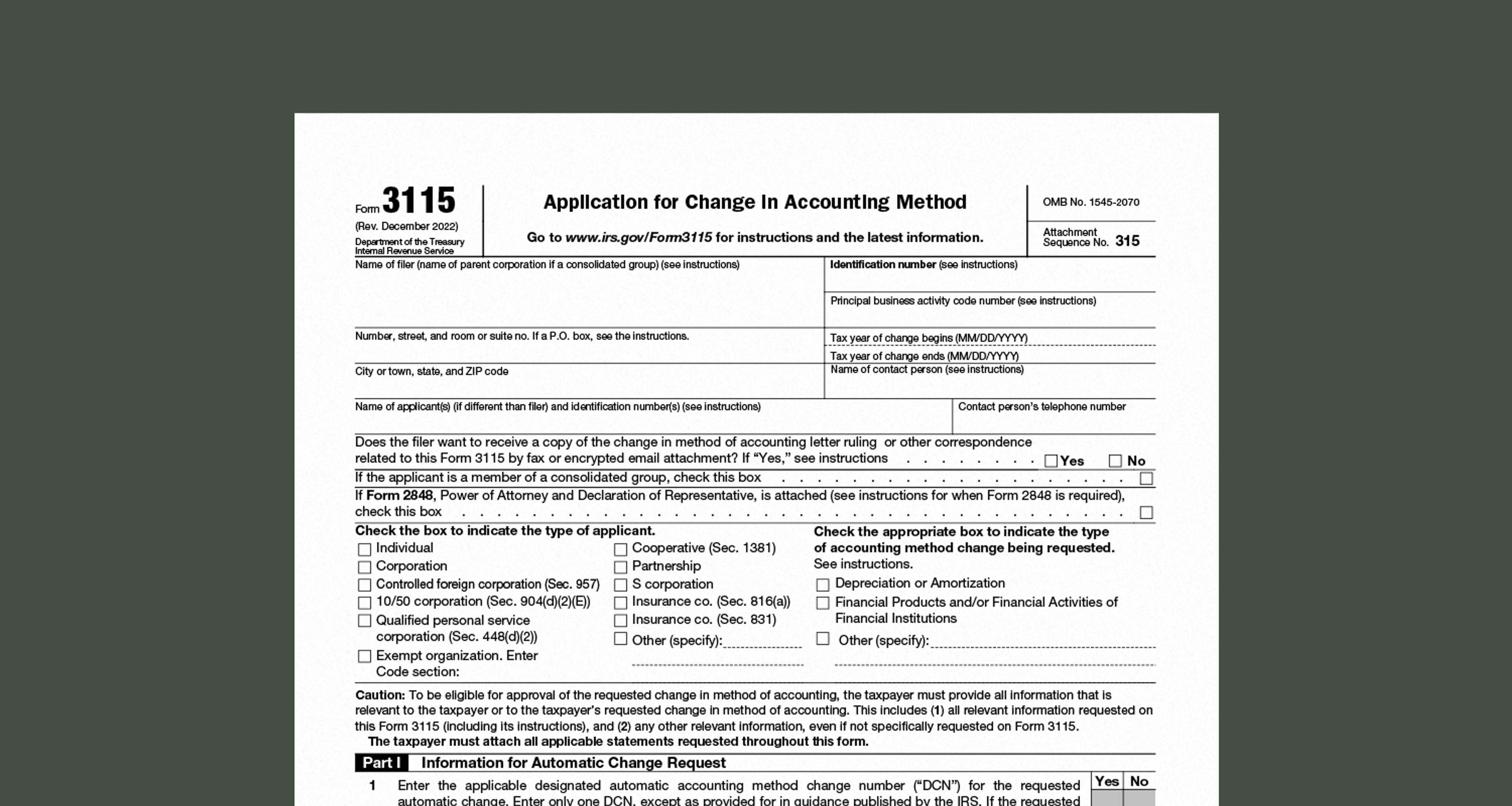

Before you change your overall accounting method or the way you treat any particular item—e.g. how you depreciate your assets or value your inventory—on your tax return, you’ll have to file Form 3115 first. Here’s how it works.

You need to file Form 3115, Application for Change in Accounting Method, if you change how you do your accounting, depreciate assets, or value or manage your inventory.

Form 3115 requests approval for the change from the IRS. Think of it as a way of making sure you and the IRS are on the same page. Your accounting method, depreciation, and inventory all affect how you report income and expenses. If the IRS isn’t up to date with these aspects of your operation, they can’t accurately process your tax return.

Also, Form 3115 can make changes retroactively. That’s important if you realize you’ve made an error in past years and you need to go back and fix it.

Here’s everything you need to know about Form 3115—what role it has to play in your business, and how to file it correctly and on time.

What is Form 3115?

You file Form 3115 to request approval for changing how you:

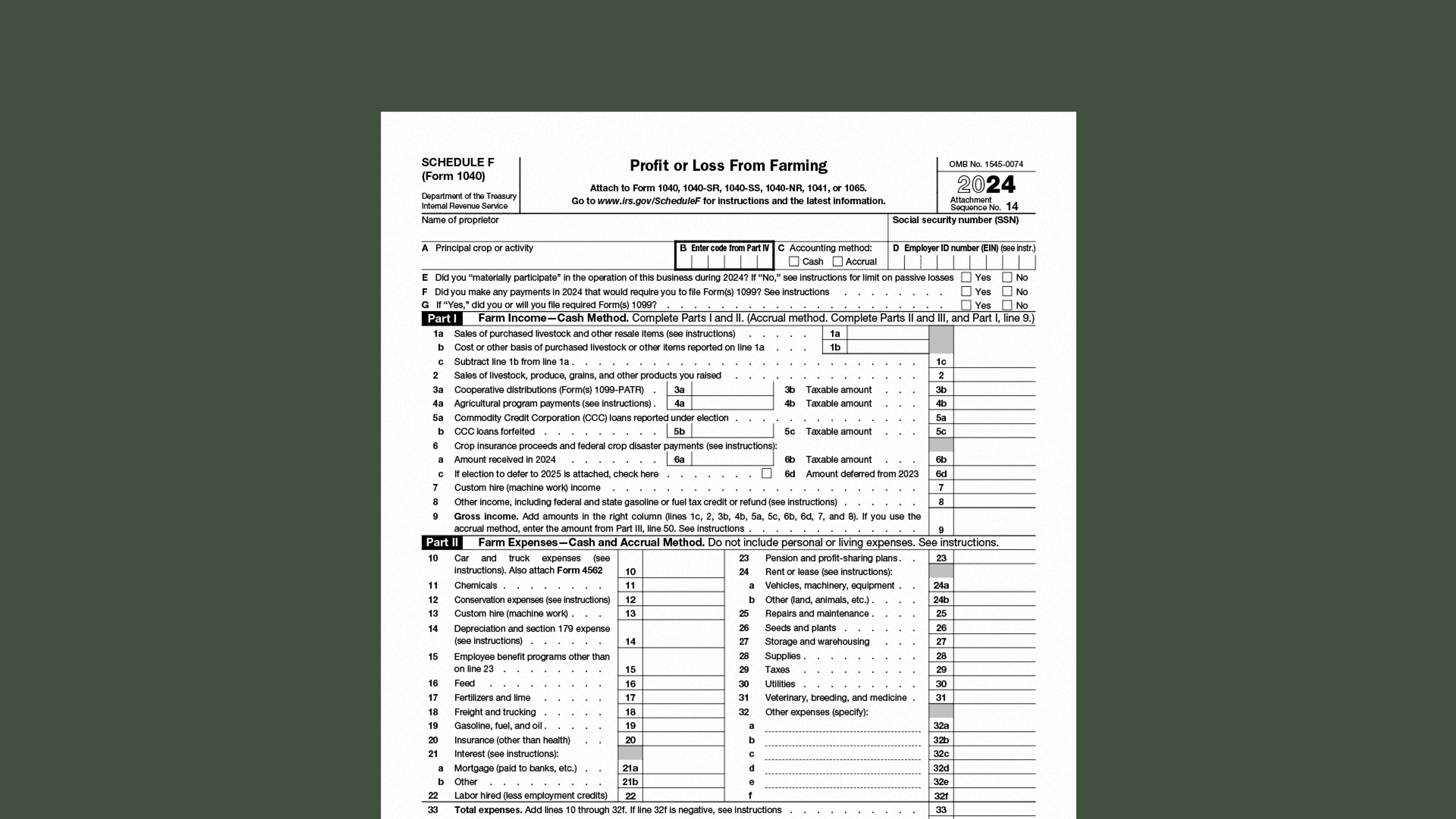

Do your accounting (your accounting method)

Depreciate assets, including depreciation methods and schedules

Value inventory (ie. cost method, lower of cast or market, farm-price, or unit-livestock-price)

You must also file Form 3115 if you are changing the base unit for how you value livestock with the unit-livestock-price method, and get the IRS’s approval for doing so.

When you file Form 3115 for the current year, the IRS adjusts your income and expenses for past years up to the present year. This is called a §481(a) adjustment.

What is a §481(a) adjustment?

When you make a request on Form 3115 and the IRS approves it, they apply it retroactively. And, no matter when you file it in the current year, the IRS treats the change as having taken place at the beginning of the tax year.

In effect, all your past income and expenses, when the old method was in effect, are treated as though the new method applies. The IRS calculates the cumulative difference. This prevents you from:

Skipping income that should have been taxed

Deducting expenses twice

Recognizing expenses too early

Improperly deferring income

Example: On January 1, 2026, your ag operation switches from the cash basis method of accounting to the accrual method. At that point in time, you have $30,000 Accounts Receivable (sales you have made, but which you haven’t been paid for) and $10,000 Accounts Payable (supplies you’ve received, but which you haven’t paid for).

Following the old cash method, the $30,000 would not yet be taxed because you hadn’t been paid yet. And the $10,000 would not yet be deducted because you hadn’t paid it.

If you made the accounting method switch without the §481(a) adjustment, the net $20,000 profit ($30,000 - $10,000) would not be included in your income for 2025, the prior year.

With the adjustment, the $20,000 is included as income for 2025. The IRS makes the adjustment, meaning you owe taxes on the $20,000. This is a positive adjustment.

If the situation was reversed—if your AR was $10,000 and your AP was $30,000—then the §481(a) would apply a $20,000 deduction rather than a $20,000 increase in income. This would be a negative adjustment.

Positive vs. negative §481(a) adjustment payments

Negative and positive adjustments are paid out differently.

If the IRS makes a negative adjustment, you typically take 100% of the deduction in the year for which you filed Form 3115. So, following the negative adjustment example above, you would claim a $20,000 deduction on your 2026 tax return.

If the IRS makes a positive adjustment, the added income is spread over the four concurrent years. Following the positive adjustment example above, your income would increase $5,000 for 2026, 2027, 2028, and 2029.

This spreading of positive adjustments is meant to help businesses budget for added tax liability. On the other hand, a negative adjustment is 100% deducted in the current year—meaning you can take advantage of the tax savings immediately.

Examples of Form 3115 changes for ag producers

Besides switching accounting methods, here are some examples of changes ag producers might request with Form 3115:

Equipment depreciation. An ag operation purchases a new piece of equipment and begins depreciating it over a seven-year schedule. After three years, they review their paperwork and realize they have chosen the wrong schedule—the equipment actually qualifies for a five-year schedule. That means they deducted too little from their taxes over those three years. With a §481(a) adjustment, they recoup the extra depreciation expense they failed to claim.

Inventory valuation. An ag operation has been using the lower of cost or market (LCM) method to value their livestock inventory. They file Form 3115 and switch to livestock-unit-price method. The livestock-unit-price method values their inventory for less than the LCM method, resulting in lower income. For previous years when they used the LCM method, their taxable income is now decreased. This is a negative §481(a) adjustment—they deduct the prior year expenses in the current year, realizing tax savings.

Inventory management: An ag operation has been using the weighted average cost (WAC) method to manage its feed inventory. It switches to the last in, first out (LIFO) method. This results in higher production costs (part of COGS) for previous years, increasing prior years’ deductions and resulting in a negative §481(a) adjustment.

Automatic vs. non-automatic Form 3115 changes

Changes requested with Form 3115 fall into two categories:

Automatic changes. These include depreciation method changes and some inventory method changes. (See the IRS Form 3115 instructions for the full list of automatic changes.) Automatic changes are relatively simple and straightforward, and do not cost a filing fee.

Non-automatic changes may include accounting method and certain inventory method changes. These are more complex changes and require a filing fee.

It’s not always clear-cut exactly whether a change is automatic or non-automatic. Because this can be difficult to figure out—and because of the complexity of Form 3115 overall—it’s a good idea to enlist the help of a tax professional when filing.

Can you amend tax returns with Form 3115?

You do not use Form 3115 to amend past returns.

Form 3115 makes an adjustment based on changes in accounting methods, inventory valuation methods, capitalization and depreciation decisions, or revenue recognition processes. Amendments are made to returns to correct errors in reporting, calculation, and missed depreciations that are not tied to your accounting method.

Who needs to file Form 3115?

If you are an ag producer making any of the method changes covered above, you need to file Form 3115.

If you incorrectly calculated or reported income or deductible expenses on prior returns, or if you need to make other changes—for instance, retroactively electing S corporation status—then you do not need to file Form 3115. Instead, you file amended tax returns and other forms as necessary.

What happens if I don’t file Form 3115?

If you make a change covered by Form 3115, but do not request approval from the IRS by filing the form, you could face serious consequences:

The IRS may consider your tax return unauthorized or improper

You may be forced to go back and resubmit your return using the old (pre-change) method

You could owe back taxes or penalties for underpaying and underreporting your taxes

You may be forced to file Form 3115, in which case the change you request will be treated as non-automatic

You may be prevented from enjoying reduced tax liability in the case of negative adjustments

Importantly, and fundamentally, if you fail to file Form 3115, your financial reports (using the new method) will not match with your tax returns. This can wreak havoc on your accounting and make it difficult to determine how much your ag operation is earning and spending.

How do you use Form 3115 for missed depreciation?

Correcting depreciation methods is one of the most common uses to which ag operations put Form 3115.

You may need to file Form 3115 and make a correction if you:

Failed to depreciate an asset

Used the wrong depreciation schedule (eg. five years instead of seven years)

Used the wrong convention (eg. half-year instead of quarterly)

Used the wrong depreciation method, or want to use a different one

Forgot to apply bonus depreciation

Treated an asset as an expense rather than a capital asset

Treated a capital asset as an expense

Made an improper Section 179 election

How to adjust depreciation with Form 3115

To make changes to past depreciation with Form 3115:

Identify the incorrect method you used

Identify the correct method you should have used

Calculate the §481(a) adjustment (total correct depreciation minus incorrect depreciation claimed)

Complete and file Form 3115, attaching a statement explaining the change

In many cases, correcting past depreciation errors results in a negative §481(a) adjustment, allowing you to claim the difference (and pay less in taxes) in the year for which you file.

What happens if you don’t request a depreciation change with Form 3115?

If you don’t request an adjustment to incorrect depreciation with Form 3115, the IRS might spot the error before you file.

If that’s the case, they may consider your tax return improper or inaccurate. The IRS could force a positive §481(a) adjustment, and you may face penalties or owe back taxes.

Also, until the adjustment has been made, you can’t claim any additional depreciation expenses. And if you have failed to claim depreciation expenses and then sell the asset, you could lose money: The IRS assumes you have been taking the expense, and you can’t write off the cost after you earn revenue from the sale.

How far back can you amend returns with Form 3115?

To reiterate: You cannot amend past returns with Form 3115.

Form 3115 requests an adjustment—it does not amend past returns.

That being said, there is no statute of limitations on Form 3115. Any adjustment made as a result of filing extends as far into the past as necessary. That means a §481(a) adjustment could apply to every year your operation has been in business.

The Form 3115 deadline and how to file

For simplicity’s sake, you should file Form 3115 along with your timely filed tax return. However, there is no penalty for filing Form 3115 late—you can file it at any point during the year.

Form 3115 can’t be filed online—you must complete a paper copy and send it by mail. When filing Form 3115, you should include a copy with your timely filed return and also send a copy to IRS Ogden, UT.

Ambrook gives you well-adjusted accounting

Ambrook is a complete financial platform for your agricultural operation. With Ambrook, you get a complete set of books and detailed financial insights. That makes it easier to request and file §481(a) adjustments.

With time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

Want to learn more about Ambrook?

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.