You might receive Form 1099-A if your lender takes possession of your property, or if you abandon it. Here’s how it works.

When you lose property through foreclosure, repossession or abandonment, you might receive a copy of Form 1099-A. You’ll have to use the amounts reported there to calculate and report any resulting gains or losses to the IRS on Form 4797 if it’s business property, or Schedule D (Form 1040) and Form 8949 if it isn’t used for business. Here’s what you need to know before you do.

What is Form 1099-A?

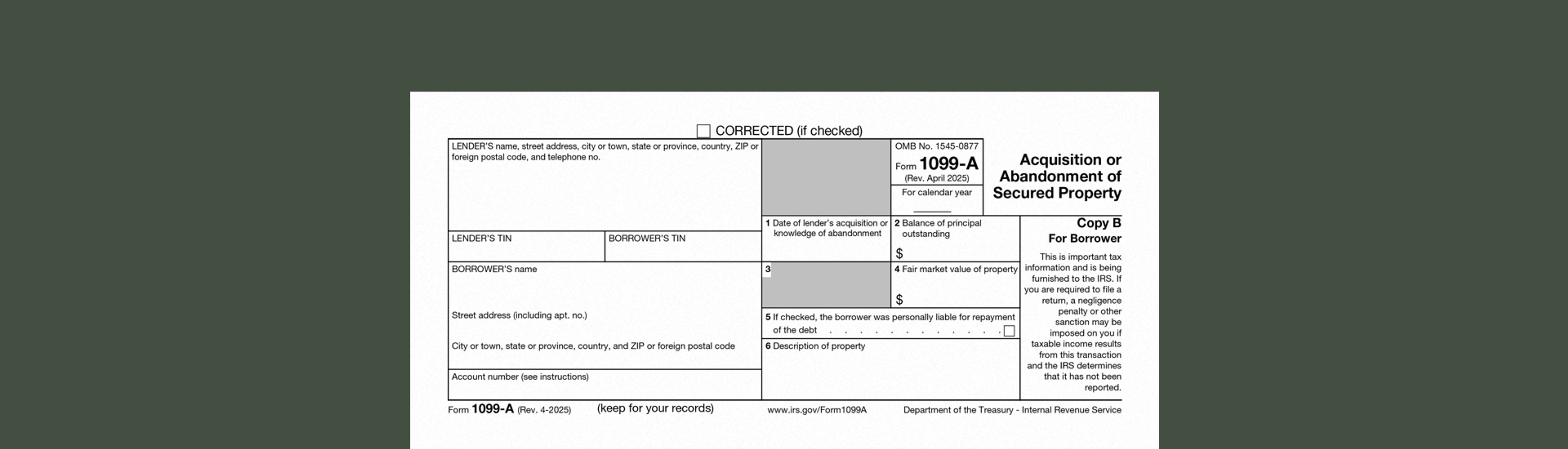

Whenever a bank or lender acquires property used to secure a loan through foreclosure or repossession, they’re required to file a copy of Form 1099-A (Copy A) with the IRS, and a second copy with the borrower (Copy B).

You might receive a copy of Form 1099-A if you lose possession of your home, land, vehicles, equipment or any other real or intangible property (like patents, licenses, trademarks or securities) through foreclosure or repossession, or if you abandon the property.

The IRS treats foreclosure and repossession like a sale, which means you might have a taxable gain or loss to report on Form 4797, Schedule D (Form 1040) or Form 8949. You’ll need the amounts reported on Form 1099-A to calculate it properly.

Form 1099-A: a box-by-box breakdown

Box 1: Date of lender’s acquisition or knowledge of abandonment

Here the lender will record the date they took possession of the property, or when they realized that you abandoned it.

Box 2: Balance of principal outstanding

This is how much of the initial loan amount was outstanding when the lender acquired the property. You might need this number to calculate the gain or loss resulting from this transaction.

Box 4: Fair market value (FMV) of property

This is the property’s fair market value, which is how much you would get for it if you sold it on the market. You might also need this number to calculate the resulting gain or loss.

Box 5: Was the borrower personally liable for repayment of the debt?

The lender will check this box if the person receiving this 1099-A was personally liable for repaying the loan.

Box 6: Description of property

The lender will provide a description of the property here.

How do I report Form 1099-A on my taxes?

Whether you have ordinary income to report from the cancellation of debt will depend on whether Box 5 is checked or not.

If it isn’t, you won’t have to report income resulting from canceled debt.

If box 5 is checked, your income is the Box 2 amount (Balance of principal outstanding) minus the amount in Box 4 (FMV of the property).

You must generally report income from the cancellation of debt as ordinary income on Form 1040.

In addition to income from the cancellation of debt, you might also have a gain or loss to report. To calculate it, you must first determine your sales price, which will depend on whether Box 5 is checked:

If Box 5 is checked, your sales price is either the amount in Box 2 or Box 4–whichever is lesser.

If Box 5 is not checked, your sales price is the amount in Box 2.

Once you’ve determined your sales price, add any other proceeds you received from the foreclosure sale. Subtract your adjusted basis in the property from the resulting amount to calculate the gain or loss.

Report the gain or loss on Form 4797, Sales of Business Property if the property is used for business or on Schedule D (Form 1040) and Form 8949 if the property isn’t used for business.

Make Tax Season a Breeze with Ambrook

Ambrook’s Schedule F category tags are tailor-made for farming businesses, saving you hours on tax prep. With features like automated financial reporting, simplified bookkeeping, and effortless bill pay and invoicing, Ambrook is more than just a farm tax and accounting tool: it takes the guesswork out of running your business. Want to learn more? Start your 7 day free trial today.

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.