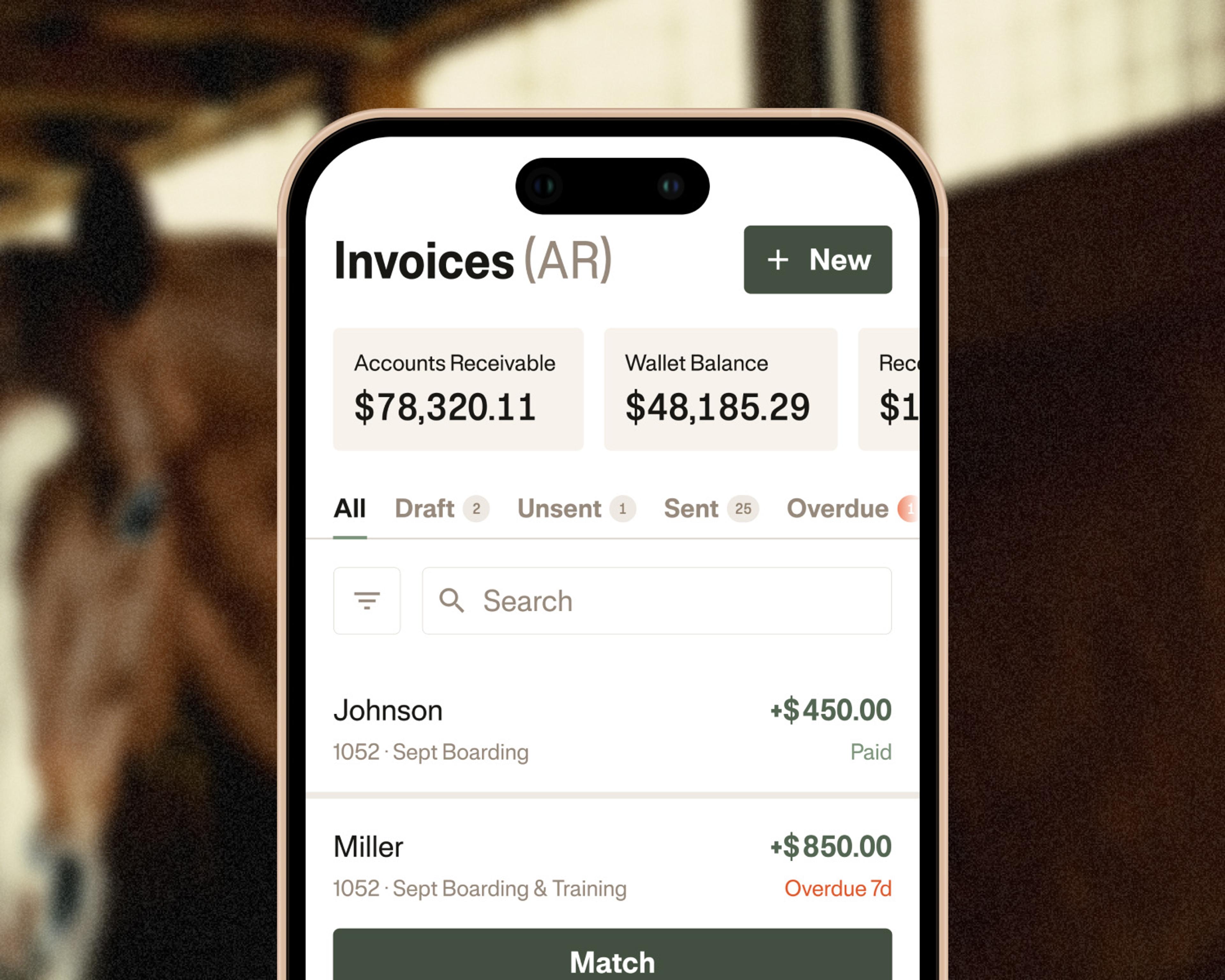

Accounting software built for equestrian professionals who manage boarding, training, and breeding. Real-time profitability by client, flexible invoicing, and a mobile app that works as hard as you do.

“Been loving bookkeeping these days, ha! Never thought I'd say that.”

"Best decision ever was to quit QuickBooks and start using Ambrook!"

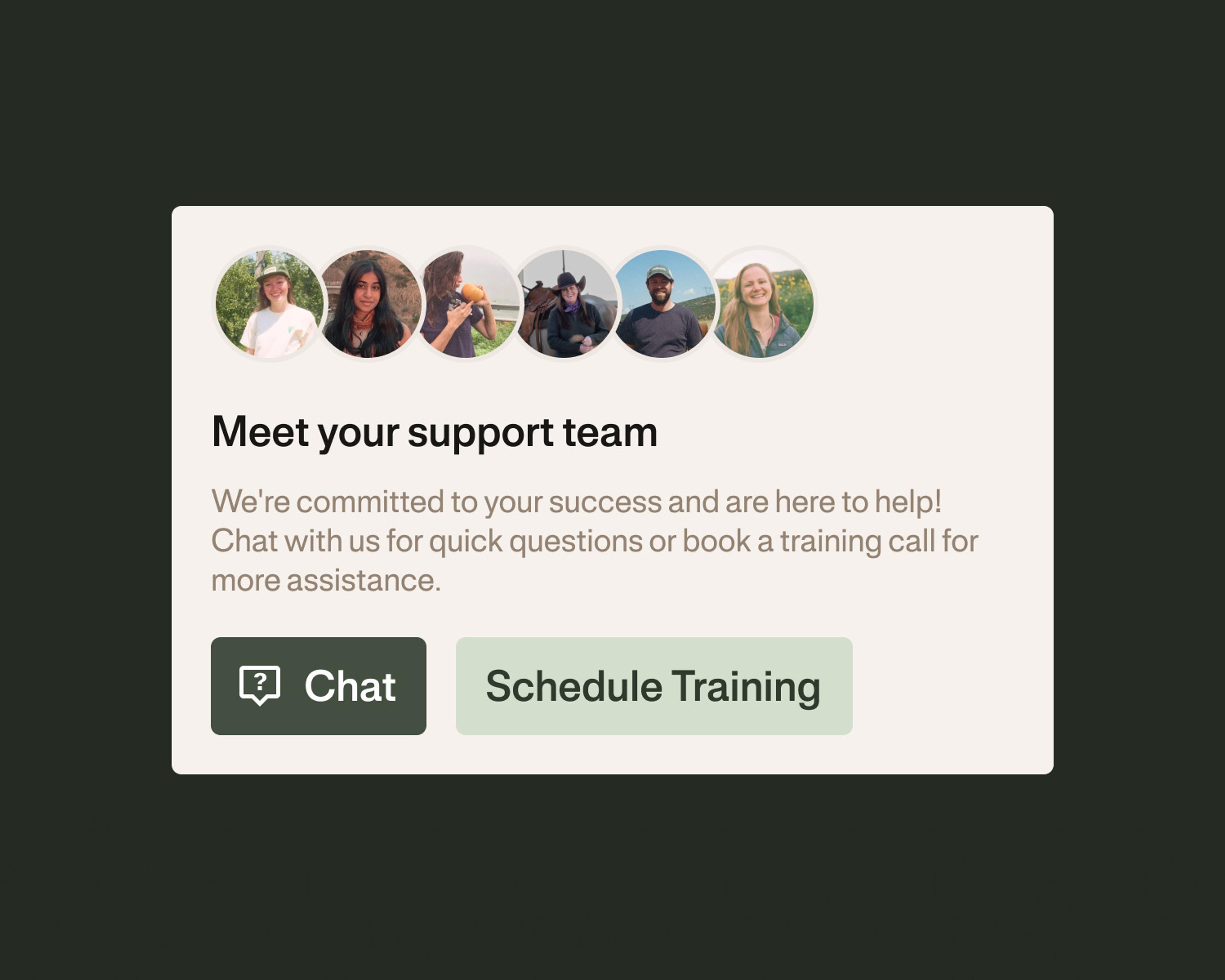

"Ambrook's tech support is the best of all the companies we have used.”

“Been loving bookkeeping these days, ha! Never thought I'd say that.”

"Best decision ever was to quit QuickBooks and start using Ambrook!"

"Ambrook's tech support is the best of all the companies we have used.”

Spend more time in the barn, not the desk

Finally, accounting software that understands your operation runs on tracking per-horse profitability and keeping clients happy, not just tax categories.

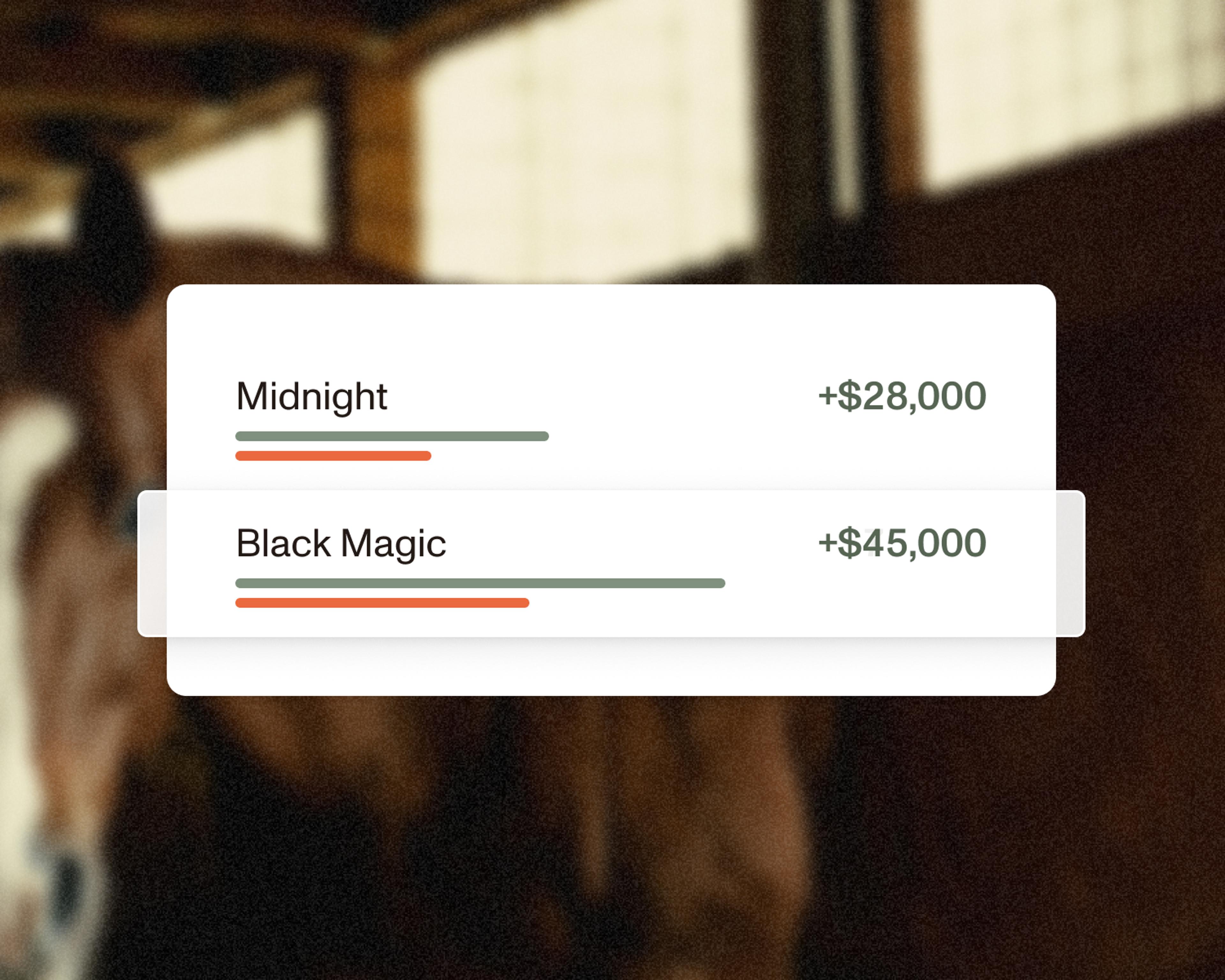

See exactly which horses, clients, or services are profitable. Tag every expense and income to individual animals across breeding, boarding, or training.

Create detailed invoices that include everything from stud fees to reimbursable costs like vet care or foaling supplies. with preset line items and flexible pricing per client.

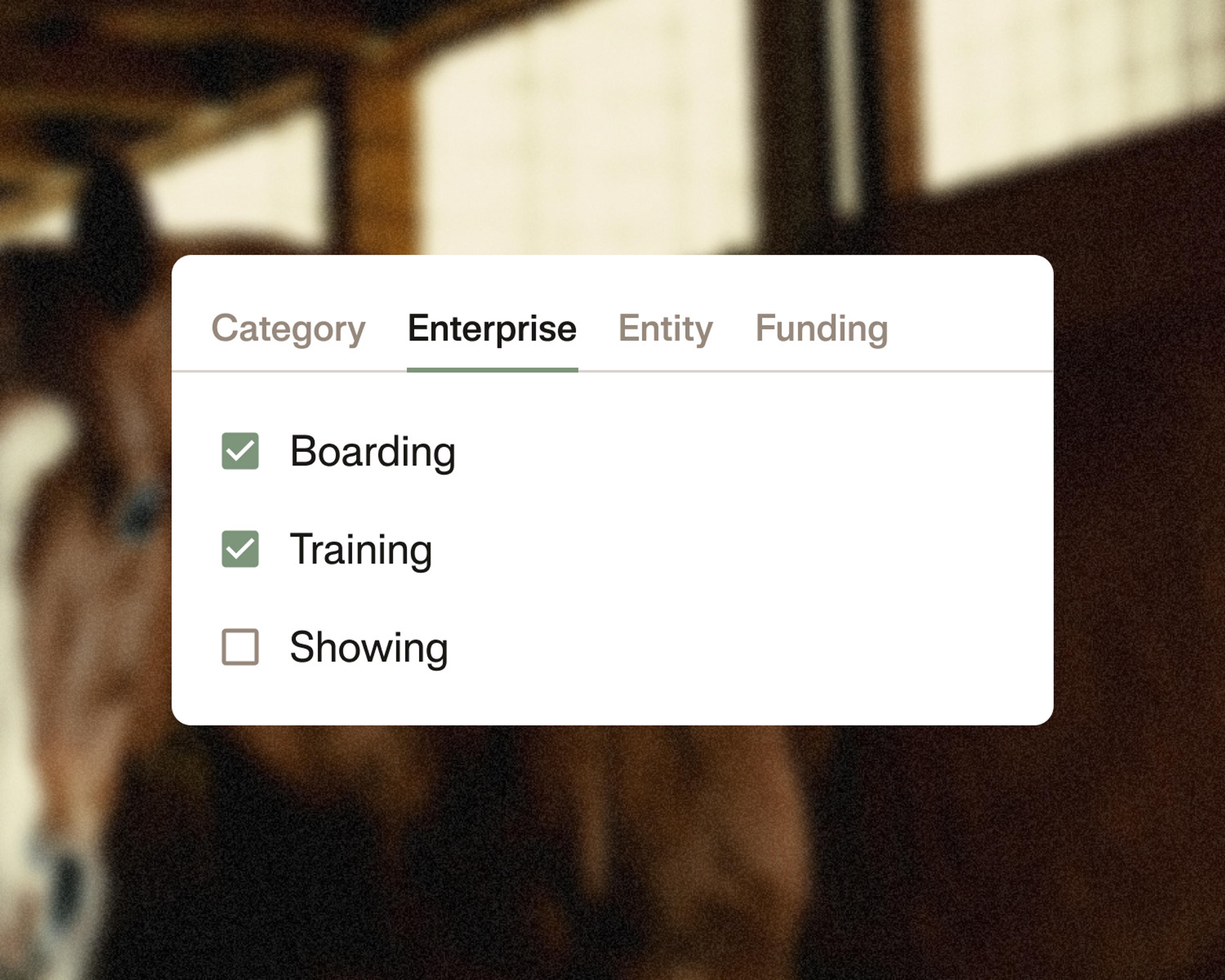

Run boarding, training, and breeding operations under one account. Track separate P&Ls for each business line while filing everything in one place.

No more tickets or offshore call centers. Get top-notch support from our team of finance experts and industry pros.

Need help setting up or migrating from a different platform? We provide live onboarding and training to make sure you get set up right the first time.

Bookkeepers, accountants, and CPAs love working with Ambrook. Accurate cost tracking, enterprise P&L and built-in reporting keep client books clean.

Customer Story

Simplifying business banking with Ambrook

“Ambrook made it simple where we could quickly and easily deposit all our checks. Our team can now photograph and deposit checks the day they arrive, and we can track it all from where we're based in Ohio.”

Nicole Miller

Sweetgrass Farms

Ambrook has everything you need and nothing you don’t

Connected Accounts

Manage multi-enterprise operations with one platform. Separate P&Ls for boarding, training, and breeding while keeping books clean and workflows shared.

Built-in Payments

Accept board payments and training fees via ACH or credit card. Option to pass processing fees to clients or absorb them.

Mobile Receipt Capture

Snap photos of any receipts and we'll scan, itemize, and attach them to the right transactions automatically. Works at shows, barns, or on the road.

Spending Cards

Give your team spending power with Ambrook cards. Every transaction imports automatically and tagged to horses, clients, or services for accurate tracking.

One-click Reports

Track your operation's health with live reports: Balance Sheet, Enterprise-level P&L by horse or service line, and cash flow projections.

Collaboration

Invite your accountant, barn manager, or assistant trainer to view and collaborate on your books before, during, and after tax season.

Try Ambrook for freeTry Ambrook for free

How to Start

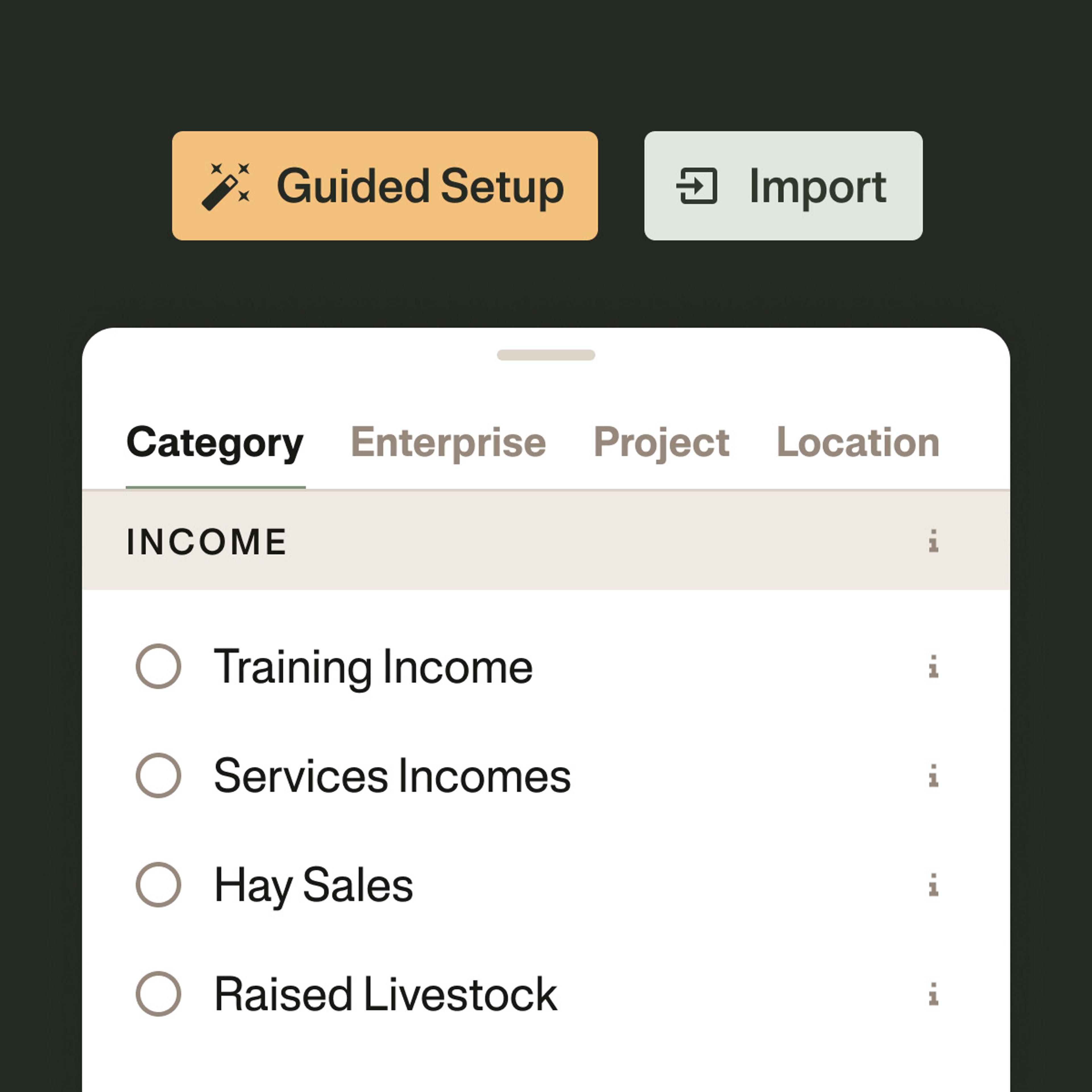

Switching to Ambrook is easy

Our team can help you move everything from your current accounting tool into your Ambrook account. It's quick and seamless.

1. Choose your starting point

Keep your QuickBooks chart of accounts or start fresh on Ambrook. It’s up to you.

2. Transfer your data

Seamlessly import transactions, contacts, vendors, and your balance sheet.

3. Get back to work

Start tagging, tracking, and getting things done with Ambrook. We’re always here to help.

See how Ambrook can helpSee how Ambrook can help

Frequently Asked Questions

How is this different from QuickBooks?

QuickBooks wasn't built for equestrian operations. Tracking profitability per horse, managing complex reimbursables, and handling multi-service invoicing requires workarounds and expensive add-ons. Ambrook is built from the ground up for horse businesses, no integrations needed, no syncing issues, just solid bookkeeping and reliable support. Plus, you get one system, one US-based support team, and one monthly price.

Can I track expenses and income by individual horse?

Yes! Use our project tagging feature to assign every transaction to a specific horse. This lets you generate P&L reports per animal to see which horses are profitable and which require extra care. This is perfect for breeders evaluating mares and stallions, or barn managers tracking boarder costs.

What is invoicing like on Ambrook?

Ambrook's invoicing is built for equine operations with pre-set, pre-tagged invoice items for everything from training and boarding to stud fees, embryos, and shoeing services. Customers can pay directly via ACH, credit card, check, or cash, with all payments automatically recorded in your books. The platform provides a clear view of outstanding invoices and sends automatic reminders to ensure you get paid on time. This seamless integration from billing to bookkeeping means your entire financial workflow is streamlined specifically for the diverse revenue streams of horse businesses.

How do I handle reimbursable expenses?

Ambrook makes reimbursables easy. Tag purchases as reimbursable when you buy supplies for clients, then add those line items to invoices. You can attach receipt photos directly to invoices so clients see proof of every charge.

What happens to my existing QuickBooks data?

We migrate everything that matters: your chart of accounts, vendor list, customer list, and open items. Your historical data remains accessible in QuickBooks if you need it, but you'll be running fresh in Ambrook within 48 hours.

What if I already have a bookkeeper?

Ambrook makes their job easier! Instead of data entry, they focus on strategy. Many customers keep their bookkeeper but cut hours (and costs) significantly.

How long does it take to catch-up on one year of taxes?

The answer varies widely depending on context, but most folks can catch up on 1 year of data in about 2-3 weeks via Automations and AI Categories/Matching on Ambrook. If you need support with this process, inquire about our Full-Service plan.

Try Ambrook today

30-day trial

Live training

US-based support