Track where your money comes from, where it’s going and how each part of the business is doing.

Your general ledger is the master financial record that organizes all of a business’s transactions into accounts so financial statements can be prepared and performance can be evaluated. It’s one of the most important financial tools at your disposal, providing a foundation for accurate recordkeeping, meaningful financial statements and sound management decisions. Here’s how your general ledger works, and what to keep in mind when setting one up for the first time.

What is a general ledger?

Your general ledger contains all of your operation’s accounts, from cash and inventory to income and expenses. It organizes every business transaction into standardized categories so you can see the full financial picture of your operation over time, helping you:

Organize and make sense of journal entries, which are posted into the ledger’s accounts.

Summarize overall activity in accounts such as cash, feed inventory, livestock, equipment, sales revenue, and operating expenses.

Turn raw financial data into financial statements, like the balance sheet, cash flow and income statement.

Many agricultural operations maintain their general ledger using farm accounting software like Ambrook or spreadsheets, but manual ledgers and paper account books are sometimes still used in smaller operations.

Why is it important?

Agriculture is different from many main street businesses because it deals with biological assets that continually change in value, such as livestock that grow over time and feed inventories that rise and fall. Production timing is also highly seasonal, with many expenses incurred months before any revenue is received.

In addition, most farms and ranches operate multiple enterprise streams—such as cow-calf operations, feedlots, dairies, and crop production—that generate income and consume resources at different times and rates, adding complexity to financial management.

A well-structured general ledger helps you:

Track profitability by enterprise

Allocate common costs (like fuel, labor, or equipment) correctly

Prepare accrual-adjusted financial statements that match income with the related costs of production — key for accurate profitability analysis and tax compliance

Communicate financial health to lenders, partners, and advisors

How the general ledger fits into farm accounting

1. Chart of accounts: your ledger’s structure

Before posting entries, you must define your chart of accounts — a list of all categories you’ll track (e.g., cash, accounts payable, sales, feed expense, livestock inventory, etc.). For livestock operations, this may include sub-categories like cow herd inventory, calf sales, or feedlot yardage income.

Read more: Building a Chart of Accounts that Works for You

2. Journals: recording transactions first

Transactions are first recorded in journals (the “books of original entry”) with information like date, description, and dollar amounts. Think of journals like your daily business diary.

Read more: Intro to Journal Entries

3. Posting to the general ledger

Each journal entry gets posted into the appropriate ledger accounts — cash movements, revenues, expenses, assets, liabilities, and equity. This is where the double-entry accounting system ensures that every debit has a corresponding credit, so your accounts stay balanced.

Read more: Debits vs. Credits

4. Trial balance and financial statements

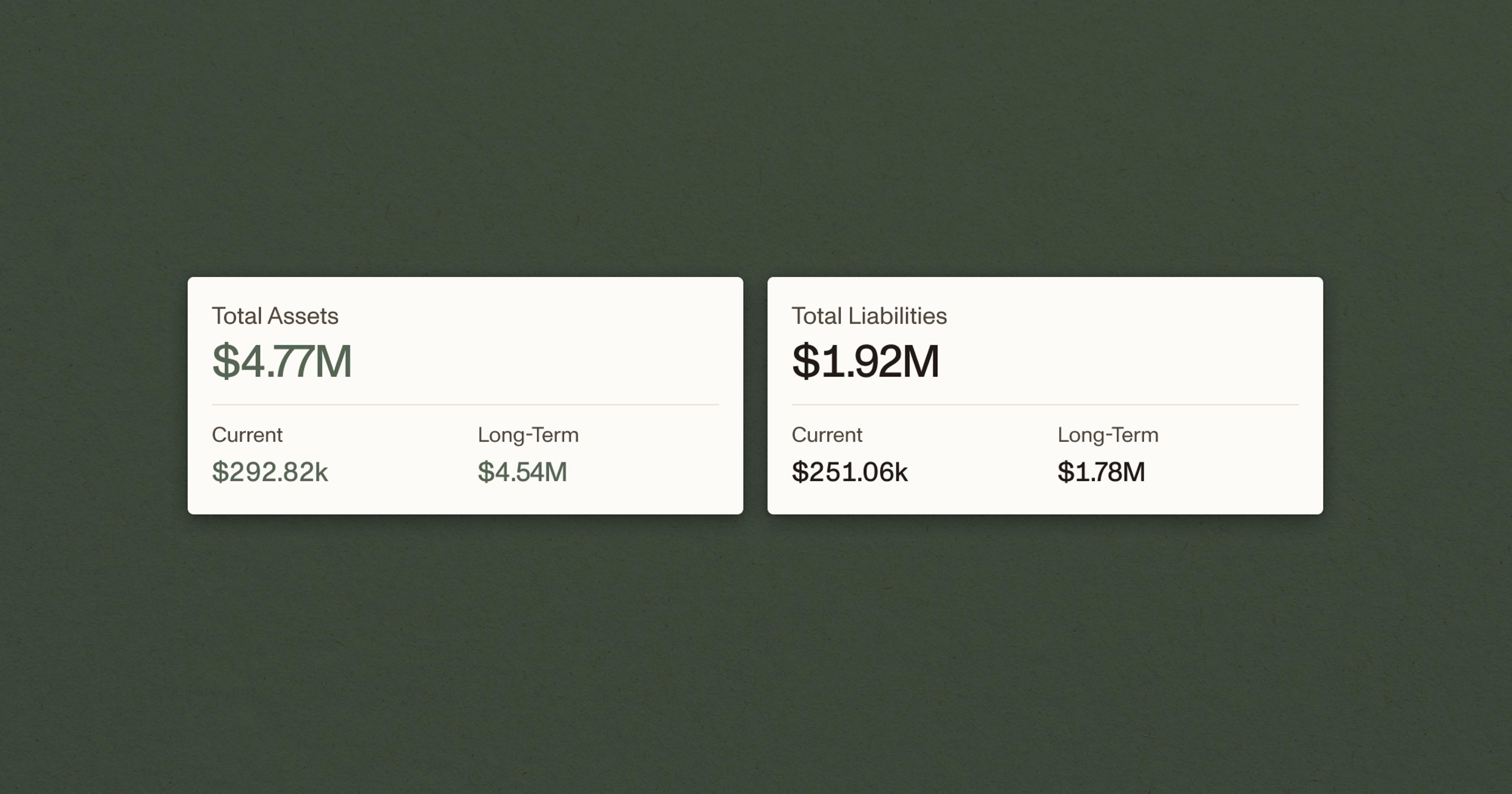

From the general ledger, accountants prepare a trial balance to ensure total debits equal credits. After adjustments, the data flows into key reports like:

Income Statement

Balance Sheet

Cash Flow Statement

Read more: Trial Balance: Best Practices, Definitions and Examples

Agriculture-specific considerations

Many farms divide their business into distinct enterprises — e.g., cow-calf, finishing (feedlot), dairy, or crop. Proper ledger setup assigns revenues and expenses to these enterprises so you can accurately assess which segments are making or losing money.

For example:

Internal transfers should be recorded as income to the crop enterprise and expense to the livestock enterprise to avoid skewed results.

Young stock moved from cow-calf to feedlot phases may require internal “sales” entries to track true costs and returns.

Tips for agricultural producers

Use accrual accounting where possible. Cash basis is fine for tax reporting, but accrual adjustments in your general ledger (accounts receivable/payable, inventory changes, depreciation) give a more accurate picture of profitability.

Leverage farm-oriented software. Packages like FBS Systems, CenterPoint, or PCMars offer agricultural templates, inventory tracking, and farm-specific reporting that integrate with your general ledger.

Keep production and financial records linked. Financial records (in the GL) should tie back to production data — weights, yields, animal inventories — to support analysis and management decisions.

Consult extension resources. State extension offices provide templates, charts of accounts, and guides specifically designed for farm recordkeeping and financial management.

Ambrook takes the guesswork out of running your business

Ambrook’s general ledger is more than a bookkeeping necessity—it’s a management engine that turns every transaction on your farm into actionable insight. Plus with time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just balance the books: it takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

Want to learn more about Ambrook?

This resource is provided for general informational purposes only. It does not constitute professional legal advice and may not apply to your specific situation. Consult with professional legal counsel before making any decisions about your business.