If you lease your livestock or pasture to other farmers, it pays to learn how the ‘passive activity’ loss rules work—especially if you have any losses to report.

If your farm or ranch leases livestock or pasture to other farmers, you may need to file Form 8582, Passive Activity Loss Limitations. You use this form to report any losses you incur in the process of earning passive income.

Form 8582 goes hand-in-hand with Form 4835, Farm Rental Income and Expenses, which you use to report income and expenses from farm rental activities. If you calculate a loss on Form 4835, you report it on Form 8582.

If you’re not already familiar with reporting passive income, check out our rundown of Form 4835. Then return to this article for more on reporting your passive activity losses.

Otherwise, read on to learn what Form 8582 does, how passive activity loss rules work, and how to report losses to your best advantage.

What is Form 8582?

You use Form 8582 to report losses you incur in the course of earning passive income. For many farmers, passive income takes the form of earnings from a grazing lease or a livestock lease.

If you complete Form 4835 and your calculations show that you incurred a loss from your passive income activities—that is, you spent more money on passive income-generating activities than you earned—then you use Form 8582 to report that loss.

Why does the IRS require farmers to file Form 8582?

When you incur a loss from passive activities, the IRS only allows you to deduct that loss against passive income. You can’t deduct passive losses from nonpassive income, like wages or business income. This is called the passive activity loss (PAL) limitation.

For instance, if you incur a loss of $3,000 renting out pasture, you can’t use that $3,000 to reduce your taxable income from farming (a nonpassive activity) by $3,000.

The purpose of this limitation is to prevent businesses, especially large businesses that can afford to lose money on passive activities, from avoiding taxes.

For instance, a chain of big box stores could purchase a large number of rental properties and intentionally incur a loss operating those properties. It could then deduct those losses from its earnings as a big box store, reducing its taxable income and avoiding paying taxes.

The accounting acrobatics needed to pull off a move like this are complex, but here’s the bottom line: save for a few exceptions, your losses from passive activities cannot reduce the amount you pay on income from nonpassive activities.

To help with this, the IRS requires you to report all passive losses on Form 8582. That way, your passive losses are distinguished from your nonpassive losses.

What are the benefits and drawbacks to earning passive income?

The biggest benefit to earning passive income is that passive income is not subject to self-employment tax. Since the self-employment tax rate is 15.3% of combined earnings from wages, tips, and net self-employment earnings, ensuring your income is correctly classified as passive can save you a considerable amount in taxes.

But there are also drawbacks to earning passive income. The most significant is that you cannot deduct losses from passive income from your nonpassive income. If your passive income activity tends to incur losses, that can be a problem.

In particular, it affects new farmers who earn income both from their farm and from a job in town.

When your farm is just getting established and you are also working full-time for an employer, you may not do enough farmwork for your farming activity to qualify as material participation. (More on that below.) In that case, any earnings from your farm are qualified as passive income.

Since your farm is new and you are investing money in getting it established, it may happen that in some years you spend more than you earn and incur a loss. Since the IRS considers your farmwork a passive activity, you can only deduct your loss from passive earnings.

For instance, you may earn $75,000 from your job in town, but incur a $10,000 loss running your new farm. In that case, it would benefit you if you could deduct the $10,000 from your $75,000 town income. But so long as your farmwork is classified as passive, you can only deduct the $10,000 from your farm income.

In this case, it benefits you to make sure your farming meets the qualifications for material participation, so it’s classified as nonpassive income and you can use it to reduce the tax burden on other passive income.

For more on this, see Who’s Considered a ‘Farmer’ for Tax Purposes?

How do Form 8582 and Form 4835 relate?

Form 4835 is where you calculate and report your earnings and expenses from farm rentals, a passive income activity. If, after completing Form 4835, you find that you have spent more than you have earned—that is, incurred a loss—then you report the loss on Form 8582.

It’s possible that you may need to file Form 4835, but not Form 8582. If you earn a profit from farm rental activities, then you have not incurred a loss and you do not need to file Form 8582.

However, it’s not possible to file Form 8582 without filing Form 4835. On Form 4835, you calculate and report your farm rental income and expenses. Form 4835 gives you the information you need to accurately file Form 8582.

What is passive activity income?

Passive activity income is income from any activity in which you do not materially participate.

Material participation is a concept the IRS uses to distinguish passive income from nonpassive income. Income is classified as nonpassive when you materially participate in it, and classified as passive when you do not materially participate in it.

To determine whether you are a material participant in an activity, the IRS uses a series of tests. These tests take into account the total amount of labor you contributed to the activity, the role you played making decisions directing the activity and overseeing it, and how much capital in the form of cash, material, and equipment you put into the activity.

Even if you do not qualify as a material participant in a farming activity, the IRS may consider you a significant participant. A significant participant is able only to claim a portion of their income as passive and thus exempt from self-employment tax.

Our guide to Form 4835 provides a detailed breakdown of these IRS tests to help you determine whether you are a material or significant participant.

Passive income from grazing leases and livestock leases

For farmers leasing land or livestock, material participation may be triggered depending on the structure of the lease.

If you lease out land or livestock for a flat cash rate and do not participate in the farming operation, you are typically not considered a material participant and you earn passive income.

In a share rental agreement, however, you may contribute resources to the farming operation to such a degree that the IRS considers you a material participant. For a detailed breakdown and factors you need to consider when drafting a lease, check out our articles on grazing leases and livestock leases.

What are passive activity losses?

In any year where you incur more expenses in a passive activity than you earn revenue, you report a loss on Form 8582.

For instance, you might lease a pasture to another farmer for grazing. You spend $1,200 reseeding and repairing fences, but only earn $800 revenue from the lease. In that case, you have incurred a passive activity loss of $400, which you calculate on Form 4835 and report on Form 8582.

However, even in years where you earn a profit from passive activities, you may still need to file Form 8582. If you have reported a loss with Form 8582 in past years, and that loss has carried forward, you must file Form 8582 to deduct that loss from the current year’s passive income.

Losses carry forward from years where your passive losses exceeded your passive income. For example, if you have a pasture that you typically lease for grazing, and you spend money maintaining the land but can’t find anyone to graze it—that is, you earn $0 from renting it out—then you incur a loss. Since there is no current-year revenue from which to deduct the loss, the loss carries forward until a year when you earn passive income, at which point you deduct it from your earnings.

What is the exception to the PAL limitation for farmers?

In most cases, the PAL limitation prevents you from deducting passive activity losses from nonpassive revenue.

But there is one important exception to this rule. If your passive losses are the result of renting out real estate—including pasture—then you can deduct some or all of the loss from your regular nonpassive income.

This PAL limitation exception only applies if your total AGI for the year is $100,000 or less. Also, you are limited to deducting no more than $25,000 in passive losses from your nonpassive income.

If that’s the case—and you have no other passive activity losses to report—then you do not need to complete and File Form 8582. Instead, you report the losses on Form 4835 and on Schedule E of Form 1040.

For more details about the exception to the PAL limitation, check out our guide to Form 4835 for farmers.

How to fill out Form 8582 for farmers

For a detailed, line-by-line breakdown of Form 8582, the IRS Instructions for Form 8582 provide the first and last word.

But for an overview of each of Form 8582’s sections tailored to farmers and ranchers, read on.

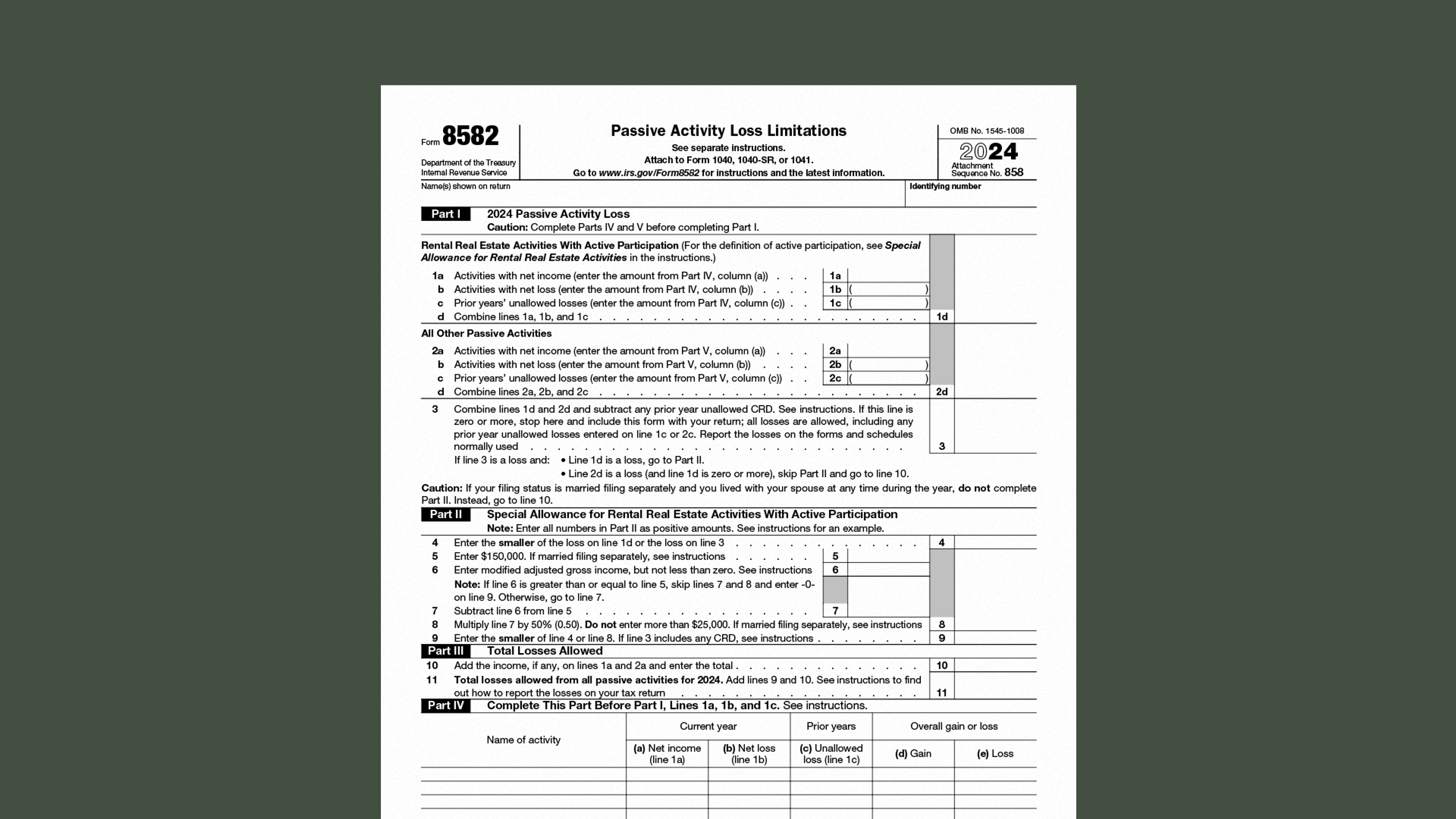

Form 8582, Part I

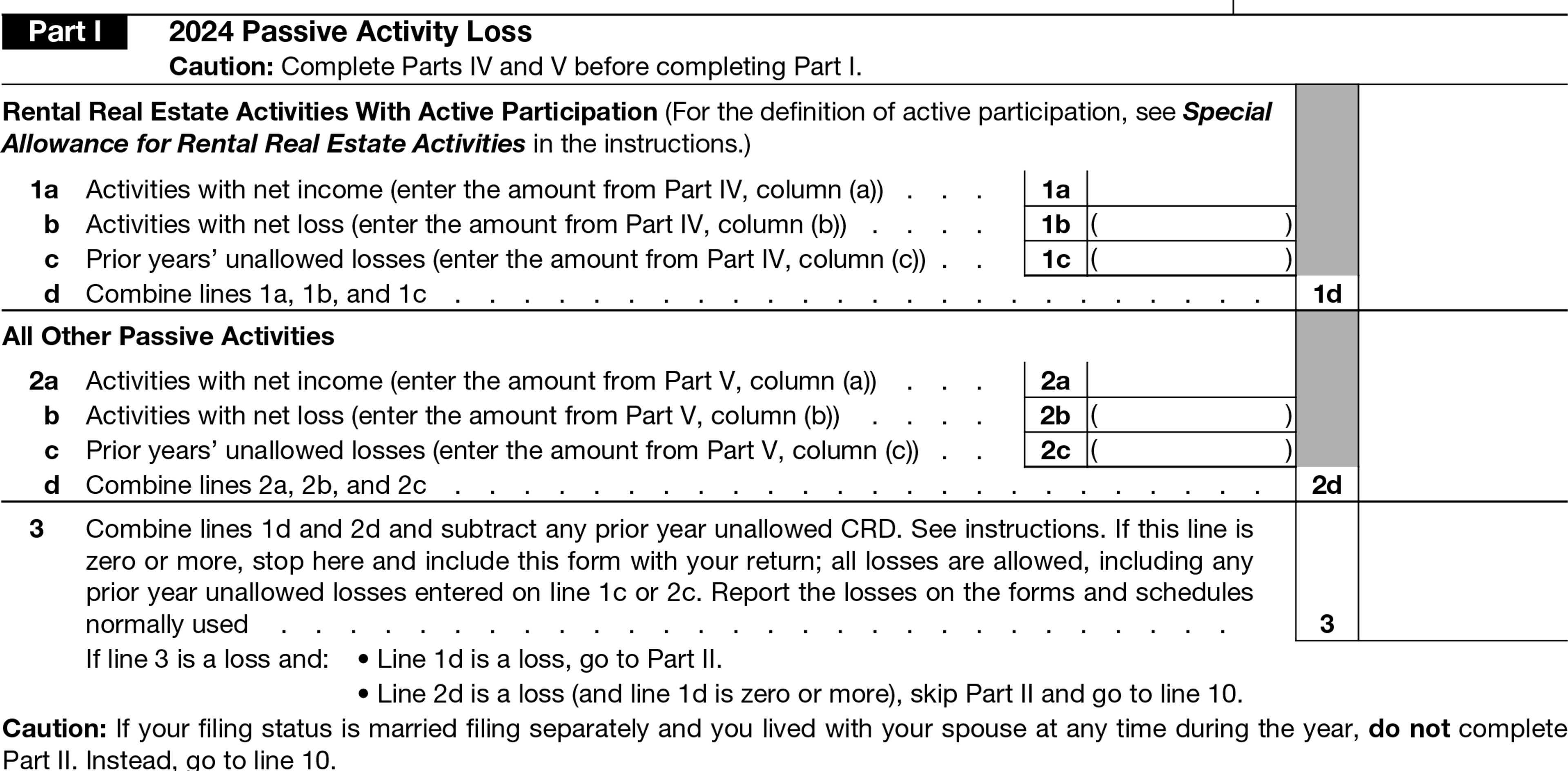

Part I of Form 8582 is where you list all your passive activities and your net income and losses from each.

Line 1 (a, b, c, and d) is where you enter your total net income and net losses from real estate activities with active participation.

Active participation is different from material participation, and simply means that you made basic decisions about the activity, such as drafting a lease agreement for an individual renting pasture from you.

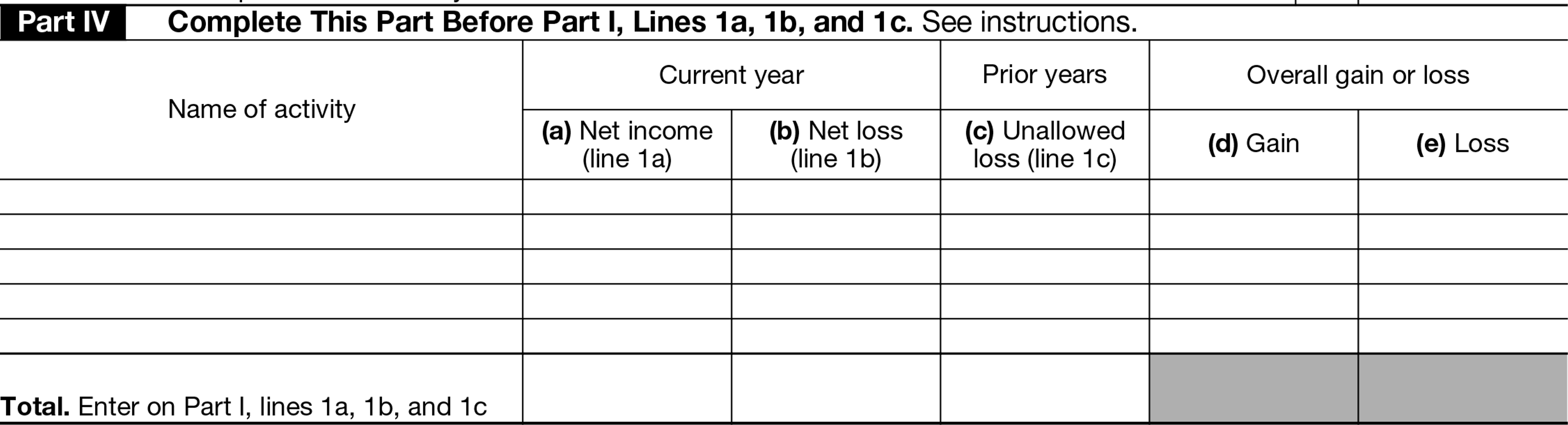

You list each of these passive activities and report income and losses on the bottom of the first page of Form 8582 in Part IV.

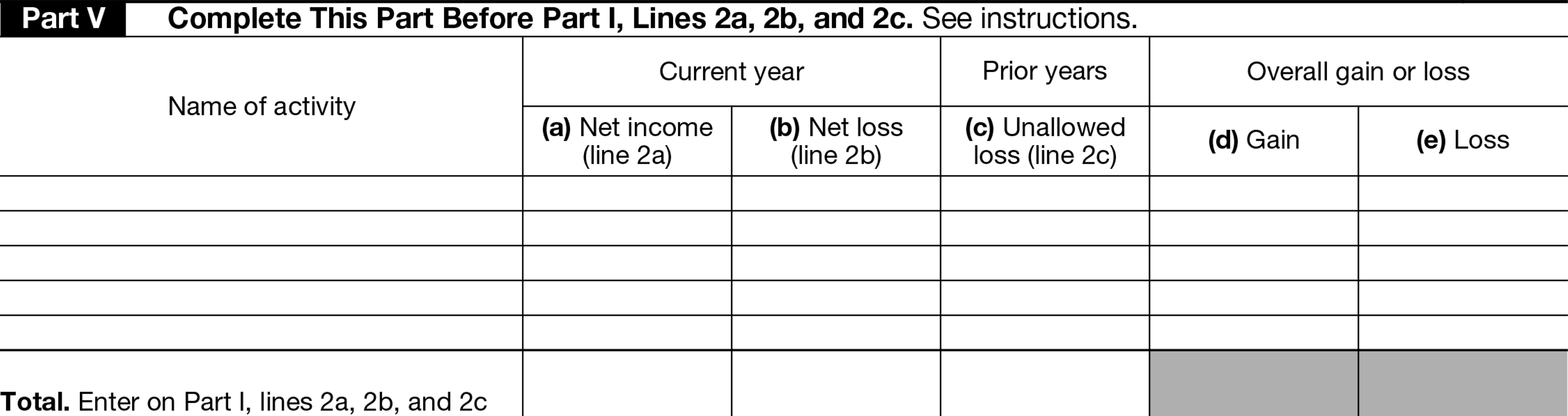

Line 2 (a, b, c, and d) is where you report net income and losses from all passive activities not including real estate. This follows the same format as Line 1. You list these activities and calculate income and losses on the second page of Form 8582 in Part V.

Line 3 is where you enter the total of your earnings from passive income. This takes into account the commercial revitalization deduction (CRD), which may reduce your taxable income. You also deduct any previous year unallowed losses (years where your passive losses exceeded your passive income, so you couldn’t fully deduct them).

If line 3 is more than zero—that is, if you did not incur a loss from passive activities this year—then you are done filling out the form.

If line 3 is less than zero, you incurred a loss. Depending on whether your losses came from real estate activities, non-real estate activities, or both types of activity, you may skip ahead to the next section (for passive real estate losses) or line 10 (for passive non-real estate losses).

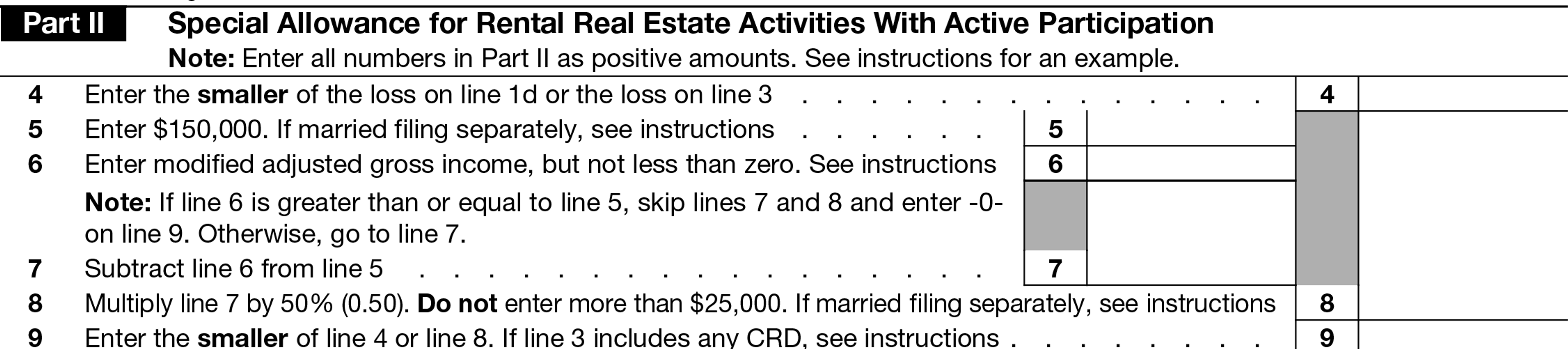

Form 8582, Part II

Part II of Form 8582 is where you calculate allowed losses from passive real estate activity.

To calculate this, you subtract your modified adjusted gross income (MAGI) from $150,000 and multiply the result by 50 percent. If this amount is less than your total losses from passive real estate activity, enter it on line 9.

Otherwise, enter your loss from line 1d or line 3 on line 9.

Certain factors come into play if you are married and filing separately, or if you took advantage of CRD to reduce your taxable income from passive real estate activities. In that case, refer to the IRS instructions.

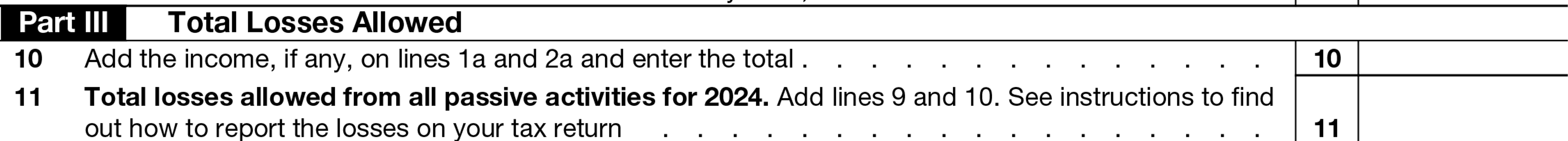

Form 8582, Part III

Part III of Form 8582 is where you calculate the total amount you are able to deduct from your passive income based on your passive activity losses.

To do this, enter your combined income from all passive activities on line 10. Then add to this amount your total losses as reported on line 9.

Form 8582, Parts IV and V

Parts IV and V of Form 8582 are where you list your net income and net loss from each passive activity you undertook over the course of the year. Part IV is for real estate activities and Part V is for non-real estate activities.

You factor in unallowed losses carried forward from past years when making these calculations.

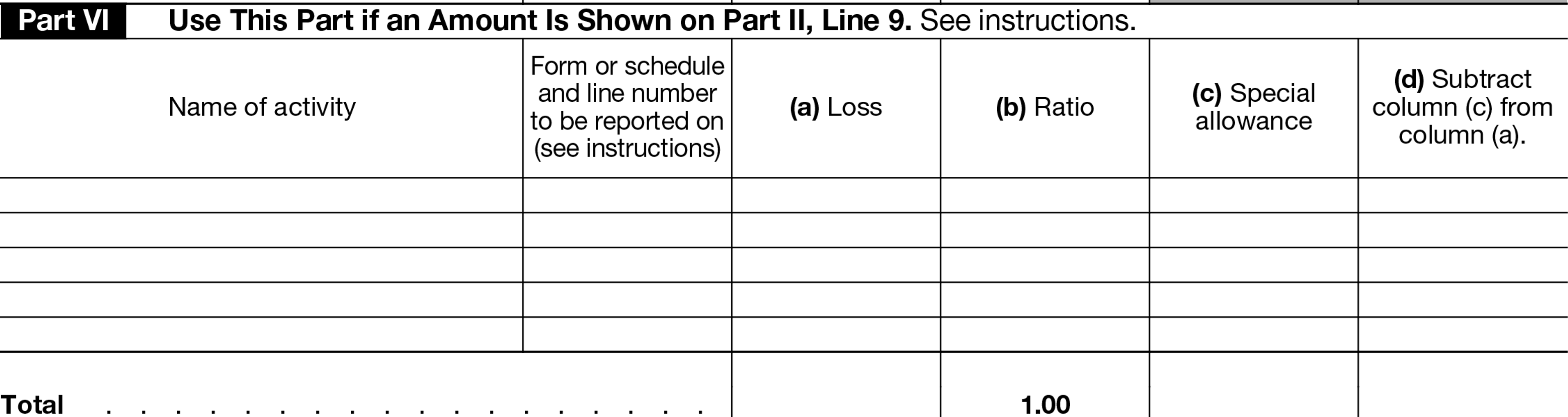

Form 8582, Part VI

Part VI of Form 8582 is where you allocate the net loss reported on line 9 of Part II to your rental real estate activities, but only if you included past year unallowed CRD in the net loss calculation. This only applies to some farmers. For a detailed breakdown, see the IRS instructions.

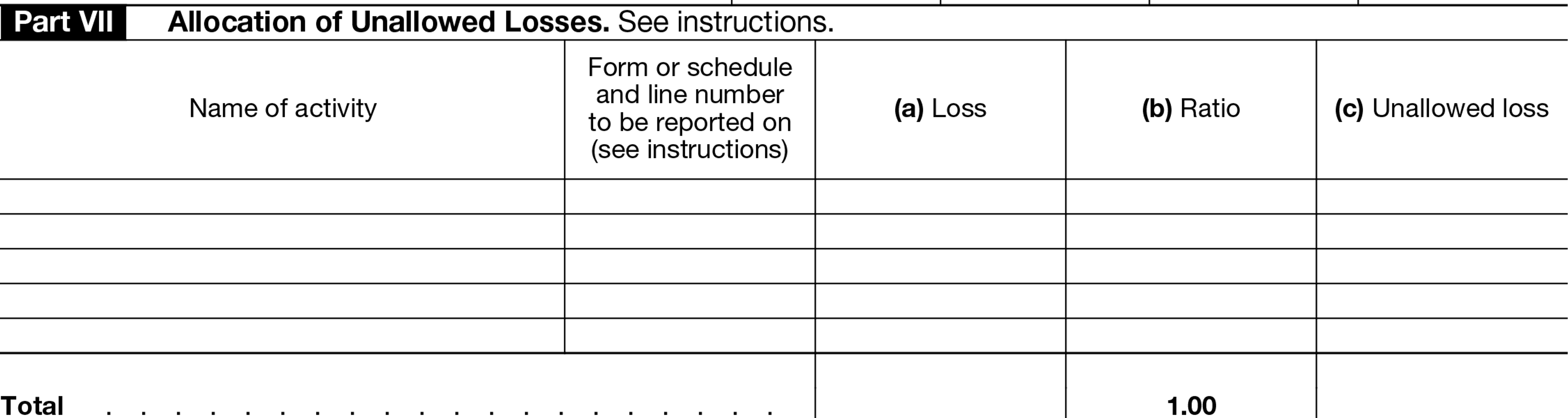

Form 8582, Part VII

Part VII of Form 8582 is where you allocate net losses reported in column (e) of Part V. These are losses from non-real estate activities.

First, enter the name of the form or schedule where the losses are reported. Then enter the amount of the loss (column (a)) and its ratio (column (b)). The ratio of a loss is what percentage of your total losses it makes up. For instance, if the first activity you list in Part VII counted for 25% of your losses, enter 0.25 in column (b).

Column (c) is where you list unallowed losses carried forward from prior years.

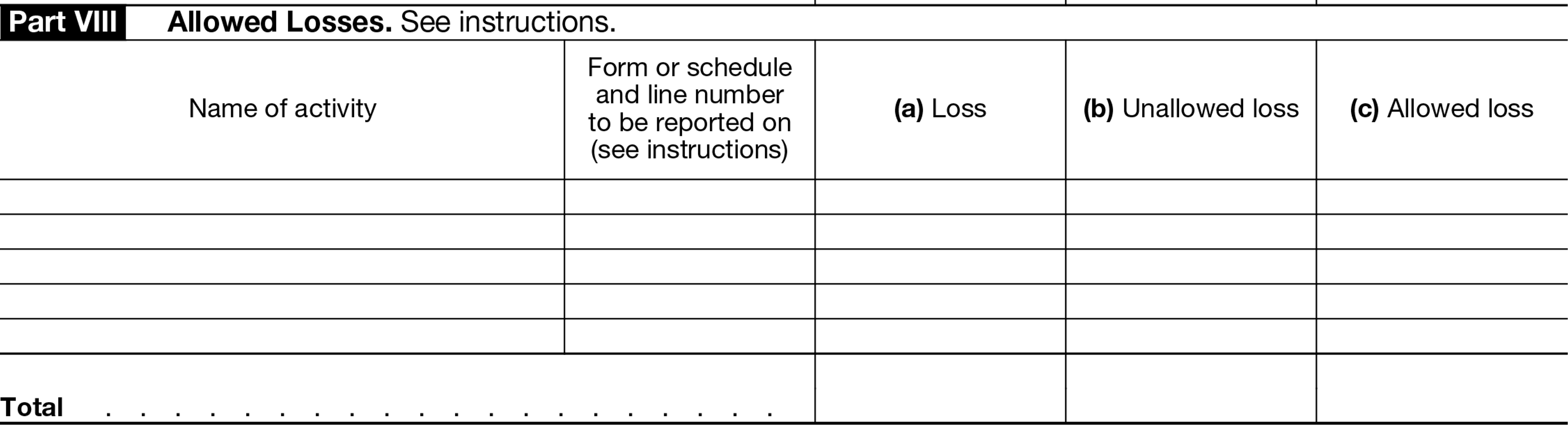

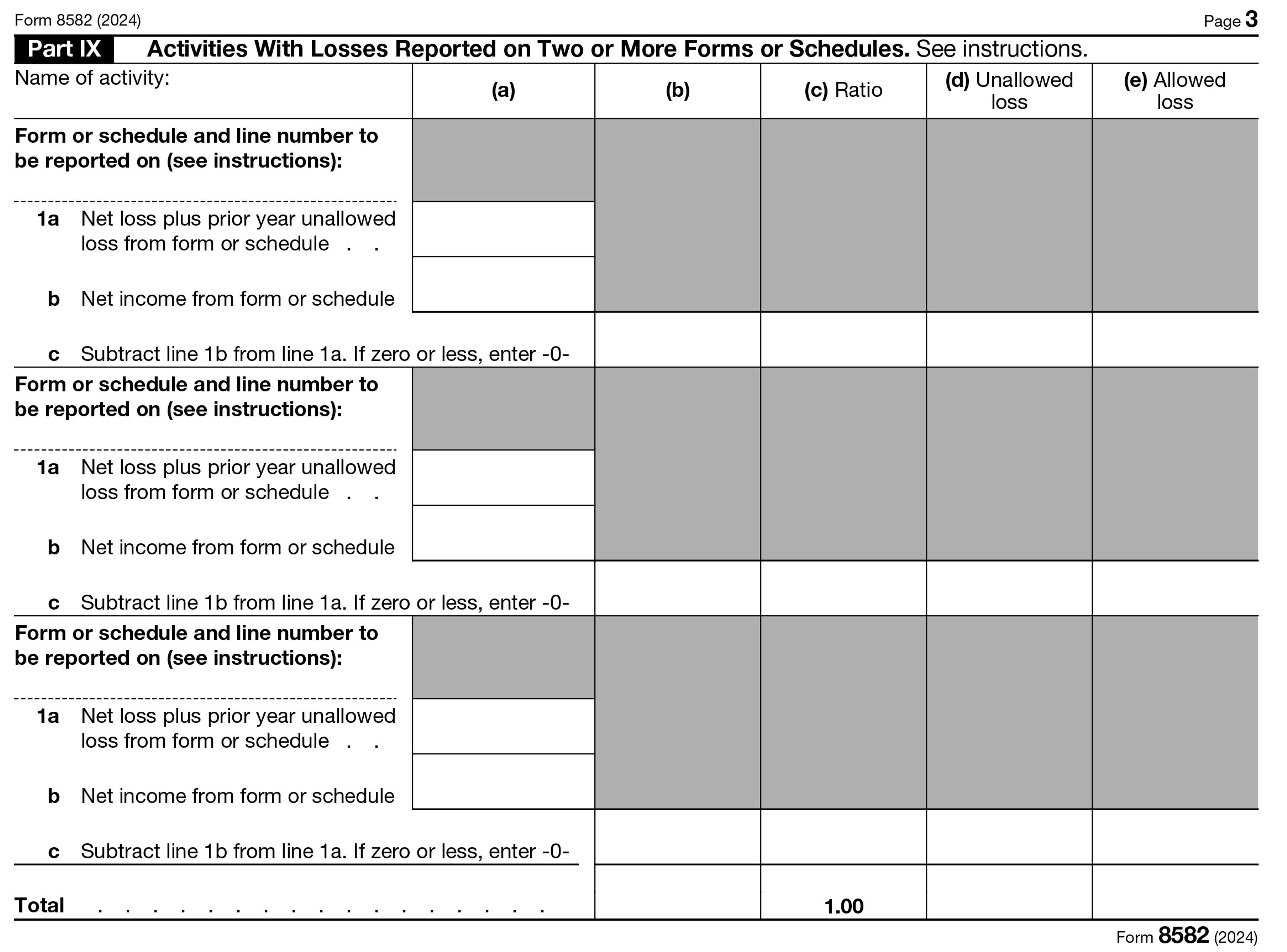

Form 8582, Parts VIII and IX

Parts VIII and IX of Form 8582 are where you calculate unallowed losses from passive activities. For losses reported on a single form or schedule, use Part VIII. For losses reported on one or more forms or schedules, use Part IX.

How to file Form 8582 for farmers

Form 8582 is due on the same date as the rest of your tax return. For individuals and sole proprietors, that date is April 15th. (If April 15th falls on a weekend or holiday, the filing deadline is the next business day.)

You can file Form 8582 by mail or online with IRS eFile.

At a loss when it comes to finances? Ambrook can help.

Ambrook is the complete bookkeeping solution for your farm or ranch. With Ambrook, every transaction is automatically imported from your bank account and categorized by bookkeeping professionals. That makes it easy, at the end of the year, to calculate income and losses from all your farming and rental activities—both passive and nonpassive.

Plus, with time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make expense and revenue tracking simple: it takes the guesswork out of running your business.

Want to learn more? Start your 7 day free trial today.

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.