The hobby rules can be tricky to parse for ag producers, particularly if your operation is new and still getting off the ground. Here’s what you need to know.

The hobby loss rules could prevent you from deducting business expenses from your income. They come into effect if the IRS determines that your business is a hobby and therefore not eligible for business deductions.

The most common reason the IRS treats a business as a hobby for tax purposes is lack of profit.

As an ag producer, that might be causing you some anxiety—particularly if your operation is new and just getting off the ground. You may not be reporting a profit from one year to the next—so, is the IRS going to swoop in and declare your business deductions invalid?

Probably not. As a new business owner, there are steps you can take to avoid falling victim to hobby loss rules. Here’s what you need to know.

What are the hobby loss rules?

The IRS only wants individuals deducting business expenses from their income if they run businesses. Some people earn self-employment income from non-business activities. In the eyes of the IRS, those activities are hobbies, not businesses.

Hobby loss rules are covered by IRC Section 183.

Prior to 2018, hobbyists could deduct the costs of their activities as Miscellaneous Deductions on their itemized personal tax returns. The Tax Cuts and Jobs Act eliminated that option for tax years 2018 through 2025, and the One Big Beautiful Bill Act (OBBBA) made the suspension permanent. Now, if you earn revenue from a hobby, you are required to report the revenue, but you can’t deduct the expenses.

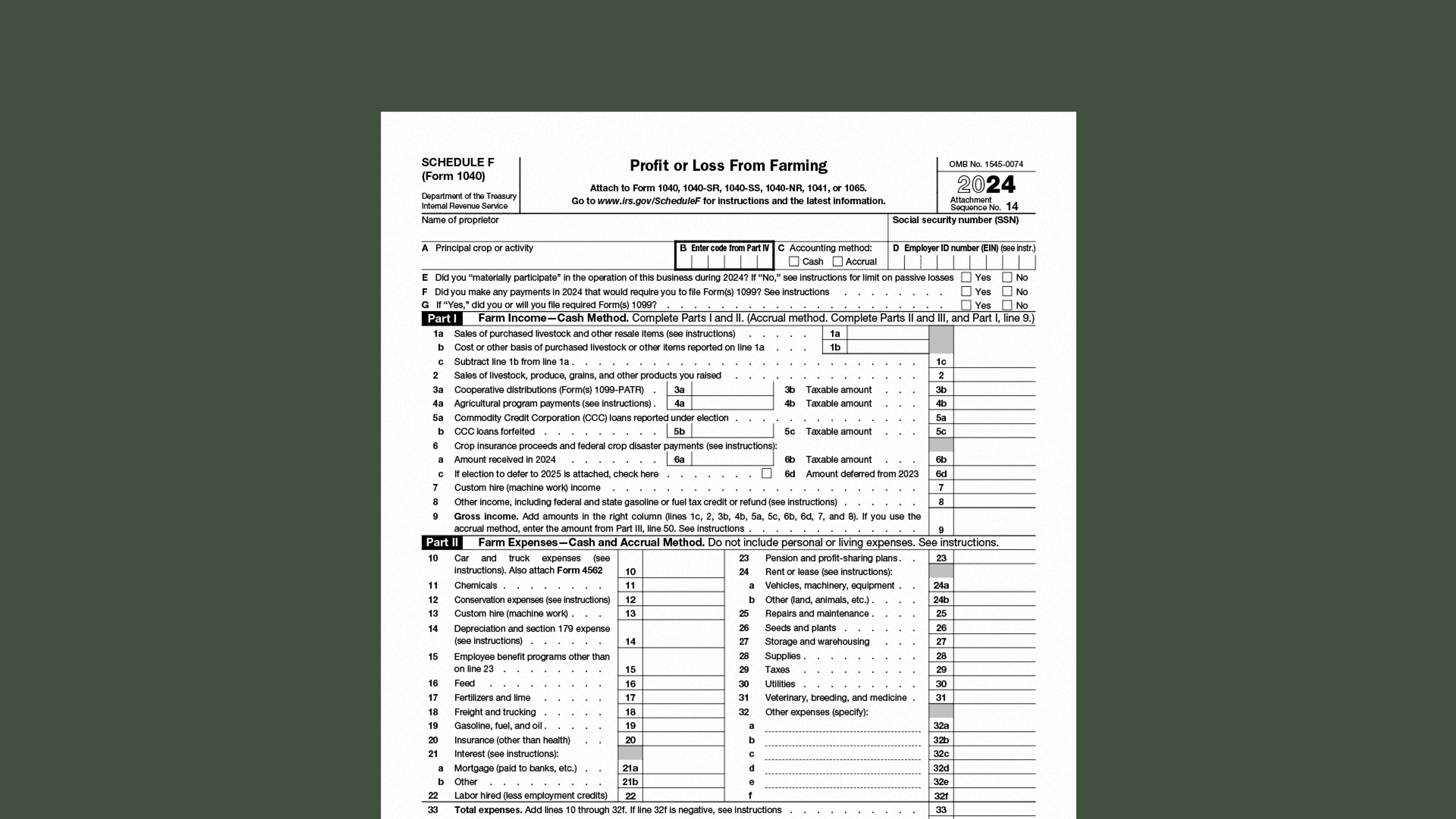

Contrast this with a business. If you run a business, you are required to report your revenue. But most of the expenses you incur in the course of earning that revenue may be deducted on Schedule C of your tax return (producing your net profit or taxable income).

If you deduct business expenses on your tax return and the IRS determines, after the fact, that your business is actually a hobby, you’re required to pay the difference in tax.

For that reason, if you’re an ag producer, it’s important to make sure the IRS sees your operation as a business and not a hobby.

How does the IRS determine whether an ag operation is for-profit?

For your ag operation to qualify as a business, you need to prove to the IRS that your activities are for-profit.

When you deduct business expenses from your taxes, but report a net income of zero, it raises red flags for the IRS. The IRS won’t automatically classify your activities as a hobby, but they will likely investigate your business to determine whether it should be treated as a hobby for tax purposes.

There are nine criteria the IRS considers when determining whether your ag operation is a business:

Operation in a business-like manner. You keep books, save receipts, and make a demonstrable effort to earn an income.

Time and effort. You put significant time and effort into running your ag operation. It’s not just a weekend pastime.

Income dependence. You rely on the income from your operation to cover your living expenses.

The circumstances of your losses. If you report a net income of zero, your losses are due to events not uncommon in agriculture (e.g. commodities market fluctuations, unexpected extra costs) or the start-up phase of an ag operation (e.g. upfront expenses for installing irrigation and fencing, purchasing equipment and livestock, etc.)

Change of farming methods for profitability. You incurred extra expenses changing your operation so you can earn more profit (e.g. clearing more land for pasture).

Knowledge. You (or your mentors or advisors) have the knowledge required to run a profitable ag operation.

Past profit. You have made a profit in the past from different agricultural operations.

Profitable years. Considering your operation’s history as a whole, you have earned profit some years, even if not all years. (The IRS takes into account the amount of your profit in profitable years.)

Profit from appreciation. The assets in your farming activity can reasonably be expected to appreciate in value and earn you a profit in the future.

You do not need to meet all of these criteria in order to qualify as a for-profit enterprise. The IRS takes all the relevant factors into account, and also considers broader circumstances like economic upturns and downturns and the performance of other operations in your region.

So it’s impossible to create a checklist you can follow to make sure your operation qualifies as for-profit. But there are some best practices you can follow to improve your chances.

How can my ag operation qualify as a business?

There are steps you can take to increase the likelihood that, in the event they investigate your ag operation, the IRS will decide it qualifies as a for-profit activity.

Here are some suggestions for meeting each of the nine for-profit criteria covered above.

Operation in a business-like manner. Detailed bookkeeping and recordkeeping go a long way towards proving that you’re operating with the intent to earn a profit. So do outward efforts to sell your product: Keep copies of marketing materials on hand; take note of meetings to negotiate contracts or sales; and maintain signage (where applicable), a website, and a doing business as (DBA) name for your business.

Time and effort. Prepare a work schedule and keep a log sheet tracking your work hours with details on how you spent your time. Track any unpaid labor contributions from friends and family.

Income dependence. Track owner’s draws from your business and keep records. Track household expenses, and be prepared to show how income from your business helps to pay for them.

The circumstances of your losses. Detailed bookkeeping will show losses you incurred running your business. But if you are reporting any unexpected or unusual expenses, make sure you have detailed records on why you had to spend the money. If your revenue decreases significantly, keep notes and records of the reasons why.

Change of farming methods for profitability. If you embark on any business ventures requiring you to pay upfront costs, make sure you have detailed records of all your expenses. You should also prepare financial projections explaining how these investments in your operation will result in greater profitability.

Knowledge. If you don’t have a formal education in agriculture, be prepared to demonstrate your experience and expertise. A resumé showing your history of working in agriculture, as well as any informal training and mentorships you participated in, can help to show you’ve worked actively to develop your skills.

Past profit. If you have run a similar ag operation in the past and turned a profit—or if you have taken on a managerial role in someone else’s operation—then make sure you have documentation to back it up: past tax returns, financial documents, or letters from employers.

Profitable years. Keep detailed financial records, and stay up to date with filing your taxes. If you have made a profit from your operation in the past, be prepared to explain why that was, and why your operation’s profitability has (temporarily) changed.

Profit from appreciation. A detailed and up-to-date inventory, plus financial projections, can demonstrate that your assets will appreciate in value and that they will allow you to earn a profit in the future. Contracts for future sales of crops or livestock are also helpful.

What is the three-year safe harbor rule for hobby losses?

The IRS will only investigate your ag operation for profitability if its records show that you fail to earn a profit. If your business has earned a profit year after year, and then one year it fails to break even, that does not mean that the IRS will investigate you.

That’s thanks to the hobby loss safe harbor rule. When considering your status as a business, the IRS looks at your past five years of operation. So long as you earned a profit for three out of five of those years, they consider your activities to be for-profit.

(If you run an equestrian ag operation, the rule is two years out of the past seven years to demonstrate business activities. This is primarily geared towards breeders of race horses.)

So, if you report a loss on your 2025 tax return, the IRS will look at your returns for 2021, 2022, 2023, and 2024. So long as you reported a profit for at least three out of those five years, they will continue to treat your operation as a business.

If, over the past five years, you have reported earning a profit in fewer than three years, the IRS may request documents helping to prove you are running your operation for the purpose of earning a profit.

If you can’t provide documentation, or if your documentation is not thorough enough for the IRS, they may request to interview you in-person or over the phone. They may even send a representative to your ag operation to investigate it personally.

You can help to avoid all of this by tracking your operations in writing, and especially by keeping up with bookkeeping and preparing financial statements.

How does the hobby loss safe harbor rule apply to new ag operations?

If your operation is just getting off the ground and you have been in business for less than five years, you don’t have enough financial history—in the form of tax returns—to prove that you have turned a profit in at least three of those five years.

In order to avoid having your business status investigated, you can file Form 5213. It prevents the IRS from analyzing your business status for your first five years of operation, giving you time to start earning a profit.

How does Form 5213 relate to hobby loss rules?

When you file Form 5213 with the IRS, you claim that your business is in its first five years of operation, and request that the IRS defer applying hobby loss rules for those first five years.

In effect, you are asking the IRS to look the other way while you cover your startup expenses, get your business off the ground, and start earning a profit.

Once the five years have elapsed, the IRS will review your first five tax returns. If you report a profit on at least three of those returns, it will consider your business a for-profit activity. If you report a profit on fewer than three of those returns, they may investigate your ag operation to determine whether it qualifies as a business.

(Following the safe harbor rule, for equestrian operations, the deferment is for seven years, and the requirement is two years of profitability.)

Filing Form 5213 also extends the period of limitation on each of your first five years of operation to two years after the last fifth return is due. Meaning, the IRS has two years after your first five years of operation to retroactively disallow business deductions if they determine your activities are a hobby rather than a business. Normally, the IRS has three years from the due date of the return or the date you filed the return, whichever is later.

So, if you file Form 5213, you have two options: You can deduct business expenses each year and assume they will be proven valid after your business proves its profitability. Or you can hold off on reporting business expense deductions until the five year period has passed, and then file them retroactively once you are certain that your operation qualifies as a business.

The approach you take will depend on your own cash flow needs and working capital, and the likelihood (in your eyes) that you will be able to prove your business is a for-profit activity.

Filing Form 5213 essentially alerts the IRS to a potential hobby loss issue, guaranteeing the IRS will take a close look at your operations if you don’t earn a profit in three out of five years. For this reason, taxpayers rarely use it unless the IRS has already notified them that it’s questioning the validity of business deductions under Section 183.

How to file Form 5213

The deadline to file Form 5213 is three years after the first year you begin your business activities or within 60 days of receiving a notice from the IRS that it intends to disallow your deductions.

So, if the first tax return you filed for your ag operation was for the 2022 tax year, you would need to file Form 5213 for the 2025 tax year in order to qualify for the deferment.

Form 5213 is due on April 15th. (In the above example, the deadline would be April 15th, 2026.) If April 15th falls on a national holiday or a weekend, the filing deadline is the next business day.

You do not file Form 5213 with your tax return, and it cannot be filed electronically. You can file it by sending a paper copy to the IRS service center where you would normally send your tax return when filing by mail.

Ambrook is the best choice for professional ag producers

Ambrook is the complete financial platform for your agricultural operation, providing a complete set of books and detailed financial insights to ensure you never miss an important business deduction.

With time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

Want to learn more about Ambrook?

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.