An accurate cash flow budget can help you stay on top of bill payments, know your borrowing needs and plan big investments with confidence.

Knowing when exactly your business will need cash on hand to pay the bills is important in any line of business, but it’s particularly important in agriculture, where large seasonal outflows and inflows of cash make planning for the future a necessity.

That’s where the cash flow budget comes in: it’s an estimate of all the cash you expect will move in and out of the business over a certain period of time, usually on a monthly or quarterly basis. Running a business without one can feel like you’re steering blind, while a good cash flow budget can help you avoid cash shortages and get peace of mind.

What is a cash flow budget?

A cash flow budget is an estimate of all your business’ monthly, bimonthly or quarterly cash inflows and outflows for the year. Businesses produce cash flow budgets at the beginning of the year based on data from previous years to better understand what their cash needs will be for each period, avoid cash shortfalls, and plan future borrowing and investing activities.

What’s the difference between ‘cash flow’ and ‘income?’

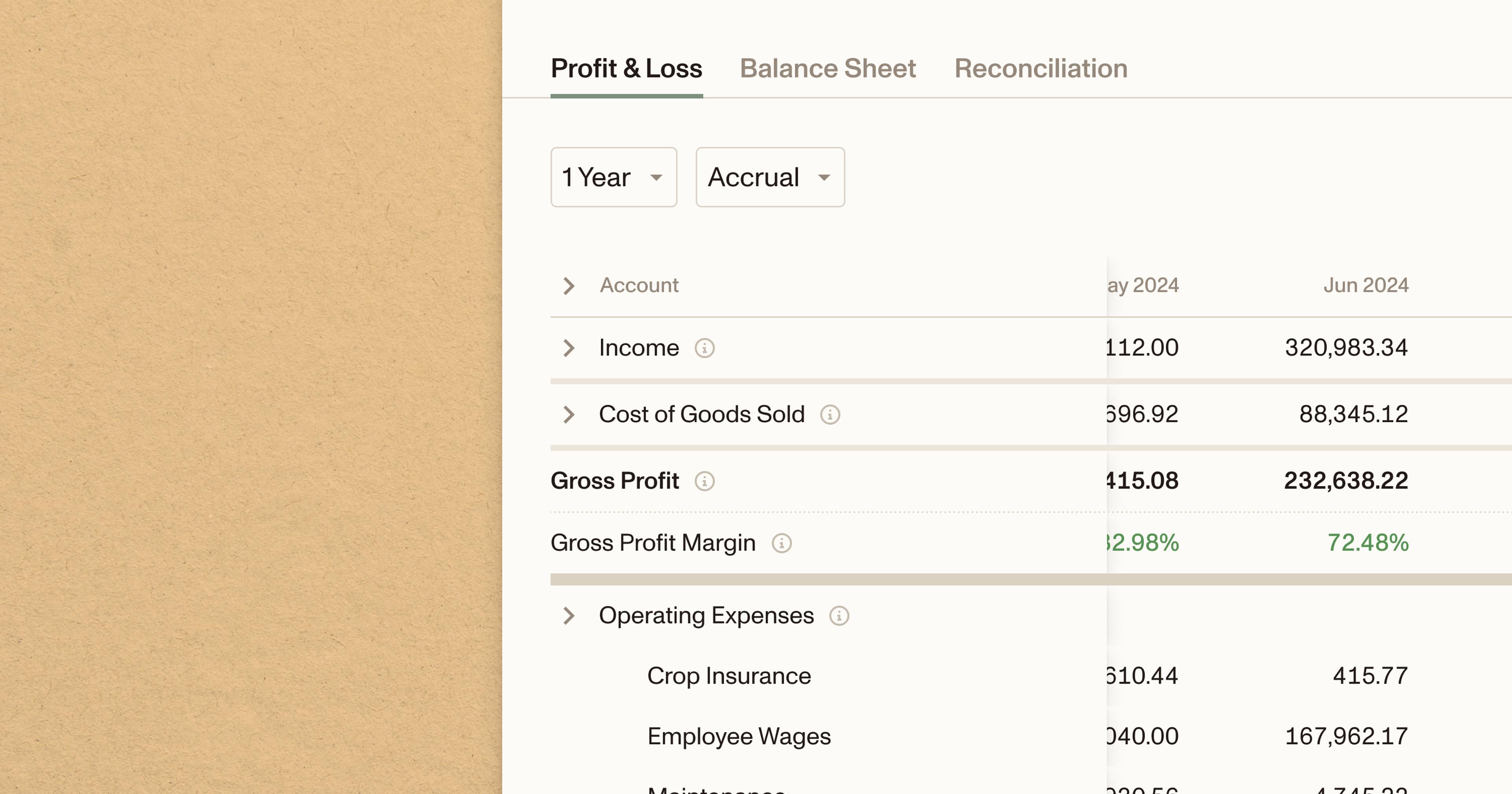

Unlike your income statement, which includes non-cash transactions like changes to inventory, depreciation, credit sales and payables, the cash flow budget only includes inflows and outflows of cash.

Revenue and expenses are recognized when they’re earned or used, while cash inflows and outflows occur as soon as they move in and out of your bank account. That’s why your cash budget will include some transactions you won’t find on an income statement, like unearned income and loan proceeds.

That’s also why profitability and cash flow are two different things. Some things you do to improve cash flow in the short term (like selling inventory or assets) can be unprofitable, while activities that increase profits in the long term (like investing in new capital) might result in decreased cash flow.

Read more: How to Read an Income Statement

What’s the difference between a cash flow ‘budget’ and a cash flow ‘statement?’

The cash flow budget includes many of the same inflows and outflows you would include on your regular cash flow statement.

Unlike your cash flow statement, which is a reporting tool that helps you understand what your inflows and outflows were in the past, the cash flow budget is a planning tool that forecasts what you believe those numbers will look like in the future.

If your business produces cash flow statements, you’ll definitely want to have those on hand when producing a cash flow budget.

Read more: How to Read a Statement of Cash Flows

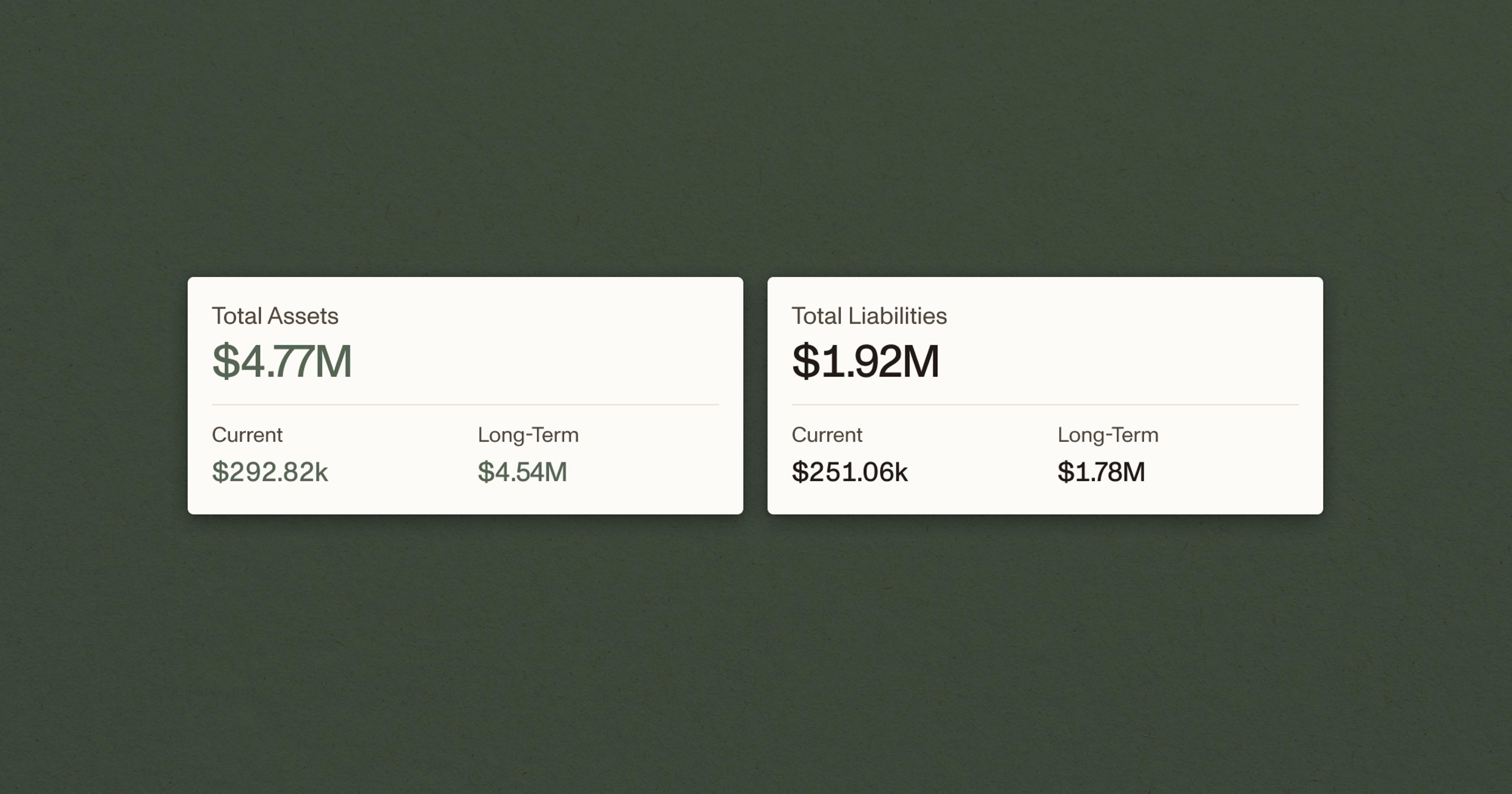

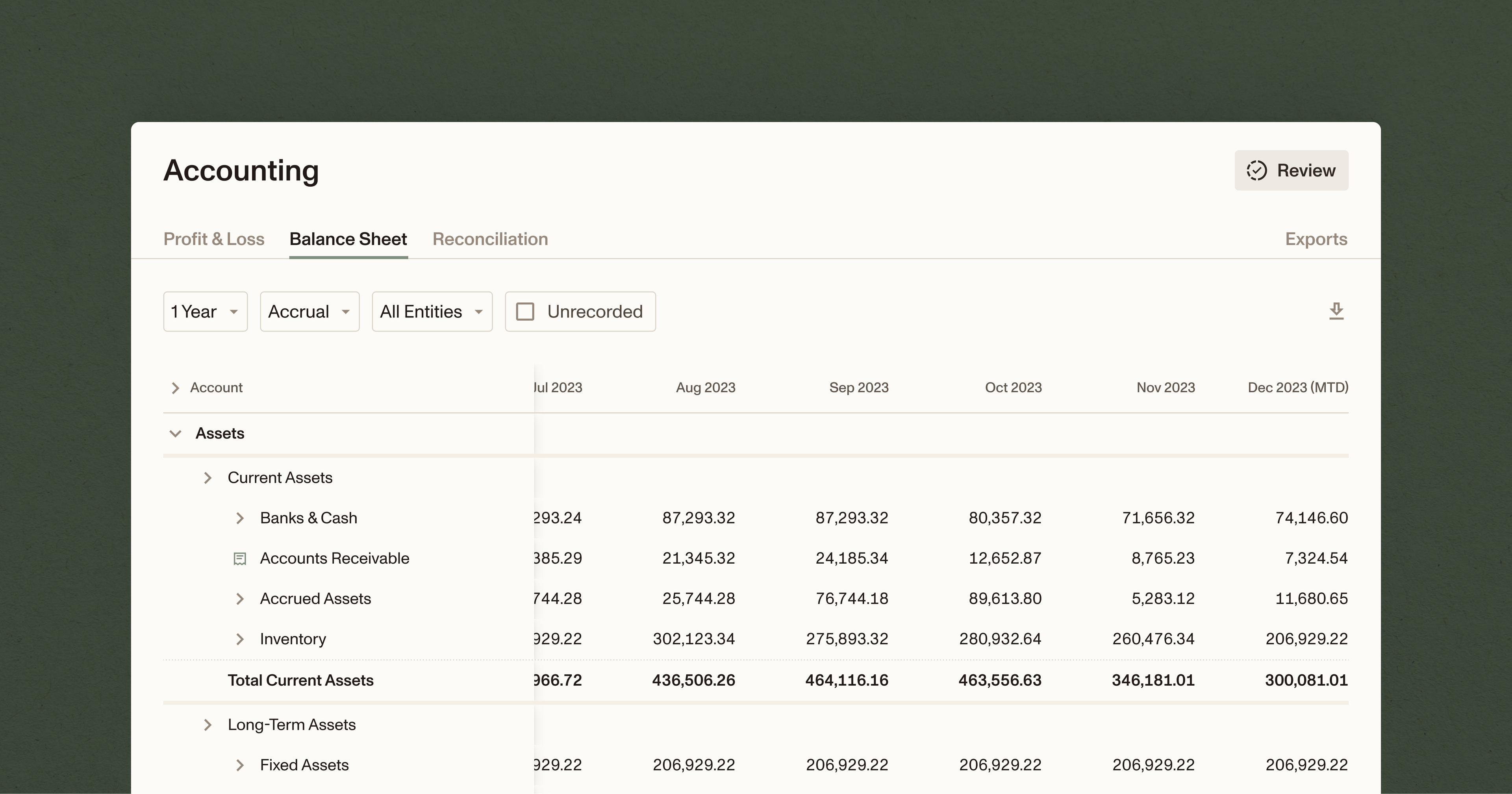

Accounting built for American ag.

Why is the cash flow budget important?

A business’ cash inflows and outflows rarely match up exactly, which is what makes the cash flow budget such an important tool: it helps businesses estimate when during the year they’ll need cash in the bank account to cover bill payments, when cash will be plentiful and available for big purchases, and when the business will need to borrow more cash.

A reliable cash flow budget can be particularly useful to agricultural businesses that see large outlays of cash in one season (to plant crops in the spring, for example) and large inflows of cash in another (like cash crop sales in the fall).

Ranching operations in particular tend to experience large outflows in the fall when purchasing feeder cattle, and large inflows in the spring when those cattle are sold. The cash flow budget helps producers navigate these large swings by:

Helping time input purchases and investment opportunities to minimize impact on cash

Helping plan sales and project whether the business will have enough revenue from future sales to cover cash needs

Identifying additional lending needs and communicating them to lenders, and helping gauge the business’ ability to repay existing loans

Provide an overall benchmark for cash flow performance throughout the year

How do I create a cash flow budget?

Most producers will create a cash flow budget at the start of the fiscal or production year, ideally before any major financial decisions are made or production begins.

1. Take inventory and look at last year’s records

Before you begin, take an inventory of your current assets, including seed, feed, supplies and livestock. (Your income statement can be helpful here, if you produce one of those.)

Looking at your records from previous years, you’ll need to estimate how much feed, supplies and other inputs you’ll need to execute your production plan for the year.

Creating a cash flow budget can get tricky if your business is just starting out or you don’t have records from previous years–if that’s the case, consider reaching out to your local extension office for data and benchmarks for similar-sized businesses in your area.

2. Estimate cash inflows

Using inventory and revenue data from your income statement, develop estimates of all your cash inflows for each period. Remember that cash inflows include all of the cash the business expects to receive from sources like:

Livestock sales, including cull cows and livestock products

Crop and excess feed sales

Payments from government programs

Machine work income

Income from off the farm

Rental income and patronage dividends

Be sure to use conservative price projections when estimating livestock or crop sales, and try projecting revenues for multiple price levels to get an idea of how much inflows could vary.

3. Estimate cash outflows

Using the inventory and income statement data from above, estimate what your cash outflows will be for each period. Cash outflows include transactions like:

Operating expenses like feed, seed, fuel, machine hire and labor

Asset purchases like machinery, equipment and livestock

Maintenance and improvements to buildings

Off-farm expenses

Loan payments

Remember that your cash flow budget should be updated every month or quarter to reflect actual inflows and outflows, and to adjust for changes in price, weather, costs and other external factors.

Cash Flow Budget: An Example

Let’s look at a simple example of a monthly cash flow budget for a hypothetical wheat and soybean business named Ambrook Farms Inc.

Ambrook Farms Inc. - Cash Flow Budget

| January 2026 | February 2026 | March 2026 | |

|---|---|---|---|

| Beginning Cash | $50,000 | $113,450 | -$26,050 |

| Cash Inflows | January 2026 | February 2026 | March 2026 |

|---|---|---|---|

| New loan | 250,000 | ||

| Wheat | 15,000 | 45,000 | |

| Soybean | 40,000 | 12,500 | 25,000 |

| Accounts Receivable | 10,000 | 25,000 | |

| Custom Work | 5,000 | ||

| Personal funds | 25,000 |

| Total cash inflows | $315,000 | $42,500 | $95,000 |

|---|

| Cash Outflows | January 2026 | February 2026 | March 2026 |

|---|---|---|---|

| Utilities | 350 | 350 | 350 |

| Maintenance | 5,000 | ||

| Fuel | 600 | 600 | 2,500 |

| Fertilizer, Chemicals | 400 | 7,500 | |

| Seed, Plants | 25,000 | ||

| Crop insurance | 14,500 | ||

| Capital investments | 250,000 | 175,000 | |

| Interest payments | 150 | 200 | 150 |

| Loan payments | 450 | 450 | 450 |

| Total cash outflows | $251,550 | $182,000 | $50,450 |

|---|

| Ending cash | $113,450 | -$26,050 | $18,500 |

|---|

Normally you would create a monthly cash flow budget for every month of the year, but this simplified budget shows cash flow for just three months: January 2026, February 2026 and March 2026.

So what does Ambrook Farms Inc.’s cash flow budget tell us about its cash needs?

Cash outflows are projected to be particularly high in January and February, when the business plans on making major capital investments in buildings, equipment and land, as well as March 2026 during crop planting. The business plans to match these outflows with revenues from wheat and soybean sales, as well as cash from a new $250,000 loan in January.

According to the budget, the business won’t be able to cover all of these outflows and will begin the month of March with a negative cash balance. With total cash inflows of $95,000 and outflows of $50,450 for the month, however, the business will generate enough cash to end the month with a positive cash balance.

How do you increase cash flow?

So you’ve drawn up a cash flow budget and realized your business might run into cash flow problems at some point during the year. What can you do next?

1. Increase production and prices

Consider whether your business has the ability to earn more from its primary source of income, either by increasing production volume, increasing prices, doing more custom work, selling more inventory, or pursuing different distribution channels.

2. Cut costs

Take a close look at your operational costs and consider opportunities to cut labor costs, negotiate better land or livestock lease terms, and lower input costs by buying in bulk or sharing equipment with other operators.

3. Sell capital assets or delay capital investments

Selling livestock, equipment, machinery or land can provide a short-term injection of cash, but it also deprives your business of the means of generating future income. If selling isn’t an option, consider whether any planned capital investments can be delayed by repairing or maintaining existing capital.

4. Reduce debt payments

If debt payments are contributing to cash flow problems, talk to your financial advisor or lender about ways to restructure or consolidate your debt to lower them. (Remember that changing repayment terms often means extending debt further into the future.)

5. Look for ways to increase non-farming income

In addition to increasing cash from core farming activities, consider whether your business can take advantage of ancillary income opportunities like agritourism, event space rentals, land leasing, hunting fees and selling of processed farm commodities.

Put a tracking collar on every dollar with Ambrook

Ambrook‘s farm accounting platform automatically generates a statement of cash flows for your business, giving you unprecedented visibility into every dollar moving in and out.

Coupled with income and expense tracking, powerful managerial accounting tools, effortless tax time prep and other features custom-built for agribusiness, Ambrook helps you make better business decisions and get peace of mind. Want to learn more? Schedule a demo today.

Want to learn more about Ambrook?