If you sell commodity futures to protect crop earnings, you’ll likely receive a copy of Form 1099-B from your broker. Here’s how it works and what it means for your tax bill.

If you buy or sell commodity futures or options, your broker will send you a copy of Form 1099-B after the end of the calendar year.

Form 1099-B records your earnings and losses from futures contracts, which is information you’ll need to complete your tax return.

Importantly, Form 1099-B includes a section reporting formal barter exchanges. These are different from regular barter exchanges—for instance, trading livestock or equipment with other ag producers—that are reported with a different form.

Here is what you need to know to read and understand Form 1099-B and use it to file your taxes accurately and on time.

What is Form 1099-B?

Form 1099-B reports all your securities, commodity futures, options, and barter exchanges for the year. On Form 1099-B, you’ll find:

Each trade carried out over the course of the year

The dates of the contracts (when they were opened and closed)

Gross proceeds from each trade

The cost basis of each trade

Gains or losses incurred by trading

Form 1099-B is an information return—the broker prepares it in order to provide information on your trading activity to relevant parties. That means there are multiple copies of the form:

Copy A goes to the IRS. The IRS checks the data against the information you report to make sure your tax return is accurate.

Copy B goes to you. You use it to calculate taxes you owe on gains from trading. You may need to attach a copy to your federal tax return if there is any federal income tax withheld in Box 4.

Copy 1 goes to your state’s Department of Revenue. Not every state requires this copy. Those that do use it to check the information on your state tax return.

Copy 2 goes to you. You may need to attach a copy to your state return if there is any state tax withheld in Box 16.

The broker’s copy is retained by the broker for their records.

Which kind of barter goes on which form? Form 1099-B vs. 1099-MISC

The barter exchanges reported on Form 1099-B are a different type from those reported with Form 1099-MISC.

Form 1099-B reports formal barter exchanges only. These are trades made on regulated exchanges, such as the Chicago Mercantile Exchange (CME) Group or the Minneapolis Grain Exchange (MGEX).

Form 1099-MISC, on the other hand, reports regular barter exchanges.

For instance, if you traded a bull for your neighbor’s old round baler, you would give your neighbor a Form 1099-MISC reporting the value of the bull, and your neighbor would give you a Form 1099-MISC reporting the value of the baler.

Rule of thumb: if there is no regulated exchange involved—and no broker—then you should use Form 1099-MISC. If you’re trading on a regulated exchange, you will receive a Form 1099-B from your broker.

Form 1099-B vs. Form 6781

Ag producers new to trading commodities also often get confused about the difference between Form 1099-B and Form 6781.

Form 1099-B reports all trades for the year. It includes the raw data you need to calculate your taxable income.

Form 6781 uses the data from Form 1099-B to calculate your taxable income from gains and losses reported on Form 1099-B. You then report that taxable income on Form 1040, Schedule D, Capital Gains and Losses.

To make things slightly more complicated, if you exclusively make formal barter exchanges for the purposes of hedging, you do not need to file Form 6781. Instead, you elect hedging treatment under IRS rules and report the income as regular income on Form 1040, Schedule F, Profit or Loss from Farming.

Hedging vs. speculating

Form 1099-B income is treated differently for tax purposes depending on whether it is earned from hedging or from speculating.

When you hedge, you sell futures to protect earnings on your crop from potential price drops (taking a ‘short position’), or buy futures to reduce input cost (e.g. buying diesel futures to lock in fuel prices, taking the ‘long position’).

For instance, you might sell canola futures early in the growing season to lock in the current price of canola. Then you sell the futures later, after canola commodity prices have dropped; your earnings from the sale offset reduced sale value of your crop.

When you speculate, you buy or sell futures based on how you expect the market to behave. The futures you buy and sell have no connection to any crop you are actually producing that year. Futures and options traded in for the purpose of speculating are sometimes called Section 1256 contracts.

The 60/40 rule

Profits from speculating are taxed according to the 60/40 rule:

60% of your total revenue is taxed as long-term capital gains

40% is taxed as short-term capital gains, i.e., ordinary income

This can benefit your agricultural operation. Rather than taxing 100% of your earnings at your income tax rate, just 40% is taxed as regular income, while 60% is taxed as long-term capital gains at a rate of 0%, 15%, or 20%, depending on your overall taxable income. As a result, there’s a good chance you end up paying a lower tax bill than you would otherwise.

The 60/40 rule applies no matter how long you hold the futures for.

How to elect hedging treatment based on Form 1099-B

To elect to have a formal barter exchange reported on Form 1099-B treated as a hedge for tax purposes, you must:

Document details of the trade at or before the trade date

Keep records of broker confirmations of the purchase and the sale

Keep crop and production input records

Report the gain or loss on Schedule F of Form 1040, as regular income

1. Details of the trade

Produce a document recording the details of the trade that includes:

The date and time of the trade

A description of the contract (whether futures or options)

The purpose of the trade (reducing risk for a specific crop or livestock, or the cost of specific inputs like fuel)

Connect it to your underlying exposure (estimated quantity and production costs for the crop year)

2. Broker confirmations

Each time you enter, modify, or close a futures position, your broker issues a confirmation including the details of the trade. You then enter the information in your hedge log, for tracking purposes.

It’s important to keep all broker confirmations on file for at least seven years from the date you file your return, or the due date, whichever is later. That’s the extended statute of limitations on IRS audits. However, if you don’t file a return for that year—which might be the case if you didn’t have enough income to require filing—there is no time limit and you should keep the records indefinitely. A broker confirmation serves as official proof that you made a trade.

3. Crop and production input records

Keeping records of your crop production and the cost of inputs proves that hedges you make are tied to a material business risk. They’re proof that you’ve actually produced the commodity you hedged.

For crops, that means keeping records of acres planted, type of crop, the total expected production, the dates of planting and harvest, and the cost of production (seed, fertilizer, fuel, etc.)

For livestock, you should also include a livestock inventory.

You’ll use this information to match your hedge to your actual production when you file Schedule F of Form 1040.

4. Underlying exposure

When you or your accountant fill out Schedule F, you match your hedge to your underlying exposure—that is, the actual production of the crop.

To do that, you enter your gains or losses from both the hedge and the crop you produced on Schedule F.

You must also provide documentation:

The hedge designation you prepared

Broker confirmations

Crop and production records

You may also provide a copy of your hedge log, although it’s not strictly required.

Does Form 1099-B affect my tax return?

Form 1099-B does not determine your tax liability, but it does give you the information you need to accurately report your income and calculate your tax liability.

How that plays out on your tax return depends on whether your gains or losses are a result of hedging or speculation.

For hedging gains and losses, take the amounts reported on Form 1099-B and enter them on Form 1040, Schedule F as regular farm income. Include supporting documents.

For gains and losses from speculation, take the amounts reported on Form 1099-B and enter them in Part I of Form 6781 (“Section 1256 Contracts Marked to Market”).

How to read Form 1099-B

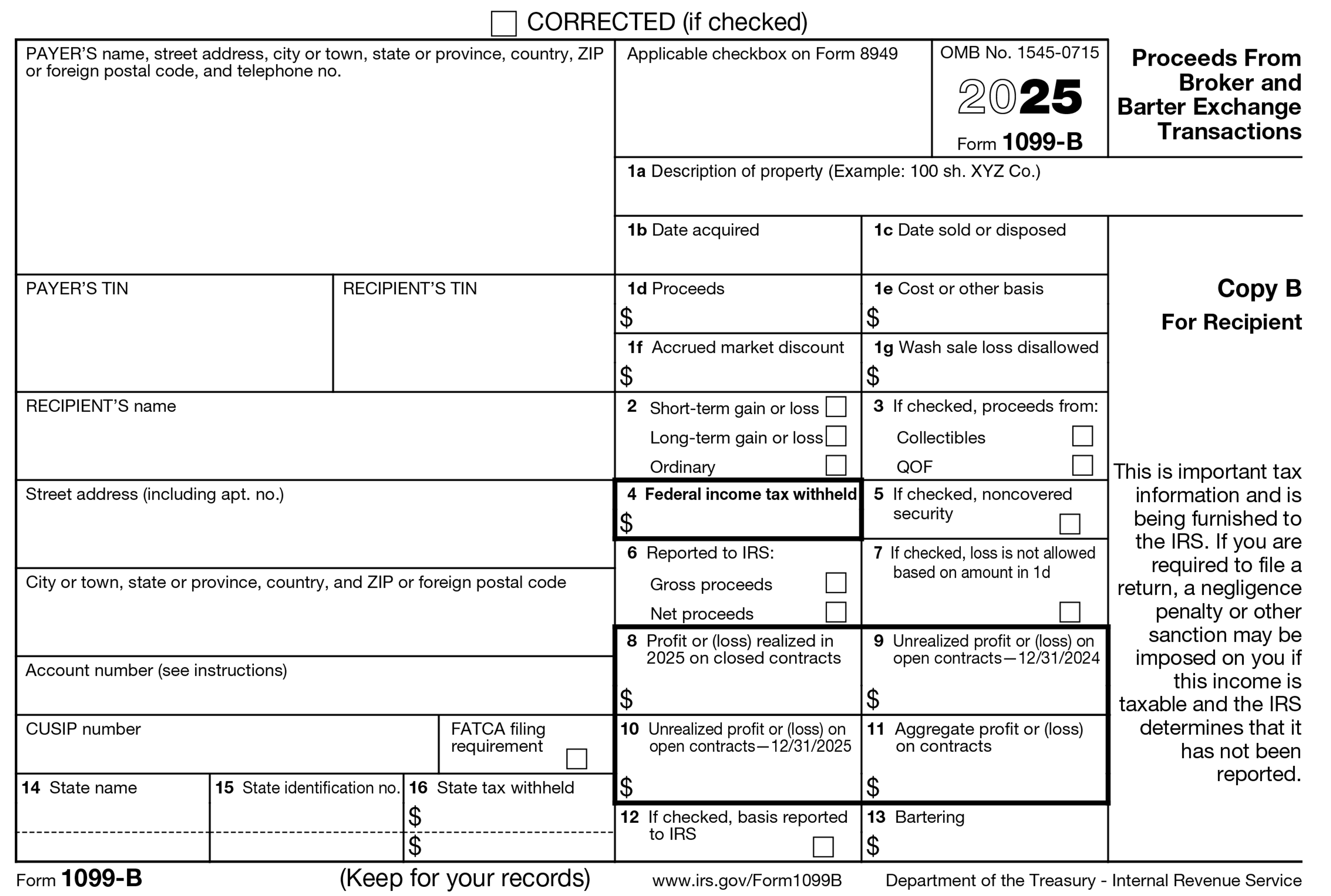

Your broker completes and submits Form 1099-B.

Here is what the copy you receive looks like:

Some important points:

The PAYER is your broker, or whoever sent you Form 1099-B

The RECIPIENT is you

The account number is the number used for trading on the relevant exchange

The CUSIP number identifies the commodities traded

“Applicable checkbox on Form 8949” indicates the checkbox you or your accountant should select when filling out Form 8949 (reporting the sale of capital assets) and Schedule D of Form 1040 (capital gains and losses).

Box 1a reports the type of property, e.g. ‘2026 Corn Futures’.

Box 1b reports the date you acquired the contract.

Box 1c reports the date you sold the contract.

Box 1d reports your proceeds from the sale.

Box 1e reports the original cost of the contract when you purchased it. If the asset was a noncovered security (see box 5), your broker will leave this line blank. You should use your own records to calculate gains from the sale.

Box 1f reports the accrued market discount, and applies only to discount bonds.

Box 1g has to do with wash sales of stock or securities, and does not apply to commodity futures and options.

Box 2 is where your broker indicates how your earnings or loss should be taxed.

Box 3 has to do with QOFs, and does not apply to commodity futures and options.

Box 4 reports backup withholding by the payer. If you did not provide the payer with your tax identification number (TIN), they are required to backup withhold, remitting a portion of your proceeds to the IRS.

Box 5, if checked, indicates that the trade was a noncovered security. Under IRS rules, brokers are not required to report the cost basis (purchase price) of noncovered securities, only the gross proceeds from the sale. It is up to you to use your own records to calculate gains.

Box 6 indicates whether the broker is reporting gross proceeds (the total amount of the sale) or net proceeds (the total amount minus commissions and transaction costs) to the IRS.

Box 7 has to do with wash sales of stock or securities, and does not apply to Section 1256 contracts.

Box 8 reports your total gain or loss from contracts closed in the current year. This is the amount you carry over to Form 1040, Schedule F (when hedging) or Form 6781 (when speculating).

Box 9 reports unrealized gain or loss on contracts that have not been closed by the end of the year. Add this to the amount in box 8 when calculating your total gain on Form 6781.

Box 10 reports unrealized profit or loss on contracts from prior years that have remained open. Add the amounts in box 8 and box 9, and then subtract the amount in box 10, to calculate your total tax liability on Form 6781.

Box 11 reports unrealized gain on contracts that remain open at the close of the year. Even though you have not closed these contracts, you must calculate their market-to-market value—the difference between their cost basis (original price) and their price on the market if you were to sell them now.

Box 12, if checked, indicates that the broker reported the cost basis of the contract to the IRS (i.e., it is not a noncovered security).

Box 13 reports gains from barter exchanges. These are different from normal barter exchanges reported on Form 1099-MISC; to qualify, the trade must take place through a regulated exchange.

Boxes 14, 15, and 16 report state tax withholdings from proceeds in states where brokers are required to withhold taxes. These withholdings are credited against your state taxes, not your federal taxes.

Do you need to file Form 1099-B?

No, you do not need to file Form 1099-B.

Form 1099-B is an information return. Your broker uses it to report your hedging and speculating proceeds to the IRS and (where applicable) state tax authorities. They also send a copy to you, so you can use the information to calculate your tax liability.

However, you should keep all Form 1099-Bs on file, along with broker confirmations, hedging logs, and your own details for each trade. You may need this information in case of an audit.

Ambrook is an investment in your ag operation’s future

Ambrook is a complete financial platform for your agricultural operation. With Ambrook, you get a complete set of books and detailed financial insights—giving you the information you need to plan and prepare for your operation’s future.

With time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

Want to learn more about Ambrook?

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.