If you pay a freelancer, contractor or other non-employee more than $600 for the year, you might have to file a 1099-NEC. Here’s how to know for sure.

If you pay someone who isn’t your employee (i.e., a freelancer, independent contractor or other worker you don’t file a W-2 for) above a certain amount over the course of the calendar year, you’ll probably have to file Form 1099-NEC to report that income to the IRS.

If you do similar work for another business as a non-employee, you might also find yourself receiving 1099-NECs in the mail and having to report that income on your own tax return. Here’s what you need to know before you do.

What is Form 1099-NEC?

IRS Form 1099-NEC is a tax form that businesses must file whenever they pay above a certain threshold over the course of the year to non-employees who are subject to the self-employment tax. For 2025 that threshold is $600, and for 2026 it’s $2,000. (See more on payment thresholds below.)

A farmer might have to file Form 1099-NEC when they pay someone to apply pesticide to their crops or repair their fence for cattle.

In addition to filing with the IRS, you must also send a copy of Form 1099-NEC (Copy B) to the recipient of the payment. If you do custom work for another business like repairs, improvements, farm labor, consulting services, and so on, that means you might also receive copies of Form 1099-NEC from your clients.

You’ll use that to report that income on your return using forms like Schedule F (Form 1040) if it qualifies as farming income, Schedule C (Form 1040) if it doesn’t, and Form 8995-A.

What’s the difference between an ‘employee’ and an ‘independent contractor?’

An employee – also sometimes called a “Form W-2” employee, named after the IRS form you’re required to file for each one – is a worker who contributes to your core business in some way.

In addition to paying them wages, hiring a W-2 employee comes with a long list of responsibilities, including filing a Form W-2, W-4, and I-9 for each one, withholding payroll taxes from their paychecks and contributing to their employee health insurance, and paying for workers compensation insurance.

An independent contractor – also sometimes called a “Form 1099” contractor – is different. Other than filing a Form 1099-NEC for each one you go into business with, your relationship with an independent contractor comes with many fewer rules and stipulations.

At the same time, contractors are fundamentally different from employees. In the eyes of the government and the IRS, they’re self-employed individuals you go into business with, not employees whose hours you can set and work you can control.

1099-NEC vs. MISC: What’s the difference?

Before 2020, taxpayers used 1099-MISC to report non-employee compensation, in addition to a broad range of other payments. That year the IRS (re)introduced an old tax form called Form 1099-NEC specifically for reporting payments to non-employees.

Form 1099-MISC is now mainly used to report rents, royalties, veterinary fees, crop insurance proceeds, barter, prizes, awards, attorney fees and a range of other miscellaneous business payments that aren’t reportable using the other 1099 forms.

What are the 1099-NEC reporting thresholds for 2025 and 2026?

Up to 2025, the threshold for filing a 1099-NEC was $600. Then in July of 2025, the One Big Beautiful Bill Act (OBBBA) changed the reporting threshold for 1099-NEC for 2026 to $2,000, which will be adjusted for inflation for 2027 and beyond.

This means that any payments made after December 31, 2025 are no longer subject to the old $600 threshold: they’ll either be subject to the new $2,000 threshold for 2026, or inflation-adjusted thresholds for 2027 and beyond.

What do I need before filling out and filing 1099-NEC?

In addition to information about the payment type and amount, you’ll need the recipient’s name, contact information and taxpayer identification number (TIN) to properly file a 1099-NEC. You can get this information by giving them a copy of Form W-9.

If the recipient doesn’t get back to you with a filled out W-9 and TIN, you’ll have to withhold taxes from their payment at the backup withholding rate of 24%. (More on that below.)

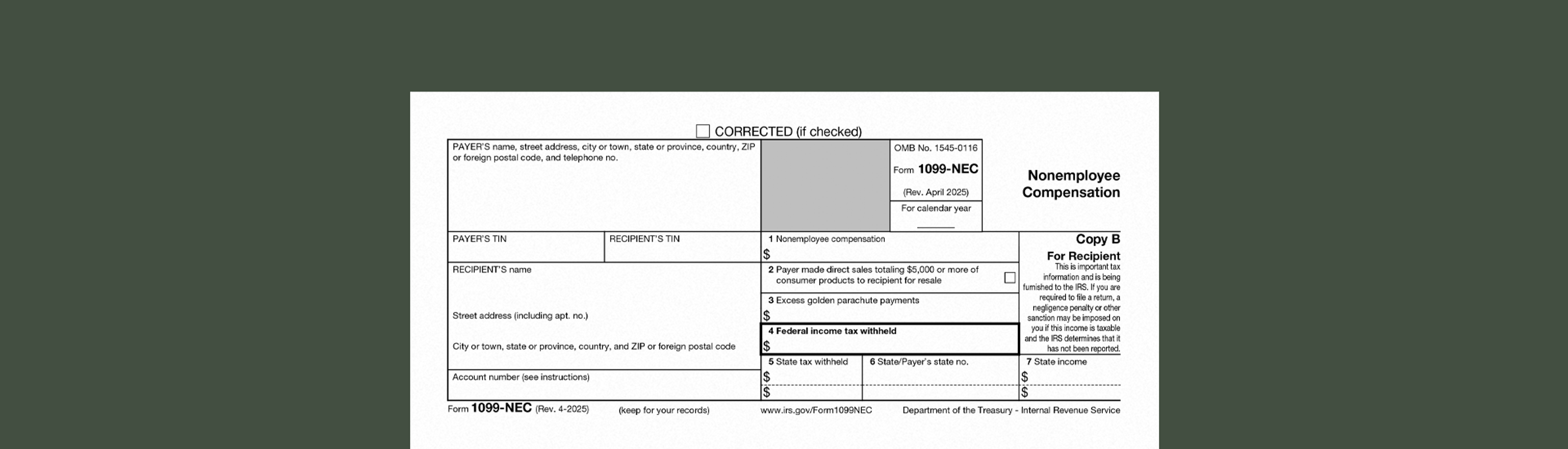

Form 1099-NEC: a box-by-box breakdown

On the left hand side of 1099-NEC, enter the payer’s (your) name and contact information, your taxpayer identification number (TIN), your recipient’s TIN, and the recipient’s name and contact information.

If you’re filing more than one information form for each recipient, include an account number at the bottom of the form. This can be a checking account number, savings account number, brokerage account number, serial number, loan number, policy number, or any other unique number you assign that payee to distinguish their account.

Box 1: Nonemployee compensation

This box should include total nonemployee compensation paid to the recipient, and can include payments like:

Professional service fees, such as fees to accountants, engineers and consultants

Payment for services like property repairs and maintenance, including payment for parts or materials

Commissions paid to nonemployee salespersons

Any fees or wages paid to independent contractors

Do not include payments reportable on other 1099 forms, including:

Rents (1099-MISC)

Prizes and awards, including certain non-government grants (1099-MISC)

Medical and health care payments (1099-MISC)

Crop insurance proceeds (1099-MISC)

Payments from the government (1099-G)

Patronage dividends from cooperatives (1099-PATR)

Attorney fees (1099-MISC)

If you receive a copy of 1099-NEC, you’ll have to report this amount on Schedule F (Form 1040) or Schedule C (Form 1040), depending on whether it qualifies as farming income.

Box 2: Direct sales

Check this box if you (the payer) made $5,000 or more in sales to the recipient on a buy-sell, deposit-commission, or other commission basis for resale (i.e., ‘direct sales’). You may also use box 7 on Form 1099-MISC to report this, however you must only use one form.

Box 4: Federal income tax withheld

This box is used to report backup withholding. If you’re the payer and the recipient hasn’t furnished you with their TIN, you must withhold tax from their payments and file Form 945 to report it. The current backup withholding rate is 24%.

If you receive a copy of 1099-NEC with an amount in this box, you may have to complete and send Form W-9 to the payer.

Box 5-7: State information

These boxes contain any state income tax withheld from payments, the payer’s TIN, and the taxable income for the tax withheld.

How do I file Form 1099-NEC?

You have to file multiple copies of Form 1099-NEC, each one with a different recipient and due date:

The first copy, “Copy A,” goes to the IRS and must be filed by February 28, 2025 if filing on paper and March 31 if filing electronically.

The second copy, “Copy B,” goes to the recipient so they can report that income on their own taxes.

You might also have to file two other copies: “Copy 1,” which goes to your state or local tax department, and “Copy 2,” which goes to the recipient and can be filed with their state or local tax department if necessary.

In addition to the extra copies of 1099-NEC, you’ll also have to file Form 1096, which acts as a kind of ‘cover sheet’ for all of your information returns (which includes all of the different 1099 forms).

When does each copy of 1099-NEC have to be sent out?

If you’re filing a 1099-NEC for payments you made, you must send a copy to the recipient (Copy B) by January 31, 2025.

You should receive a copy of Form 1099-NEC for any payments you received in 2024 by early February 2025. If you don’t, follow up with the payer about getting one issued.

For 1099 forms filed in 2025, there’s a $60 late penalty per form if you file within 30 days of the deadline, which goes up to $130 if you’re more than 100 days late, $330 if you file after August 1st, and $660 if you intentionally fail to file.

If you fail to file and the income goes unreported, the payee could also be subject to a penalty equal to 20% of the unreported income.

1099-NEC deadlines for 2025:

| 1099-NEC, Copy B (For Recipient) sent to payees: | January 31 |

|---|---|

| 1099-NEC, Copy A (For IRS), if filing on paper: | February 28 |

| 1099-NEC, Copy A (For IRS), if filing electronically: | March 31 |

Late filing penalties:

| If you file Copy A or B within 30 days of the deadline: | $60 per form |

|---|---|

| If you file Copy A or B within 100 days of the deadline: | $130 per form |

| If you file Copy A or B before August 1: | $330 per form |

| If you intentionally fail to file: | $660 per form |

Make Tax Season a Breeze with Ambrook

Ambrook’s Schedule F category tags are tailor-made for farming businesses, saving you hours on tax prep. With features like automated financial reporting, simplified bookkeeping, and effortless bill pay and invoicing, Ambrook is more than just a farm tax and accounting tool: it takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

Want to learn more about Ambrook?

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.