Analyzing Your Business’ Ability to Generate Cash

The statement of cash flows tells you everything that happened to your cash over a certain period: how much of it came in and where from, and also how much of it left the business and where it went to. It’s a bit like putting a tracker on every dollar, letting you know exactly where each one is coming and going.

Why is it important?

The statement of cash flows reports whether you have enough cash on hand to cover your expenses and stay in business, how efficient your business is at generating cash overall, and can even help you project how much cash your business might need or generate in the future.

Knowing when your business will generate extra cash versus when your business will need cash can be particularly useful when:

Applying for a new loan to cover expenses in times when cash reserves are low

Figuring out a repayment schedule for an old loan

Deciding whether or not to sell inventory to generate extra cash flow

Deciding to make big equipment, real estate, or other important capital purchases

The cash flow statement is particularly useful if your business is seasonal or goes through periods of particularly high cash inflows and outflows. For highly seasonal industries like agriculture, knowing how much cash you need and when you need it can be a game changer.

Businesses will usually produce a statement of cash flows once a year, but accounting software like Ambrook can automatically generate a statement of cash flows for your business every quarter or month, depending on how closely you’d like to track your cash position.

What’s on a statement of cash flows?

Cash flow statements record inflows (or ‘receipts’) and outflows (or ‘disbursements’) of cash: dollars that are either entering your business or leaving your business. All cash flows are organized into three categories: operating, investing, and financing activities.

Cash from operating activities

These are cash inflows and outflows that your business experiences in the course of its regular business producing and selling goods and services. This includes income from the sale of goods, purchases of supplies and goods for resale, interest expenses, and income tax.

Cash from investing activities

Investing activities include long-term investments in physical assets like breeding livestock, equipment, vehicles, buildings, and land. If you buy shares in another business or earn money from the sale of stocks and bonds, those also qualify as cash flows from investing activities.

Cash from financing activities

Financing activities are any cash flows that have to do with debt or equity. If you take out or pay down a loan, issue shares in the business, or pay your existing shareholders a dividend, all of those cash flows should be recorded in the financing activities section.

Adjustments

One other thing you might notice on a cash flow statement are adjustments, which have to do with what’s called the ‘indirect method’ of preparing cash flow statements. The indirect method is called that because it works ‘backwards,’ starting with your net income and methodically eliminating transactions that don’t actually generate cash to come up with your actual cash flows.

The other method for preparing cash flow statements is called the direct method, which records each individual cash flow in your business line by line and figures total cash flow that way. Because of how time consuming the direct method is, many businesses prefer to use the indirect method instead.

How to read a statement of cash flows

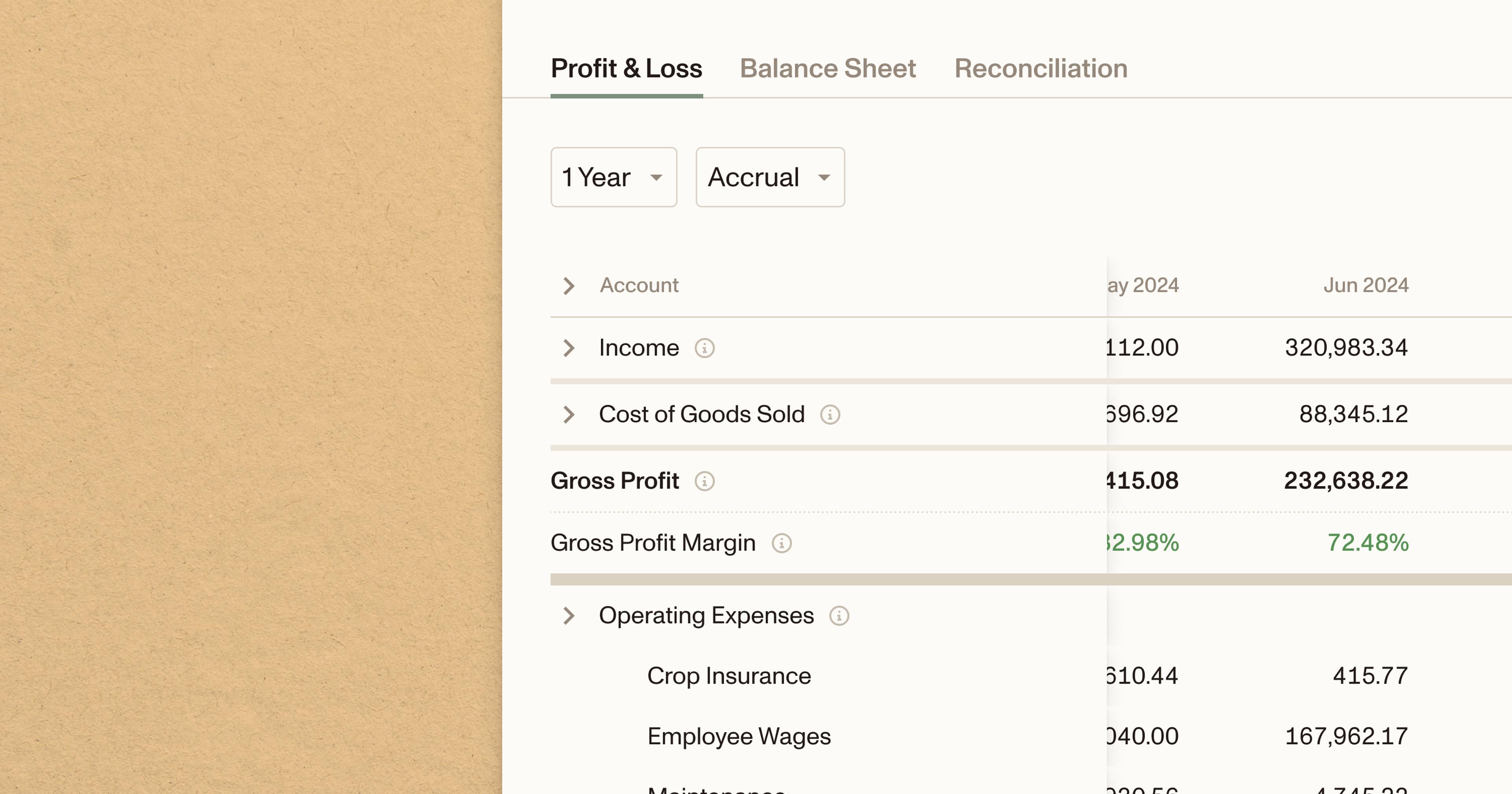

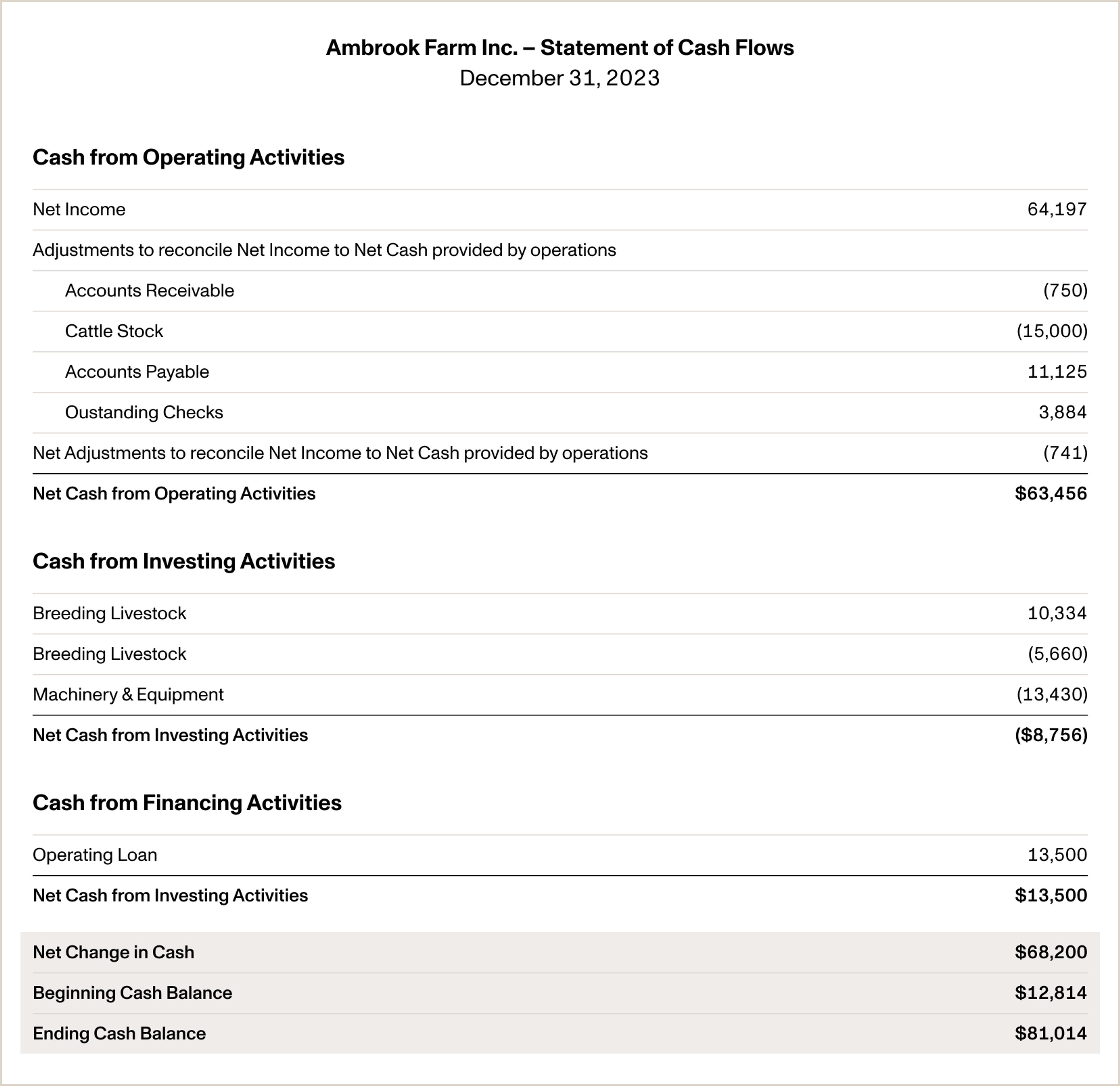

Let’s look at an annual statement of cash flows for a fictional business called Ambrook Farm, an agricultural business that produces beef, poultry, pork, and produce for sale to distributors, farmer’s markets, CSA boxes, and restaurants:

Reference our statement of cash flows example

As you can see, much of the operating activities section of the statement is taken up by adjustments to Ambrook Farm’s net income, which is the first line on any cash statement prepared using the indirect method.

The adjustments following net income eliminate transactions that didn’t actually result in cash inflows (like accounts receivable) and add back transactions that didn’t actually result in cash outflows (like accounts payable) to show you how much cash operations actually generated for the business.

Let’s look at some of the insights this statement of cash flows can give us into Ambrook Farm’s business:

Operating cash flow

One of the first things a statement of cash flows shows us is a business’ operating cash flow, which is the amount of cash it brings in (or loses) over the course of its regular, day-to-day business activities.

Ambrook’s operating cash flow is the same as its net cash from operating activities, which due to strong sales and low production costs in 2023 was $63,456.

Free cash flow

Another important financial metric we can calculate is free cash flow, which is how much cash a business has left over after paying for any operating expenses and capital expenditures it made during the period.

Free cash flow is cash a business can use ‘freely’ without worrying about jeopardizing the business – on new investments, to withdraw and distribute to its shareholders, or keep as a financial cushion for the future. The formula for free cash flow is:

Free cash flow = Operating cash flow - Capital expenditures

Capital expenditures occur any time a business buys or maintains productive physical assets, which in Ambrook Farm’s case includes the breeding livestock (-$5,660) and the machinery and equipment (-$13,430) expenses it reported in the investing activities section.

Substituting in the values from Ambrook Farm’s statement of cash flows, we get:

Free cash flow = $63,456 - $19,090

Free cash flow = $44,366

In 2023, Ambrook Farm had free cash flow of $44,366.

Total cash flow

The most important cash flow metric is total cash flow, which is the value of all cash inflows minus all cash outflows. Maintaining a healthy cash flow is crucial, ensuring you have enough cash on hand to cover your short-term debts and bill payments, make new investments in equipment, and survive periodic dips in income.

Total cash flow is usually included near the end of a statement of cash flows, in this case under ‘Net Change in Cash.’ Ambrook Farm’s total cash flow for 2023 was $68,200.

Segmented cash flow statements

In addition to producing a statement of cash flows for the entire business, accountants will also produce cash flow statements for a particular segment of a business known as an enterprise or segmented cash flow statement.

Segmented cash flow statements can be particularly useful for enterprises that are particularly cash-intensive, allowing owners to keep a close eye on cash outflows and ensuring the enterprise isn’t endangering the business’ overall cash position.

How do I generate a statement of cash flows for my business?

Ambrook‘s all-in-one platform automatically generates a statement of cash flows for your business, giving you unprecedented visibility into every dollar moving in and out.

Coupled with income and expense tracking, powerful managerial accounting tools, effortless tax time prep and other features custom-built for agribusiness, Ambrook helps you make better business decisions and get peace of mind.

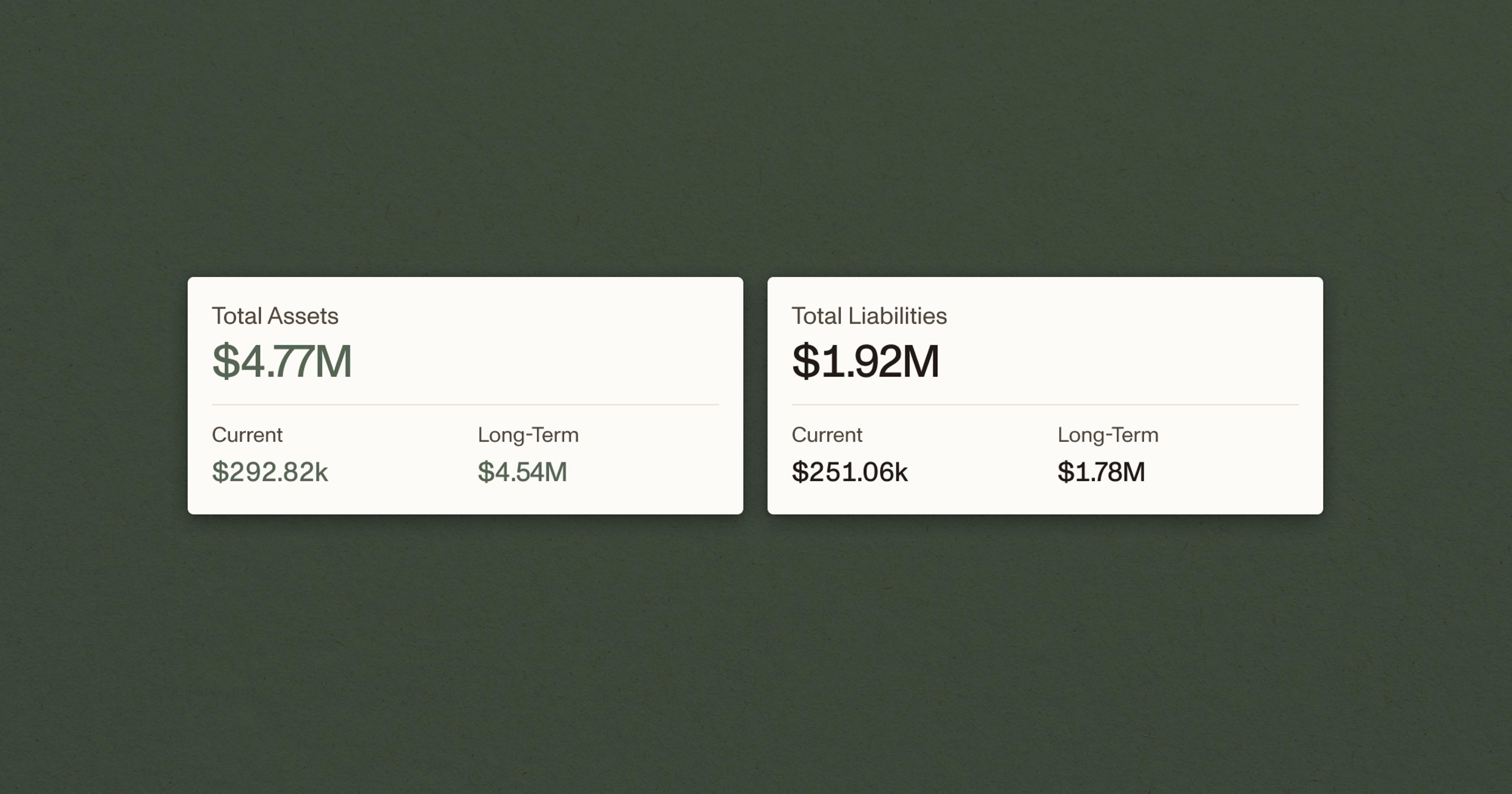

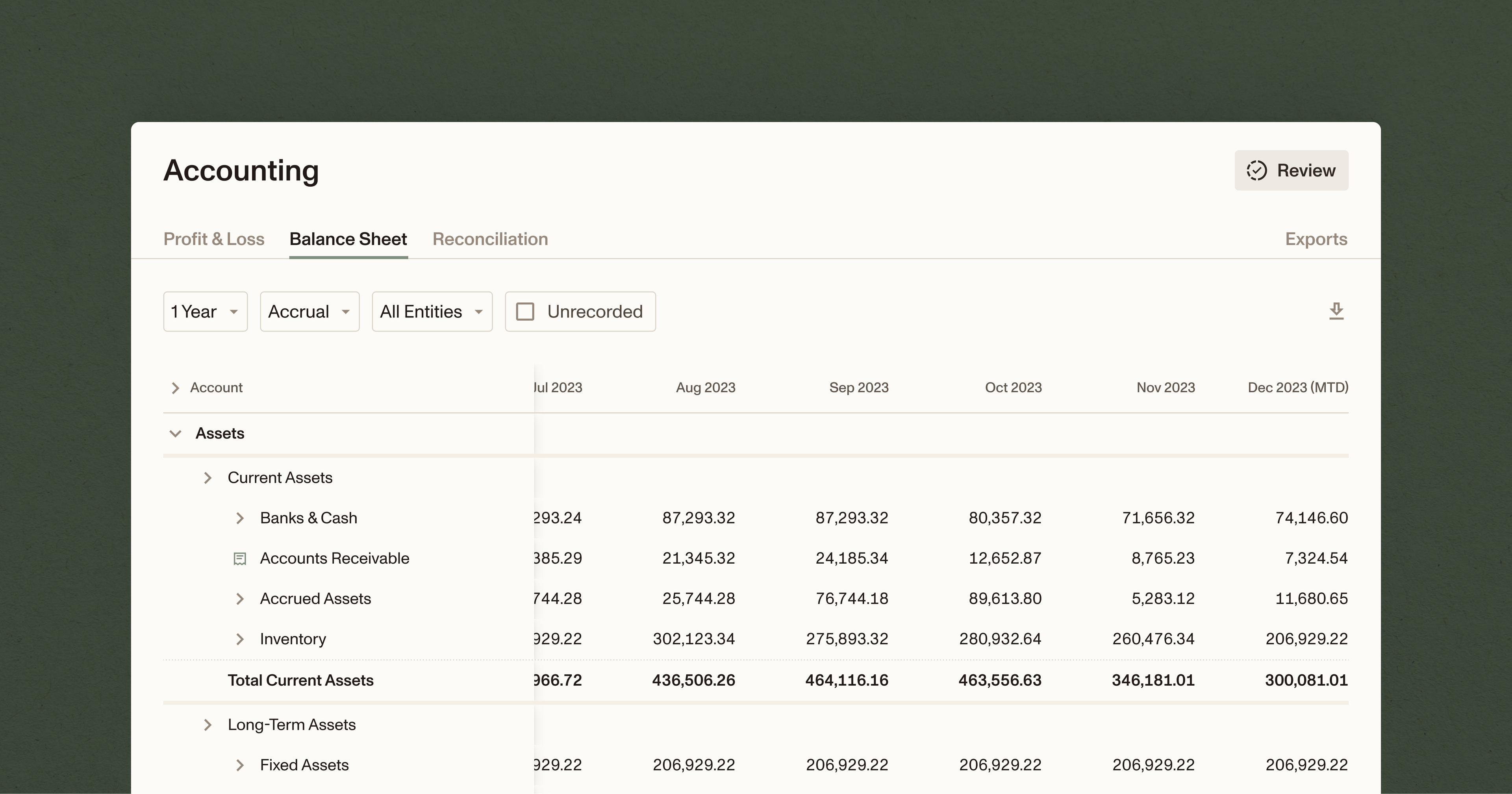

Need more guidance on your financial statements? Catch up with our “how to” guides on the balance sheet and income statements.