If you belong to a cooperative, you might receive Form 1099-PATR with your patronage dividends. Here’s what you’ll have to do next.

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.

You might receive a Form 1099-PATR if you belong to an agricultural cooperative and receive a patronage dividend or refund from them

If that dividend is attributable to purchases of deductible business items, it qualifies as taxable income and you’ll need to report it on Lines 3a and 3b of Schedule F (Form 1040).

What is IRS Form 1099-PATR?

IRS Form 1099-PATR is a tax form that cooperatives must file whenever they distribute profits to their members through patronage dividends. Some examples of organizations that might send you a 1099-PATR include:

Agricultural cooperatives that help farmers market their products

Supply cooperatives that help farmers purchase inputs and services

Credit unions and farm credit associations

Taxpayers who receive their copy of the form must then use 1099-PATR to report that income on their own tax return using forms like Schedule F (Form 1040) and Form 8995-A.

When should I receive Form 1099-PATR?

Cooperatives are required to send a copy of Form 1099-PATR for any payments they sent you in 2024 by January 31, 2025. If you don’t receive the form by early February, follow up with your cooperative about getting one issued.

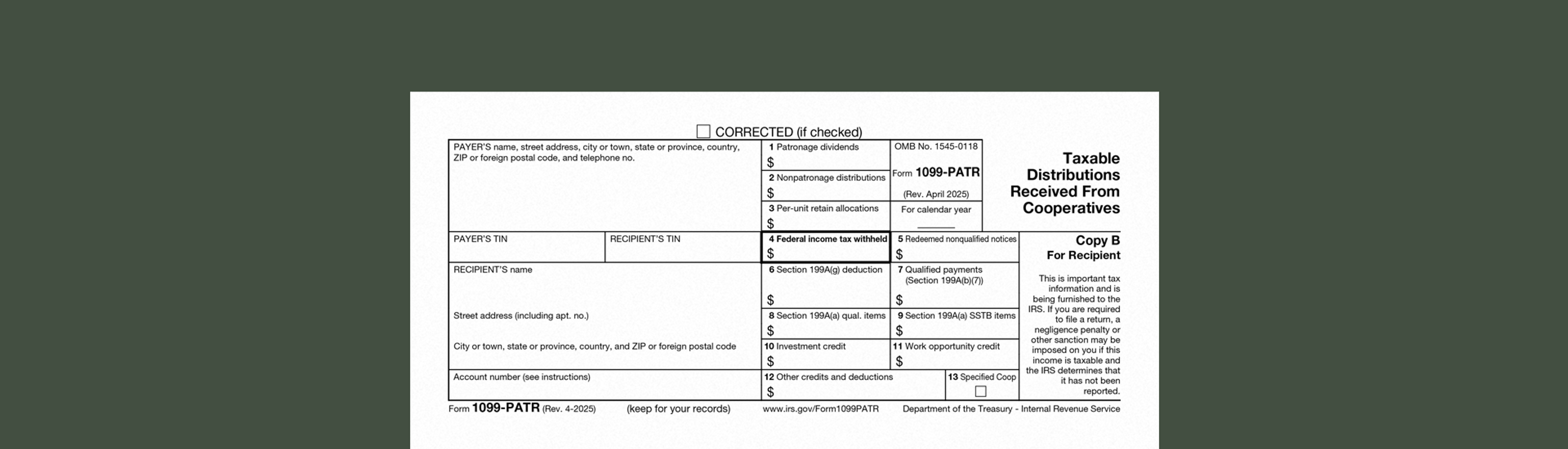

Form 1099-PATR: a Box-by-Box Breakdown

Box 1: Patronage dividends

This number represents total patronage dividends paid in cash to you by the cooperative for the previous tax year. This includes qualified checks, qualified written notices of allocation, and other property except nonqualified written notices of allocation. Report this amount on Line 3a and 3b of Schedule F (Form 1040).

Keep in mind that patronage dividends are only taxable if they’re attributable to your trade or business. If they are received for the purchase of personal items, they are not reported as income (which means you’ll report on Schedule F, line 3a, but not 3b). If you receive a patronage dividend for purchasing depreciable property, reduce the basis of the asset by the amount of the dividend instead of including it in your income.

Box 2: Nonpatronage distributions

This represents total distributions paid to you by farmers’ cooperatives exempt from tax under Section 521, which is a special tax status for certain qualifying agricultural marketing and supply cooperatives. Report this amount on Line 3a and 3b of Schedule F (Form 1040).

Box 3: Per-unit retain allocations

This represents your share of the total per-unit retain allocations paid in cash, qualified per-unit retain certificates and other property except nonqualified per-unit retain certificates. Report this amount on Line 3a and 3b of Schedule F (Form 1040).

Box 4: Federal income tax withheld

Sometimes a payer will be required to withhold tax from your payments (also called “backup withholding”) because you failed to provide a taxpayer identification number (TIN) or failed to report interest, dividend, or patronage dividend income. If they do, they’ll report that amount here.

Box 5: Redeemed nonqualified notices

This represents total nonqualified written notices of allocation paid to you for the previous tax year. (For qualified written notices of allocation, see ‘Box 1.’)

Box 6: Section 199A(g) deduction

This represents your share of the section 199A(g) “Domestic Production Activities” deduction (DPAD) claimed by the cooperative and passed through to you. Report this amount on Line 38 of Form 8995-A.

Box 7: Qualified payments

This represents total “qualified payments” paid to you by the cooperative, which will usually equal the total amount reported in boxes 1 and 3. Use this amount to calculate the reduction to your Section 199A(a) QBI deduction on Schedule D, Form 8995-A.

Box 8: Section 199A(g) qualified items

This represents qualified items of income, gain, deduction or loss from qualified trades or businesses that are not a specified service trade or business (SSTB) for purposes of section 199A. (See Form 8895 for more information on SSTBs.)

Box 9: Section 199A(g) SSTB items

This represents qualified items from qualified trades of businesses that are a specified service trade or business (SSTB) for purposes of Section 199A. (See the Form 8895 for more information on SSTBs.)

Box 10-12: Credits

This represents your share of the total investment credit, work opportunity credit and other credits and deductions, including:

The empowerment zone employment credit (Form 8844).

The low sulfur diesel fuel production credit (Form 8896).

The credit for small employer health insurance premiums (Form 8941).

The credit for employer differential wage payments (Form 8932).

The deduction for capital costs incurred by small refiner cooperatives when complying with EPA sulfur regulations.

The small agri-biodiesel producer credit of an eligible small agri-biodiesel producer (Form 8864).

Make Tax Season a Breeze with Ambrook

Ambrook’s Schedule F category tags are tailor-made for farming businesses, saving you hours on tax prep. With features like automated financial reporting, simplified bookkeeping, and effortless bill pay and invoicing, Ambrook is more than just a farm tax and accounting tool: it takes the guesswork out of running your business. Want to learn more? Start your 7 day free trial today.