If you run an agricultural business and earn income that isn’t directly related to farming, you’ll have to file Schedule C to report your non-farming income.

In 2019, 96% of farm households earned at least some of their income off the farm, and small family farms derived more than half of their household income from off-farm sources. In addition to the stress and work involved in maintaining a second job, non-farming income can also create considerable headaches for farmers during tax season.

If you earn money off the farm or from any activities that don’t strictly qualify as farming income, like processing food products, agritourism, or event space rentals, you must complete and file Schedule C to report that non-farming income, in addition to Schedule F.

What is Schedule C, Form 1040?

Schedule C is part of your U.S. Individual Tax Return (Form 1040). Taxpayers use it to calculate and report profits or losses from business they operate or professions they practice as a sole proprietor.

If you haven’t incorporated or filed paperwork to become an LLC or corporation, you’re probably a sole proprietor and have to file Schedule C with your tax return. You’ll also file Schedule C if you’re a single-member LLC, meaning you’re the sole member of the LLC.

Want to get a head start on your taxes this year?

Who needs to file Schedule C?

If you are not incorporated, not a partnership or multi-member LLC and you haven’t elected S Corporation status, you are probably a sole proprietor and must file Schedule C.

You don’t need to create a sole proprietorship: according to the IRS, you are automatically considered one if you continuously and regularly engage in an activity for income or profit–i.e., to make money.

Single-member LLCs also have to file Schedule C unless they’ve elected to be taxed as a C corporation or S corporation.

When do farmers have to file a Schedule C?

Farmers who only earn agricultural income don’t have to file Schedule C: they just file Schedule F. As mentioned earlier, however, most farmers derive some of their income from non-farm sources, and must file Schedule C to report that income, including:

Income they earn from working as a freelancer or contractor on the side

Income from commodities they process in some way–for example, from making and selling wine, cheese, jams or other processed products

Income from any educational, recreational, or tourism-related activities, like wedding venue rentals, corn mazes, and u-pick operations.

Income from agritourism, which for tax purposes is considered a “non-farm” business activity

If you’re already reporting income or expenses on Schedule F, do not report them a second time on Schedule C.

What to get before filling out Schedule C

Schedule C requires detailed information about your income and expenses to complete.

You’ll need your balance sheet and income statement if you have those, as well as your check register or any other record of your business’ transactions and documentation (receipts, invoices, etc.) to back those expenses up.

If you’re reporting vehicle expenses, you’ll need a mileage log for each vehicle.

You’ll also need some basic information like your business name and contact information, your Social Security Number (SSN), Taxpayer Identification Number (TIN) and Employer Identification Number (EIN) if you have one.

How to fill out Schedule C: A step-by-step guide

Basic Information Fields

Enter your name (if you’re the business proprietor) and your Social Security Number (SSN) at the top of the form.

Line A: Principal business or profession

Briefly describe the business you’re reporting income or losses for here, including your industry and the type of product or service you provide.

If you operate multiple businesses, complete a separate Schedule C for each one.

Line B

Enter the six-digit Principal Business or Professional Activity (PBA) Code that corresponds to your business. Select the code from the ‘Principal Business or Professional Activity Codes’ section at the bottom of the instructions to Schedule C on the IRS website, or on pages C-19 through C-21 of the PDF version of the instructions.

Some relevant PBA codes for farmers might include:

112900 - Animal production

115210 - Support activities for animal production (including farriers)

115110 - Support activities for crop production (including cotton ginning, soil preparation, planting, & cultivating)

532400 - Commercial & industrial machinery & equipment rental & leasing

721100 - Traveler accommodation (including hotels, motels, & bed & breakfast inns)

445230 - Fruit & vegetable retailers

445100 - Grocery & convenience retailers

445240 - Meat retailers

445290 - Other specialty food retailers

Line C

Enter your business name here, if your sole proprietorship operates under a different name than your own.

Line D

Enter the employer identification number you applied for with Form SS-4 here, or leave it blank if you don’t have an EIN.

Line E

Enter your business address here.

Line F

Use these checkboxes to indicate whether you use the cash method, accrual method, crop method, or any other method of accounting. Remember that you have to file Form 3115 to change your method of accounting.

Line G

Use these boxes to indicate whether you materially (‘yes’) or passively (‘no’) participated in the business.

Generally speaking, you materially participate in the business if you participate in the activity on a “regular, continuous, and substantial basis” during the year. (However, rental activities are generally considered passive activities.)

The IRS has a series of tests for this: generally you materially participate if you spent more than 500 hours on the business, or spent more than 100 hours and at least as much as any other individual. You can find a full list of material participation tests in Publication 925 under ‘material participation tests.’

Line H

Check this box if you acquired the business during the tax year.

Line I and J

Check these boxes if you’re required to file a Form 1099 for the last year, and whether you plan to file the required forms. If you pay someone who isn’t your employee more than $600 in the calendar year for non-employee compensation, interest, use of rental property, royalties, annuities or barter, you’ll probably have to file a 1099 Form to report it to the IRS.

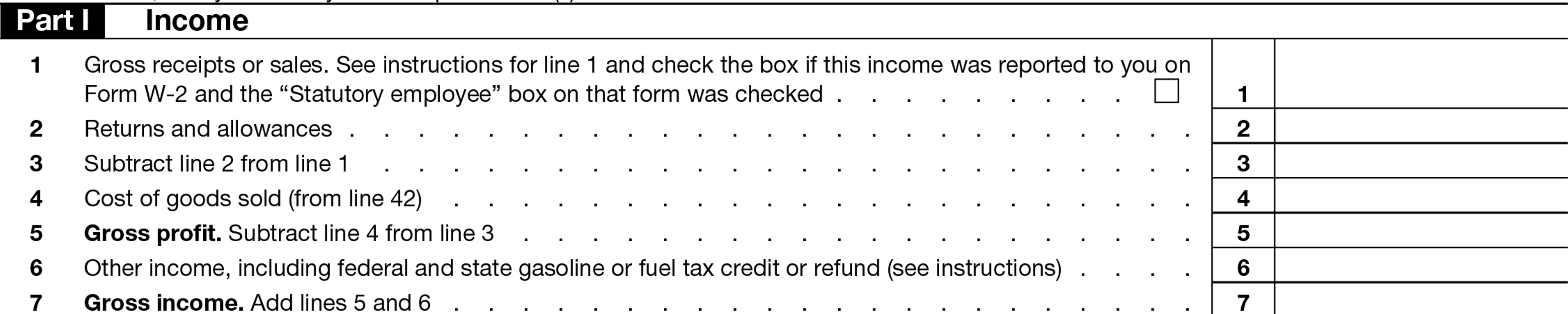

Part I: Income

This part is about calculating the gross income and gross profit of the business.

Line 1: Gross Receipts or Sales

Enter gross receipts for your business for the tax year on this line. Gross receipts are the total amount your business earned from all sources, without subtracting costs, returns or expenses. Make sure to include all income from any Form 1099s you received over the course of the tax year, including:

If you’re a farmer, don’t include farming-related income from Form 1099s. (Report that on Schedule F instead.)

If you receive a Form W-2 with Box 13 checked, enter your statutory employee income from Box 1 on that form on Line 1 of Schedule C and check the “statutory employee” box.

Line 2: Returns and allowances

If you issued refunds or credit to customers for returned goods or offered sales allowances (i.e., reduced the selling price of your products to certain customers) report those amounts here.

Line 3

Subtract line 2 from line 1.

Line 4: Cost of Goods Sold

If your business manufactures or purchases goods for resale, you can deduct the costs involved in manufacturing or acquiring them here. If you do, skip ahead and complete Part III first, then enter the resulting amount from line 42 here.

Line 5: Gross Profit

Subtract line 4 from line 3 to calculate your gross profit.

Line 6: Other Income

Use this section to report any other income your business earned that you didn’t enter on any of the other lines on Schedule C, including income from:

Recovered bad debts

Prizes and awards

Scrap sales

Federal and state gasoline or fuel tax credits or refunds

Biofuel credit claimed on Line 3 of Form 6478

Biodiesel credit claimed on Line 10 of Form 8864

Line 7: Gross income

Add Line 5 and 6 together to get gross income.

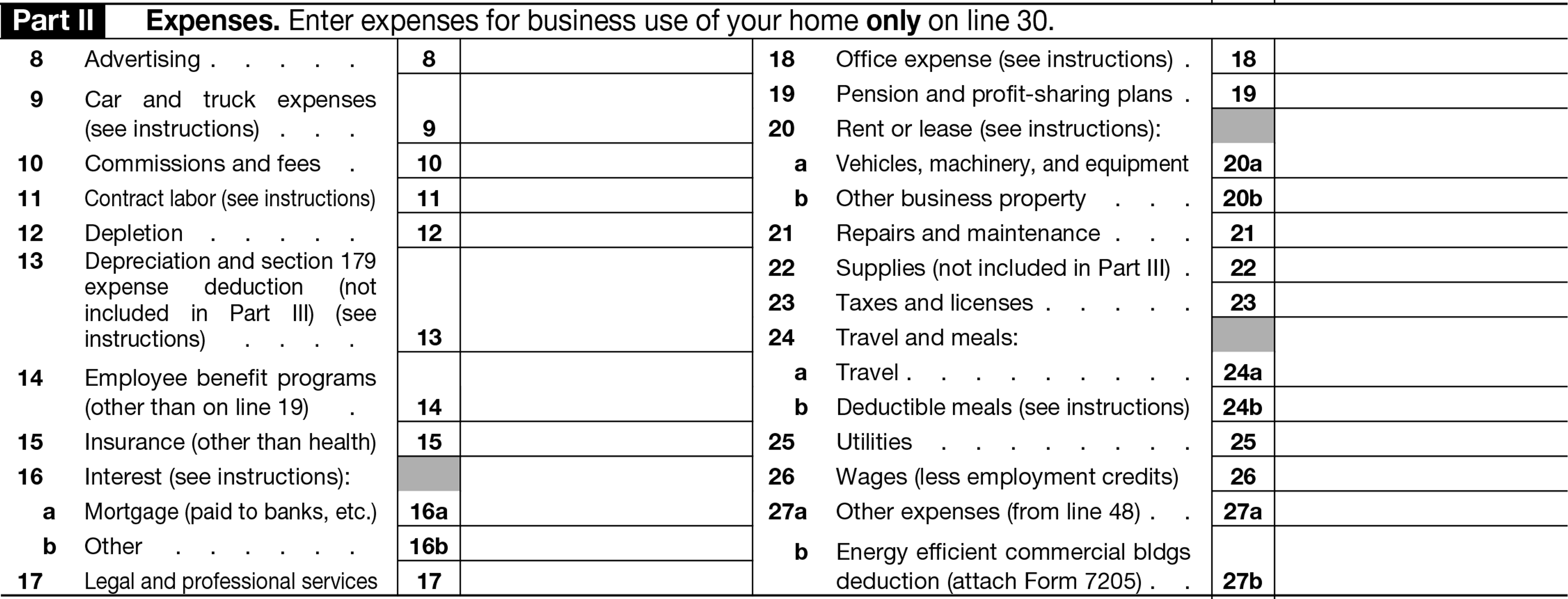

Part II: Expenses

Here you’ll add up all of your business expenses, similar to how you use Part II of Schedule F to add up all of your farming-related expenses.

Line 8: Advertising

Record any advertising-related expenses here. This might include print advertising fees, classifieds, promotional inserts, online ads, coupons, and any other expenses related to promoting your business online, on television or in print media.

Line 9: Car and truck expenses

Businesses have two options when reporting vehicle expenses: the Actual Expenses method and the Standard Mileage Rate (SMR).

The actual expenses method involves totaling up all of the costs involved in owning and operating a vehicle–e.g., oil, gas, repairs, tires, insurance, license, registration fees and depreciation–and multiplying that number by the total percentage for business use to figure your deduction.

Under the standard mileage rate method, instead of adding up expenses, you simply multiply the total number of miles driven for business purposes by the Standard Mileage, which for 2024 is 67 cents per mile.

Line 10: Commissions and fees

Enter total commissions and fees you paid over the course of the tax year. Remember that you’ll probably also have to file Form 1099-NEC to report commissions and fees over $600.

Keep in mind that unless you’re a dealer who regularly sells property in the ordinary course of their trade or business, you might have to capitalize commissions and fees paid to facilitate the sale of property.

Line 11: Contract labor

Record your total non-employee contract labor costs for the year, and remember to file Form 1099-NEC for any payments above $600 for the year.

Exclude any contract labor you’re including elsewhere on the return, including legal services (line 17), repairs and maintenance (line 21) and cost of labor (line 37).

Line 12: Depletion

Depletion is the using up of natural resources by mining, quarrying, drilling, or cutting. For more on calculating depletion for a mineral property or standing timber, consult the “Depletion” section of Publication 225, Farmer’s Tax Guide.

Line 13: Depreciation and Section 179

Expenses that benefit your business for more than one year like machinery, equipment and buildings must usually be ‘depreciated’ or spread out and deducted over multiple years instead.

Before depreciating their expenses, many businesses will also take advantage of Section 179, which allows them to deduct some or all of the cost of assets in the first year that they’re placed in service, up to a limit of $1,220,000 in 2024.

Enter total depreciation and Section 179 deductions for the year on this line. If you’re claiming depreciation or a Section 179 expense deduction, you must also complete and attach Form 4562.

Line 14: Employee benefit programs

Enter any contributions to employee benefit plans you made, other than contributions to pension and profit-sharing plans you made (and reported on line 19 of Schedule C). Examples might include:

accident and health plans

group term life insurance

dependent care assistance programs

Remember to complete Form 2441, Parts I and III if you contributed on your behalf as a self-employed person to a dependent care assistance program. Don’t include contributions you made on your behalf as a self-employed person for group-term life insurance or to an accident and health plan.

Reduce the amount on line 14 for any credit for small employer health insurance premiums determined on Form 8941.

Line 15: Business insurance premiums

Enter any premiums you paid for business insurance. Don’t include any amounts paid for employee accident or health insurance–include those on line 14 above instead.

Lines 16a and 16b: Interest

If you receive a Form 1098 for mortgage interest you paid on business property, report that mortgage interest amount on line 16a. Enter any other business interest you paid on line 16b.

If you have average annual gross receipts of $30 million or more and aren’t considered a “small business taxpayer,” you might have to file Form 8990 to deduct any interest expenses related to your business.

Line 17: Legal and professional services

Enter any fees you paid to accountants or attorneys for services related to your business like business incorporation, contract negotiation, tax preparation and advice, and tax deficiency resolution.

Line 18: Office expense

Enter any office supplies (i.e., paper, labels, ink and toner, organizers, shipping and packaging supplies, business cards and stationary) and postage expenses here.

Line 19: Pension and profit-sharing plans

Enter any contributions you made for your employees to pension plans, profit sharing plans or annuity plans. Don’t include any employer contributions (i.e., contributions for yourself as a self-employed person) here. Record those on line 16 of Schedule 1 instead.

Line 20a and 20b: Rent or lease

Enter any business-related rental costs for vehicles, machinery, and equipment on line 20a, and any other business-related rent payments you made–for commercial office or retail space, for example–on line 20b.

Line 21: Repairs and maintenance

Enter any business-related repairs and maintenance costs like labor, supplies, tools and contractor fees. Do not include any expenses that ‘improve,’ ‘better,’ or ‘restore’ property in some way, and don’t include the value of your own labor.

Line 22: Supplies

Enter the cost of any supplies you consumed and used in the course of your business, excluding those you reported in the Part III COGS calculation.

This can include the cost of books, professional instruments, equipment, etc., if you normally use them within a year, but if their usefulness extends beyond a year you must depreciate them.

Line 23: Taxes and licenses

Record any business-related taxes or license fees you paid, including:

State and local sales taxes

Real estate and personal property taxes on business assets

Licenses and regulatory fees

Social security and Medicare taxes paid to match required withholding from your employees’ wages (reduced by the Form 8846, Line 4 amount)

Federal unemployment tax

Federal highway use tax

Contributions to a state unemployment insurance fund or disability benefit fund if they are considered taxes under state law

Don’t include any taxes you paid on your home or personal property, federal income or self-employment taxes, or other taxes and license fees not related to your business. Remember that you can deduct half of your self–employment taxes on line 15 of Schedule 1.

Line 24a and 24b: Travel and meals

Enter any “ordinary” (common and accepted in your industry) and “necessary” (it helps develop or maintain your business in some way) lodging and transportation expenses incurred while traveling on line 24a.

Only include expenses related to overnight travel away from the home. Do not include entertainment expenses, or expenses for any other individual unless they’re an employee and the travel has a real business purpose.

Similar rules apply to business meal expenses. You can either include 50% of meal expenses, or 50% of a standard meal allowance. Meal expenses can include food, beverages, taxes, and tips. Do not include entertainment expenses, or any lavish or extravagant meal expenses.

Line 25: Utilities

Include telephone, internet, cell phone, and other utility expenses, but only the portion you use for business. Don’t include the cost of the first telephone line in your home, however you may include a second line used exclusively for business.

Line 26: Salaries and wages

Enter total salaries and wages paid to employees for the previous tax year. Reduce this amount by the following credits, if you claimed them:

Work Opportunity Credit (Form 5884).

Empowerment Zone Employment Credit (Form 8844).

Credit for Employer Differential Wage Payments (Form 8932).

Employer Credit for Paid Family and Medical Leave (Form 8994).

Line 27a and 27b

Enter total other expenses calculated on line 48 in part V on line 27a.

If you claim part or all of the expenses of modifying an existing commercial building to make it energy efficient, record that amount on line 27b and attach Form 7205.

Line 28 and 29

Add all of the lines in Section II up until this point (line 8 - line 27b) to calculate total expenses before expenses for business use of home and enter that amount on line 28.

Subtract the amount on line 28 from the gross income figure on line 7 to calculate tentative profit or loss and enter on line 29.

Line 30: Expenses for business use of your home

Enter your business use of home expenses here. You have two options here: the actual expenses method and the simplified method.

Under the actual expenses method, you can deduct expenses directly associated with running and maintaining the office. Complete and attach Form 8829 if you use this method and enter the resulting amount on line 30.

Under the simplified method, you multiply the total area of the home office in square feet by the prescribed rate from Publication 587, which is currently $5 per square foot (up to 300 square feet).

If you use the simplified method, enter the total square footage of your home and office in the fields provided, complete the simplified method worksheet in the instructions to Schedule C, and enter the resulting amount on line 30.

Line 31: Net profit (or loss)

Subtract line 30 from line 29 to calculate net profit or loss for the business.

Enter any resulting profit on line 3 of Schedule 1 (Form 1040), line 2 of Schedule SE, and line 3 of Form 1041 if your business is an estate or trust.

Line 32

If line 31 shows a loss, check box 32a and/or 32b to indicate how much of your investment in the business is at risk, i.e., how much of the loss is coming out of your own pocket.

Check box 32b if there’s money invested in the business for which you are not at risk, including:

Nonrecourse loans, i.e., loans that only allow the lender to pursue the collateral

Borrowed amounts that are protected against loss by a guarantee, stop-loss agreement, or other similar arrangement, excluding casualty insurance and insurance against tort liability

Funds borrowed from a related person or a person who has an interest in the business

If you check box 32b, complete Form 6198 to determine the extent of the losses you can claim on Schedule C.

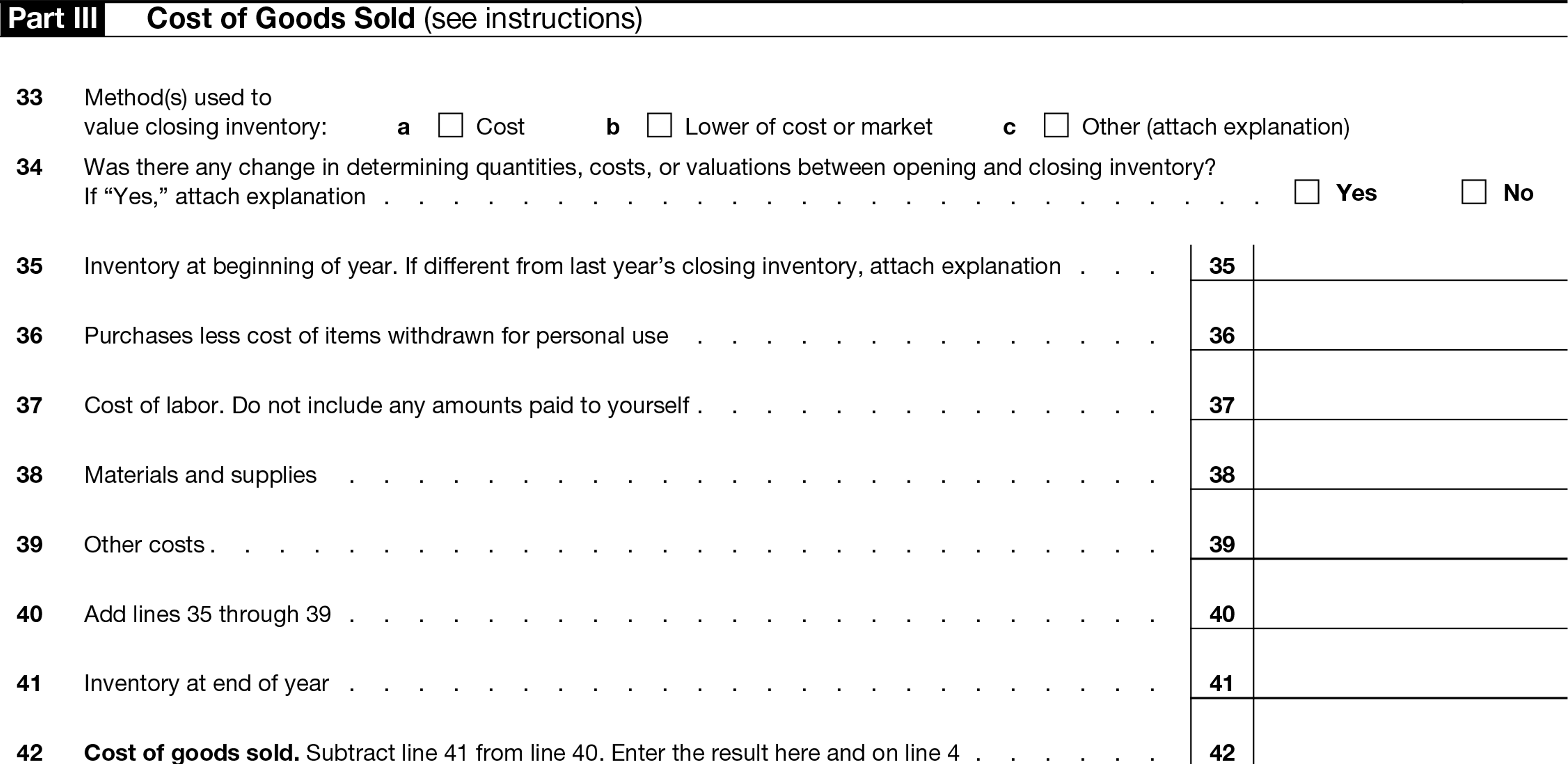

Part III: Cost of Goods Sold

If your business manufactures or purchases goods for resale, you can deduct some of the expenses involved in the Cost of Goods Sold section.

Line 33: Method(s) used to value closing inventory

Use the boxes here to indicate the method you use to value your inventory: cost, lower of cost or market, or other.

If you use the cash method of accounting, you probably use the cost method, which uses the original purchase cost to value inventory.

The lower of cost of market method uses either the original purchase cost, or the fair market value of the inventory, whichever one is lower.

If you use another method, check the “other” box and attach an explanation to Schedule C.

Line 34

If at any point during the year you changed the method by which you determined inventory quantities, costs, or valuations, check the “Yes” box and attach an explanation.

Line 35: Inventory at beginning of year

Enter the opening inventory at the beginning of the tax year. If this amount is different than the closing inventory reported for the tax year preceding, attach an explanation.

Line 36: Purchases less cost of items withdrawn for personal use

Enter your total purchases for the tax year, minus the cost of any items withdrawn for non-business use.

Line 37-39: Cost of labor, materials, supplies, and other costs

Using information from your income statement, enter the cost of labor (Line 37), materials and supplies (Line 38) and other costs (Line 39) for the tax year.

Line 40

Add lines 35 through 39.

Line 41: Inventory at end of year

Enter your closing inventory for the end of the tax year.

Line 42: Cost of goods sold

Subtract line 41 from line 40 to get the total cost of goods sold for the tax year. Record the amount here and on Line 4.

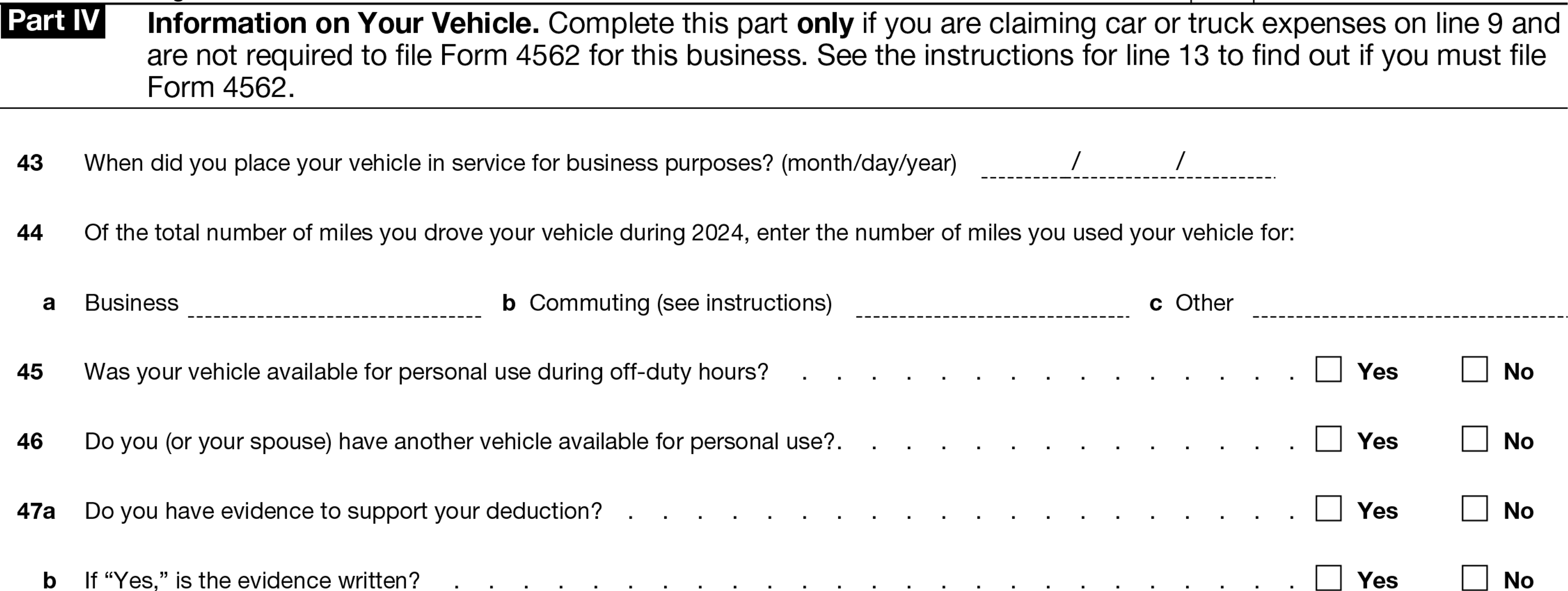

Part IV: Information on Your Vehicle

You only have to complete this section if you’re claiming vehicle expenses on Line 9 and aren’t required to file Form 4562. (You must file Form 4562 if you’re claiming depreciation or a Section 179 expense deduction.)

If you aren’t claiming vehicle expenses on Line 9 or you are required to file Form 4562, skip ahead to Part V.

Line 43

Enter the date you placed your vehicle in service.

Line 44

Using information from your mileage log, enter the total number of miles you drove your vehicle for business (Line 44a), commuting (Line 44b) and other purposes (Line 44c).

Line 45

Note whether your vehicle was available for personal use during off-duty hours.

Line 46

Note whether you (or your spouse) had another vehicle available for personal use.

Line 47a and 47b

Note whether you have written evidence to support your vehicle deduction. Written evidence for business mileage usually comes from a timely and accurate mileage log. (Check out our guide to keeping a vehicle mileage log for more information.)

Part V: Other Expenses

Use this section to list any business expenses not mentioned elsewhere on Schedule C, including:

Amortization for goodwill and certain other intangibles, research and experimentation, and amounts paid to acquire trademarks

Losses from the business that were not allowed last year because of the at-risk rules

Debts and partial debts from sales or services that were included in income and are definitely known to be worthless

De minimis safe harbor for tangible property

Consult the instructions to Schedule C for a full list of expenses that you can include in Part V. Do not include the cost of business equipment or furniture, replacements or permanent improvements to property, or personal, living, and family expenses on Part V.

Kickstart your Tax Planning with Ambrook

Ambrook’s category tags correspond directly to each line on Schedule F, making it easy to compare your tax return to your records and saving you hours of work during tax season.

With time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make filing your taxes easy: it takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

Want to learn more about Ambrook?

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.