Ambrook for Farming

Production insights and tax prep in one place

Modern accounting software built for growing farms that need to know their numbers. Track real-time profitability by each enterprise and make expansion decisions based on data, not just gut feel.

“Been loving bookkeeping these days, ha! Never thought I'd say that.”

"Best decision ever was to quit QuickBooks and start using Ambrook!"

"Ambrook's tech support is the best of all the companies we have used.”

“Been loving bookkeeping these days, ha! Never thought I'd say that.”

"Best decision ever was to quit QuickBooks and start using Ambrook!"

"Ambrook's tech support is the best of all the companies we have used.”

Farmers across America love Ambrook

Finally, accounting software that understands your operation runs on enterprise profitability and Schedule F compliance, not generic business categories.

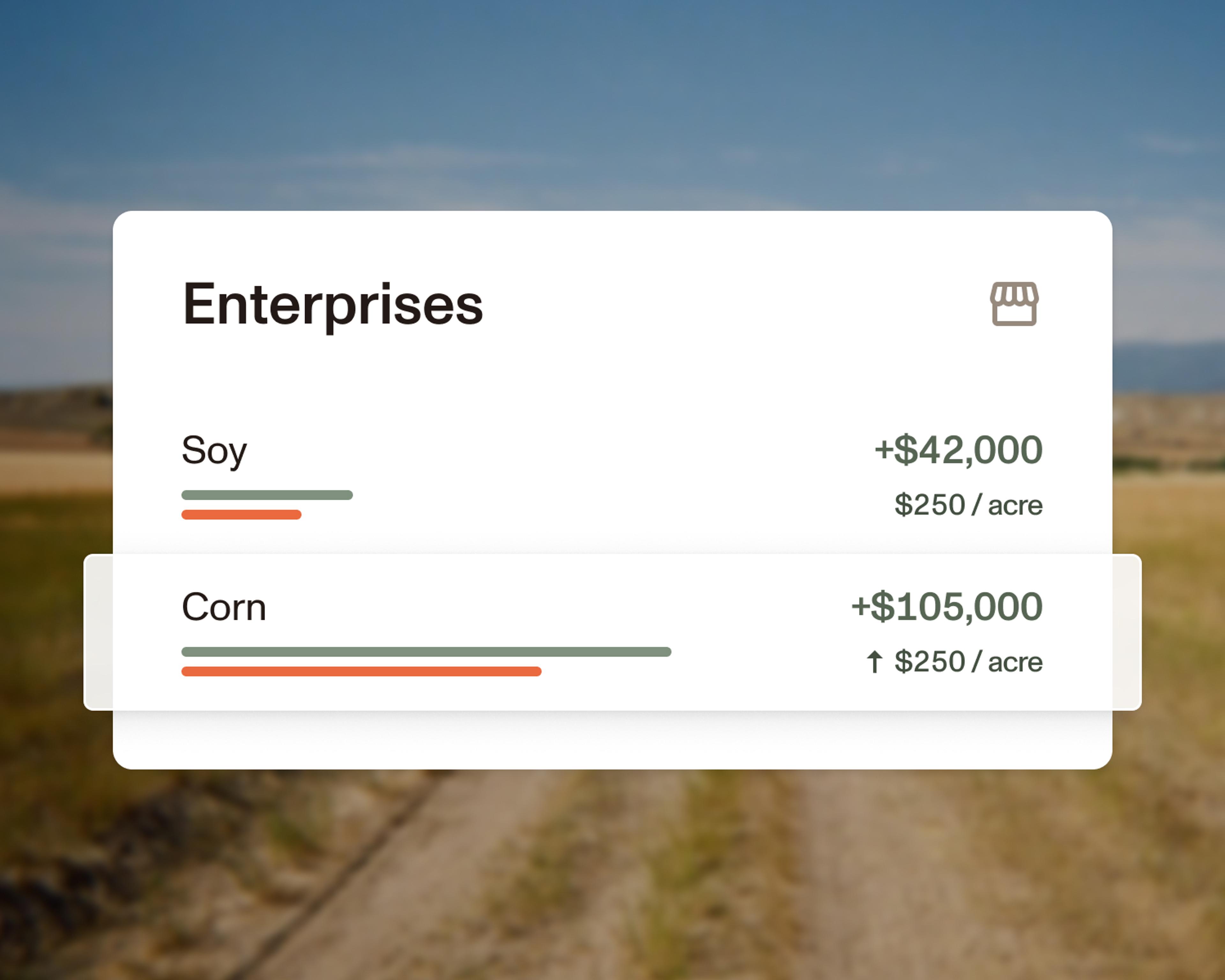

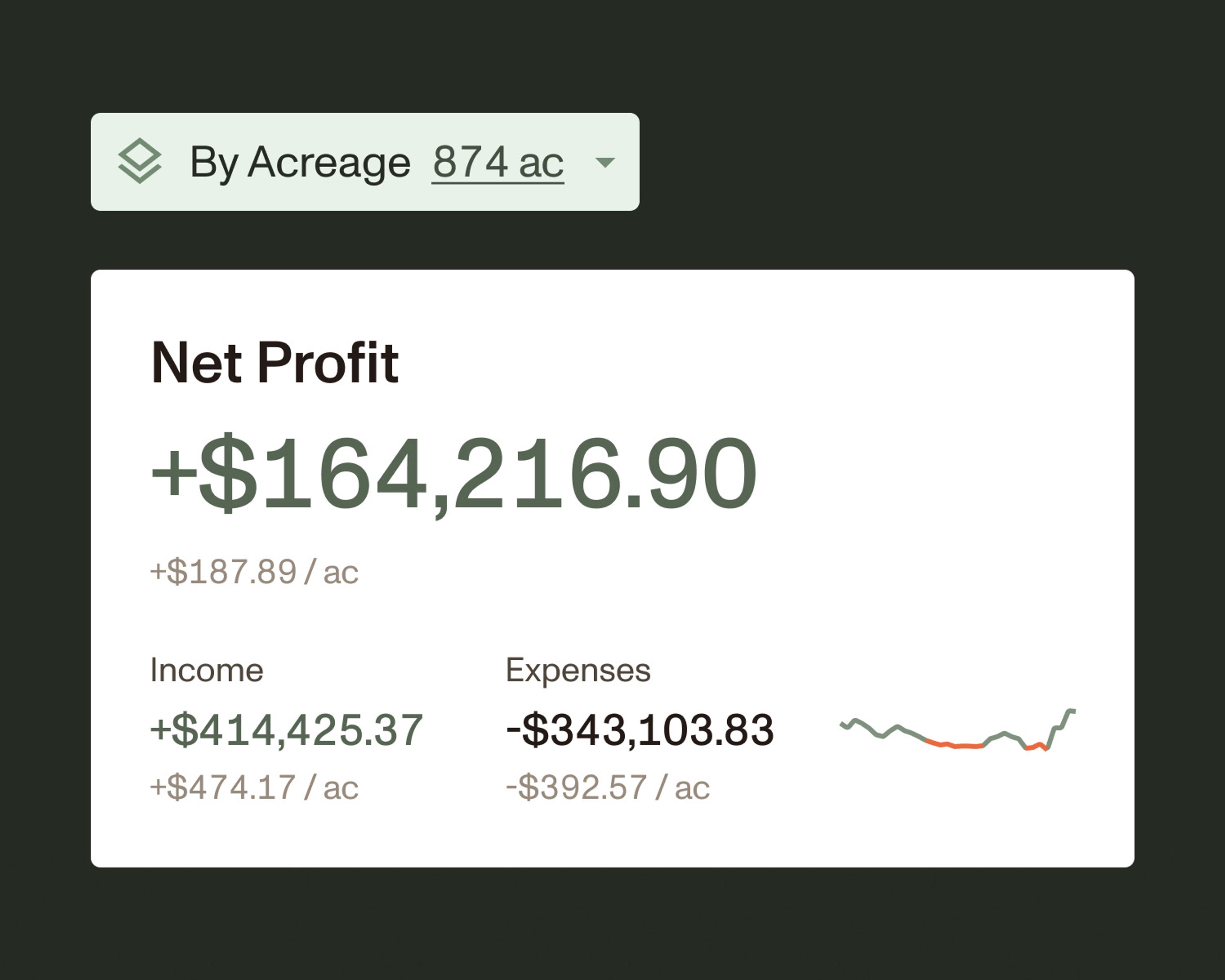

Stop finding out your operation lost money after harvest. See profit margins by enterprises like corn or soy updated daily as costs come in.

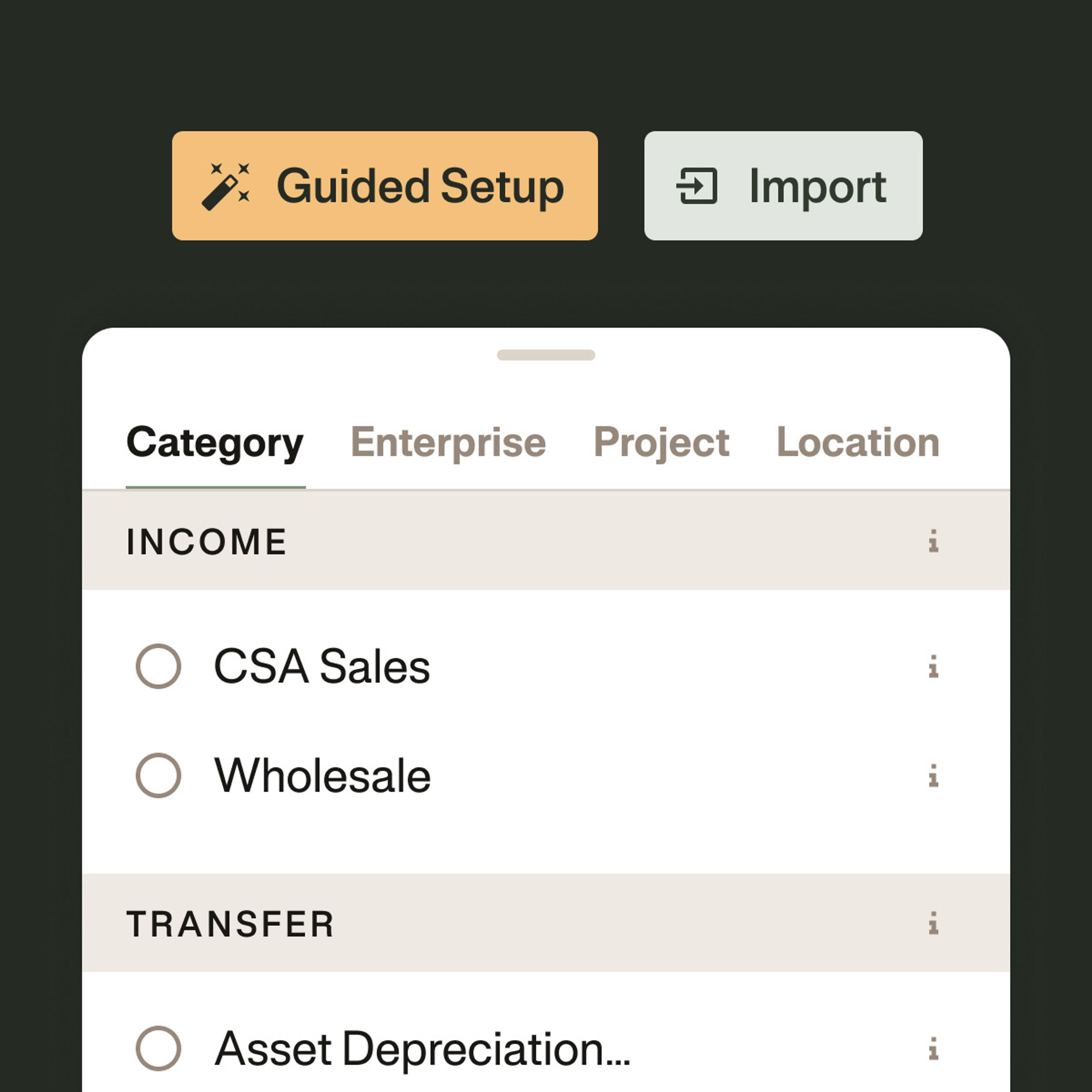

Get pre-built Schedule F categories, enterprise tracking, and farm-specific features right out of the box. No messy setup needed.

No more shoe boxes full of receipts or 50-60 hour weeks sorting paper from January to March. Stay audit-ready year-round with organized digital records.

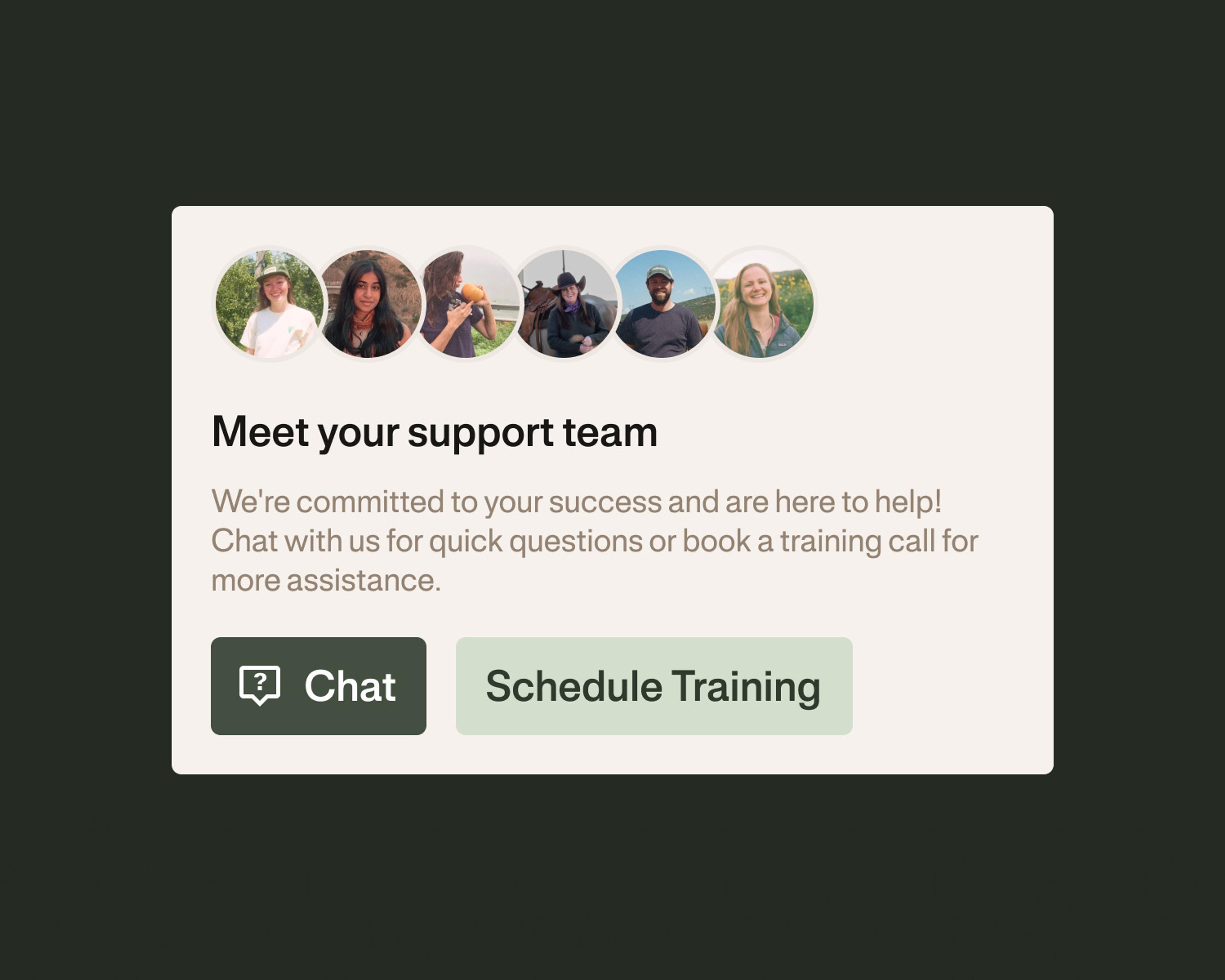

No more tickets or offshore call centers. Get top-notch support from our team of finance experts and industry pros.

Need help setting up or migrating from a different platform? We provide live onboarding and training to make sure you get set up right the first time.

Bookkeepers, accountants, and CPAs love working with Ambrook. Accurate cost tracking, enterprise P&L and built-in reporting keep client books clean.

Customer Story

From 50 hours to 10 minutes weekly

“With Ambrook, I feel like that hole in the ship has been patched and there's a pump pumping the water out, and it's starting to come back up again. I really feel like it's a turn in the right direction for all of my operations.”

Jo Ellen and Lee Carey

Owners, Lee Carey Farms, Beef cattle, grain, horse, hay

Ambrook has everything you need and nothing you don’t

Enterprise Tracking

Track profitability by enterprise (cattle, hay, vegetables, custom work) with individual P&Ls and cost of production per acre/head.

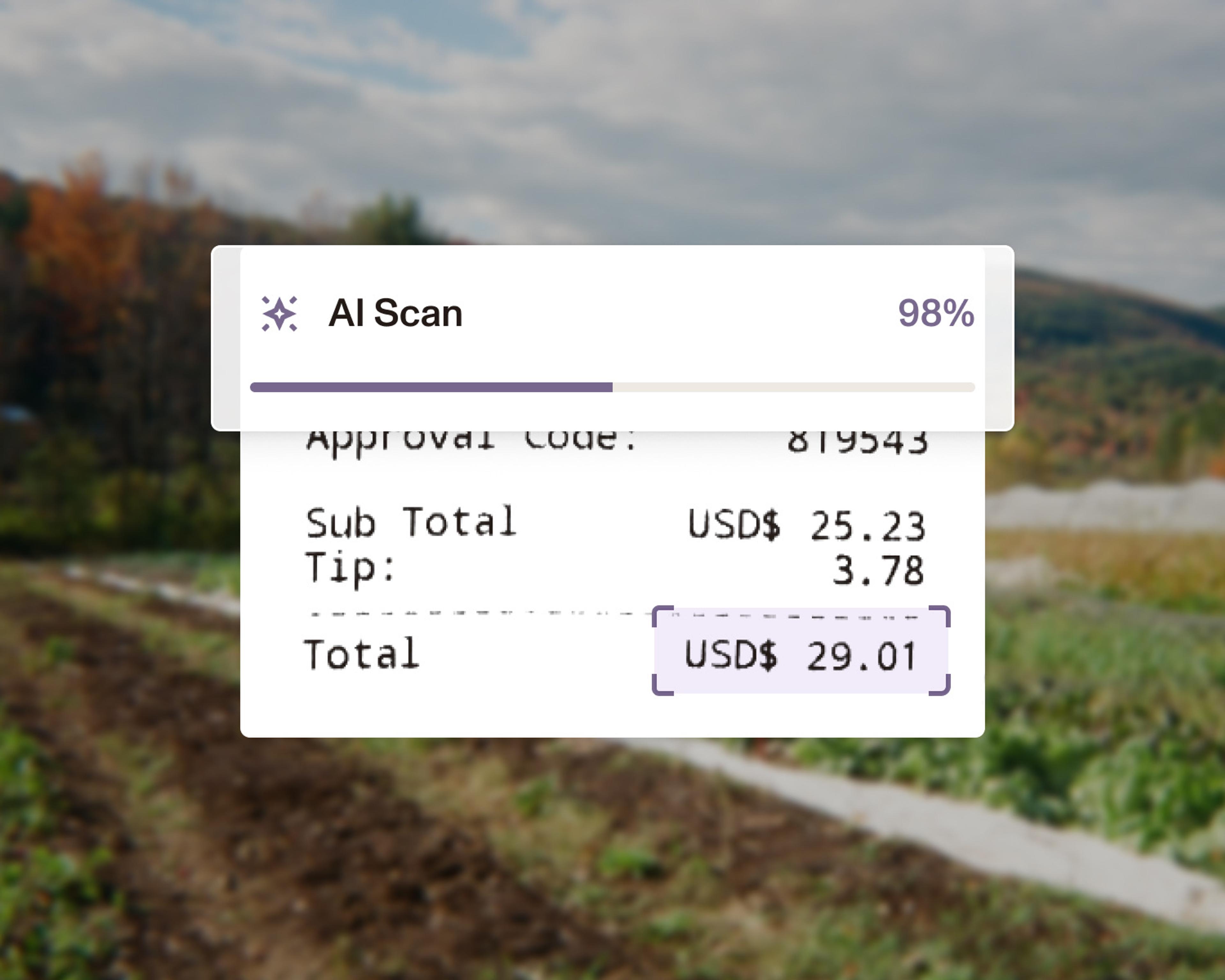

Mobile Receipt Capture

Snap photos on the go, forward emails from suppliers, and we'll scan, categorize, and attach everything to the right enterprise automatically.

Multi-Entity Management

Manage complex family operations, partnerships, and multiple LLCs with clean, separate books from one platform.

Live Bank Feeds

Bank transactions update daily so you always know your cash position and can make quick decisions on equipment or livestock purchases.

One-click Reports

Generate Schedule F tax reports, enterprise P&Ls, balance sheets, and FSA loan documentation instantly.

Accountant-friendly

Give your CPA secure access to review books before tax season. They'll love the clean, organized records and Schedule F alignment.

Try Ambrook for freeTry Ambrook for free

How to Start

Switching to Ambrook is easy

Our team can help you move everything from your current accounting tool into your Ambrook account. It's quick and seamless.

1. Choose your starting point

Keep your QuickBooks chart of accounts or start fresh on Ambrook. It’s up to you.

2. Transfer your data

Seamlessly import transactions, contacts, vendors, and your balance sheet.

3. Get back to work

Start tagging, tracking, and getting things done with Ambrook. We’re always here to help.

See how Ambrook can helpSee how Ambrook can help

Frequently Asked Questions

How is this different from QuickBooks?

QuickBooks was built for retail shops. Ambrook is built exclusively for agriculture with Schedule F categories ready on day one, free enterprise tracking (no "classes" fees), and a full mobile app designed for working in the field.

Will this work for our multi-generation family farm?

Absolutely. Ambrook handles complex ownership structures, multiple entities, and partnership stakes. Track each family member's operations separately while maintaining consolidated views for family meetings and succession planning.

What happens to my existing QuickBooks data?

We migrate everything that matters: your chart of accounts, vendor list, customer list, and open items. Your historical data remains accessible in QuickBooks if you need it, but you'll be running fresh in Ambrook within 48 hours.

What if I already have a bookkeeper?

Ambrook makes their job easier! Instead of data entry, they can focus on strategy. Many customers keep their bookkeeper but cut hours (and costs) significantly. Your bookkeeper can be invited to collaborate directly in Ambrook.

How long does it take to catch up on one year of taxes?

The answer varies widely depending on context, but most folks can catch up on 1 year of data in about 2-3 weeks via Automations and AI Categories/Matching on Ambrook. If you need support with this process, inquire about our Full Service plan.

Try Ambrook today

30-day trial

Live training

US-based support