If you earn passive rental income from your farmland, you could avoid paying self-employment taxes on it by filing Form 4835. Here’s how to know if you qualify.

If you’ve leased out a portion of your farm or ranch, you may be able to avoid paying extra taxes by filing Form 4835.

You use Form 4835 to report income from rental agreements where the tenant pays you with a percentage of their earnings—for instance, in a share rental agreement as part of a grazing lease. The rent you collect—and the profit you report on Form 4835—is not subject to self-employment tax. That could mean significant savings for you and your business.

Here’s how to figure out whether you qualify, and how to complete and file Form 4835 to your best advantage.

Who needs to file Form 4835?

Form 4835 is used to report passive rental income from farmland.

You need to file Form 4835 if all of the following apply:

You are a landowner

You leased land to a tenant over the course of the year

Your income was based on a share of the tenant’s production, not on a flat rate

You did not ‘materially participate’ in the tenant’s farming activity (more on what that means below)

You do not need to file Form 4835 if:

You participated materially in the farming activity. If that’s the case, report your income as farm income on line 8 of Schedule F.

You received rent as cash based on a flat rate. If that’s the case, report your income as regular rental income on Schedule E, Part I.

You were an S corp or partnership and received rent based on crop or livestock shares. If that’s the case, report your income on line 2 of Form 8825.

Form 4835 is used to report passive rental income, which is subject to income tax but not to self-employment tax (which is typically 15.3% of net income).

When you participate materially in farming activity, you’re not earning passive income, since you’re taking a hands-on role in day-to-day operations.

So, for the sake of determining whether you need to file Form 4835—and for planning your business activities so you can benefit from lower taxes on passive income—it’s important to understand what type of income qualifies as ‘passive.’

What qualifies as passive income for the sake of Form 4835?

For your rental income to qualify as passive, you can’t materially participate in your tenant’s activity.

Here’s the bottom line: if you were a material participant in the farming activities of your tenant, the IRS doesn’t want you to report your rental income as passive. They want you to report it as regular farming income and pay self-employment tax on it.

That doesn’t mean that, in order to record the income as passive, you have to take a completely hands-off approach—you can still manage and monitor your tenant’s farming activity, and help out with some of the labor involved. But the amount of effort you put in has to fall below certain thresholds, and those thresholds are set out by the material participation tests.

Material participation tests for 4835

In the eyes of the IRS, you materially participated in your tenant’s farming activities if any of the following apply:

1. You work 100 hours or more over a period of five weeks or more in activities connected with agricultural production.

Example: You spent 50 hours planning and coordinating pasture rotation, 15 hours clearing brush, 20 hours monitoring the herd and moving temporary fencing, 50 hours setting up stock tanks and supplemental feed troughs, and 10 hours tilling and reseeding damaged pasture. That’s a total of 145 hours, making you a material participant in the farming activity.

2. You do things that, considered in their totality, show you’re materially and significantly involved in the farming or ranching operations.

Example: You leased a parcel of land to a farmer for grazing. They dropped off their cattle, and you did all of the work raising the herd. You qualify as a material participant.

3. You regularly and frequently make (or take an important part in making) management decisions that contribute to or affect the success of the enterprise.

Example: You make decisions about when and where your tenant plants and sprays, when they harvest, what standards they follow, and what records they keep.

4. You do at least three of the following:

Pay at least half of the direct costs of producing the crop or livestock

Furnish at least half the tools, equipment, and livestock used in the production activities

Advise or consult with your tenant on things like deciding what crops to plant, the type of seed or fertilizer they use, or when and at what price they sell the crops

Periodically inspect the production activities

Example: A short-term tenant leased grazing land for six months of the year. During that time, you checked on the herd daily, provided half the feed, and advised your tenant when and at what price to sell the livestock. Even though you worked less than 100 hours, you were a daily participant in the activity with set, recurring duties. You qualify as a material participant.

Significant participation and Form 4835

Even if you pass all of the material participation tests, you may still qualify as a significant participant.

Significant participation is any participation in a farming activity of 100 hours or more over the course of the year that doesn’t qualify as material participation.

When you’re a significant participant, you may only be able to claim a portion of your income from rental activities as passive income.

You’re most likely to be a significant participant if you lease multiple parcels of land to different tenants and your total activity in the farming activities meets a particular threshold.

You are a significant participant if any of the following apply:

1. You participated 100 hours or more in each of the farming activities of your tenants, and the total number of hours comes to 500 or more. If that’s the case, your rental income does not qualify as passive.

Example: You have four tenants with grazing leases. You participated in Tenant A’s activity for 150 hours, Tenant B’s activity for 100 hours, Tenant C’s activity for 200 hours, and Tenant D’s activity for 100 hours, for a total of 550 hours. You are a significant participant.

2. You participate 100 hours or more in each tenants’ farming activities over the course of the year, and your gross income from those activities is greater than your total expenses. In that case, a portion of your net income qualifies as non-passive income.

Example: You lease land to four tenants and participate 100+ hours in farming activities for each. At the end of the year, your gross income exceeds your total deductions, so a portion of your net income qualifies as non-passive.

To determine whether you were a significant participant in farming activities, and to figure out what portion of your income qualifies as non-passive, complete the IRS’s significant participation worksheet.

Retired or disabled farmers and surviving spouses

Certain conditions apply if you are a retired or disabled farmer or the surviving spouse of a farmer:

Retired or disabled. If you are retired or disabled, and you materially participated in the activity for any 5 of the 8 years prior to your disability or retirement, then you are considered to be a material participant for the present year.

Surviving spouse. If you are the surviving spouse of a farmer and you manage the farm, and the farm meets the estate tax rules for special valuation of farm property passed from a qualifying decedent, you’re considered a material participant.

What exactly counts as ‘participation?’

So your rental income might not qualify as passive if you ‘materially’ or ‘significantly’ participated in it. But that leaves us with another question: what does it mean to ‘participate’ in an activity at all?

According to the IRS, you participate in a farming activity if:

You do any work in connection with the farming activity and you have an interest in it. In the case of land rentals, having an interest consists of being paid rent as a portion of the tenant’s income from their farming activities.

Your spouse participates. Any participation of your spouse in farming activities counts as your own participation. This applies even if your spouse does not own an interest in the activity and if you file your taxes separately.

However, you do not participate if any of the work you do is not the type of work typically done by the owner of that activity and one of your main reasons for doing the work is to avoid the disallowance of any loss or credit for the work under the passive activity rules (covered below).

Proof of participation

In the event of an audit, the IRS requires you to prove your level of participation in any passive rental activity reported on Form 4835.

You can keep log books and prepare daily time reports to track your participation, but these aren’t necessary if you can prove your participation in some other way. A calendar, an appointment book, or a written summary of your participation may be enough.

What are the passive activity loss limitations on Form 4835 income?

Broadly, passive activity loss limitations prevent tax filers from claiming losses on passive income activities against their non-passive income.

For instance, if you lease grazing land to another farmer on a share rental agreement, and you end up losing money on the deal—i.e., your total income is less than your expenses—you can’t deduct that loss from your regular farming activities. The rental income is passive; your regular farming income activities are non-passive.

If you generate zero income from passive rental activity, but incur expenses, you can’t apply that loss in the current year. It’s an unallowed loss, and it carries forward to next year—and every following year until you have passive income to offset. You can only apply losses in years when you generate passive income.

Finally, some good news: an exception to this rule allows you to apply losses from passive rental activity to regular non-passive income, offsetting your tax burden. More on that in a moment.

Reporting losses on Form 8582

You report your losses from passive income activities on Form 8582.

Here’s how: On Form 4835, you add up your gross income and expenses from passive rental activities to determine your net income. If your net income is in the negative—that is, if it’s a loss—then you carry that loss over to Form 8582, where you can determine whether you meet the exception to passive loss limitations.

The PAL exception for farmers on Form 8582

The passive activity loss (PAL) exception for rental activities may allow you to offset your non-passive income with up to $25,000 in losses from passive income activities.

Namely, if:

Your total passive rental losses were $25,000 or less; and

Your adjusted gross income (AGI) was $100,000 or less,

Then you can offset your non-passive income with your passive rental losses.

To qualify, you need to be an active participant in the rental activity. This isn’t the same as being a material participant or significant participant. To qualify as an active participant, you only need to carry out the basic tasks of finding a tenant, setting up a grazing lease (or similar land use lease), collecting rent, etc.

If you do qualify as a material participant, however, you cannot take advantage of the PAL exception (since, as a material participant, you don’t earn passive income on the activity).

Provided you meet the requirements for the PAL exception, you do not need to file Form 8582. Instead, you enter your losses on Schedule E (Form 1040), Supplemental Income and Loss, Part I, line 21, and carry them forward to line 22 of the same form and section.

Limitations for special filers

If you lived with your spouse during the course of the year but filed a separate tax return, you qualify only for a maximum deductible amount of $12,500, and the AGI threshold is $50,0000.

If you and your spouse lived separately all year and filed separate tax returns, you don’t have to file Form 8582.

The full list of requirements

Besides everything covered above, you need to meet the following requirements in order to take advantage of the PAL exception:

Your only passive income activities for the year consisted of rental real estate (leasing land)

You have no unallowed losses from prior years for these (or any other) rental activities

You have no prior or current year unallowed credits from a passive activity

You hold no interest in a rental real estate activity as a limited partner or as a beneficiary of an estate or a trust

You can get a detailed breakdown from the IRS Instructions for Form 8582.

How to fill out Form 4835

Form 4835 is split into two sections:

Part I, for calculating gross income, and

Part II for calculating expenses.

The final section (line 32 onward) is where you calculate your net income.

Top section: Basic information

At the top of Form 4835, enter your tax information. In most cases, you will select “yes” on Line A, indicating you were an active participant in the rental activity.

(Active participation includes selecting and approving tenants, signing lease agreements, etc.)

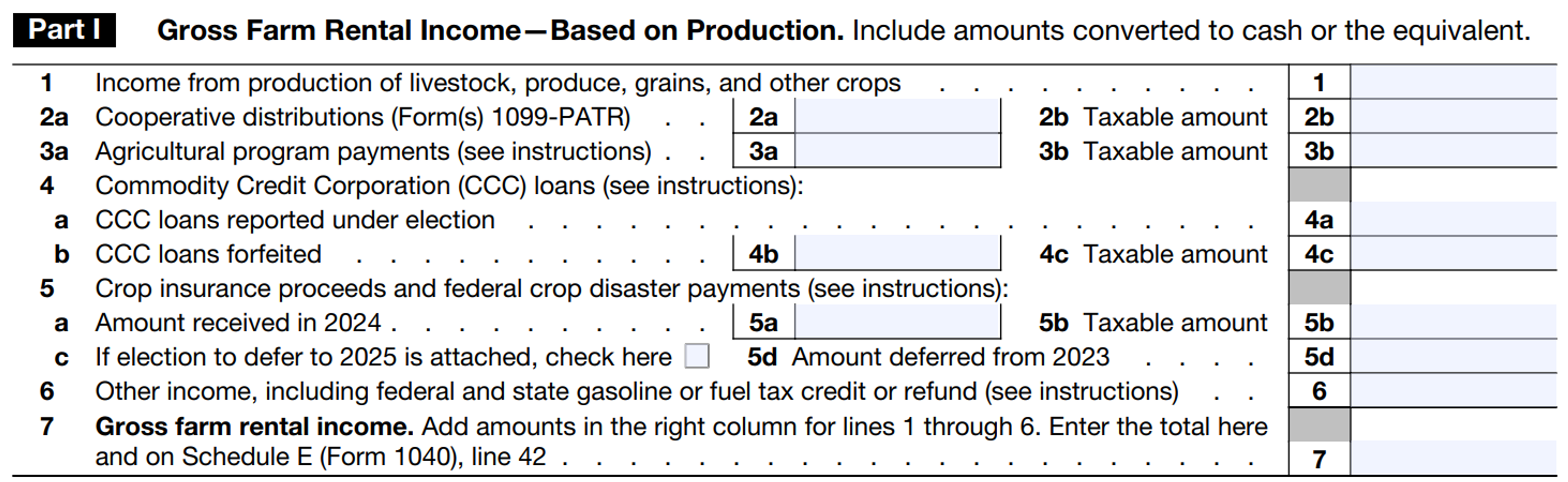

Part I: Gross farm rental income

In Part I, you calculate the total gross income you earned from renting your land to tenants.

The bulk of this will go on line 1. You are not required to specify what percentage your share was in the lease agreement, or any other terms of the agreement—just the total amount you collected as rent.

If you were paid in a share of the crop, convert that share to its cash equivalent.

Lines 2 through 6 include other sources of income connected with the rental activity, including Commodity Credit Corporation (CCC) loans, insurance payouts, and tax credits and refunds.

Line 7 is where you total the amount you earned in gross income. You also enter this amount on line 42 of Schedule E (Form 1040), where you report regular rental income.

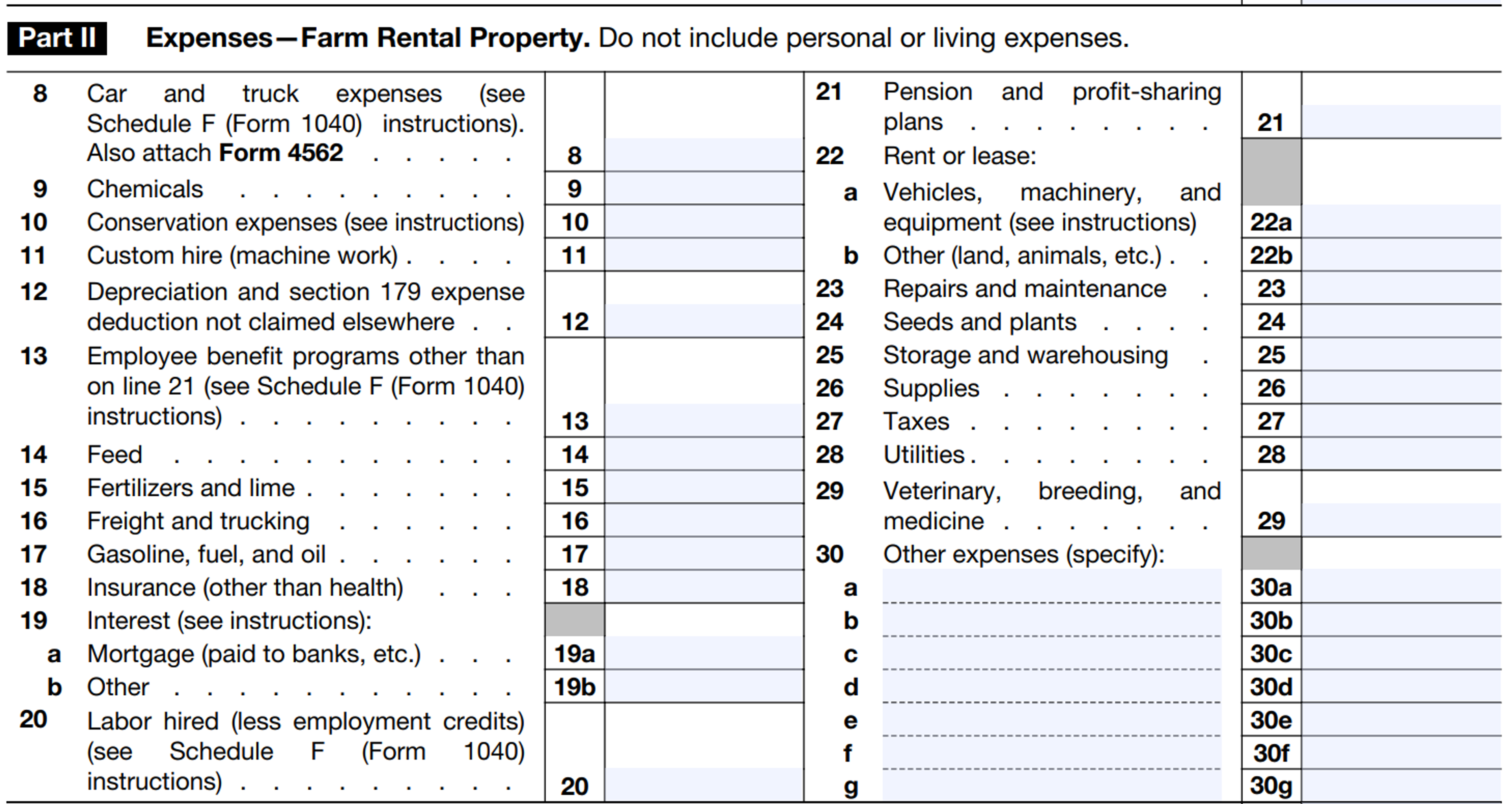

Part II: Expenses — farm rental property

In Part II, you enter various expenses incurred in the course of the rental activity (including any farming activity you contributed to the tenant’s operations).

Line 30 gives you space to enter expenses not specified on prior lines. Consult with an accountant before including any expenses not already specified on Form 4835 to make sure they qualify, and plan to include supporting documentation with your filing.

Line 31 is where you total your expenses.

Final section

The final section of Form 4835 is where you calculate your net income from rental activity—your gross income minus expenses.

This is also where you indicate whether the rental activity resulted in a loss. If you invested cash in the farming operation, your investment may qualify as “at-risk,” which affects your passive activity limitations and how you claim your losses. In that case, complete Form 6198 before filling out Form 8582.

Put paperwork out to pasture with Ambrook

When you use Ambrook, it’s easy to calculate your income and expenses from leasing land to a tenant. All your bank transactions are automatically imported and categorized by your bookkeeping team, so that when tax time rolls around you’re not stuck tracking down receipts and invoices in order to complete Form 4835.

Plus, with time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make expense tracking simple: it takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

Want to learn more about Ambrook?

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.