The QBI deduction allows owners of sole proprietorships, partnerships, LLCs and S Corps to reduce their taxable business income by 20%. Here’s how to calculate it using Form 8895.

If you receive income from a ‘pass-through’ business like a sole proprietorship, partnership, LLC or S corporation, you might be able to reduce your taxable income with the qualified business income (QBI) deduction by completing and filing IRS Form 8995.

Here’s how to find out whether you’re eligible for QBI, what the limits are, and how to calculate the deduction itself using Form 8995.

What is Form 8995?

Taxpayers use Form 8995 to calculate and claim the qualified business deduction (QBI), also known as the ‘Section 199A’ or ‘pass through’ deduction, which is a tax deduction available to owners of certain ‘pass-through’ businesses like LLCs, S corporations, sole proprietorships and partnerships.

Qualifying individual taxpayers, trusts and estates can use the QBI deduction to reduce their taxable income from a trade or business by 20%.

What is a ‘pass-through’ entity?

While C corporations pay corporate taxes, certain other businesses like sole proprietorships, partnerships, LLCs and S corporations ‘pass-through’ their income and losses to their owners, who then report and pay taxes on that income on their personal tax returns.

Pass-through entities include:

Partnerships

General partnerships

Limited partnerships

Limited liability partnerships (LLPs)

Sole proprietorships

Limited liability companies (LLCs)

S corporations

What is the QBI deduction?

After lowering the tax rate for C corporations, the 2017 Tax Cuts and Jobs Act (TCJA) created the qualified business income deduction (QBI) to also cut taxes for small businesses that aren’t registered as C corporations.

The QBI deduction lowers your tax bill by decreasing the amount of qualified business income that is taxed, up to a certain limit. For example, if you earn $100,000 in qualified business income and take the deduction, QBI will lower the taxable amount by $20,000 to $80,000.

In July 2025, the One Big Beautiful Bill Act (OBBBA) made the QBI deduction permanent and also introduced a minimum QBI deduction of $400 for businesses that have at least $1,000 in qualified business income.

Who qualifies for QBI?

So what exactly is the difference between ‘ordinary’ and ‘qualified’ business income? QBI applies to most of the income you receive from a pass-through business, as well as qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income.

QBI doesn’t apply to income that isn’t connected to a trade or business, capital gains and losses, dividends, or income from businesses outside of the U.S. It also generally doesn’t apply to income from trades or businesses conducted by C corporations and services you perform as a regular employee.

It also doesn’t apply to income from specified service trades or businesses (SSTBs), however your income from an SSTB might qualify if it’s below a certain threshold (see below).

What’s a specified trade or business (SSTB)?

According to the IRS, an SSTB is “any trade or business where the principal asset is the reputation or skill of one or more of its employees or owners.” SSTB include services in the fields of:

Health

Law

Accounting

Actuarial science

Performing arts

Consulting

Athletics

Financial services

Brokerage services

Investing and investment management

Trading or dealing in securities, partnership interests, or commodities

SSTB income generally doesn’t qualify for QBI, however there are two exceptions:

If your 2024 income is less than or equal to $383,900 if married filing jointly, and $191,950 for all others, your SSTB is treated as a qualified trade or business.

If your taxable income before the QBI deduction is more than $383,900 but not more than $483,900 if married filing jointly, and is more than $191,950 but not more than $241,950 for all other returns, an applicable percentage of your SSTB is treated as a qualified trade or business, and you must complete Schedule A (Form 8995-A).

What changed about QBI in 2025?

The One Big Beautiful Bill Act (OBBBA) made the QBI deduction permanent and introduced a minimum deduction of $400 for businesses with at least $1,000 in QBI. It also increased the “phaseout” ranges for both SSTB and non-SSTB owners–from $50,000 to $75,000 for single filers and from $100,000 to $150,000 for joint filers.

That means that for 2025, single filers will have a phaseout range of $197,300 - $272,300 and joint filers will have a range of $394,600 - $544,600.

Form 8995 vs. Form 8995-A: What’s the difference?

The QBI deduction was created for small businesses, which means there are limits to your taxable income while taking the deduction: in 2025, less than or equal to $394,600 if married filing jointly, and $197,300 for all other returns.

If your income is more than that, but less than $544,600 if married filing jointly, and less than $272,300 for all other returns, you can still claim the QBI for some of your income by completing Form 8995-A.

If you received payments on Form 1099-PATR from a specified agricultural or horticultural cooperative, you’ll have to reduce your QBI by the patron reduction and use Form 8995-A instead of Form 8995.

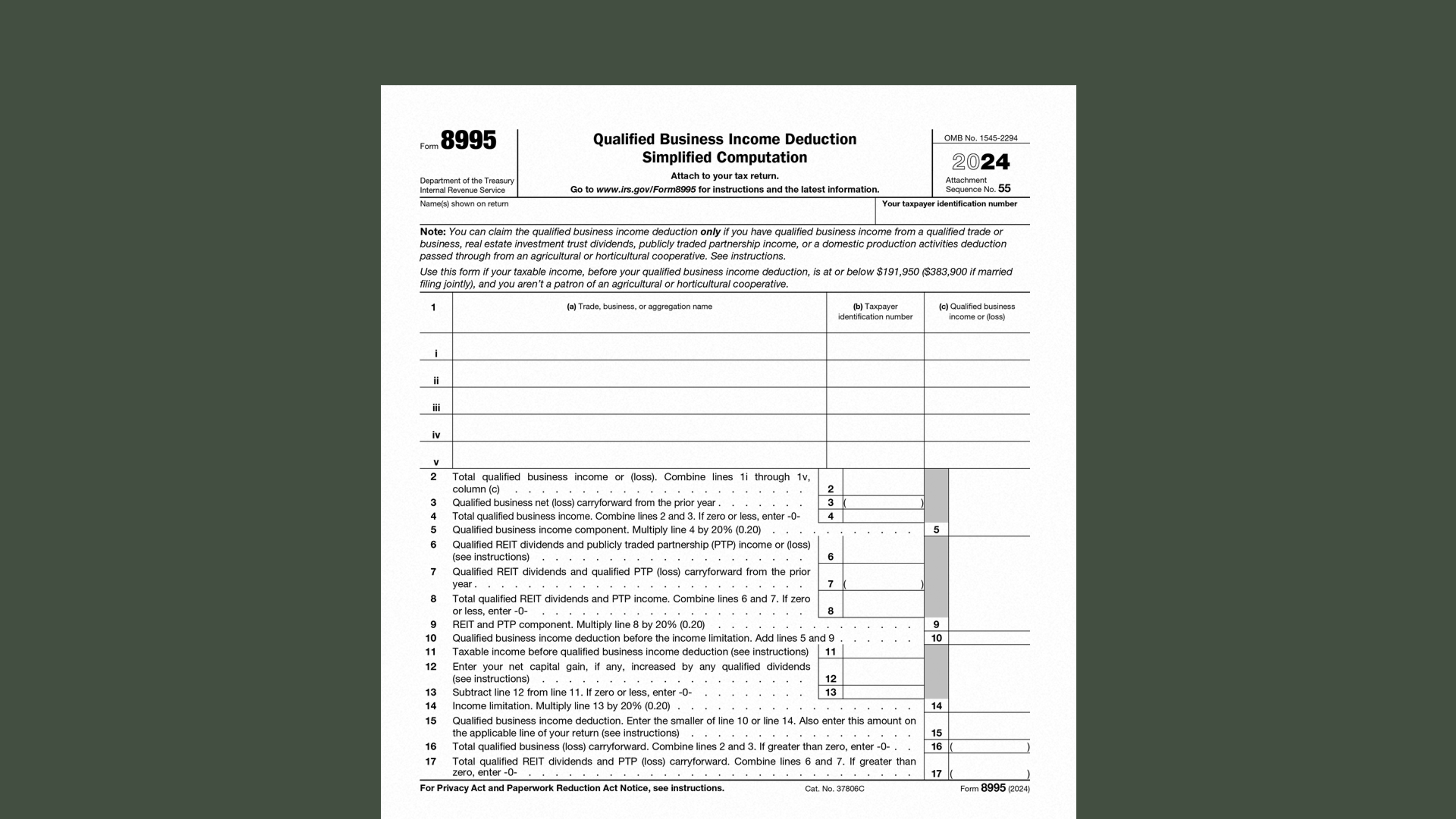

Form 8895: Line-by-Line Instructions

Line 1: Business name, TIN and income

Here you’ll enter the business names, identification numbers and income amounts for every source of QBI you’ll be claiming on your tax return this year.

Record the business names in column 1(a), employer identification numbers (EIN) in column 1(b). If you don’t have an EIN for the business, enter your Social Security Number (SSN) or individual taxpayer identification number (ITIN). Enter the total QBI or loss for each business using column 1(c).

If you have more than five sources of QBI to report, attach a separate sheet with the business names, TINs and QBIs for each additional source.

If you ‘aggregate’ or combine multiple businesses into a single source of income, enter the name of that aggregated source and complete Schedule B (Form 8995-A).

Line 2: Total qualified business income

Combine all of the amounts you reported in column 1(c) above (rows i through v) and enter the total here.

Line 3: Qualified business net (loss) carryforward from the prior year

If you filed Form 8995 last year and entered an amount on line 16 there, record that amount here.

Line 4: Total qualified business income

Add together the amounts on line 2 and line 3 to calculate your total QBI for this year.

Line 5: Qualified business income component

Multiply the amount you calculated on line 4 by 20% to calculate your total maximum QBI deduction.

Line 6: Qualified REIT dividends PTP income

Enter your qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income (or loss) here.

Line 7: REIT and PTP carryforward

If you filed Form 8995 last year and entered an amount on line 17 there, or on line 40 of Form 8995-A, record those amounts here.

Line 8: Total qualified REIT dividends and PTP income

Add together the amounts on line 6 and 7. If it’s a negative amount, you’ll carry it forward to the next year.

Line 9: REIT and PTP component

Multiply the amount you calculated on line 8 by 20%.

Line 10: Deduction before the income limitation

Add together the amounts on line 5 (your maximum QBI deduction) and line 9 (REIT and PTP component) to calculate your total deduction before income limitations.

Line 11: Taxable income before QBI deduction

Enter your taxable income figured before any QBI deduction, computed as follows:

Form 1041: line 23 plus line 20.

Form 1041-N: line 13, plus QBI deduction reported on Form 1041-N, line 9.

Form 990-T: Part I, line 11, plus line 9.

S-corporation portion of ESBT filers: ESBT Tax Worksheet, line 13 plus line 11.

Line 12: Net capital gain

Enter the amount from your tax return as follows:

1. Form 1040, 1040-SR, or 1040-NR, line 3a, plus your net capital gain.

If you’re not required to file Schedule D (Form 1040), your net capital gain is the amount reported on Form 1040, 1040-SR, or 1040-NR, line 7. If you file Schedule D (Form 1040), your net capital gain is the smaller of Schedule D (Form 1040), line 15 or 16, unless line 15 or 16 is zero or less, in which case nothing is added to the qualified dividends.

2. Form 1041, line 2b(2), plus your net capital gain.

For estates or trusts required to file Schedule D (Form 1040), add the qualified dividends to the smaller of Schedule D (Form 1041), line 18a(2), or line 19(2), unless either line 18a(2) or 19(2) is zero or less, in which case nothing is added to the qualified dividends.

3. Form 1041-N, line 2b, plus the smaller of Form 1041-N, Schedule D, line 10 or 11, unless line 10 or 11 is zero or less, in which case nothing is added to the qualified dividends.

4. Form 990-T filers who are trusts, Schedule D (Form 1041), the smaller of line 18a(2) or 19(2), unless either line 18a(2) or 19(2) is zero or less, in which case the net capital gain for purposes of section 199A is zero.

5. S-corporation portion of an ESBT, your ESBT Tax Worksheet, line 2b, plus the smaller of your ESBT’s Schedule D (Form 1041), line 18a(2) or 19(2) is zero or less, in which case nothing is added to your qualified dividends.

Line 13

Subtract line 12 from line 11.

Line 14: Income limitation

Multiply the amount you calculated on line 13 by 20%.

Line 15: QBI deduction

The smaller of line 14 and line 10 is your final QBI deduction amount. Record that amount here, as well as on:

Line 13 of Form 1040 or Form 1040-SR

Line 13a of Form 1040-NR

Line 20 of Form 1041

Line 9 of Form 1041-N

Line 16: Total qualified business (loss) carryforward

Add together lines 2 and 3. You may carry this amount forward to offset next year’s QBI.

Line 17: Total qualified REIT dividends and PTP (loss) carryforward

Add together lines 6 and 7.

Make farm taxes less taxing with Ambrook

Ambrook’s category tags correspond directly to each line on Schedule F, making it easy to compare your tax return to your records and saving you hours of work during tax season.

With time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make filing your taxes easy: it takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

Want to learn more about Ambrook?

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.