This mileage log template is easy to use and comes straight out of the IRS’s vehicle recordkeeping manual.

If you use a vehicle for both personal and business use, you’ll need to keep a vehicle log to properly deduct business expenses for that vehicle on your taxes.

A good mileage log doesn’t have to be complicated: a simple spreadsheet recording the mileage, date, purpose and vehicle expenses for each trip can be more than enough. As with anything tax-related, however, there are some nuances worth keeping in mind.

What’s the purpose of a mileage log?

In a nutshell, a mileage log helps you and the IRS determine which portion of your vehicle mileage is personal and which portion is for business–and therefore eligible for tax deductions.

If you use a vehicle for both personal and business use, you’ll need a vehicle log to determine either the percentage of business use or the total number of miles driven for business, depending on which method you use to claim your vehicle deductions on your taxes.

Actual Expenses vs. Standard Mileage Rate

Most businesses have two options when deducting their vehicle expenses: the Actual Expenses method and the Standard Mileage Rate (SMR).

The Actual Expenses method involves totaling up all of the costs involved in owning and operating a vehicle–e.g., oil, gas, repairs, tires, insurance, license, registration fees and depreciation–and multiplying that number by the total percentage for business use to figure your deduction.

If the total cost of owning and operating a vehicle in 2024 ends up being $10,000 and you use it for business purposes 55% of the time, for example, then you would deduct $5,500 under the actual expense method.

Under the Standard Mileage Rate method, instead of adding up expenses, you simply multiply the total number of miles driven for business purposes by the Standard Mileage, which for 2024 is 67 cents per mile.

So for example, if you log 5,000 miles for business use on a vehicle in 2024, the Standard Mileage Rate deduction for it would be $3,350 (5,000 x 0.67).

What does the IRS say about mileage logs?

According to the IRS, mileage records need to be timely, which means they’re recorded at or near the time of expense. Daily records aren’t mandatory–a weekly log is considered a timely kept record, for example–but the earlier and more frequently you record, the better.

Proper mileage records must also, at minimum, include the following information for each trip:

Date

Mileage

Destination

Business purpose

If you’re using (or plan to use) the Actual Expenses method, you must also record the expenses you incur during each trip, like tolls, gas and parking.

There’s no required mileage log template: you can use a paper log book, a spreadsheet, or even a mileage tracking app to log your mileage.

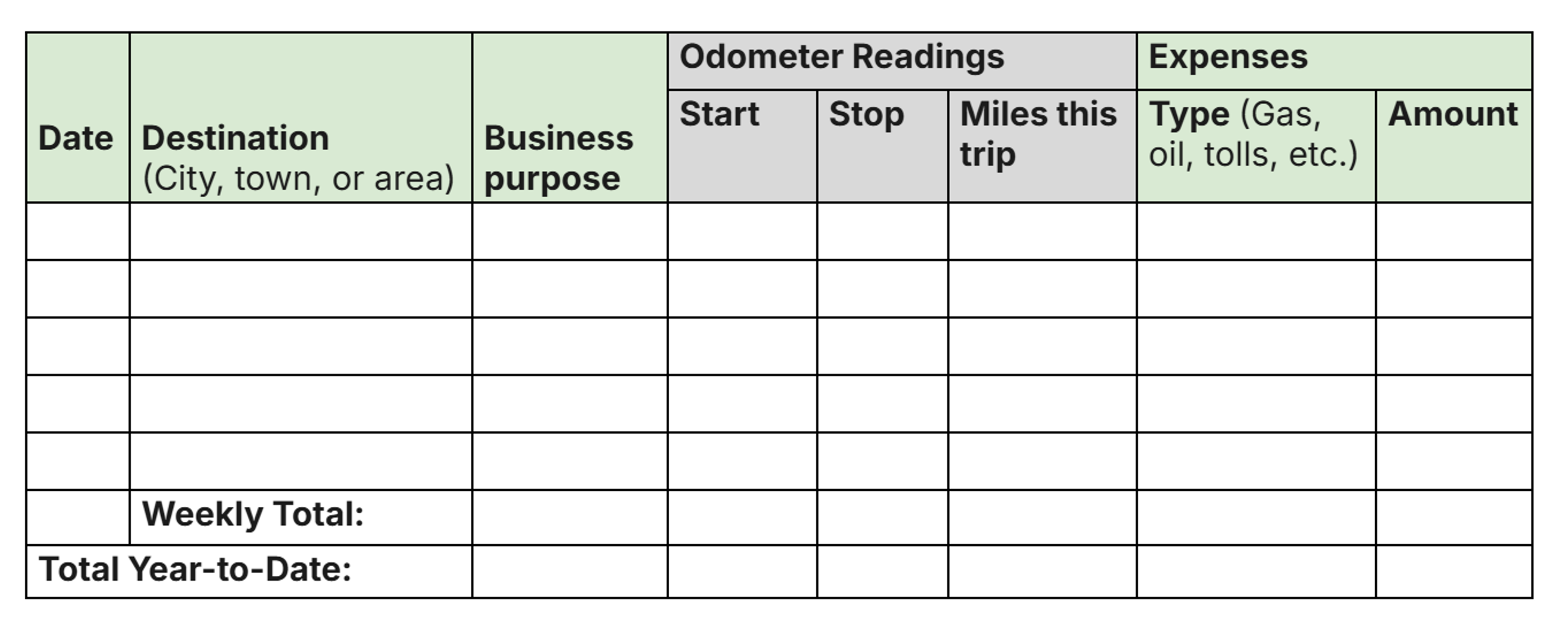

The IRS does provide a business mileage and expense log example template in part 5 of Publication 463, which covers recordkeeping requirements for vehicle expenses.

Daily Business Mileage and Expense Log: IRS Template

Table 5-2 from IRS Publication 463 (2024)

This mileage log format should work for taxpayers using either the Standard Mileage Rate or the Actual Cost method of deducting vehicle expenses.

Tips for keeping an accurate mileage record

1. Don’t mix up SMR with Actual Expenses

You cannot deduct both mileage and actual vehicle expenses–you have to choose one deduction method for the year and stick to it.

If you drive 5,000 business miles in one year and spend $3,000 on gas, for example, you can’t deduct both the miles and the gas: it’s one or the other.

2. Your morning commute doesn’t count

Remember that while most types of business travel–including transporting goods, purchasing supplies and equipment, servicing equipment, visiting customers, selling goods and attending trade shows–are deductible, commuting to and from work is not a deductible expense.

3. Record odometer readings for each trip

Recording start and end odometer readings for each trip is the most reliable way of logging mileage, and you might run into problems claiming mileage if you don’t.

4. Hang onto your receipts

A mileage log won’t be enough to claim expenses like tolls, gas, maintenance and parking. If you’re using the actual expense method, be sure you’re holding onto receipts for those expenses.

Should I keep a mileage log even if I use a vehicle for 100% business use?

It depends. If you’re a smaller or family-run business with lots of overlap between personal and business expenses, the IRS will be less inclined to believe that your vehicle is used purely for business purposes and might decide to take a closer look. If you’re in doubt, we recommend consulting your tax professional.

What about personal trips, should I log those?

While it might seem time-consuming, being diligent and logging every vehicle trip can help prevent unexplained gaps in your mileage log and ensure the percentage of business use you calculate for the actual expenses method is accurate. We recommend making a habit out of logging personal trips as well.

What happens if I don’t keep a vehicle log?

1. You might have to pay more in taxes

If your business employs drivers, you’ll need vehicle logs to properly reimburse those employees for vehicle expenses. If you don’t, your reimbursements could qualify as wages, which unlike reimbursements are taxable.

2. You could run into problems with the IRS

If you deduct vehicle expenses without the right records, documentation and proof of mileage, you could get audited and/or fined by the IRS.

3. If you’re a farmer, you’ve got other options

To avoid the extra recordkeeping burden, farmers have a special rule or “safe harbor” called §1.274-6T(b) which allows them to claim 75% of the use of a vehicle for business use without records. According to the IRS, farmers can only use the safe harbor if they use the vehicle “during most of the normal business day directly in connection with the business of farming.”

Never Miss Another Deduction Again with Ambrook

Ambrook’s category tags correspond directly to each line on Schedule F, making it easy to compare your tax return to your records and saving you hours of work during tax season.

With time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make filing your taxes easy: it takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.