You might get a 1099-R if you received payments from a retirement plan, pension, annuity or IRA. Here’s what you need to do if that happens.

If you received money from a retirement plan, pension, annuity, or IRA, you’ll likely get IRS Form 1099-R. This form reports distributions to you during the tax year and helps you and the IRS correctly report income and taxes on your federal return. Here’s what to do if you receive one, and what the numbers on it mean for your tax bill.

What Is IRS Form 1099-R?

Form 1099-R is an IRS tax form used to report distributions of $10 or more from:

Pensions and annuities

Retirement or profit-sharing plans

Individual Retirement Accounts (IRAs)

Insurance contracts

Other similar retirement arrangements

If you took money out of one of these plans during the year, the payer (i.e. the plan administrator, insurance company, etc.) sends you Copy B of 1099-R and also files a copy with the IRS.

Who usually receives a 1099-R?

You’ll get a copy of 1099-R if you:

Received a distribution or withdrawal from a retirement plan or IRA.

Rolled over money from one retirement account to another.

Took an early withdrawal or received pension payments.

Received disability or death benefit payments from a retirement plan or insurance contract.

When should I expect one?

Payers are required to send a copy of Form 1099-R for any payments they sent you by January 31 of the following year. (So you’ll get 1099-Rs for any payments you receive in 2025 by January 31, 2026.) If you don’t receive the form by early February, follow up with your payer about getting one issued.

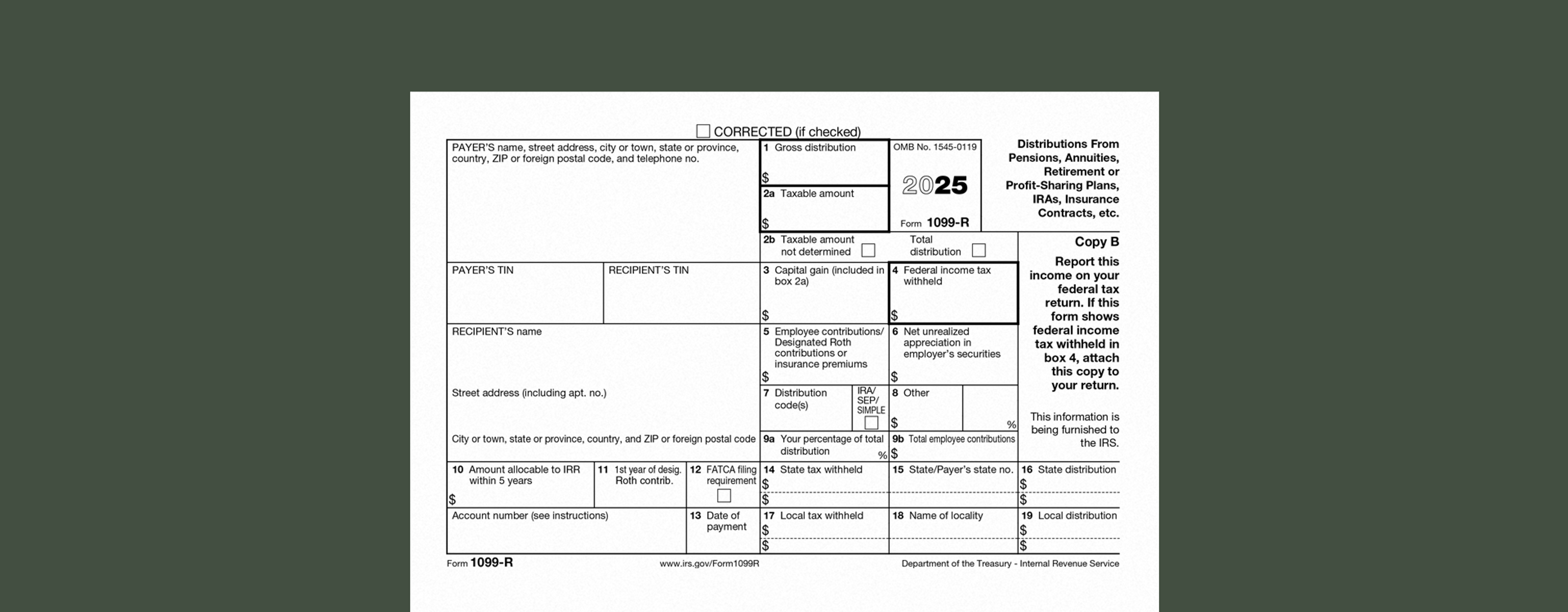

Form 1099-R: a Box-by-Box Breakdown

Box 1: Gross Distribution

This box shows the total amount of money you received from a retirement plan or IRA during the tax year. This includes the full distribution before any taxes were taken out.

You generally report the taxable portion of this amount on Form 1040, Line 5a (Pensions and Annuities) or Line 4a (IRA Distributions). The gross amount appears on the “a” line for informational purposes.

Box 2a: Taxable Amount

This shows the part of your distribution that is taxable income. Sometimes the taxable amount is less than the total distribution if you made after-tax contributions or if some of the distribution qualifies for special tax treatment.

Report this amount on Form 1040, Line 5b (taxable pension/annuity income) or Line 4b (taxable IRA distributions). This is the amount used to calculate your tax.

Box 4: Federal Income Tax Withheld

This box shows how much federal income tax was taken out of your distribution. Include this amount on Form 1040, Line 25b (Federal income tax withheld). This counts as pre-paid tax toward your total tax liability.

Box 5: Employee Contributions or Insurance Premiums

This box shows after-tax contributions you made to the plan. This “basis” helps ensure you’re not taxed twice on these contributions. This amount is used in determining your taxable amount and basis. If you file Form 8606 (Nondeductible IRAs), you’ll report your basis here to avoid double taxation.

Box 7: Distribution Code

The code here explains what type of distribution you received and affects how it’s taxed and whether penalties apply. Common codes include:

1 – Early distribution with no known exception (possible 10% penalty if under 59½).

2 – Early distribution, exception applies (e.g., disability or medical expenses).

7 – Normal distribution (age 59½ or older).

G – Direct rollover (usually not taxable).

If you owe an early withdrawal penalty, you’ll use Form 5329 to report and calculate any additional tax. Otherwise, report your distribution on Form 1040 as described above.

Box 9b: Total Employee Contributions

This box shows your total after-tax contributions to the plan. This “basis” amount helps determine the taxable portion of your distributions. If applicable, report this on Form 8606 to track your basis and prevent double taxation.

Make Tax Season a Breeze with Ambrook

Ambrook’s Schedule F category tags are tailor-made for farming businesses, saving you hours on tax prep. With features like automated financial reporting, simplified bookkeeping, and effortless bill pay and invoicing, Ambrook is more than just a farm tax and accounting tool: it takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

Want to learn more about Ambrook?

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.