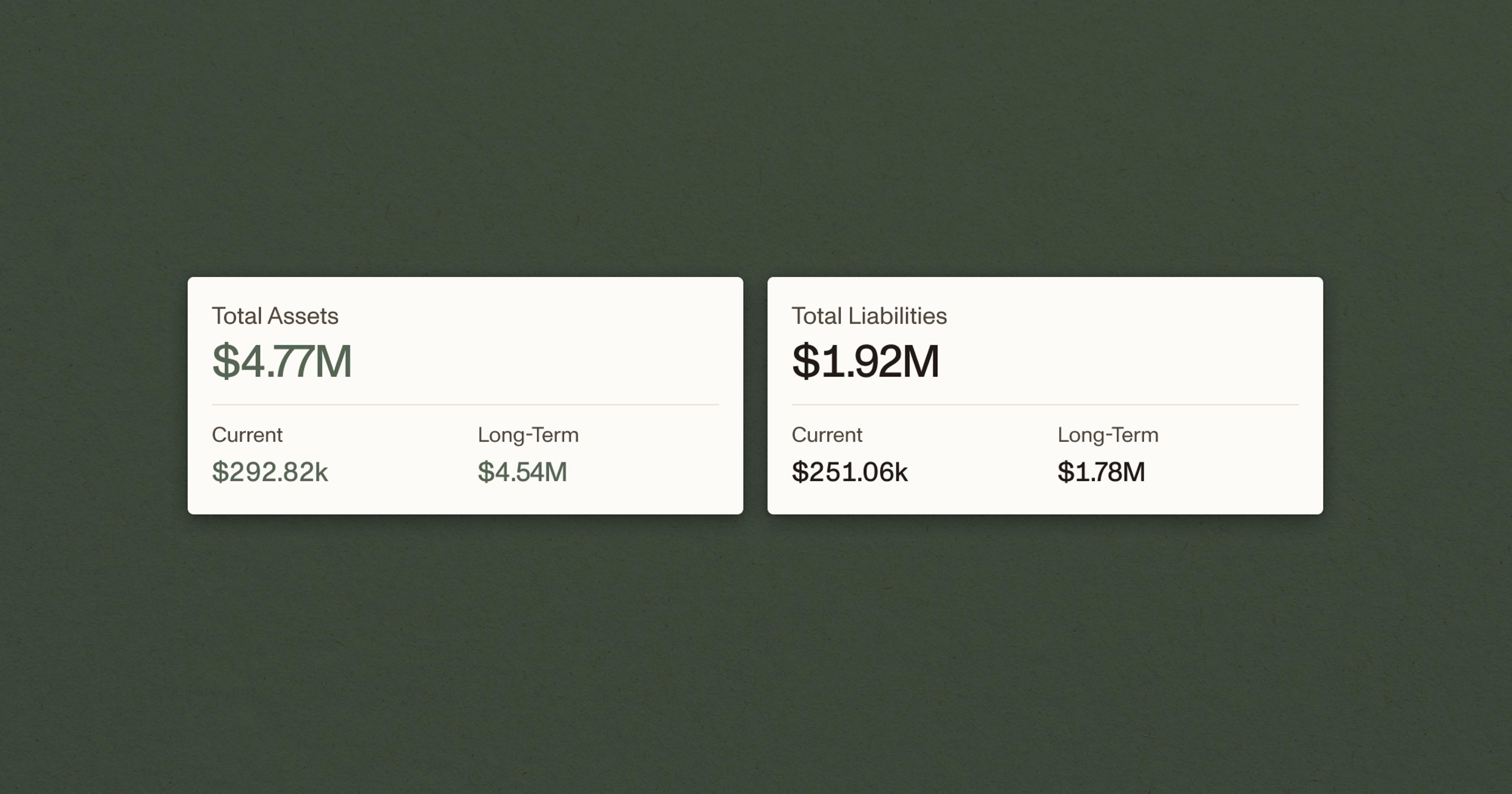

As a farmer, you likely use accounting to satisfy external requirements, like filling out Schedule F during tax season or preparing financial statements to apply for loans or grants. You also are likely asking operational questions that, with the right habits and systems in place, could be answered through accounting.

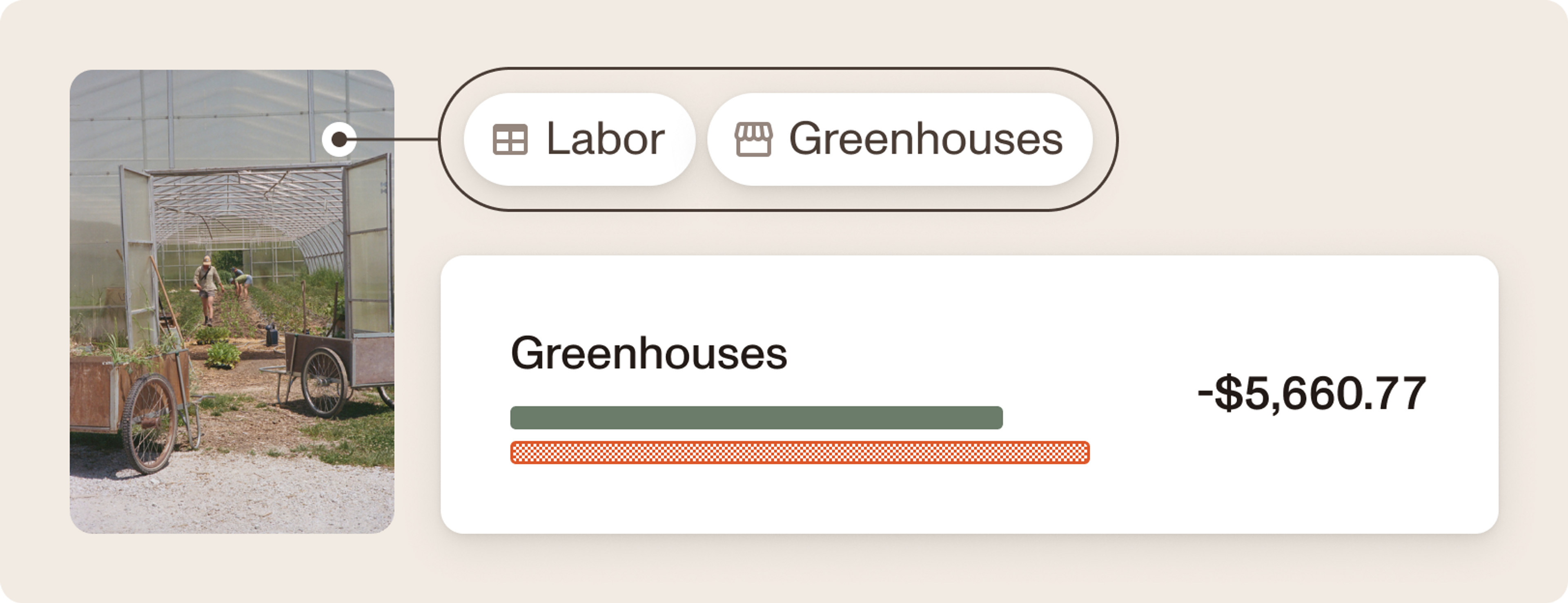

Are my greenhouses making money?

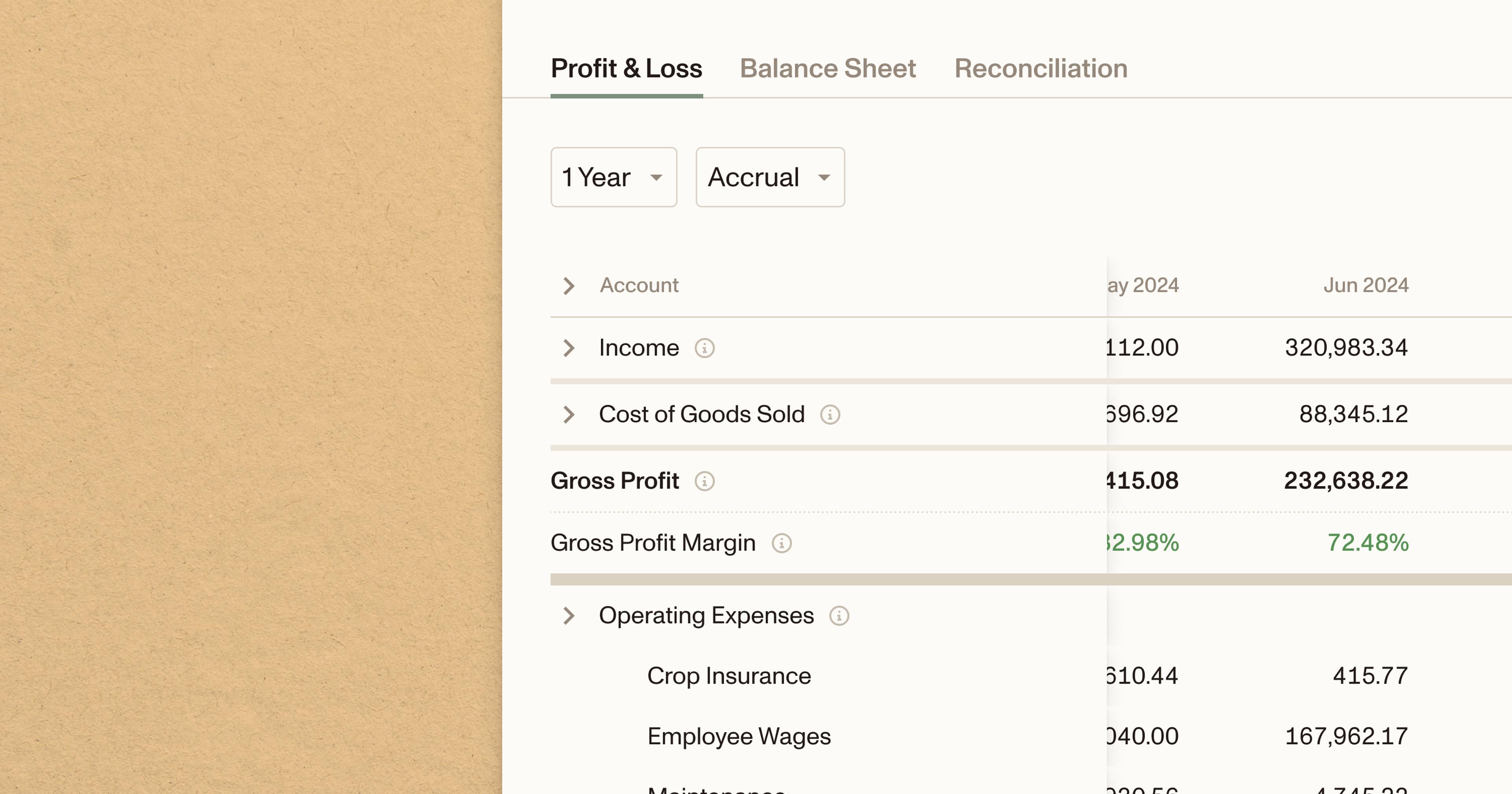

If you run a diversified farming operation, it’s critical to understand where you are making and losing money at the enterprise-level. For example, knowing the amount your operation spends on labor is helpful, but knowing that your labor costs for your greenhouses are pushing them into the red is an actionable insight. Getting to this level of granularity is possible with enterprise accounting, which tracks the profitability of each business line and enables you to make decisions through enterprise analysis.

How much should I charge for a pork chop?

Another way to assess your operation is through unit economics, tracking the revenue and costs associated with producing each unit (like a pound of pork, a dozen eggs, or a bushel of hay). As an operator, you know if your feed costs have risen over the last year, but unit economics can help you assess how those cost increases have affected your pork chop profit margin. By understanding the drivers behind cost per unit and profit margin per unit, you gain insight into operational efficiency.

How can I get started?

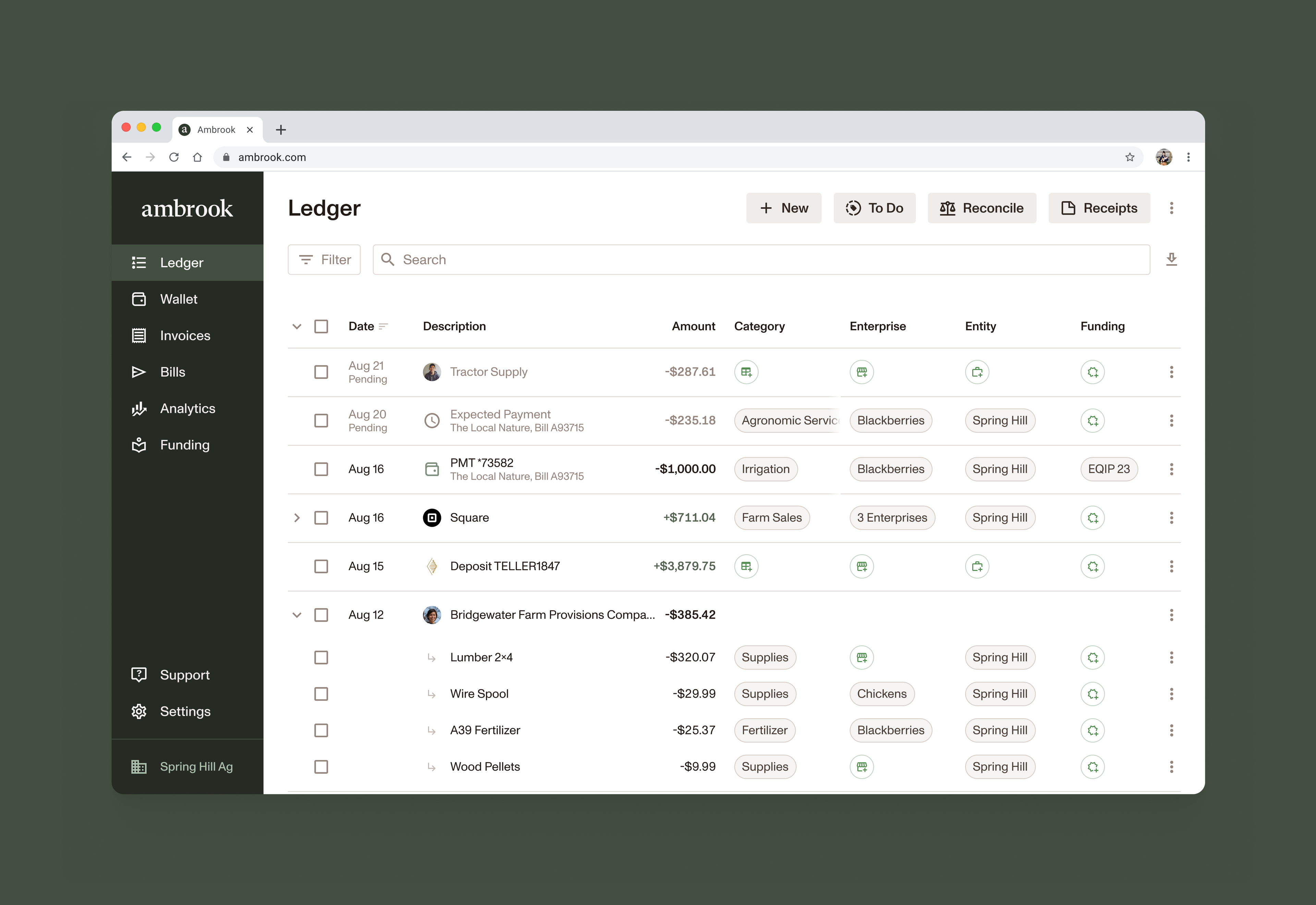

Leveraging accounting to inform operational decisions starts with building a solid habit around bookkeeping — capturing as much data as possible at the time of the transaction. However, it may be difficult to know where to start. That’s where Ambrook comes in.

Ambrook features a customizable tagging system that automatically transforms your financial data into tax prep, financial reports, enterprise analysis, and more. Ambrook tags allow you to represent your business as you see it, so you can answer operational questions. And there’s no extra transformation for taxes, as category tags are linked to Schedule F under the hood, so you can name them and organize them the way that makes sense to you.

Ready to get more out of your financial data?

Get started with Ambrook.

This content was written by the team at Ambrook. We know farm finance, but are not CPAs or financial advisors.