Understand and accurately report farming income and expenses on Schedule F for optimal tax planning.

Between determining who is and isn’t a farmer for tax purposes and navigating complicated tax deductions and benefits, figuring out your tax bill as a farmer isn’t easy.

Even something as seemingly simple as figuring your taxable income can be difficult for cash basis farmers, because transaction records don’t always tell the full story. Not all money coming in during the year is taxable income, and not all of the taxes a farmer pays will necessarily have a corresponding cash inflow.

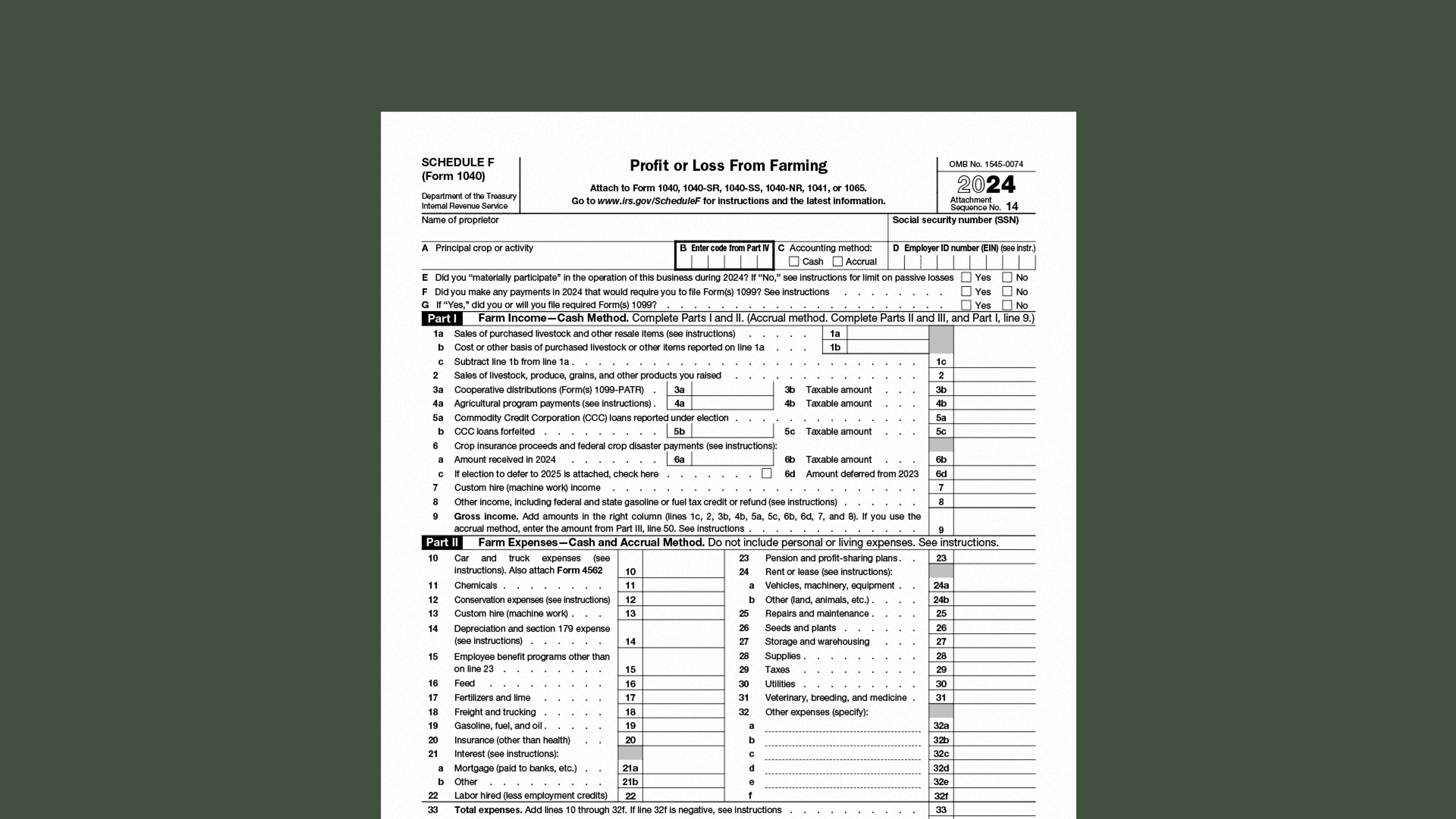

That’s why Schedule F (Form 1040), Profit or Loss From Farming is so crucial: farmers use it to report and calculate their profit (or loss) from farming activities, which is subject to regular and self-employment taxes.

Who must file Schedule F?

You’ll use Schedule F if your farm business is structured as a sole proprietorship, LLC, or partnership. However, if your farm is incorporated, you’ll report farm income and expenses on Form 1120 or 1120-S.

What kind of income is reported on Schedule F?

Farmers use Part I of Schedule F to report income earned by their core farming business. It’s also where they report other sources of farming-related income, like payments from government programs, insurance payments, cooperative distributions, and miscellaneous income.

Line 1: Sales of purchased livestock and other resale items

Income from the sale of any livestock purchased for resale by a farmer or rancher should be recorded on line 1a. The original purchase price (or ‘cost basis’) of that livestock is entered on 1b, which is then subtracted from 1a to calculate gross income.

The amount on line 1b should include any expenses incurred in delivering the animal and completing the purchase, like trucking and transportation costs. It must not, however, include regular expenses involved in raising the animal like feed and hay. Those expenses should be recorded in Part II of Schedule F instead.

Note on reporting income from livestock purchased for resale

Sometimes it can be confusing when an animal is purchased in one tax year and then sold in another, and a common resulting mistake is to deduct the purchase price of the animal in the year that it’s purchased, rather than the year that it’s sold.

Remember: the expense involved in acquiring the animal must be carried over until the year that it’s sold. Only perform the calculation above for animals that were sold in the current tax year.

Line 2: Sales of livestock, produce, grains, and other products

This is usually the primary source of income for the business, and includes cash from the sale of any agricultural commodities raised or cultivated on the farm, including wheat, corn and canola, fruits and vegetables, hay, milk, eggs, farmed fish, market calves and market feeder pigs. It does not, however, include:

Income from the sale of assets like breeding, dairy, or draft animals, which is reported on Form 4797 instead

Income from products that are processed in any way, like wine, juices, cheeses, jams, and meat, which is reported on Schedule C (Form 1040) instead

Line 3: Cooperative distributions

Some farms belong to cooperatives that help market their products and procure important inputs like fertilizer and seed. When a cooperative distributes profits to its members in the form of a patronage dividend (sometimes also called a ‘patronage refund’) or a per-unit allocation, farmers should record those payments on line 3a.

Line 4: Agricultural program payments

Line 4a is used to report any payments received from federal, state, and municipal government agencies. Some common examples include USDA grant payments and payments from state Natural Resources and Environment Department programs.

Tax Tip: Ambrook’s Farm Funding Library makes it easy to discover new funding opportunities your farming business might be eligible for.

Line 5: Commodity Credit Corporation (CCC) loans

CCC loans provide farmers with cash flow in times when crop prices are low and it’s less advantageous to sell. But they’re also unique from a tax perspective: farmers can either treat them like any other loan, or elect to report them as taxable income, usually to avoid large spikes in taxable income when crops are sold in later years. Farmers that elect to report their CCC loans as income under Section 77 record those payments on line 5a.

Line 6: Crop insurance and federal disaster payments

Farmers must generally report crop insurance and federal disaster payments in the year that they’re received on line 6a. In some cases, however, farmers can postpone recognizing this income under Section 451F for one year, but only if they would have sold their crop the following year.

Line 7: Custom hire (machine work) income

Custom hire or ‘machine work’ refers to any work a farmer does for someone else – neighbors, other farmers, government agencies – using farm equipment, like baling hay, towing, construction, and landscaping.

If this work makes up only a small part of their overall farming operation, income from this work is reported on line 7. If this work is a separate business – for example, if it makes up more than half the farmer’s income – that income should be reported on Schedule C (Form 1040) instead. (Remember that this might result in the loss of some tax benefits that only apply to farming income.)

Line 8: Other income

Farmers use line 8 to report any income related to their business that doesn’t easily fit into any of the categories above, including:

State and federal fuel or gasoline credits

Income from line 3 of Form 6478, Biofuel Producer Credit

Barter income, which is the fair market value (FMV) of the labor and/or property a farmer receives from someone else in exchange for their own labor or property

Refunds and reimbursements for expenses deducted on a previous year’s tax return

Canceled or forgiven debts

Breeding fees

Fees from renting farm machinery

The IRS includes a longer list of examples in the instructions to Schedule F.

Supercharge Your Farm Tax Planning with Ambrook

Ambrook’s category tags correspond directly to each line on Schedule F, making it easy to compare your tax return to your records and saving you hours of work during tax season.

With time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make filing your taxes easy: it takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.