Gross profit can be an important decision-making tool, revealing the profitability of different business segments and sales channels. Here’s how it works.

Most agricultural businesses are diversified in some way, whether by crop type, distribution channel, or via side businesses like custom harvesting and agritourism. No matter what your line of business is, however, it pays to know how much gross profit each segment of your operation is generating.

Calculating gross profit can tell you whether certain crops might be worth growing over others, which production methods to pursue as a livestock producer, and even how to get your product to market. Here we’ll review how to find gross profit and what it can tell you about your business.

What is the gross profit formula?

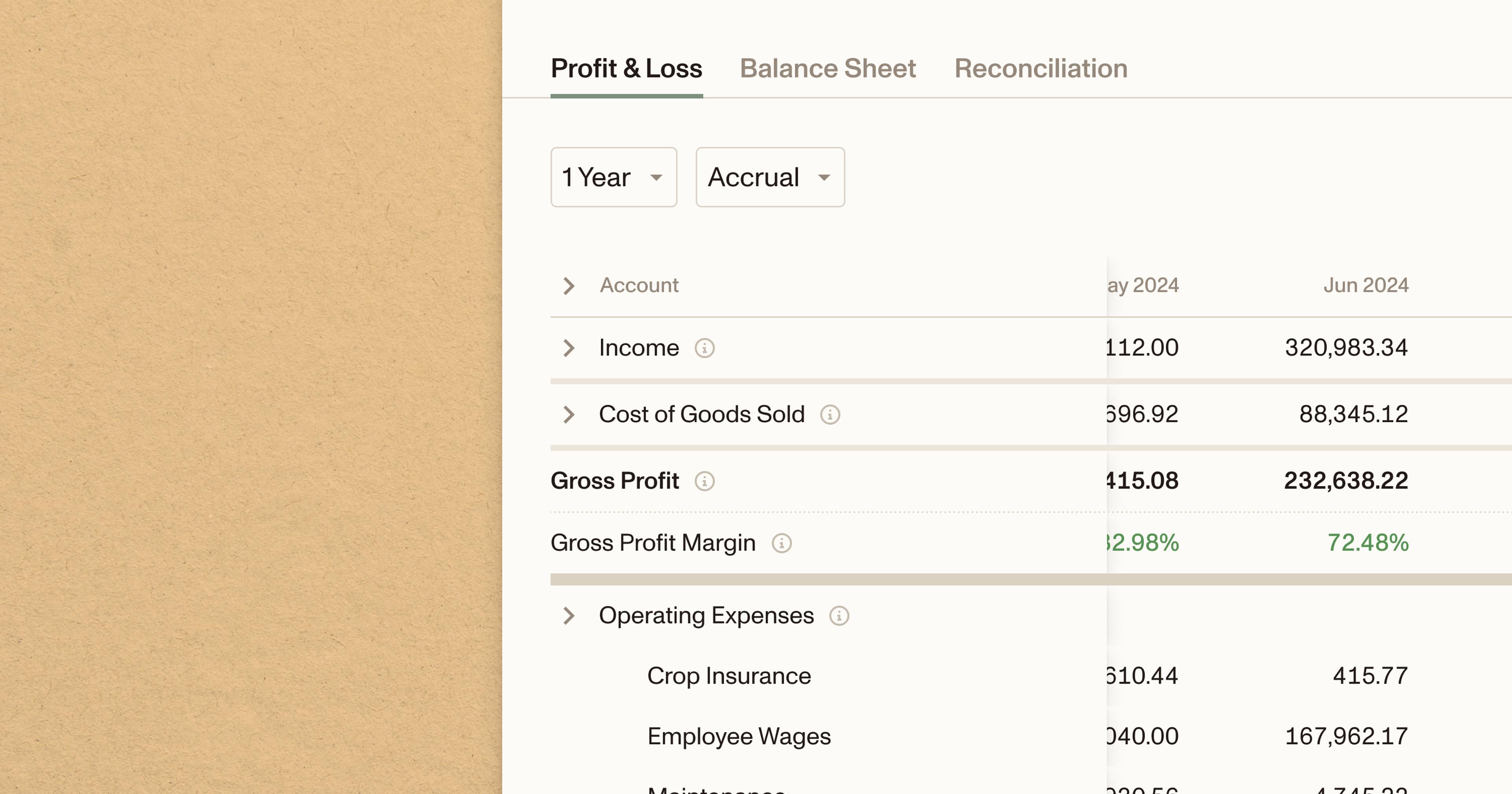

Also sometimes called gross margin or gross profit dollars and listed on the income statement right under COGS, gross profit is the difference between your revenue and your cost of goods sold (COGS). The gross profit formula is:

Gross Profit = Revenue - COGSRevenue is money that you earn from the sale of your products.

Cost of goods sold (COGS) refers to the variable costs that directly go into making your product. They vary depending on how many units of any particular good you produce, and can include expenses like:

Grain, seed and straw

Salt, minerals and protein

Forages and pasture rental

Herd replacement

Veterinary medicine and supplies

Death loss

Breeding costs and bull leasing

Fertilizer

Production labor

Manure removal

Trays, boxes, bags, overwrapping, labels, and other packaging costs

Packing costs if you work with a co-packer

Your income statement might include another category of variable costs called ‘operating expenses.’ While these costs might not go directly into producing the goods you sell, they still go up and down depending on how much you produce, and might include things like:

Marketing costs

Fuel and utilities

Maintenance and repairs

Transportation

Retailer fees

Distributor fees

Commissions

COGS and operating expenses are subtracted from revenue to get operating profit, a related financial metric:

Operating profit = Revenue - (COGS + Operating Expenses)Variable costs don’t include your fixed costs, which are expenses that aren’t affected by how many units you produce. Fixed costs can include things like:

Land and property taxes

Livestock

Buildings and fencing

Insurance

Interest and taxes

Depreciation

Equipment costs

Office supplies

What’s the difference between gross profit and net income?

Gross profit only includes COGS and sales returns and allowances. It measures your business’ efficiency, or how well it turns inputs into outputs. Generally speaking, gross profit is easier to change in the short term than net income.

Net income includes both variable and fixed costs, representing the overall profitability of the business. Because it includes fixed costs, net income is generally more difficult to change in the short term than gross profit.

Gross profit percentage formula

Sometimes the income statement will show gross profit as a percentage of revenue, which we refer to as the gross profit margin or gross margin efficiency. The formula for gross profit margin is:

Gross Profit Margin = (Revenue - COGS) / RevenueIf your business spends $1 on COGS for every $2 of revenue it generates, for example, it has an overall gross profit margin of 50%.

Why is gross profit important?

In addition to calculating the gross profit margin for the whole business, operators will often also calculate gross margin by crop type, per animal, per hectare or by sales channel, which can make it a valuable decision making tool for day-to-day business, helping you:

1. Make better marketing decisions

Calculating gross profit for each crop type can help cultivators determine what their ideal crop mix should be, while livestock producers can use gross profit to determine whether to focus on premium markets and increase herd size.

2. Identify cost drivers and inefficiencies

Gross profit measures the profitability of your core business, and includes those variables you have the most control over in your day-to-day work. Low or negative gross profit might require you to increase prices, make better purchasing decisions, reduce waste or inefficiency, or adjust herd management practices for better returns.

3. Identify unprofitable sales channels

If you sell through multiple channels, calculating gross profit for each channel can also reveal that certain channels are less profitable than others and might be worth dropping, or that certain profitable channels might be worth doubling down on.

What’s a good gross profit margin?

As Farming for Profit’s Dallas Mount points out, the gross profit margin of a livestock operation generally shouldn’t be higher than local custom grazing rates. “After all, if you can make more money taking care of someone else’s cows and you have little risk and no capital outlay, then it is a tough economic argument that you should own cows,” writes Mount.

What exactly constitutes a healthy gross profit margin will depend a lot on your location, operation type and size, the current price of inputs, and livestock and crop prices, among other variables.

One 2023 USDA study found that 54 percent of large-scale family farms (gross annual cash farm income of $1 million or more) had an operating profit margin of 25 percent or higher, for example, while only 10-19 percent of small family farms (less than $350,000) reached an operating profit margin of 25 percent or higher.

How do I improve gross profit?

While the resources and markets each farmer has at their disposal might be different, some strategies your operation might use to increase gross profit include:

Increase revenues

For ranchers this might involve capturing more value from each animal sold by participating in branded beef programs and directly marketing to consumers or local retailers, which often brings in a higher price per pound than commodity markets.

For cultivators that might mean introducing specialty or niche crops, or adopting production methods that improve soil fertility, lower input costs and increase yield, like crop rotation.

Decrease costs

For livestock operations, this might mean cutting down on overhead costs, improving feed costs by using cell, rotational or intensive grazing, and more closely tracking individual animal performance.

For cultivators this might mean buying inputs in bulk and negotiating better deals with suppliers, choosing high-performing, disease-resistant varieties to reduce chemical use, switching to drip or pivot systems to reduce pumping and water costs, and joining a co-op to increase buying power.

Ambrook helps you hone in on profitability

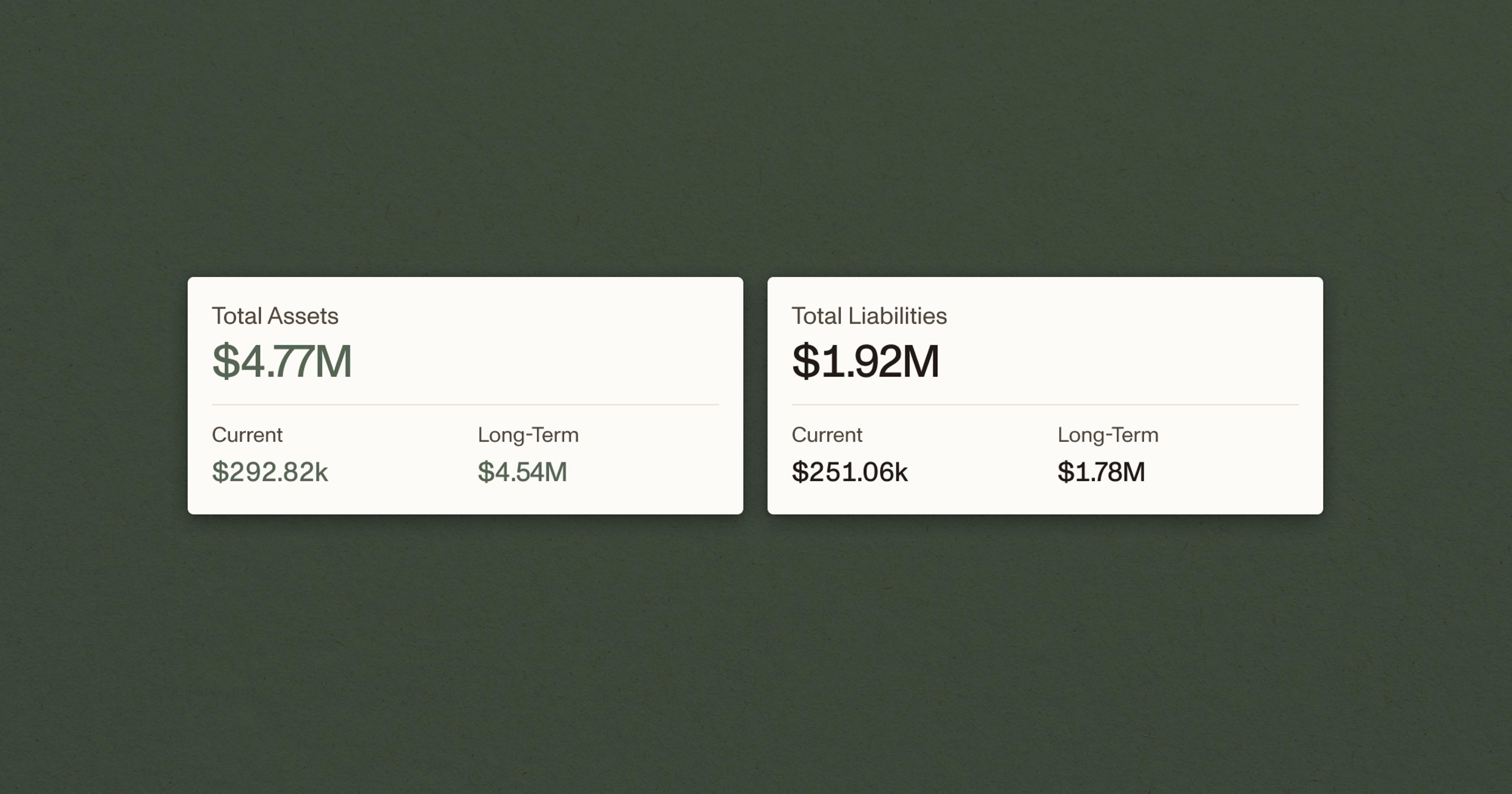

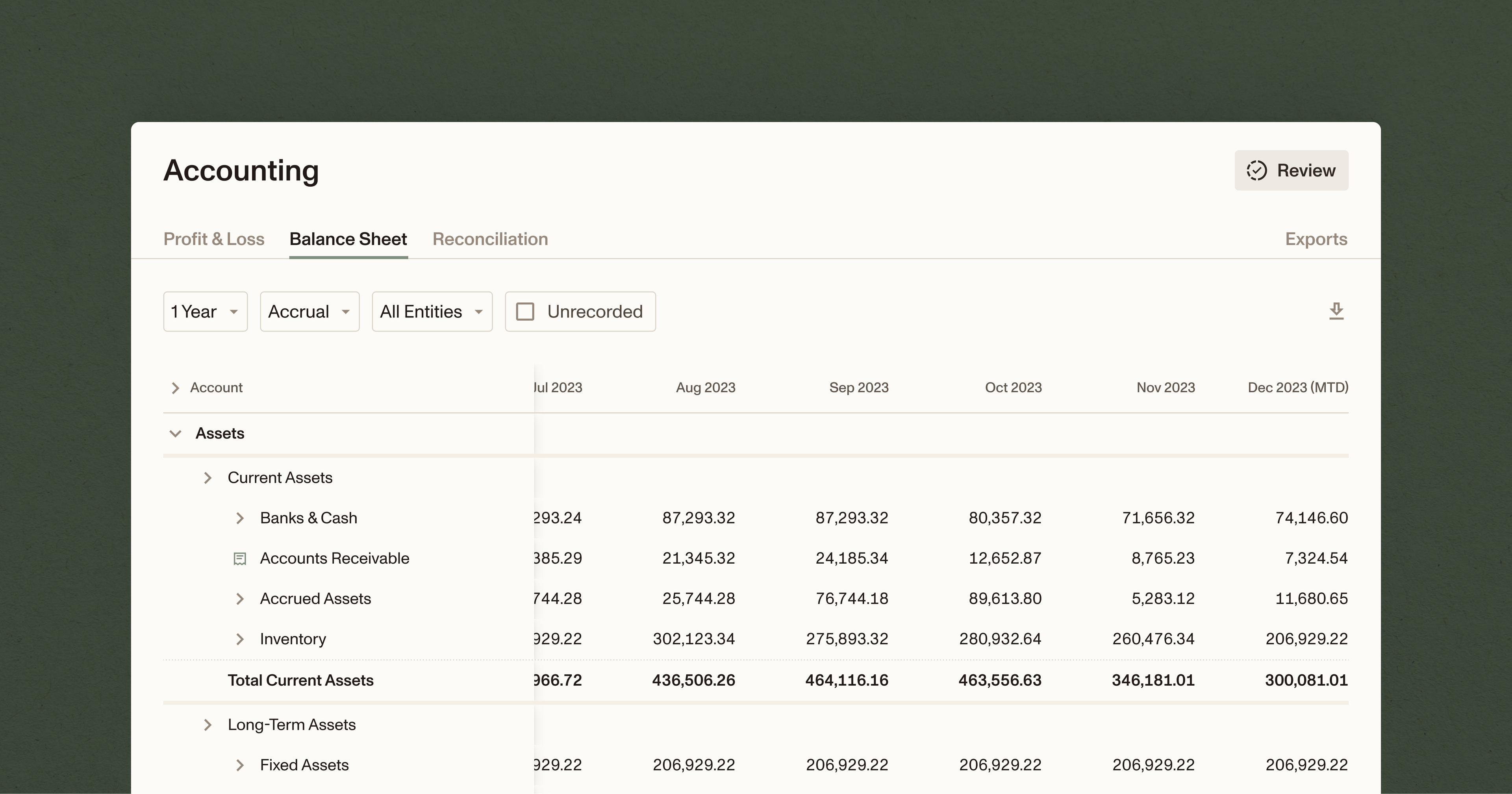

Tired of out-of-date spreadsheets and pen-and-paper accounting? Ambrook‘s real‑time, interactive reports give you access to the numbers you need to make decisions now.

Coupled with automatically-generated financial statements, income and expense tracking, effortless tax time prep and other features custom-built for farming and livestock operations, Ambrook helps you make better business decisions and get peace of mind. Want to learn more? Schedule a demo today.

Want to learn more about Ambrook?

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.