If you hire a contractor or pay another business in the form of barter, there’s a good chance you’ll need to request a Form W-9. Here’s how it works.

Form W-9 gives you all the information you need from a contractor (or a business you’ve traded with in barter) so that you can file a Form 1099-NEC or Form 1099-MISC.

It’s up to you to pay the taxman and collect Form W-9 from individuals and businesses. But in order to do it right, you need to understand how Form W-9 and the different types of Form 1099 relate, and your obligations to the IRS.

What is Form W-9?

If you pay a contractor, you use Form W-9 to collect their personal and business information. You later use that information to fill out and file a Form 1099, which reports how much you paid the contractor over the course of the year.

Form 1099-NEC is required for any contractor you pay $600 or more over the course of the year.

Unlike other tax forms, you do not file Form W-9 with the IRS. After the contractor completes Form W-9 and sends it to you, you keep it on file. Then you refer to it while filling out a Form 1099 (usually after year-end).

Since you’re also required to file a Form 1099-MISC for anyone with whom you exchanged goods or services in barter over the course of the year, you need a Form W-9 from these individuals or businesses too.

Who needs to file Form W-9?

Because you’re required to file a Form 1099 for any contractor you pay $600 or more over the course of the year, you also need a Form W-9 from any contractor you pay $600 or more.

How do you get a Form W-9 from a contractor?

It’s the contractor’s responsibility to complete Form W-9 and send it to you. Some farmers find it easier to partially fill out Form W-9 (entering their name and address), and send it to a contractor to complete and return.

When should you request a Form W-9 from a contractor?

If you expect to pay a contractor $600 or more over the course of the year, it’s a good idea to request a Form W-9 as soon as you start doing business with them. That way, when it’s time to complete Form 1099—during tax season—you’re saved the trouble of chasing down contractors and getting their W-9s. It also avoids potential complications if the contractor refuses to submit a Form W-9 later on.

Should I file a Form W-9S?

In a word: No. Form W-9S relates to student loans, and you should not use it to collect information from contractors.

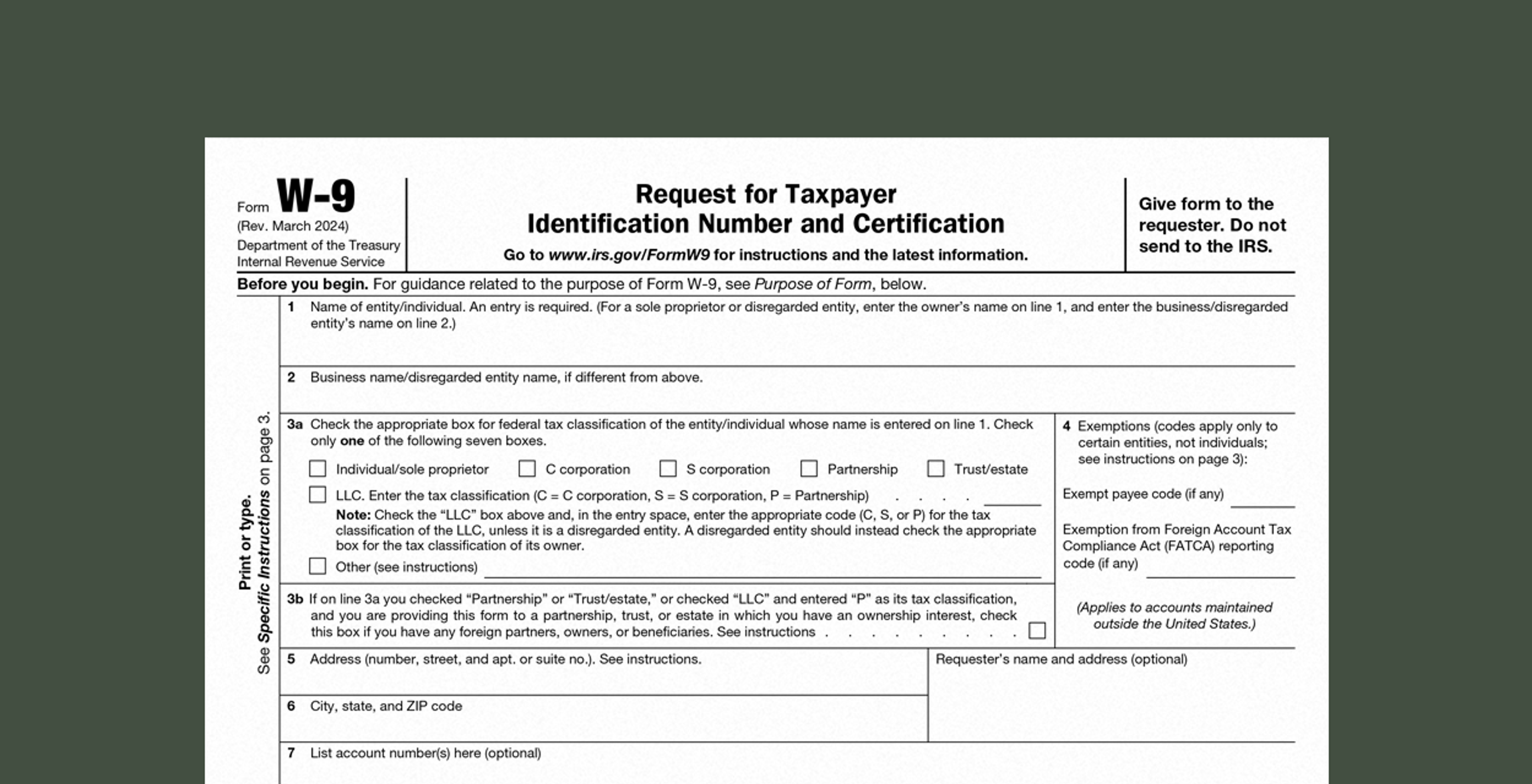

How to fill out Form W-9

Form W-9 is short—less than one page long, with four pages of IRS instructions.

Some more good news: It’s the contractor’s responsibility to fill out the bulk of the form. If you choose, you can enter your name and address on the form, but it’s not required.

But here’s a quick breakdown, so you understand what you’re looking at when a contractor sends you Form W-9:

Line 1. This is where the contractor’s business name goes. If they operate as a sole proprietor or single-member LLC, they enter their first and last name here. For LLCs, partnerships, or corporations, they can enter the business name on this line.

Line 2. If the contractor operates as a sole proprietor or a disregarded entity, and their business name is different from the name on their tax return, they should enter the business name here.

Line 3a. The contractor specifies their federal tax entity here.

Line 3b. The contractor further specifies whether they operate as part of a partnership or trust.

Line 4. If the contractor qualifies for any tax exemptions, they enter the information here.

Line 5. The contractor’s address.

Line 6. The contractor’s city, state, and zip code.

Line 7. The contractor’s account number with you, if they have one.

Requester’s name and address (optional). This is the only part of the form you need to worry about filling out—and it’s totally optional. If you like, you can enter your name and address here before sending Form W-9 to a contractor to be completed and returned.

Part I. Here, the contractor provides their taxpayer identification number (TIN).

Part II. The contractor certifies that the information they have provided is true. Then they sign and date the form.

Form W-9 vs. Form 1099

Form W-9 is a small but important part of a larger “ecosystem” of forms used to report payments to contractors.

In particular, it’s essential if you intend to file a Form 1099. All the information on Form W-9 is necessary in order to complete Form 1099.

Here’s how Form W-9 and Form 1099 work together:

When you start working with a contractor, you request a Form W-9. They send it to you.

You keep the Form W-9 from your contractor on file.

After the close of the tax year, you complete two copies of Form 1099 using the information on Form W-9 and including the total amount you paid the contractor over the course of the year.

You submit one copy of Form 1099 to the contractor for their files. It’s due January 31st.

You submit a second copy of Form 1099 to the IRS. For most types of 1099, it’s due March 31st (e-file). It’s due January 31st (e-file) if it’s a Form 1099-NEC.

Keep every Form W-9 on file after you receive it. Unless the contractor’s information changes, you can use the same form from one year to the next to complete Form 1099.

Types of Form 1099 relevant to farmers and ranchers

There are 22 different types of Form 1099 covering every type of payment you could possibly make to another individual or business. Only a handful are relevant to farmers and ranchers.

Here’s a quick overview of each type of Form 1099 you may find yourself filing or receiving.

Form 1099-NEC for farmers

Form 1099-NEC reports non-employee income—that is, any payments you make to workers who aren’t on your payroll. That includes everyone from short-term fieldworkers to the freelance graphic designer who created a logo for your business.

Form 1099-MISC for farmers

Form 1099-MISC is for “miscellaneous” payments. That’s a broad term, but for farmers and ranchers it usually takes the form of rent, payments in barter, veterinary fees, and proceeds from crop insurance. You can learn more from our guide to Form 1099-MISC for farmers.

Form 1099-PATR for farmers

If you’re part of a cooperative, you may receive a patronage dividend from them. In that case, they will send you a copy of Form 1099-PATR. For a detailed guide, check out our article on Form 1099-PATR for farmers.

Form 1099-G for farmers

If you receive a payment from the USDA or from any other government agency, they may send you a Form 1099-G. Qualifying payments include unemployment compensation, state or local income tax refunds, grants, and USDA payments like ARC, PLC and CRP. Read our guide to Form 1099-G for farmers for more details.

Form 1099-A for farmers

If you lose a piece of property due to foreclosure—or if you abandon it—a lender may send you a copy of Form 1099-A. Learn more from our guide to Form 1099-A for farmers.

What if you don’t receive a Form W-9?

A contractor or business may forget to send you Form W-9. Or they may send you one that’s incomplete. In either case, it’s up to you to follow up with them and get a completed copy of the form.

If you don’t receive a W-9 from a contractor, you can’t file an accurate Form 1099 and claim the amount you paid them as tax deductible income. That could significantly increase your tax bill.

Plus, if the IRS discovers you failed to file Form 1099, or if you file an inaccurate Form 1099, you could be penalized anywhere from $50 to $270 for each form.

What to do if a contractor refuses to give you a Form W-9

Some contractors—particularly ones who are paid in cash—may refuse to complete a Form W-9.

Here are the steps to take if a contractor refuses to complete Form W-9 for you:

Document every attempt to request Form W-9. You’re expected to make the “first annual solicitation” (in the IRS’s words) when you begin working with them. You make the “second solicitation” before December 31st of the current tax year. The third request, your “third solicitation,” must come before December 31st of the following tax year. Make these requests in writing (email or regular mail).

You’re still required to file a Form 1099 for the contractor. Complete the form to the best of your ability and submit both copies. For the contractor’s TIN, enter “REFUSED.” You must file this form on paper, since the IRS e-file service won’t allow you to submit incomplete forms.

The IRS will send you a CP-2100 or CP-2100A letter instructing you to partially withhold payments from the contractor.

You’re required to withhold 24% of their pay. You remit that money to the IRS and report it on Form 945.

The IRS will not penalize you for failing to get a Form W-9, but if you follow the steps above, the contractor will likely face penalties.

How to file Form W-9

You don’t need to file Form W-9; just keep it as part of your business records.

You are, however, required to file a Form 1099 for each contractor (or trading partner, in the case of barter) you paid $600 or more over the course of the year.

You can file Form 1099 online, using the IRS Information Returns Intake System (IRIS) service, or by mail.

Below you’ll find the filing deadlines for the different types of Form 1099. If the deadline falls on a weekend or a federal holiday, it moves forward to the next regular business day.

| 1099 type | Filing by mail | Filing online | Copy sent to recipient |

|---|---|---|---|

| NEC | Jan. 31 | Jan. 31 | Jan. 31 |

| MISC | Feb. 28 | March 31 | Jan. 31 |

| PATR | Feb. 28 | March 31 | Jan. 31 |

| G | Feb. 28 | March 31 | Jan. 31 |

| A | Feb. 28 | March 31 | Jan. 31 |

Ambrook makes W-9 hassle free

When you add a contractor or vendor in Ambrook, you can automatically store their completed Form W-9 and their tax information, so you have it on hand when 1099 season comes around. Plus, with Ambrook expense tracking, you’re never left guessing whether you’ve met the $600 threshold for each contractor. Schedule a demo today.

Want to learn more about Ambrook?

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.