Go into tax season with confidence knowing which forms you need for your farm

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.

Farm tax and bookkeeping are a special breed compared to other businesses. They often involve multiple sources of income and expenses and include eligibility for various benefits and deductions. And we all know year-end filing can be a headache even with the best farm accounting done over the past 12 months.

Whether you hire a tax accountant or not, you will need to do the legwork to ensure they have all the necessary farm tax forms and additional information to file accurately by April 15. This guide will give you the rundown of what forms you need and the information to complete them properly.

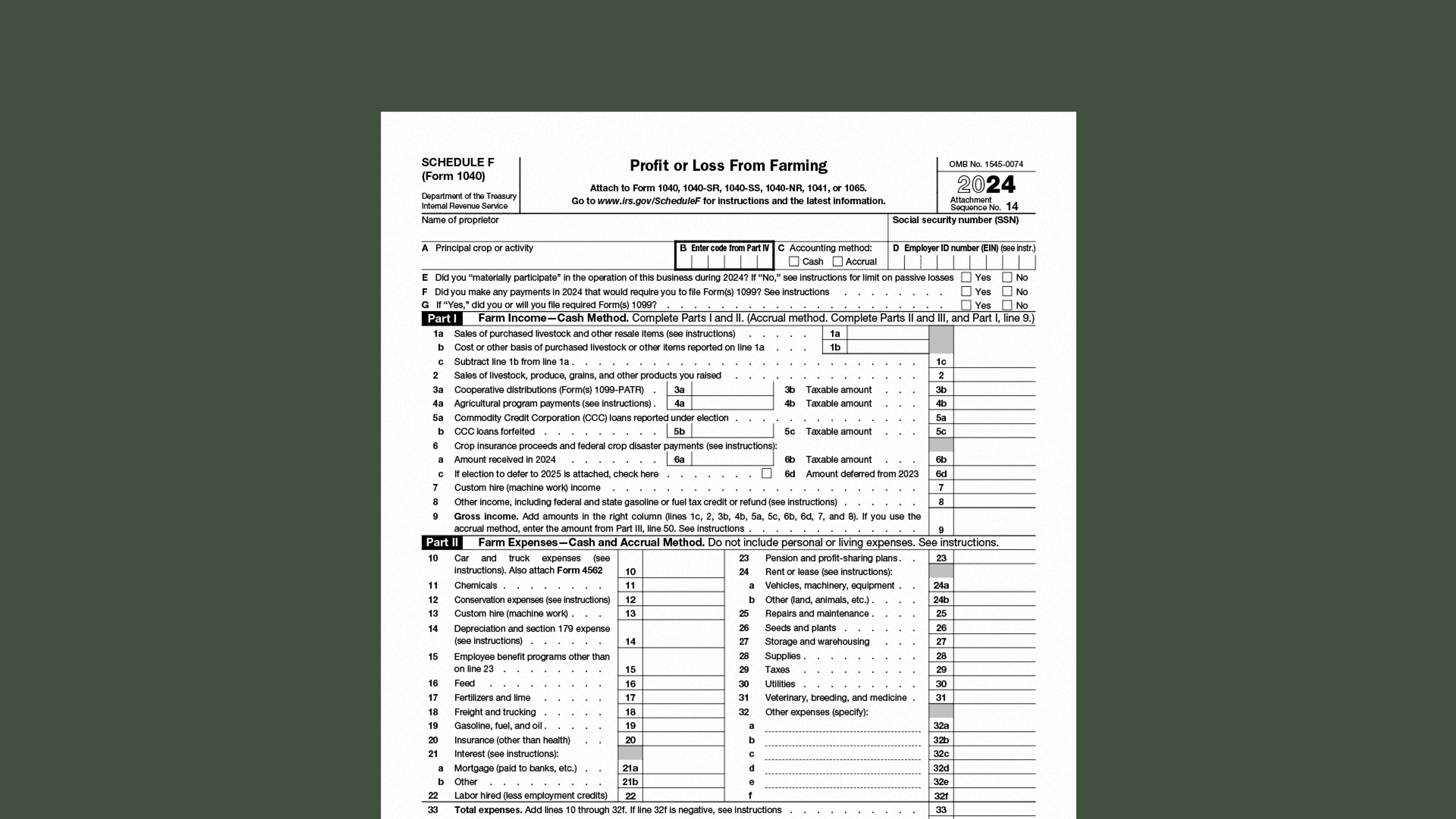

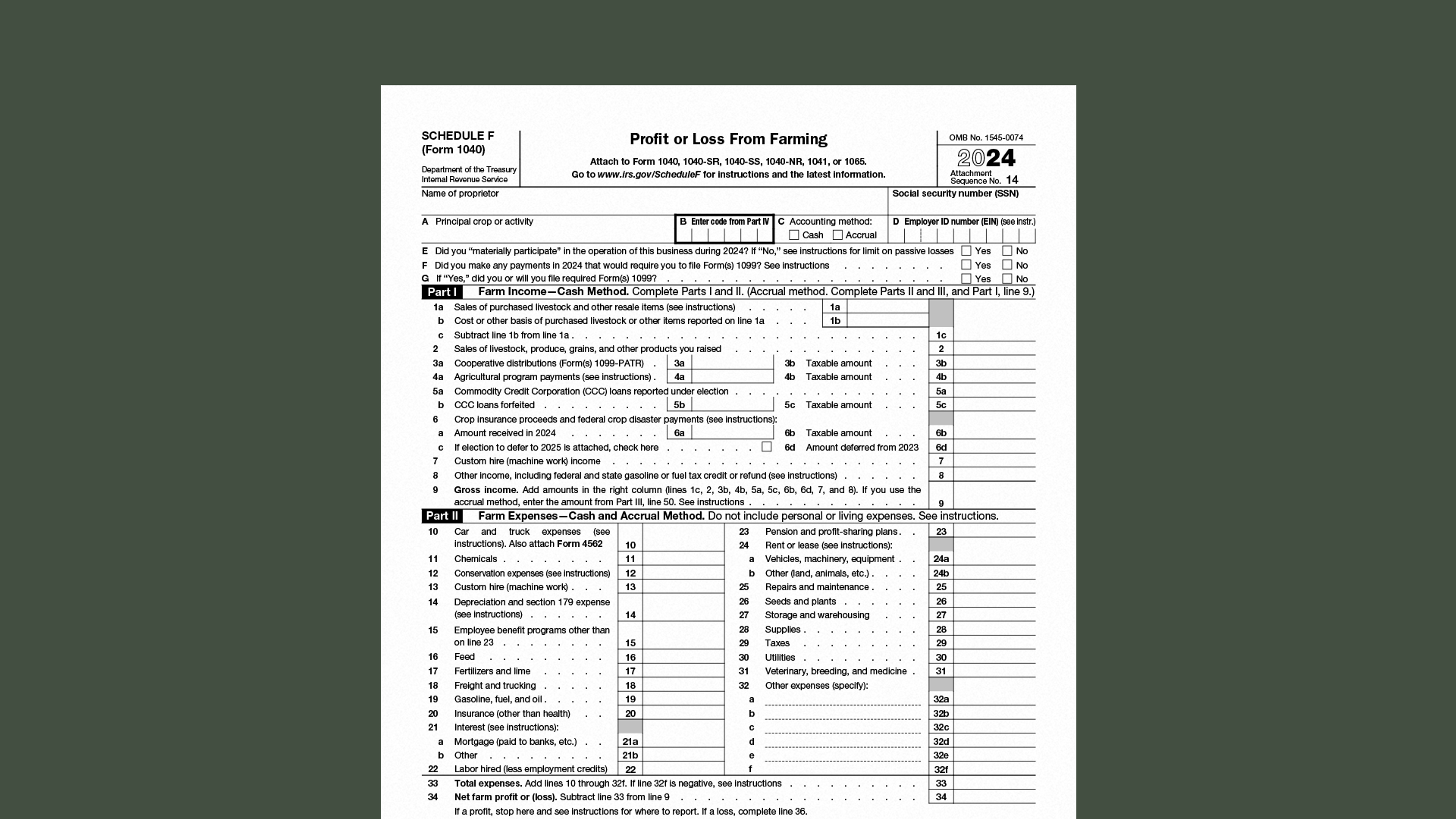

The home base: Schedule F (Form 1040)

Schedule F (Form 1040) is the bedrock of most farm tax returns and the quintessential starting point for reporting income and expenses. This form is where you report any sales of farm products from crops to livestock.

You’ll use Schedule F if your farm business is structured as a sole proprietorship, LLC, or partnership. However, if your farm is incorporated, you’ll report farm income and expenses on Form 1120 or 1120-S.

The form works for both cash and accrual farm accounting methods. However, before you can complete Schedule F, you’ll have to prepare supporting reports, such as profit and loss statements, expense records, and receipts.

The 2024 Schedule F (Form 1040) Link

What income gets listed

Income from selling anything you raised on-farm, like fruits, vegetables, or grains, belongs on Form 1040. It can even include non-cash equivalents of the fair market value of any bartered goods or services you trade for your produce.

The net profit of livestock and other goods purchased for resale are also documented as income – animals like feeder pigs and calves are a great example.

Keeping tabs on expenses

Schedule F isn’t just about the income your farm generates; it’s also where you tally up all costs associated with running your operation. These expenses directly reduce your taxable income – and put more green back in your wallet by enhancing tax deductions.

Some of the most common expenses in your farm accounting should include things like:

Seeds, fertilizer, and young plants

Costs of all farm-related repairs, maintenance, and shop tools

Interest paid on farm loans used for operational purposes

Property taxes on farmland and any business-related licenses or permits

Don’t forget those special cases

Prepaid expenses are a fact of farming, but they are subject to some additional accounting rules by the IRS. For example, the deduction for prepaid is capped at 50% of all other deductible farm expenses for that tax year. The remainder can be deducted in the next tax year.

It’s worth noting that there are some exceptions to this rule. If your prepaid expenses exceed 50% of all your other tax-deductible expenses because of a change in business operations caused by unusual circumstances, or your total prepaid farm expenses for the past three years was less than 50% of your total other deductible expenses for those years, you can deduct the full amount of your prepaid expenses the same year you purchased it.

Exemptions for Form 1040

Your Form 1040 has a handful of important exemptions. These are mainly long-term assets and goods you might sell unexpectedly due to an emergency weather event.

Land, buildings, major equipment, and breeding, sport, and dairy livestock are considered long-term assets and sales are reported on Form 4797.

In the case of unforeseen weather events like droughts or floods where you might be forced to sell livestock earlier than usual, you can postpone reporting the gain from these sales until the following year under specific circumstances.

Remember, most farms use the cash method of accounting, meaning you report income on Schedule F in the year you receive payment, not necessarily when you harvest or sell your products. This is important for farm businesses with staggered income streams.

Because this form can be a bear to tackle, you want it to be as clean-cut and well done as soon as possible before handing it off to your tax accountant.

Read more: Reporting Income on Schedule F (Form 1040), Profit or Loss From Farming

Additional farm tax forms you should know

The additional forms you need outside the standard Schedule F will vary greatly depending on your unique farm accounting situation. IRS Publication 225: The Farmer’s Tax Guide will be your friend and keystone for evaluating the needs of your specific farm. Likewise, it’s also worth referencing this guide one last time before handing off anything to your tax accountant.

Form 943 (Employer’s Annual Tax Return for Agricultural Employees)

You would file this form if you paid wages to any farm workers who were “subject to Social Security and Medicare taxes or federal income tax withholding.”

It includes:

Detailed wage information of qualified workers

Taxes withheld

Adjustments and totals before adjustments

Total deposits

Total taxes after adjustments

Nonrefundable credits

Balance due

Form 4797 (Sales of Business Property)

This form is used to report the sale or exchange of business property, involuntary conversions from sources other than casualty or theft, and other transactions involving business property. It calculates the gain or loss of such transactions and reports the net gain or loss on the return.

The Ambrook Profit & Loss statements support guide can be a helpful reference if you qualify for this form as you calculate details like:

The property sold or exchanged (description, date acquired, date sold, and gross sales price)

Cost or other basis of the property and any depreciation or amortization

Transaction profit or loss

Schedule J – Income Averaging for Farmers and Fishermen (Form 1040 or 1040-SR)

Schedule J is used to elect income averaging. This allows you to preemptively calculate income tax by averaging the current year’s taxable income from farming over the previous three years. Using this form can lower your tax burden if a current year’s income is significantly higher than in the past three years. To file this form, you’ll need your current year’s taxable income, income from the past three years, and all relevant farm tax documents.

Form 2210-F (Underpayment of Estimated Tax By Farmers and Fishermen)

If you owe a penalty for underpayment of estimated tax, this is the form you will be filing. Form 2210-F helps calculate the penalty based on estimated tax payments made during the year in relation to required payments (failure to pay at least two-thirds of total tax liability for the current year or 100% of the tax liability for the previous year by the deadline).

Bringing everything together

Navigating the farm tax landscape requires careful attention to detail. It requires a solid understanding of IRS forms and why they are used. When you are familiar with the tax process, it will be far less painful to file taxes and help you develop a collaborative relationship with your banker and your tax accountant.

Remember that you will also need to keep records to support the information you report on your tax return for at least three years from when your tax return was due or filed, whichever is later. Some records may need to be kept for longer periods, so if in doubt, check with your accountant before cleaning your office.

Ultimately, you are the one who is responsible for what is filed on your tax return, even if you use an accountant. Because of this, it’s in your best interest to maintain and organize all your on-farm documentation and become familiar with the tax process.