Don’t want to pay your suppliers too early, but also don’t want to pay them too late? It’s time to take a closer look at accounts payable.

So you have a stack of outstanding bills that need to be paid soon. Or maybe one of your suppliers is asking for payment faster than usual.

You don’t want to burn any bridges–you value and rely on your suppliers when the business is doing well–but you’re also wary of spending too much cash at the same time. What should you do?

Welcome to the world of bill pay, or ‘accounts payable’ (AP) in accountant speak. Managing it properly is about more than just negotiating favorable payment terms and staying on top of your invoices. It’s also about managing your relationships with suppliers and ensuring your business has enough cash for day-to-day activities.

What are accounts payable?

Also sometimes referred to as “bills payable” or simply “bill pay,” “accounts payable” can actually refer to a few different things within a business.

At the most basic level, accounts payable refers to all of your unpaid bills. If you receive an invoice that you don’t plan on paying immediately, that’s one of your ‘accounts payable.’

Your accounts payable can include things like:

Bills for seed, feed, fuel or other supplies

Monthly payments for vehicles or equipment

Utility bills for water and electricity

Contractor invoices for hauling, construction and custom work

Invoices for professional services, like breeders, accountants and lawyers

Bills for maintenance and servicing equipment

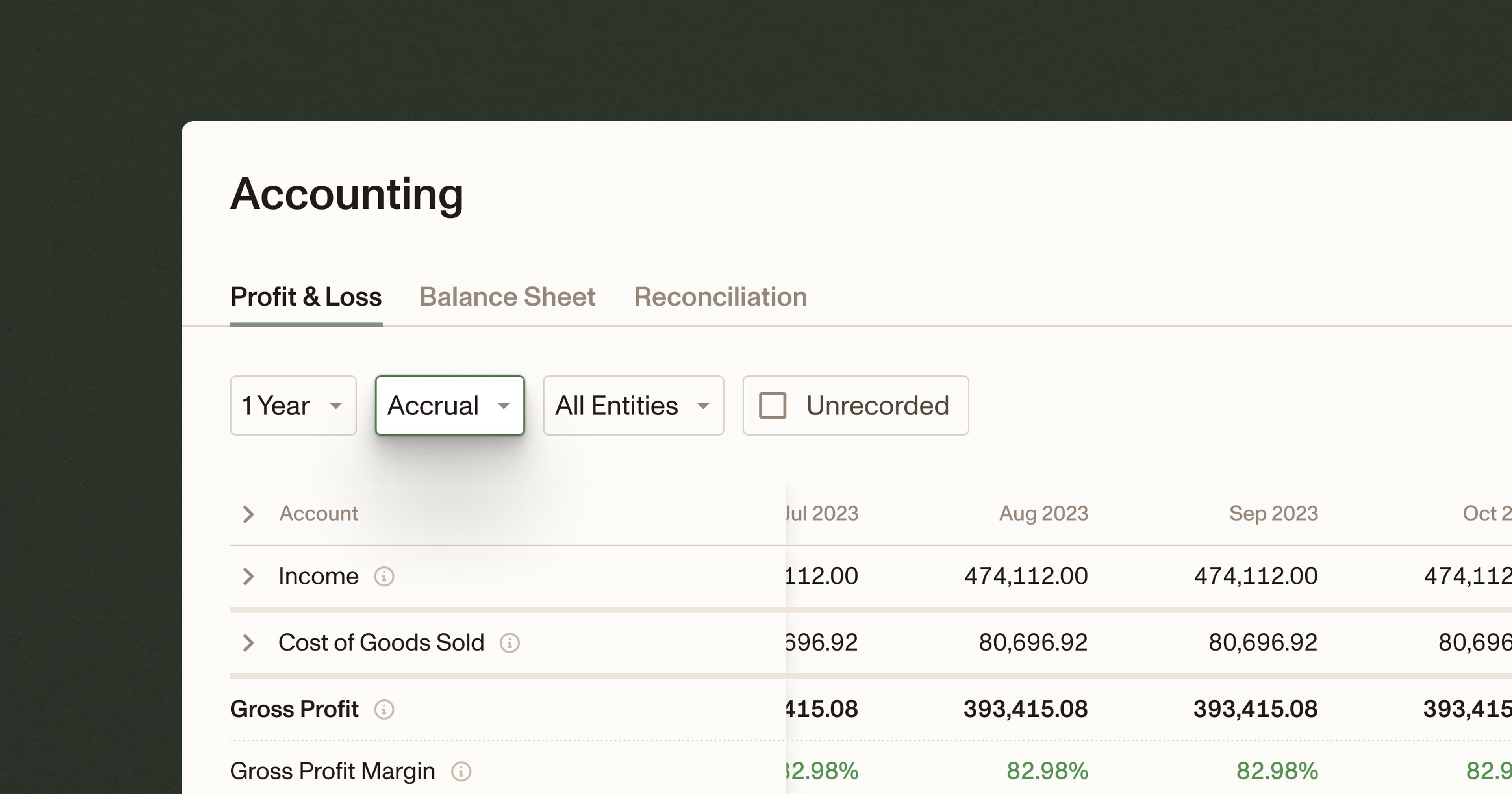

If your business generates financial statements on an accrual basis, “accounts payable” also refers to a specific account on your balance sheet. Accounts payable are recorded on the balance sheet under current liabilities, and they can affect your business’ value on paper just like any other liability.

“Accounts payable” can also refer to the act of going through your bills every week or month, planning future payments, and renegotiating payment terms in a way that ensures the financial health of your business.

Altogether, “accounts payable” management usually refers to all three of these things: receiving invoices and bills, recording them in your books, and managing them in a way that benefits your bottom line.

Accounts payable vs. accounts receivable

Accounts receivable and accounts payable are two sides of the same coin: receivables are invoices you’ve sent to people you’re expecting to receive payments from soon. Payables are invoices you’ve received from other people that you yourself need to pay.

Why is managing accounts payable properly so important?

1. It improves cash flow

For many businesses, healthy cash flow can be just as important as profitability. Improving the way you manage your payables–by avoiding late payments and securing more favorable payment terms, for example–can free up cash for other parts of the business.

Taking a closer look at your accounts payable might identify other issues with the business that need addressing. If you’re regularly behind on supplier payments, for example, you might find that you need to follow up with your own customers about their outstanding bills.

2. It keeps your suppliers happy

AP is just as much a financial issue as it is about managing supplier relationships. When your suppliers send you an invoice for a product or service they already delivered, they’re technically extending your business credit based on trust.

Staying on top of those payments can help preserve trust and ensure that your suppliers are there when you need them most–when times are busy and you need to particularly rely on them, or when times are tough and you need to adjust payment terms.

3. It gives you peace of mind

For newer businesses that are growing rapidly and don’t have a dedicated bookkeeper, staying on top of bill payments can get tricky. Developing a routine for bill pay doesn’t just help the business’s bottom line and credibility with suppliers; it also gives you peace of mind knowing that everything is under control.

Best practices for managing accounts payable

Managing accounts payable is all about getting a firm hold on your cash flow, understanding your suppliers’ needs, maintaining good relationships and turning good bill pay practices into habits.

1. Do your homework

Before approaching new suppliers or signing new contracts, familiarize yourself with common and acceptable payment terms for your industry.

Understand the difference between Net 15, 30, 60, 90, know which terms are typical in your line of work, and know which ones your suppliers prefer and expect to be paid by.

2. Master your cash flow

Since so much of the pain around accounts payable comes from cash flow uncertainty, one of the best things you can do to manage AP better is to master your cash flow.

Producing a cash flow statement for your business and segmented cash flow statements for different enterprises using accounting software like Ambrook can help you stay on top of exactly how much cash is entering and leaving the business every month.

Get in the habit of producing a cash flow budget at the beginning of the year, and create projections for different scenarios. Running through the best, worst and historical cash scenarios can help you get a better idea of how much cash you’ll have on hand every month to cover payments.

The more confident you can get about the numbers and exactly how much cash can leave the business while still keeping the lights on, the more confident you can be about managing vendor relationships and laying out cash.

3. Talk to your suppliers

If you’re enjoying solid cash flow and you’ve been with a supplier for a while, ask them whether they’d consider extending your business discounts for early payment.

If you run into cash flow problems, be open with your suppliers and ask them whether they’d consider special payment plans or more spread out payments, like being paid once a week instead of monthly.

If you’ve been with a certain vendor for a long time, it might not hurt to ask for more favorable payment terms–changing from net 30 to net 60, for example.

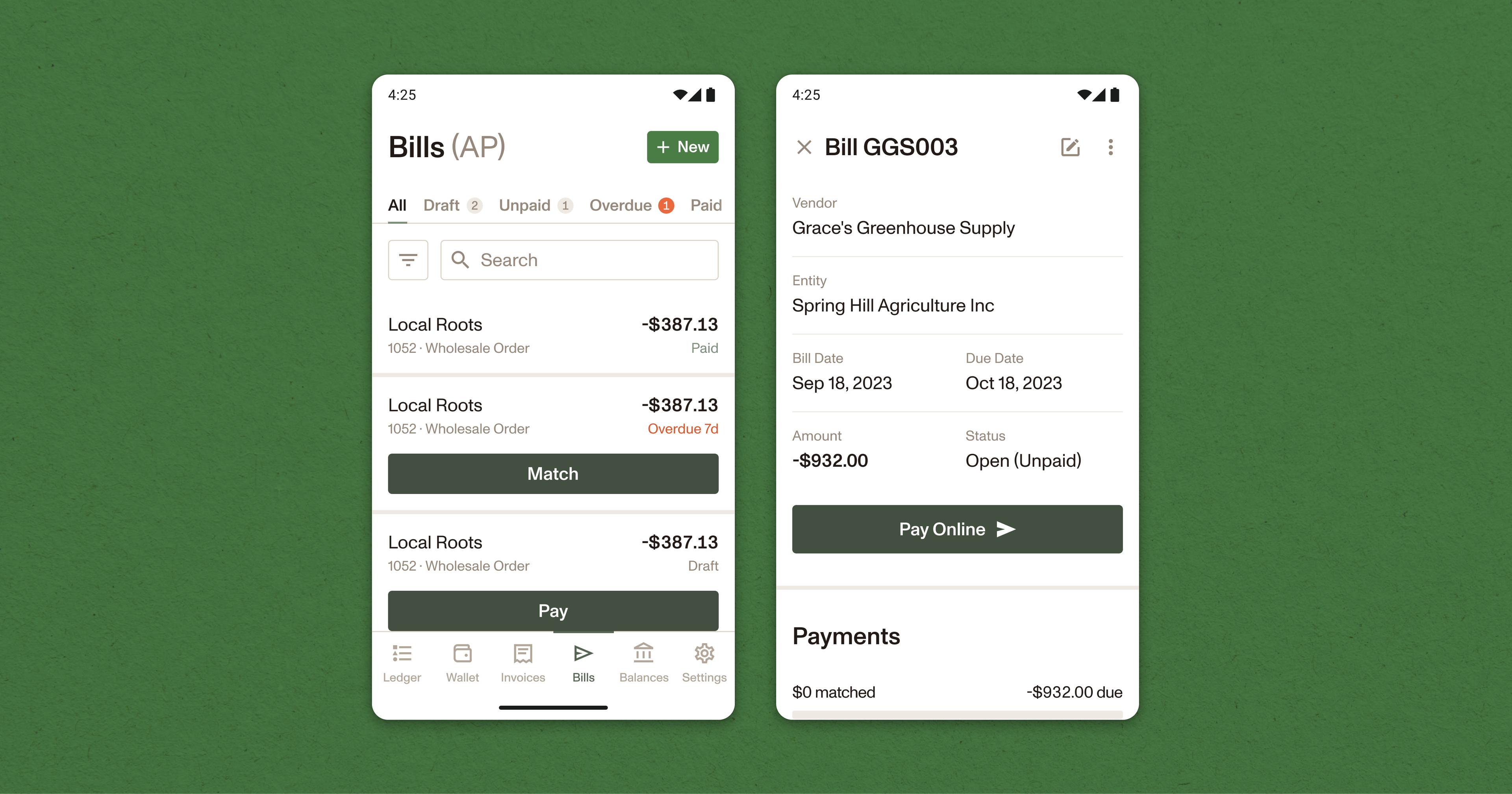

4. Set up a dedicated AP/bill pay system

A stack of physical invoices in your inbox probably isn’t going to cut it: your business likely needs a dedicated system for sorting through and tracking outstanding bills quickly and easily.

Designate a single day of the week or month to take care of bill payments, and set up some kind of calendar, spreadsheet or software-based system for tracking payments.

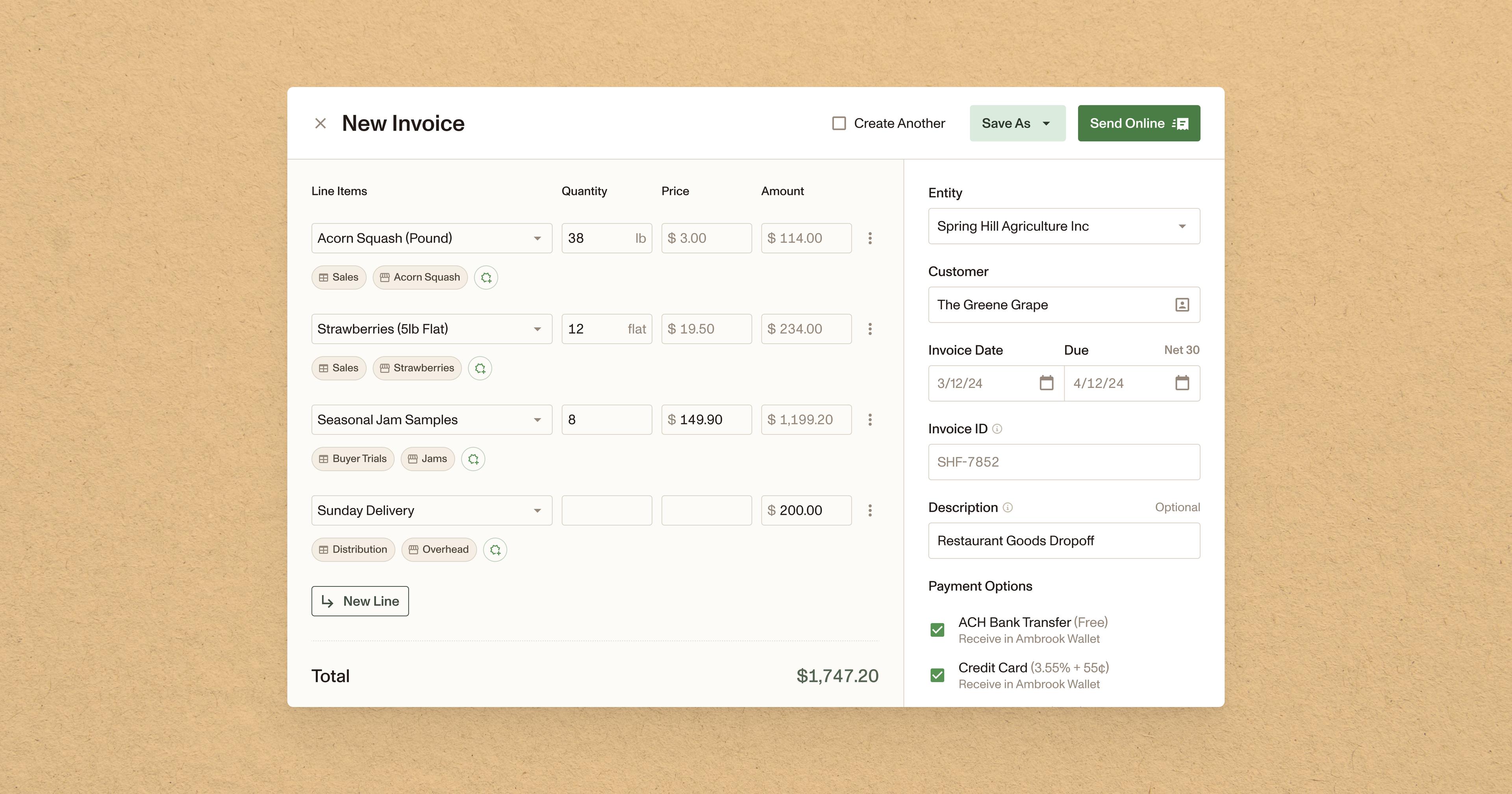

Accounting software like Ambrook can be particularly helpful for this. Want to know which invoices are coming up next? Or which bills were created recently? Ambrook’s filter tools let you know in seconds, and will remember your preferences for your next bookkeeping session

5. Pay your suppliers with a credit or spending card

If your vendor accepts card payments, paying them with a dedicated business or dedicated payment cards can be a great way to stay organized and ensure your vendor gets paid quickly.

6. Become payment-agnostic

Your vendors might want to be paid in different ways–via physical check, card, cash or digital payment for example–so it pays to stay flexible.

Ambrook’s own payment tools can be particularly useful for maintaining payment flexibility, giving you maximum control over how you pay your bills and the ability to:

Have Ambrook mail their vendor a check on their behalf

Have vendors print a check themselves via an external bank account

Pay via ACH transfer, credit card, or Ambrook card

Pay instantly in-network via Ambrook Pay

Pay off-platform

Bookkeeping for ACH payments, mailed checks, and Ambrook Pay is also processed automatically, eliminating even more administrative work and saving users time.

Take the guesswork out of bill pay with Ambrook

Ambrook takes your bill pay system to the next level, allowing you to track and manage your bills in one place while eliminating hours of repetitive administrative work every month with powerful automation tools.

Team members can capture and import bills in the field, batch upload multiple bills, and use powerful automation tools to save time on manual data entry and bookkeeping. Ambrook’s powerful payment tools also help businesses become payment method agnostic, allowing them to pay vendors how they’d like to be paid without the hassle.

Want to learn more? Start your 7 day free trial today.

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.