Customers paying late? Want to get paid faster? It might be time to take a closer look at your accounts receivable.

Selling to customers on credit is common in many industries, which is why managing your accounts receivable–or the unpaid invoices and bills you’ve sent out to customers–is so important.

A well-managed accounts receivable system can improve your cash flow, increase credit sales and decrease administrative headaches. On the other hand, a poorly-managed one can make cash flow unpredictable, saddle your business with bad debts and hurt your customer relationships. Here’s what you need to know.

What are accounts receivable?

Your ‘accounts receivable’ (AR) are what accountants call the money your customers owe you for goods and services you’ve delivered, but haven’t received payment for yet.

Accounts receivable are recorded on the balance sheet as an asset and are created whenever you invoice or bill a customer for a credit sale.

Managing accounts receivable encompasses every aspect of ‘getting paid’ as a business, including setting payment terms, invoicing, and enforcing a payment schedule.

Read more: What is a Balance Sheet?

What are examples of accounts receivable?

A farmer might record an account receivable when they:

Invoice a customer for a fence repair job

Sell livestock to a customer on credit

Bill a customer for boarding or feedlot services

Invoice customers for a monthly milk delivery

Send a customer a bill for pasture leasing services

Businesses that deal with different receivables in their day-to-day business might further subdivide ‘accounts receivable’ on their balance sheet.

For example, a dairy farm might record milk sales under an account called ‘commodity receivables’ while recording cull cow receivables and upcoming tax credit payments under ‘other receivables.’

Accounts receivable vs. accounts payable: what’s the difference?

Accounts receivable and accounts payable are two sides of the same coin: receivables are invoices you’ve sent other people, who you’re expecting to receive payments from soon, while payables are invoices you’ve received from other people that you yourself need to pay.

Does accounts receivable count as revenue?

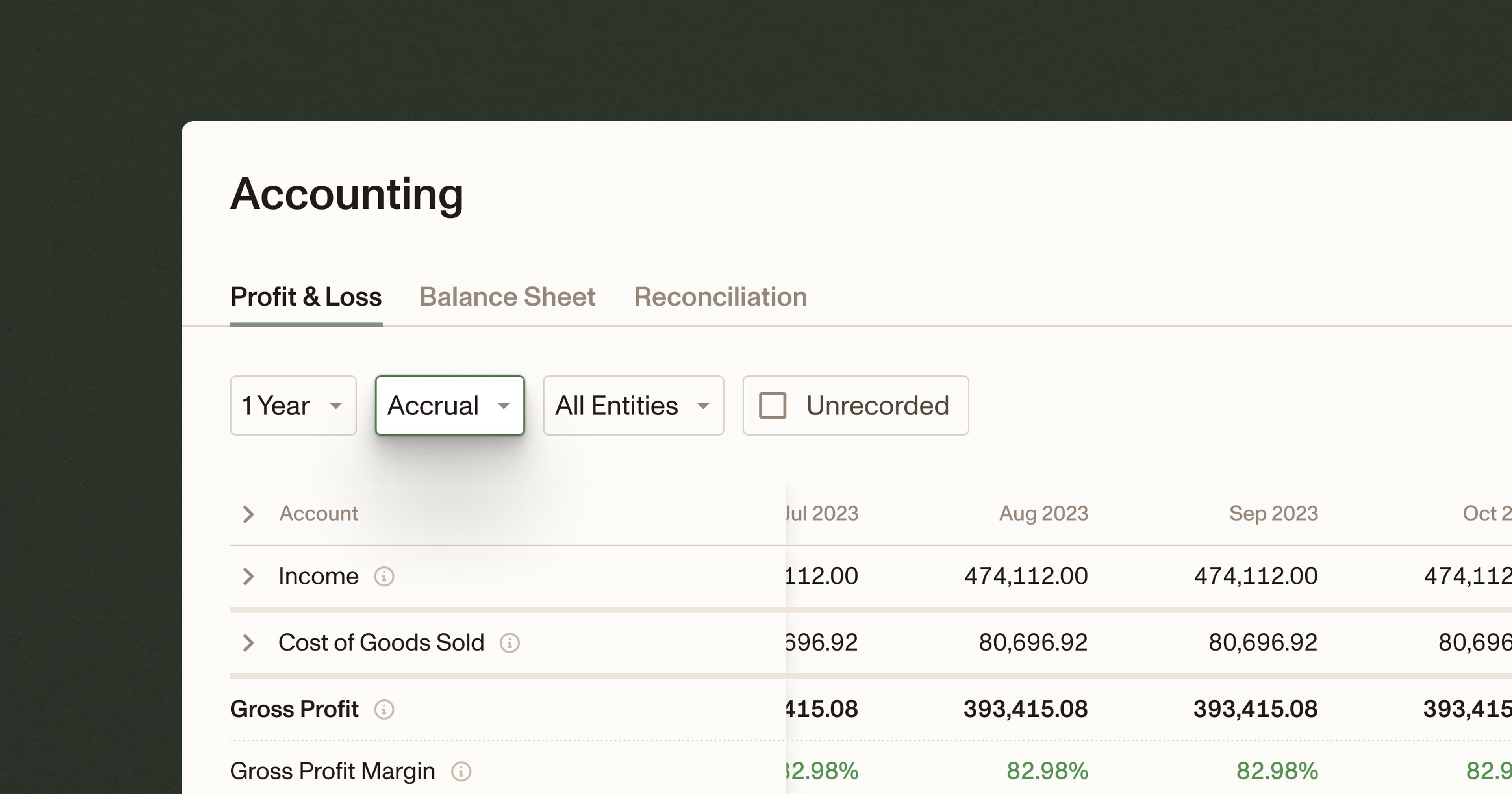

Yes, but only if your business has adopted the accrual method of accounting. Accrual accounting recognizes revenues when they’re earned–i.e., when you invoice and deliver goods and services to your customers–not when they hit your bank account.

Under the cash method of accounting, however, revenue isn’t recognized until cash hits your bank account, which means accounts receivable don’t count.

Read more: Understanding Accounting Methods: Cash vs Accrual Basis

What is accounts receivable turnover?

The accounts receivable turnover ratio measures how good your business is at getting its customers to pay their bills on time. The formula for accounts receivable turnover is:

AR turnover ratio = net credit sales / average accounts receivableTo calculate it, you’ll need to know your net credit sales for the period, which are total credit sales you made to customers minus returns and discounts. You’ll also need to know your average accounts receivable, which is just the average value of your accounts receivable for the period.

Calculating accounts receivable turnover: an example

Let’s calculate AR turnover for a hypothetical business: Ambrook Dairy Inc., an organic dairy farm in Colorado.

The owner of Ambrook Dairy, Mackenzie, wants to determine how good her business was at collecting AR over the previous year, so she decides to calculate annual AR turnover.

First she looks at Ambrook Dairy’s income statement, which indicates that net credit sales for the year were $860,000. Then she looks at her balance sheet, which indicates a total AR of $45,000 at the beginning of the year, and a total AR of $85,000 at the end of the year.

Let’s also assume Ambrook Dairy uses net 30 payment terms–in other words, it requires that customers pay their invoices no more than 30 days after receiving them. Mackenzie now has everything she needs to calculate AR turnover.

First, she calculates average accounts receivable by adding the beginning and ending AR balances and dividing them by two:

Average accounts receivable = (beginning AR + ending AR) / 2

Average accounts receivable = ($45,000 + $85,000)/2

Average accounts receivable = $65,000

Then she plugs average AR into the AR turnover formula we introduced above:

AR turnover ratio = net credit sales / average accounts receivable

AR turnover ratio = $860,000 / $65,000

AR turnover ratio = 13.23

This means that on average, Ambrook Dairy collects on its accounts receivable 13.23 times per year. (According to OSU Extension’s guide to financial ratios, a common benchmark for AR turnover in agriculture is a minimum of 8.0 or above.)

If we divide 365 by Ambrook Dairy’s AR turnover ratio, we get another useful number:

Average duration of AR = 365 days / AR turnover ratio

Average duration of AR = 365 days / 13.23

Average duration of AR = 27.59 days

This means that on average, it takes Ambrook Dairy 27.59 days to collect an account receivable. If we compare that to their payment terms (30 days), we can say that on average, Ambrook Dairy’s customers pay their bills 2.41 days early.

This indicates the business is doing a good job of collecting AR. If it turned out that its customers were (on average) paying late, Ambrook Dairy might consider either changing its payment terms or encouraging its customers to pay earlier.

What are ‘bad debts’ expenses?

Sometimes businesses determine that they won’t be able to collect certain accounts receivable–when a customer goes AWOL, for example. In this case, the business might record a bad debts expense, close out the account receivable in question and record the uncollected debt as a business expense.

If this happens often enough, a business might establish an “allowance for uncollectible accounts,” which is simply an estimate of its bad debts.

If a business expects to do $100,000 in credit sales this year and finds that it fails to collect 3% of its accounts receivable on average, its allowance for uncollectible accounts might be $3,000 ($100,000 x 3%).

What are some best practices for managing accounts receivable?

Good accounts receivable management is particularly crucial in agriculture, where many sales are done on credit and operations have a small window of time to do their business.

Accounts receivable management encompasses every aspect of ‘getting paid’ as a business, including setting payment terms, spelling those terms out in contracts, invoicing customers, and following up with customers about late or upcoming payments.

Businesses can generally improve the accounts receivable process by doing things like:

Establishing firm and definite credit policies

Communicating payment terms and expectations to customers early and clearly

Only offering credit sales to customers who have good credit histories

Invoicing customers quickly and on time

Sending simple, accurate, and easy to read invoices

Enforcing payment deadlines with late fees

Automating the accounts receivable process

Some benefits of effective accounts receivable management include:

Higher and more predictable cash flow

Higher credit sales

Reduced bad debt loss

Lower administrative cost

Better customer service

Check out our guide to invoicing efficiency for more on optimizing customer invoicing and ensuring your business gets paid on time.

Read more: How to Make Invoicing More Efficient

How do I automate my accounts receivable processes?

Your accounts receivable system should let you easily track and manage outstanding payments while cutting down on the amount of time you actually spend manually managing AR.

Accounting platforms like Ambrook can help you achieve this by automating much of the AR process, including:

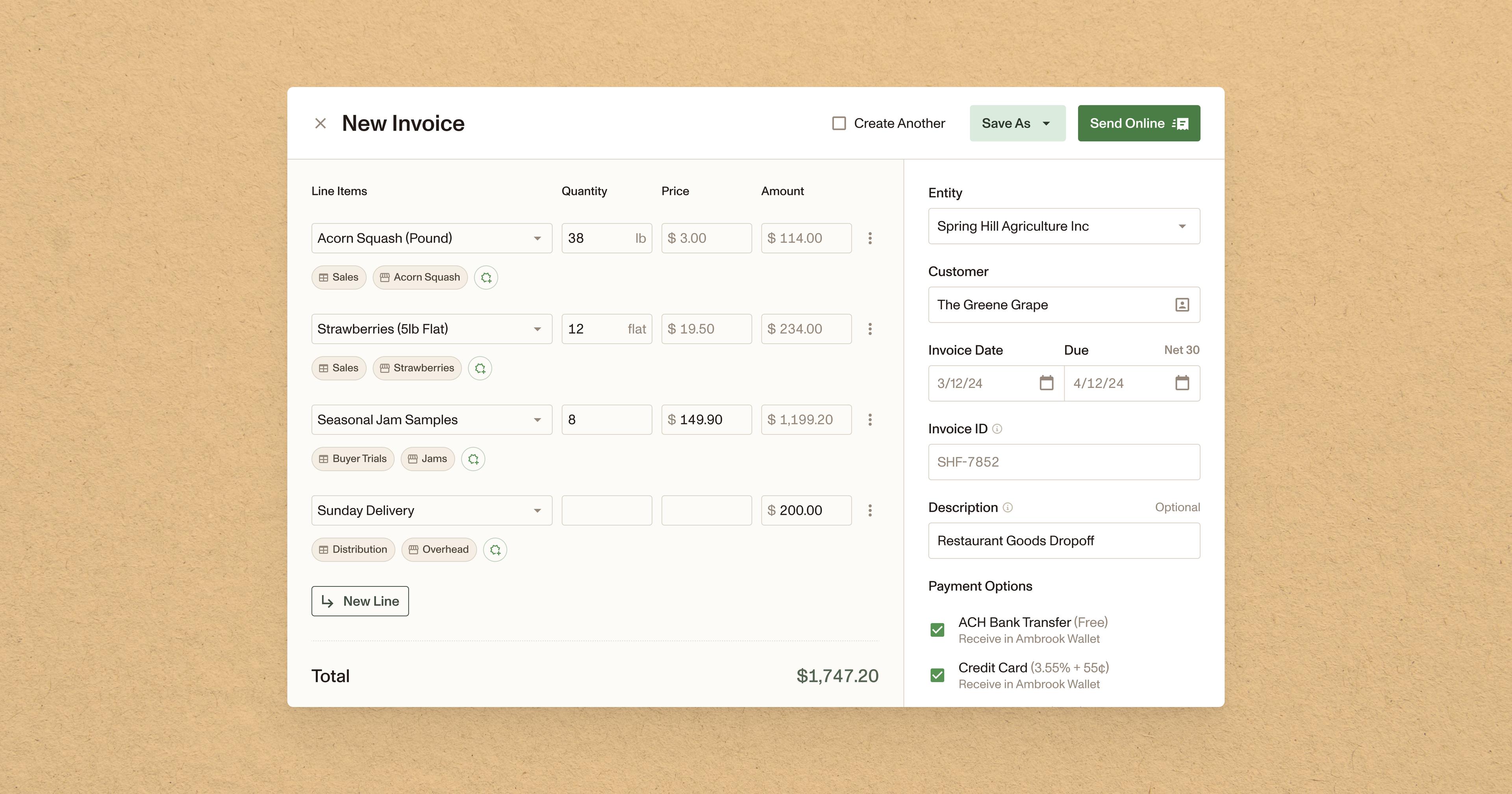

1. Generating invoices quickly

Business owners who invoice at a high volume often find themselves repeating the same tasks over and over again when creating invoices from scratch. Ambrook can automate away much of this work with powerful autofill functions, saveable line items, and automatic bookkeeping at the moment of invoice creation.

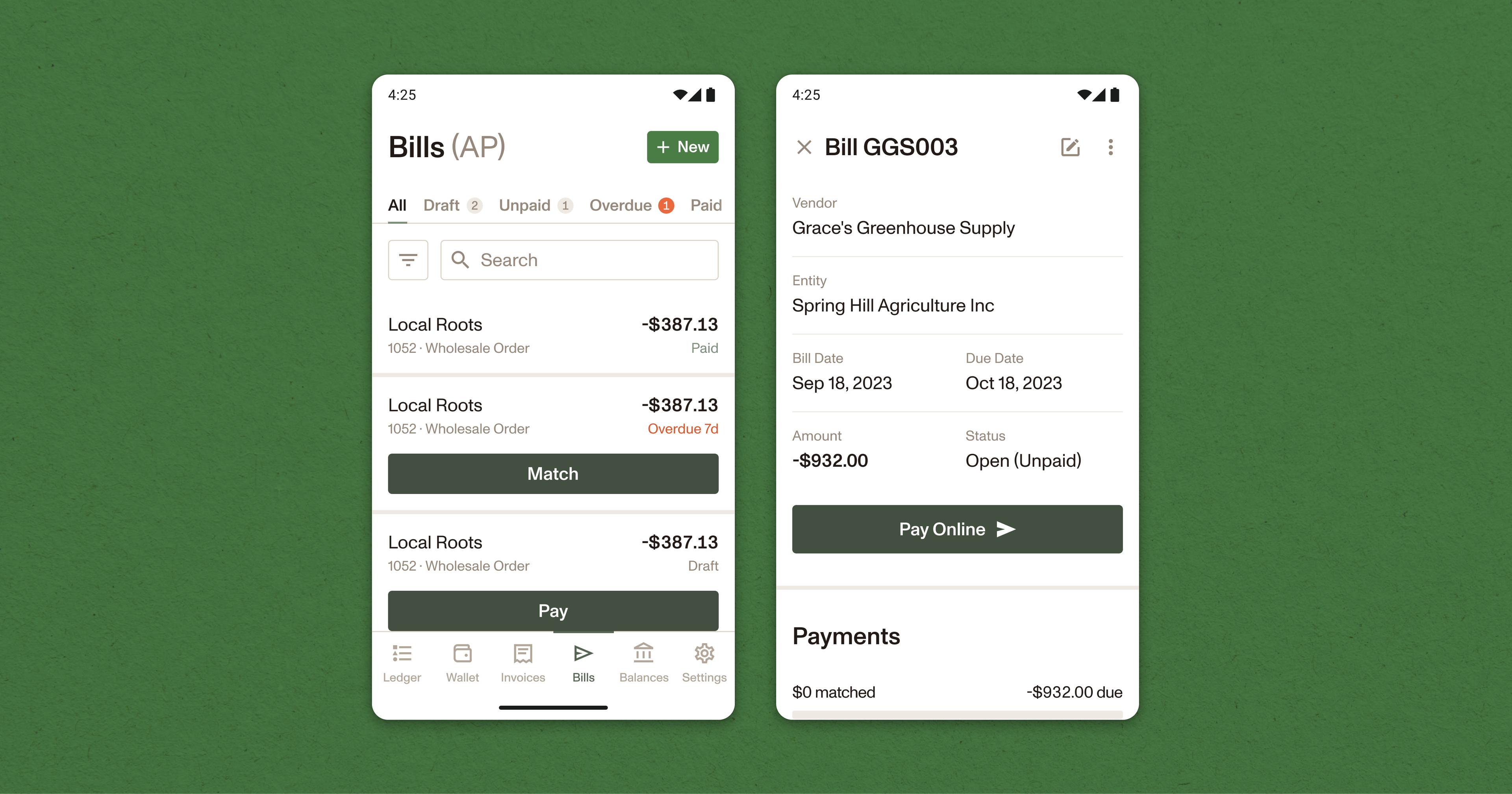

2. Maintaining a reliable invoice calendar

Ambrook allows users to quickly identify recently created invoices, track unpaid and overdue invoices, and look up paid and canceled invoices at a glance. Powerful filters allow users to instantly sort invoices by vendor, due date, amount and status, allowing them to quickly find outstanding or near-due payments.

3. Keeping tabs on payments with reports

Ambrook’s reporting tools provide a summary of accounts receivable for each customer that includes all outstanding invoices and remaining amounts grouped by days past due, making it easy to identify which customers are driving income and which ones might need a follow up or payment reminder.

Improve AR efficiency and cash flow with Ambrook

Ambrook takes your invoicing to the next level, giving you powerful tools for generating and tracking invoices and eliminating hours of repetitive administrative work.

Pre-saved vendor and product information allow users to generate new invoices quickly, and the platform’s intuitive interface and reporting functions make it easy to track down any outstanding or near due payments. Ambrook’s payment tools make your business completely payment method agnostic, giving your customers more flexibility and increasing the chances you’ll get paid sooner.

Want to learn more? Start your 7 day free trial today.

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.