Ambrook Full Service

Personalized support and planning

Full Service combines the full power of Ambrook Pro with expert setup, hands-on support, monthly check-ins, and detailed financial reviews—all tailored to your operation’s exact needs.

Trusted by thousands

of American businesses

Who It's For

Take the stress out of bookkeeping

Want to know your exact cost per acre and profit per head? Full Service is built for busy operators who want to stay close to their finances, but need help turning their numbers into strategy.

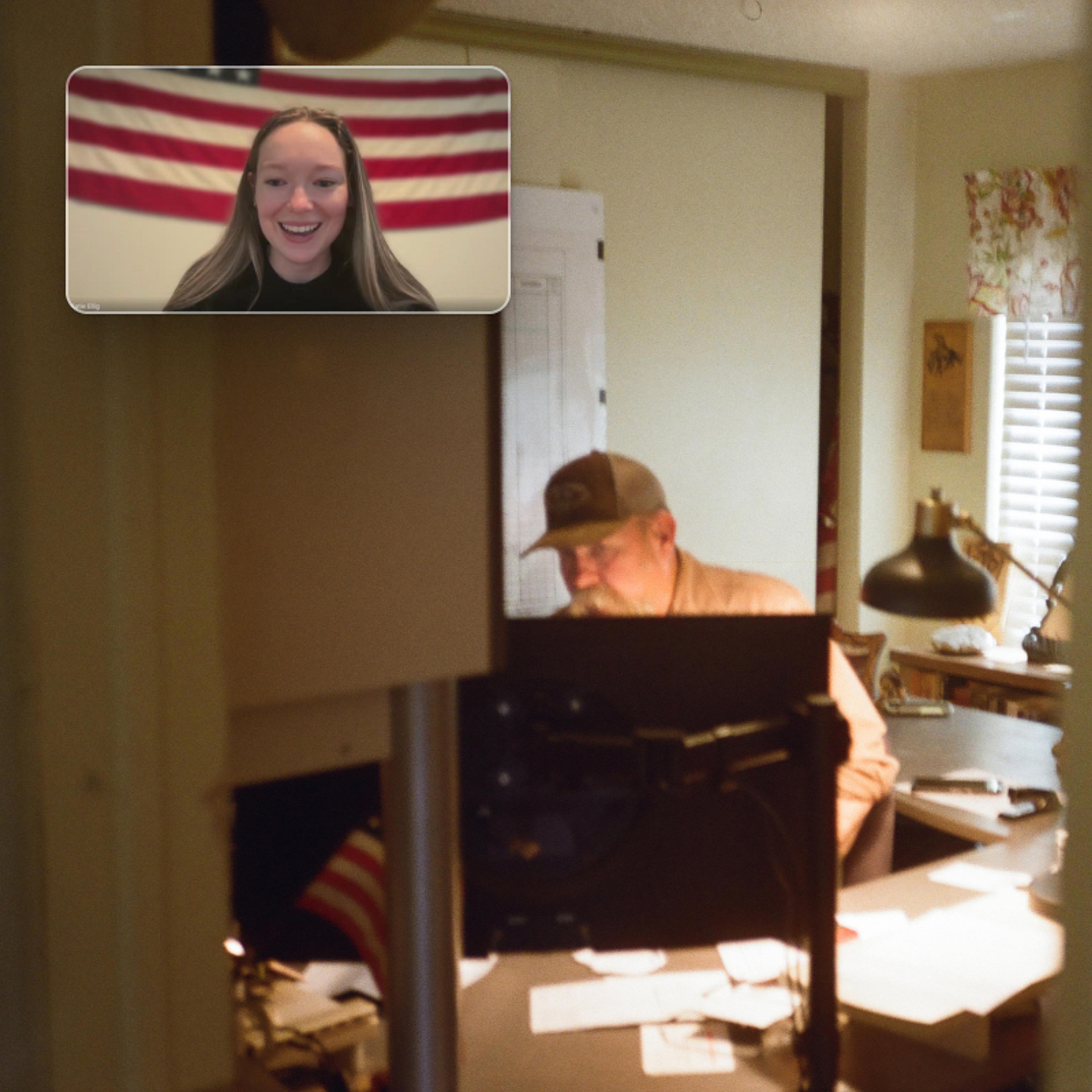

Live training and onboarding

Need help setting up or migrating from a different platform? We provide live onboarding and training to make sure you get set up right the first time.

Insights you can act on.

We don’t just crunch the numbers — we help you interpret the data and use it to make smarter, more confident business decisions.

Built for funding and the future.

Prepping for a loan? Setting breakeven prices? Or planning a big investment? We're here to help you move forward with confidence.

Full Service Plan Highlights

What's included?

Sometimes software isn’t enough. Ambrook Full Service pairs our powerful Pro plan with dedicated human support to help you understand your numbers and make informed decisions. Better accounting should mean better business.

Dedicated Account Manager

One expert, dedicated to you, to help you see what's making money and where to invest next. Same person, every time.

Business Reviews

Two annual strategy calls to review profitability, prepare for funding, and set strategic pricing that supports your long-term growth.

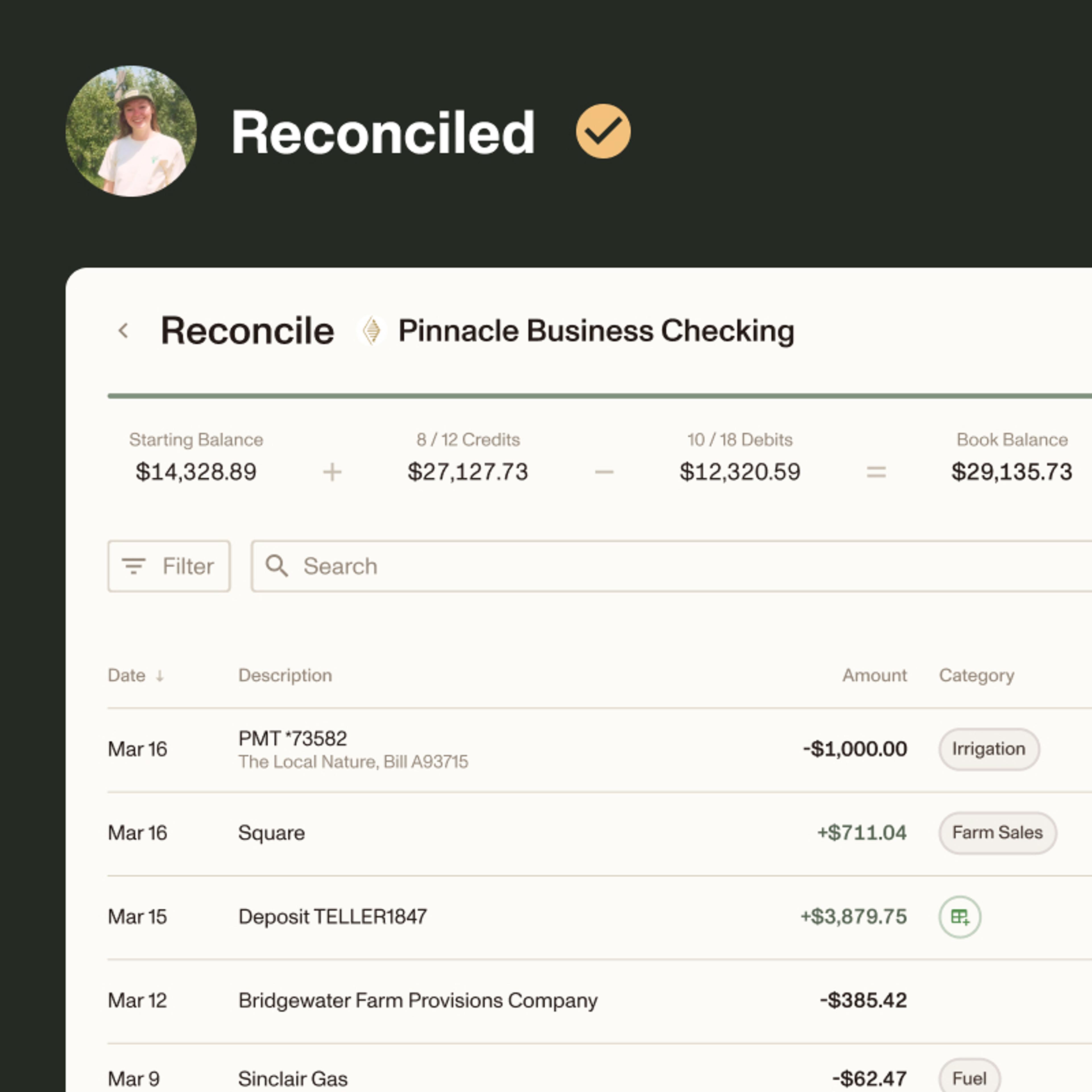

Monthly Data Entry

Our team of ag-savvy experts imports your transactions and reconciles your accounts — so your books stay accurate and up to date.

“With this FSA purchase and gathering all the documents we need, they're very accessible on Ambrook.”

The Baraks

Strawberry Canyon

Owners

Oregon

“With this FSA purchase and gathering all the documents we need, they're very accessible on Ambrook.”

The Baraks

Strawberry Canyon

Owners

Oregon

“Real quick, instantly, boom, we know where we're at with the beef business. Like, okay, let's keep growing that.”

The Barnards

WhiteBarn Cattle

Owners

Arizona

“I've been using Ambrook for our farm accounting and have been very impressed. We have used QuickBooks, Wave, Excel – none compare.”

Zach Scherler-Abney

Re:Farm

Owner & Operator

Lawton, OK

Additional Benefits

More than just expert bookkeeping

We built Ambrook to fit your operation — not the other way around. Our team’s truly invested in your success, which is why Full Service includes custom setup, in-depth financial reviews, and balance sheet prep to help you grow and thrive.

Business Insights Reports

We'll help you interpret your reports and turn complex data into clear actions.

Guided System Setup

We’ll translate your questions into an easy tagging system that tracks what matters.

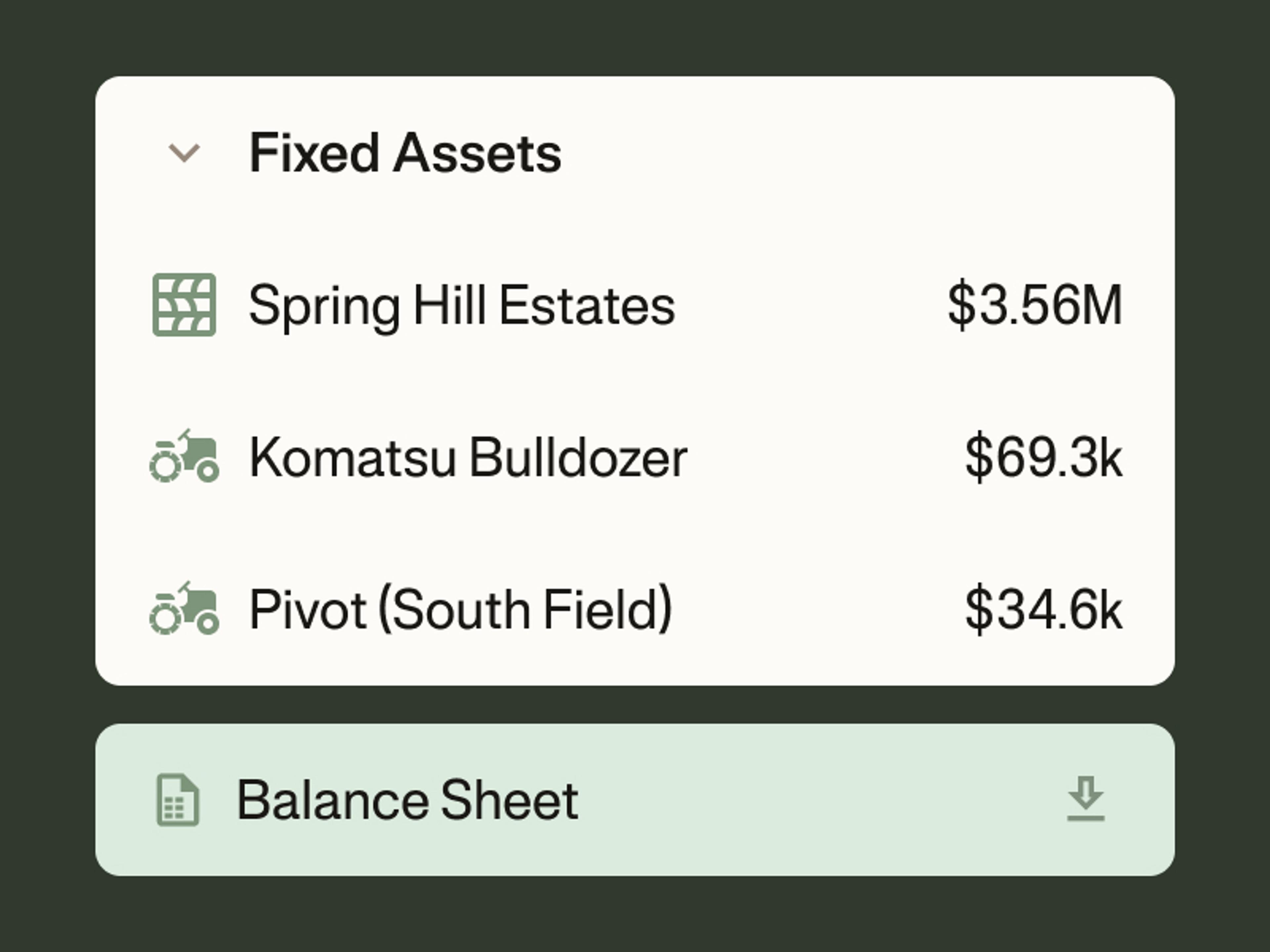

Balance Sheet Preparation

We'll help you prepare a strong professional balance sheet for securing better loan rates.

Customer Story

JG Livestock

275 acres · Madison, VA

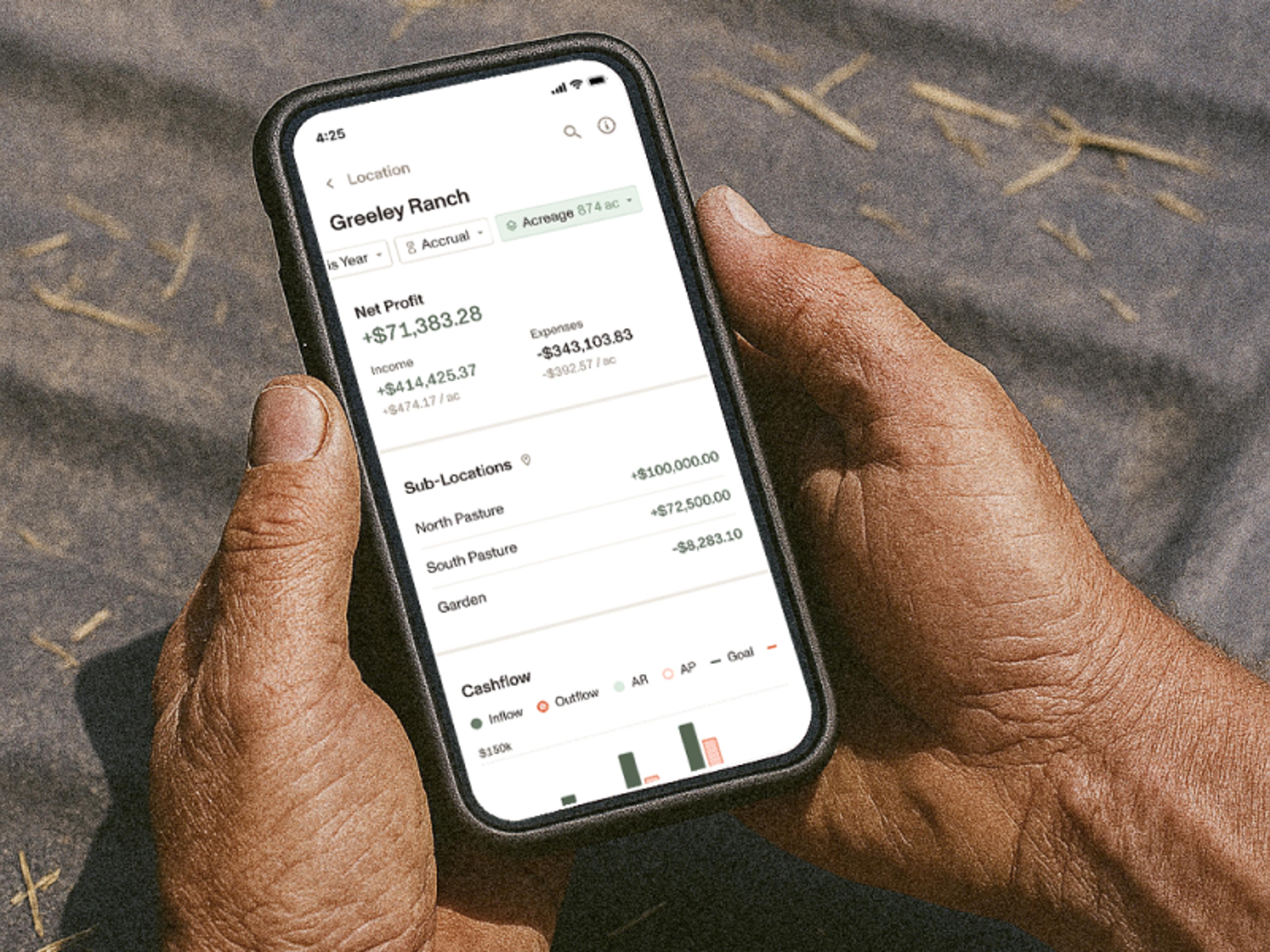

“Now, if I have downtime, I pull out my phone and just start tagging expenses. I can say this was a feed expense and it was tied to the Stocker enterprise and all of a sudden I can start doing managerial accounting looking at each enterprise and determining which is the most profitable. And I can do it out in the field.”

Jacob Gilley

Owner, JG Livestock

Ownership

Jacob Gilley in Madison, VA

Land

275 acres, owned & leased

Operation Type

Diversified Livestock

Frequently asked questions

Does Ambrook replace my bookkeeper?

No. Ambrook works with your bookkeepers and accountants to help you get even more out of the platform. If you're a bookkeeper or accountant and you'd like to learn more about becoming one of our certified advisors, learn more here.

What makes Full Service different from other plans?

Full Service is our only hands-on, service-based offering that pairs you with a dedicated account manager who handles monthly reconciliation, provides strategic guidance, and offers personalized support whenever you need it.

Do I still have control over my books?

Absolutely. You maintain full access over your data in our easy-to-use platform.

What happens during the bi-annual business reviews?

During these sessions, your account manager will help you analyze your financial performance, identify trends and opportunities, discuss seasonal planning, and provide strategic recommendations tailored to your operation's goals and challenges.

Can Ambrook help me outsource my bookkeeping entirely?

Our Full Service model is collaborative: we support operators who want to stay involved. If you’re looking for full outsourcing, we can recommend one of our certified advisors. Learn more about the program here.

What if I just need a little bit of help getting my books back on track?

If you need short-term support, our Catch-Up package is a special one-time service with our team to get your books cleaned up quickly. Learn more.

How does this differ from the other Ambrook plans?

Full Service combines the power of Ambrook Pro with expert bookkeeping, concierge onboarding and strategic guidance tailored to your operation.