Getting Valuable Insights Into Your Business’ Assets, Debt, and Equity

The balance sheet is an important management tool, helping owners understand how valuable their business is, how much risk and debt they’re carrying, and whether the business has enough of a financial cushion to continue operating in the future. But if you’ve never seen a balance sheet before, it can be difficult to understand how to read it.

Here we’ll walk you through everything you need to know about reading, analyzing, and getting the most out of the balance sheet.

What is a balance sheet?

The balance sheet is more than just a checkbox on a loan application – it provides a valuable snapshot of a business’ financial position and health at a given point in time.

With a few simple calculations, a balance sheet can tell you your net worth, your ability to stay in business in the short and long term, and whether you might be carrying too much debt.

Knowing that your business has enough working capital to weather periods of uncertainty isn’t just financially prudent – it can also remove a big layer of stress from your day-to-day work, which for many owners is priceless.

Basic balance sheet terminology

Here’s a quick overview of what you can expect to find on a balance sheet:

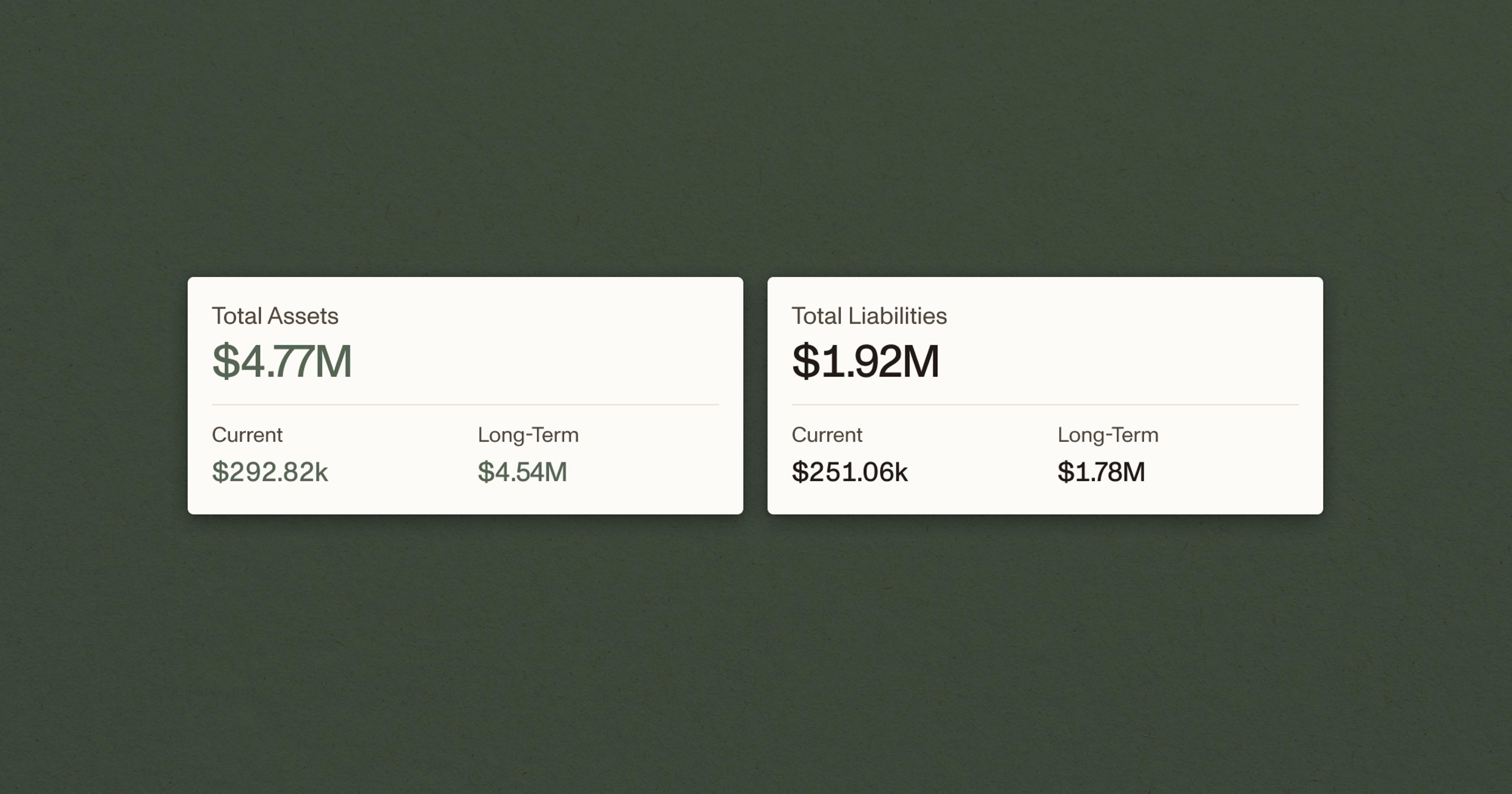

1. Current and long-term assets

A business’ assets include anything of value that a business owns and uses to produce the goods and services it sells. A business’ most liquid assets are referred to as current assets, or assets that can be converted to cash in a year or less, while assets that you don’t expect to convert to cash or liquidate within the next year are referred to as ‘fixed’ or ‘long-term’ assets.

2. Current and long-term liabilities

Any debts a business owes its creditors are included under the liabilities section of a balance sheet. Current liabilities are debts that are due in the next 12 months, while long-term liabilities are debts that are due in more than 12 months.

3. Equity

Equity is what’s left over when you subtract total liabilities from total assets. In theory, it represents the part of the business that you have a claim on, rather than your creditors.

Reading a balance sheet

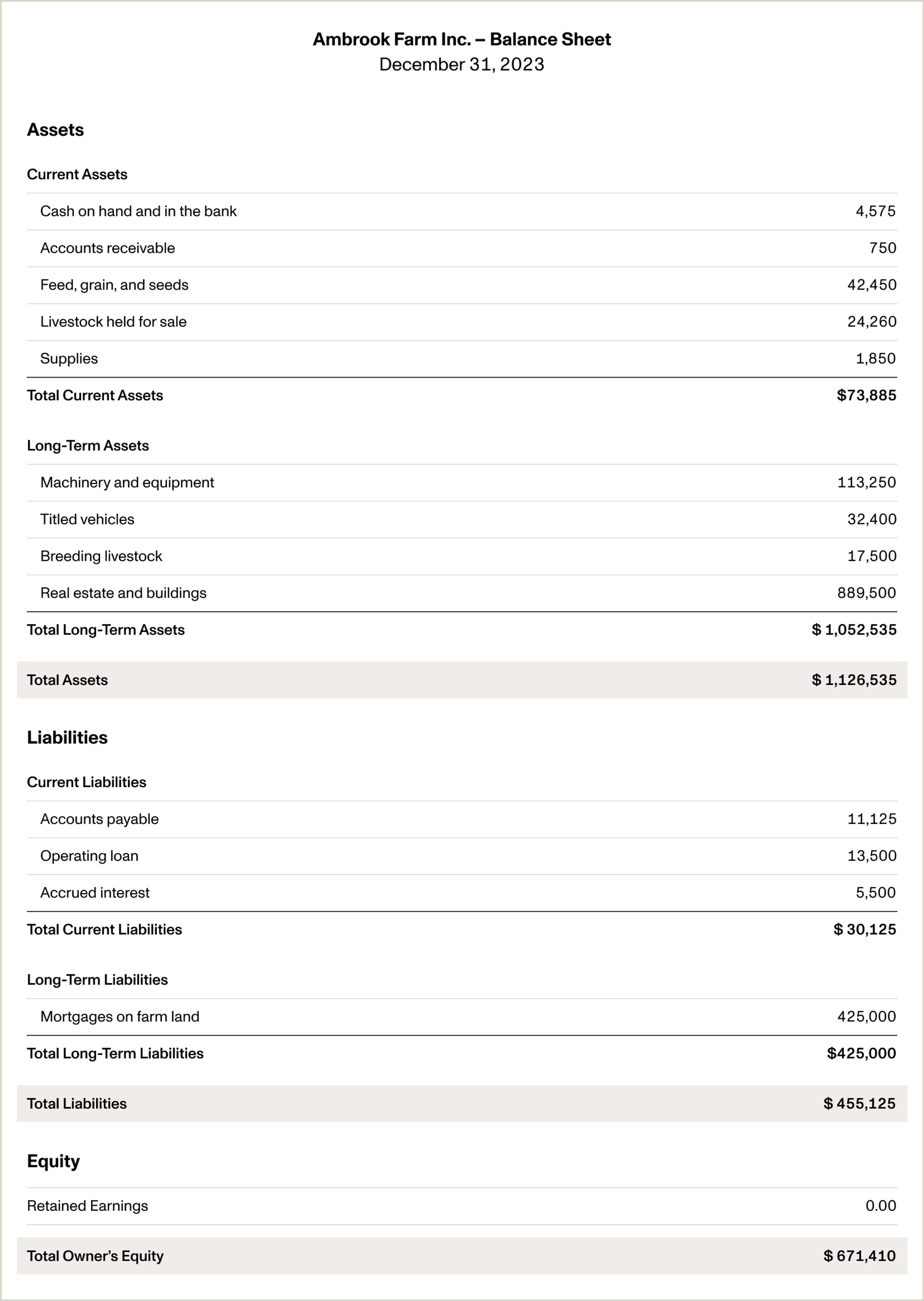

To see what a balance sheet can tell us about a business, let’s look at the December 31, 2023 balance sheet for a fictional business called the Ambrook Farm:

Reference our balance sheet example

Using this balance sheet, let’s ask three important questions about the Ambrook farm:

How much equity is in the business?

How liquid is the business?

How solvent is the business?

How much equity is in the business?

Equity, also referred to as the ‘owner’s equity’ or book value,’ is simply what’s left over after you’ve subtracted all of a business’ total liabilities from their total assets.

Ambrook farm’s assets total $1,126,535, and its liabilities total $655,125. If we substitute those values into the accounting equation:

Assets - Liabilities = Equity

We get:

$1,126,535 - $455,125 = $671,410According to this balance sheet, Ambrook Farm has $671,410 in owner’s equity.

On some balance sheets, you might also see ‘retained earnings’ listed under equity. This refers to all of the net income your business earned and didn’t pay out to its owners in the form of cash or stock dividends. If you have an income statement for your business and the retained earnings from your previous accounting period ready, you can calculate retained earnings for the current period using the following equation:

Current RE = Previous RE + Net Income (or Loss) - Cash Dividends - Stock Dividends

How liquid is the business?

Another important question a balance sheet can answer is how liquid a business is, or whether a farm has enough short term assets to cover its short term debts. Another way to think about this is: could the business survive a year of low income?

To answer this question, we calculate the business’ working capital, which is just the difference between its current assets and its current liabilities, or:

Current Assets - Current Liabilities = Working Capital

Substituting the values from Ambrook Farm’s balance sheet in, we get:

$73,885 - $30,125 = $43,760Ambrook farm has $43,760 in working capital, which means that it has more than enough current assets to cover its short-term debts and survive the year.

Another important liquidity measure is the current ratio, which is the ratio between a business’ current assets and current liabilities, or:

Current Assets / Current Liabilities = Current Ratio

Substituting the values from Ambrook Farm’s balance sheet in, we get:

$73,885 / $30,125 = 2.453According to the University of Minnesota’s Farm Financial Scorecard, a current ratio above two is strong, indicating that a business has more than enough assets to cover its short term liabilities for the year. A current ratio below one means that a business doesn’t have enough current assets to cover its current liabilities, and might soon run into liquidity problems.

Ambrook Farm’s current ratio of 2.453 means that it’s in pretty good shape. Even if it stopped generating revenue altogether, it has enough current assets to cover its current liabilities for more than a year.

Keep in mind that the ratios we’re discussing here are highly specific to each industry. Businesses in capital-intensive industries like utilities, telecommunications, and transportation tend to carry more debt to finance investments in infrastructure, equipment, and real estate, while businesses in less capital-intensive industries like services tend to carry less.

How solvent is the business?

A business’ solvency is all about whether it can continue operating in the long term, and we measure it by calculating its debt-to-asset ratio, or:

Total Liabilities / Total Assets = Debt-to-Asset Ratio

Substituting the values from Ambrook Farm’s balance sheet in, we get:

$455,125 / $1,126,535 = 0.404 or 40.4%According to the Farm Financial Scorecard , a debt-to-asset ratio below 60% is considered healthy for an agricultural business, and Ambrook Farm’s debt-to-asset ratio of 40.4% more than clears that threshold.

How much debt is too much debt?

It depends on the nature of your business and your appetite for risk. Debt is one of the biggest sources of risk in a business, besides changes in income.

If you value growth and expansion at all costs, you might put up with a higher amount of risk. If you value peace of mind, you might put up with a lower rate of growth in exchange for a lower probability of big losses resulting from too much debt.

Other important balance sheet calculations

Another important ratio is the debt-to-equity ratio, which tells us how leveraged the business is, or how reliant on debt it is. The formula for the debt-to-equity ratio is:

Total Liabilities / Equity = Debt-to-Equity Ratio

Substituting the values from Ambrook Farm’s balance sheet in, we get:

$455,125 / $671,410 = 0.678 or 67.8%This means that Ambrook farm has 67 cents of debt for every dollar of equity it has. Generally speaking, a debt-to-equity ratio below one is considered good, while a ratio above two might be risky.

Another important ratio is the equity-to-asset ratio, which tells us how much of a business’ assets actually belong to the owner:

Equity / Total Assets = Equity-to-Assets Ratio

Substituting the values from Ambrook Farm’s balance sheet in, we get:

$671,410 / $1,126,535 = 0.6 or 60%According to the Farm Financial Scorecard, an equity-to-asset ratio above 70% is strong, while a ratio below 40% is weak. At 60%, Ambrook Farm’s equity-to-asset ratio is on the healthier side.

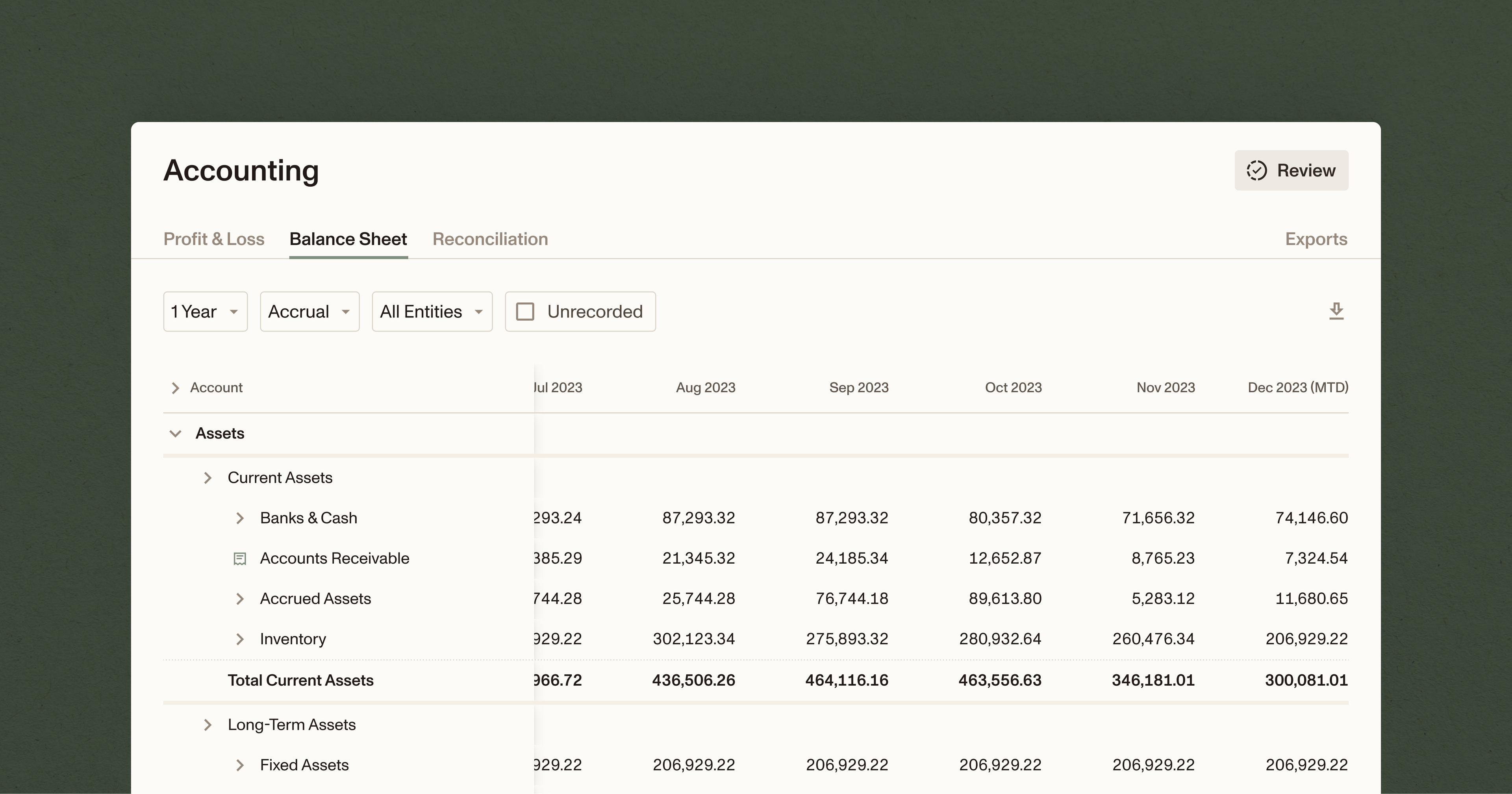

How do I create a balance sheet for my business?

Move beyond one-off balance sheet creation with Ambrook‘s real-time, interactive reports. Ambrook’s easy-to-use workflows help you build habits around balance sheet maintenance ensuring your financial data is always ready to answer your operational questions and satisfy the needs of outside parties. Curious to learn more? Explore the interactive demo below or schedule a demo.

Looking for an overview of the balance sheet? Read “What is a Balance Sheet?” next.