Introducing Your Number One Tool for Managing Business Debt and Risk

The balance sheet is one of the most powerful tools in accounting, allowing owners to gauge how much debt and risk their businesses are carrying and helping them make better decisions about their business’ future.

The balance sheet is also important to people outside of your business. For example: if you ever approach a bank for a loan, your balance sheet is the first thing they’ll ask you for, before your business plan or even your tax return. That’s because without a balance sheet, it’s difficult to know whether a business is struggling or thriving.

Here we’ll review what a balance sheet is, what you can expect to find on one, how they’re produced, and what it all means for your business.

What goes on the balance sheet?

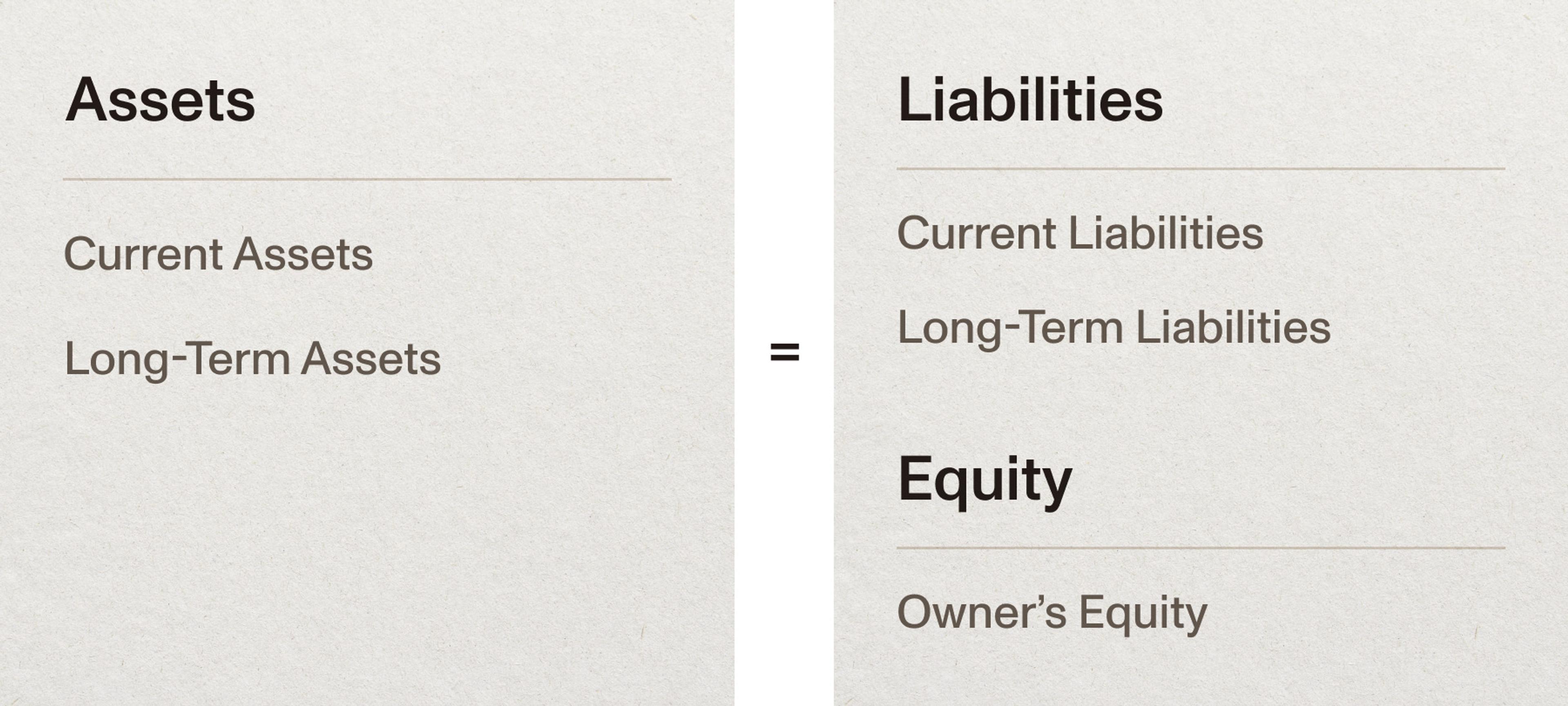

Also called a ‘net worth statement’ or a ‘statement of financial position,’ the balance sheet shows us everything a business owns (their assets), owes (their liabilities), and what’s left over when we subtract the liabilities from the assets (their equity).

If you placed your assets on one side of a scale, and your liabilities and equity on the other side, they should ‘balance,’ hence the name. Balance sheets sometimes use a two-column format to express this relationship:

Balance sheets are drawn up for a single point in time – usually on December 31st, if you produce one annually. However because of the work required to generate a balance sheet, many small businesses won’t produce a balance sheet until a lender, investor, insurer or government agency asks for one.

But producing an accurate balance sheet at the last minute is difficult, especially if you haven’t taken inventory and tracked your expenses and receipts throughout the year.

Why is the balance sheet so important?

The balance sheet makes it easy for someone outside of your business – usually a lender or investor – to get a sense of what’s going on inside.

When lenders look at a balance sheet, they’re trying to figure out whether a business can continue to cover its debts and stay in business, as well as its ability to take on more risk.

Assets on a typical balance sheet

The first step to putting together a balance sheet is to inventory your assets, which is anything of value that a business owns and uses to produce the products it sells.

The balance sheet organizes a business’ assets by liquidity – or how readily an asset can be converted to cash – and sorts them into two categories: current assets and long-term assets.

A business’ most liquid assets are referred to as current assets, or assets that can be converted to cash in a year or less. Common examples of current assets for an agricultural business include:

Cash

Savings

Accounts receivable

Fertilizer, seed, feed, and supply inventories

Crops in the field and harvested

Market livestock inventories

Assets that you don’t expect to convert to cash or liquidate within the next year are referred to as ‘fixed’ or ‘long-term’ assets, and might include:

Machinery, vehicles, and equipment

Breeding livestock

Land and buildings

Improvements such as tile and fence

Investments in capital leases and cooperatives

Retirement accounts

Some balance sheets will also include a category called ‘intermediate assets,’ or assets that are somewhere in between a current and long-term asset. (The Farm Financial Standards Council (FFSC) generally recommends sticking to the two category format.)

‘Fair market value’ vs. ‘book value’

Some assets on a balance sheet will have two different kinds of value listed: their fair market value and their book value.

An asset’s fair market value is how much you would get for it if you sold it on the market. An asset’s book value is the initial price you paid for it – or its ‘cost basis ’– minus depreciation, or the decrease in the value of that asset due to wear and tear over time.

Which valuation method should I use?

The main difference between the two valuations is that fair market value changes according to the market and is less predictable, while book value is calculated using cost basis and doesn’t change.

Generally speaking, market value is more forward-looking, while book value is more conservative. You might need to know both values to do your accounting properly, for a few reasons:

Because it’s standard practice in your industry. For example, the FFSC recommends that an agricultural producer reports inventories of harvested crops held for sale at the lower of either cost or market value.

To determine whether changes in the value of your business are due to inflation and deflation (i.e. changes in the price of goods), or because of your earnings, or both.

You’ll need certain cost and market values to perform more advanced financial calculations, like estimating deferred taxes, calculating valuation equity, and preparing accrual-adjusted financial statements.

Knowing both the market value and book value is one reason why it’s important to keep good records and track expenses throughout the year: it can be difficult to determine an asset’s cost value without an accurate record of historical costs.

Liabilities on a typical balance sheet

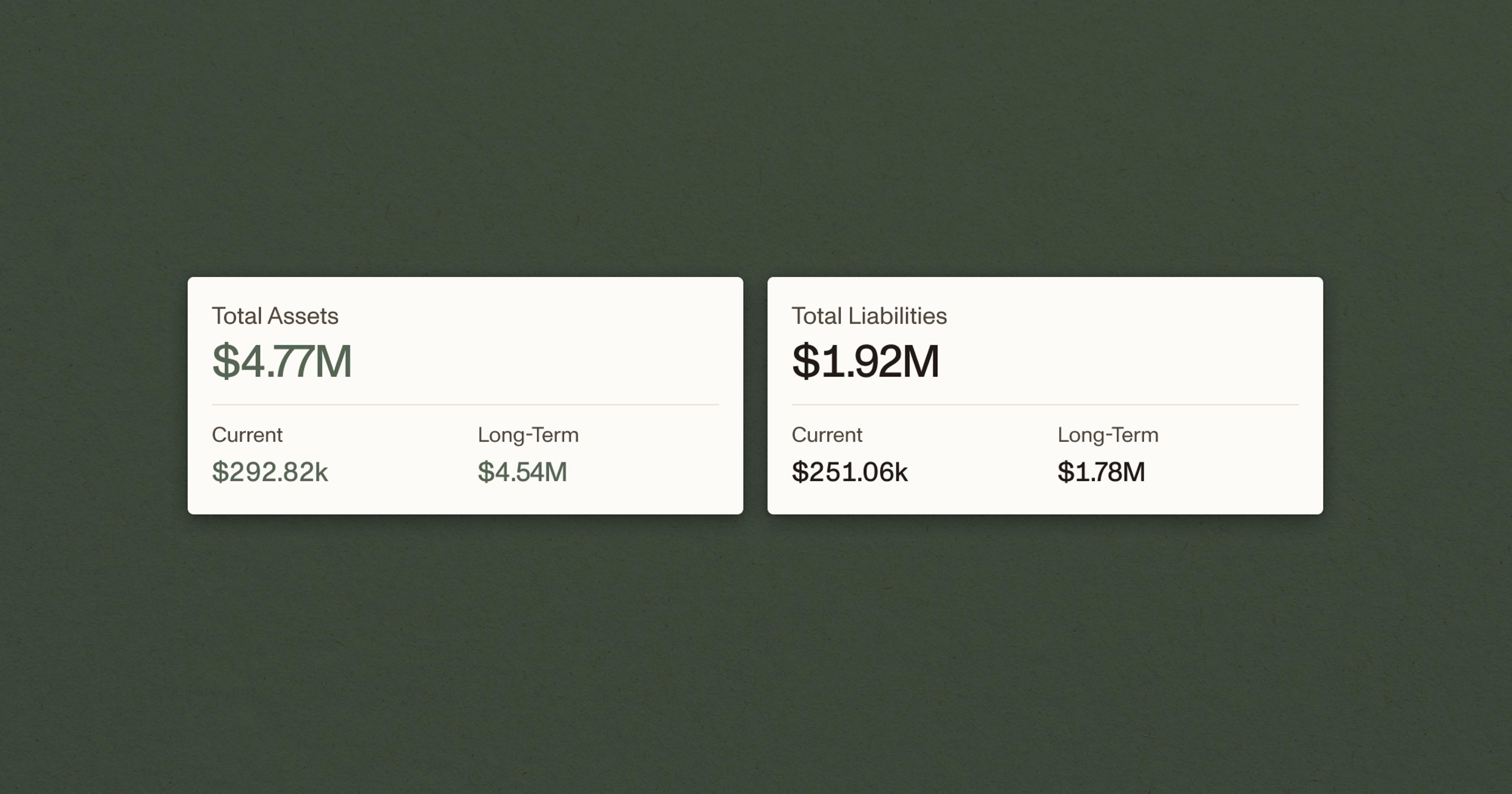

Any debts a farm owes to others, including commercial lenders, vendors, and private individuals, are included on the balance sheet as liabilities. Like assets, they’re sorted into current and long-term liabilities.

Current liabilities are debts that are due in the next 12 months, and might include:

Accounts payable

Operating loan balances at the end of the accounting period

Term debt payments due in the next year

Long-term liabilities are debts that are due in more than 12 months, and often include any mortgage debt a farm holds, as well as other longer-term notes payable.

Equity on the balance sheet

Equity is what remains after you subtract your business‘ total liabilities from its total assets. It represents the part of your business’ assets that you (and its other owners) have a claim over, rather than your creditors. Put another way, it represents the assets that would be returned to you if you liquidated all of them and settled all of your debts.

This amount is often referred to as “owner’s equity” on the balance sheet, and will be included under a dedicated “equity” section separate from assets and liabilities. You might see one or two other equity metrics listed in this section, like retained earnings, which refers to any profits your business has earned and decided not to pay out to its owners.

How to read a balance sheet

Ready to find out what the balance sheet can tell you about your business? Our guide to reading a balance sheet reviews the structure of a typical balance sheet, how to analyze a balance sheet using liquidity, and how you can use the balance sheet to make better business decisions.

How do I generate a balance sheet for my business?

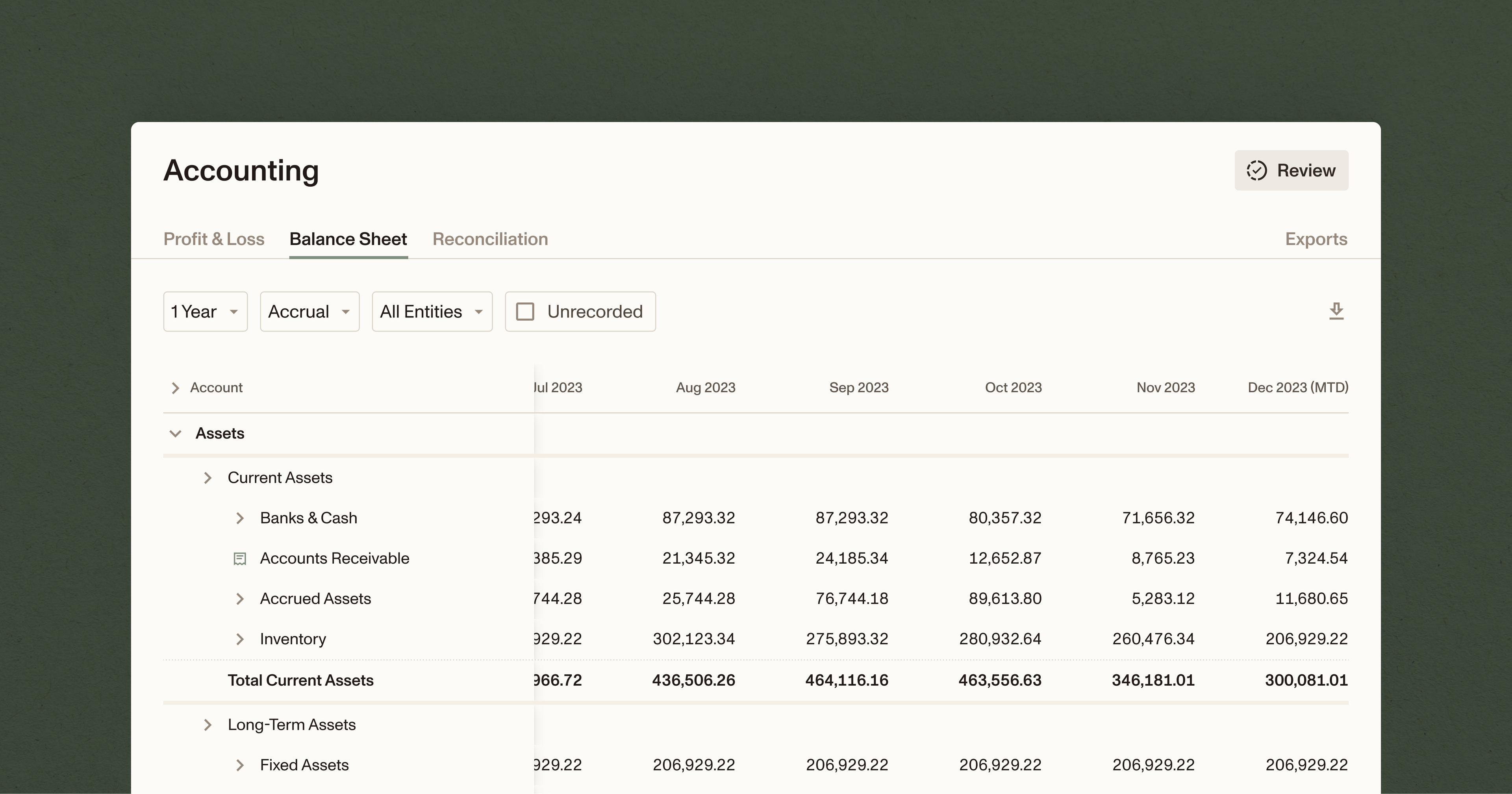

Generating a balance sheet should be pain-free. Avoid a last minute rush by keeping your balance sheet current with Ambrook, the all-in-one accounting platform. Ambrook’s real-time, interactive reports provide you with the financial data you need to run your operation while ensuring you are ready when an outside party needs to dig into your numbers. Review and export reports in cash or accrual basis or invite your accountant onto the platform to collaborate. Curious to learn more? Explore the interactive demo below or schedule a demo.

Looking for guidance on how to navigate and evaluate your balance sheet? Read “How to Read a Balance Sheet” next.