This form ensures you report your cost of goods sold (COGS)—direct cost such as feed, seed, and supplies—properly, so you’re taxed only on your actual profits, not total sales.

Form 1125-A, Cost of Goods Sold helps accrual basis filers calculate their Cost of Goods Sold (COGS), or the direct costs of raising or producing crops, livestock, or other farm products. Producers report and subtract these costs from their total sales to determine their taxable income, which is what ends up getting taxed.

In short, 1125-A ensures you only pay taxes on your actual profits, rather than your total sales. Accurate inventory records are key, since the IRS uses this information to confirm the COGS deduction claimed on your return.

What is Form 1125-A and who must file it?

Form 1125-A is used to calculate and report the cost of goods sold (COGS) for certain businesses that track their inventory, including corporations and partnerships. If you’re filing one of the following tax returns and you report a deduction for cost of goods sold, you must complete and attach Form 1125-A:

Form 1120 (U.S. Corporation Income Tax Return)

Form 1120‑C (U.S. Income Tax Return for Cooperative Associations)

Form 1120‑F (U.S. Income Tax Return of a Foreign Corporation)

Form 1120-S (U.S. Income Tax Return for an S Corporation)

Form 1065 (U.S. Return of Partnership)

If you’re a cash basis filer and don’t track inventory for your operation, you likely won’t need to file this form.

Before you get started…

Inventories required: You likely don’t need to file 1125-A unless your business produces, purchases or sells goods and tracks inventory for them.

Small business exception: A small business taxpayer may not need to treat inventory the same way that larger businesses do; there are simplified methods available.

Uniform capitalization rules (section 263A): If you produce or acquire property for resale, you may need to include certain additional costs under section 263A.

Before filling the form, make sure you understand if your business is required to keep inventories, what method you use, and whether section 263A costs apply. (Ask your tax preparer if you aren’t sure.)

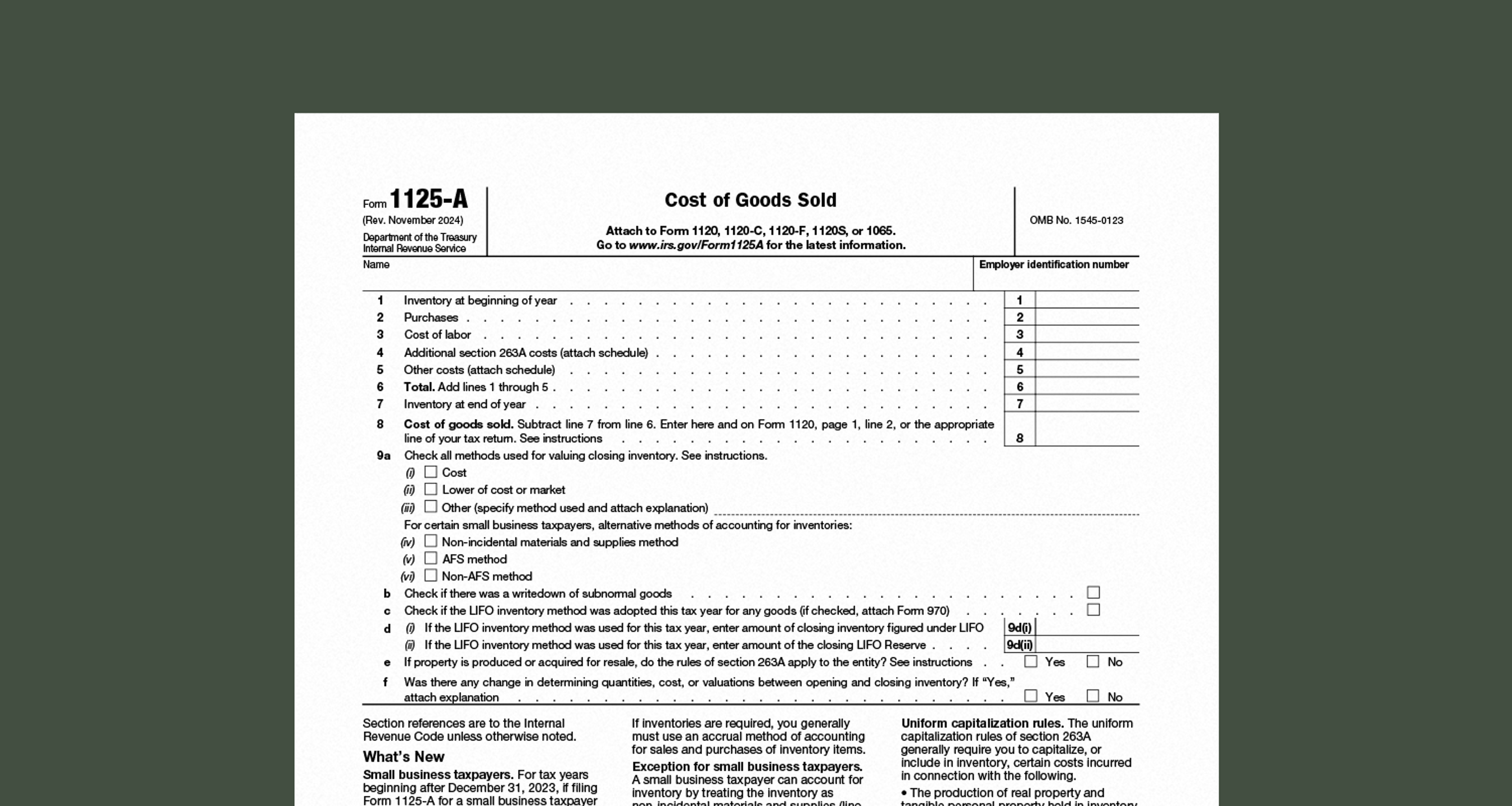

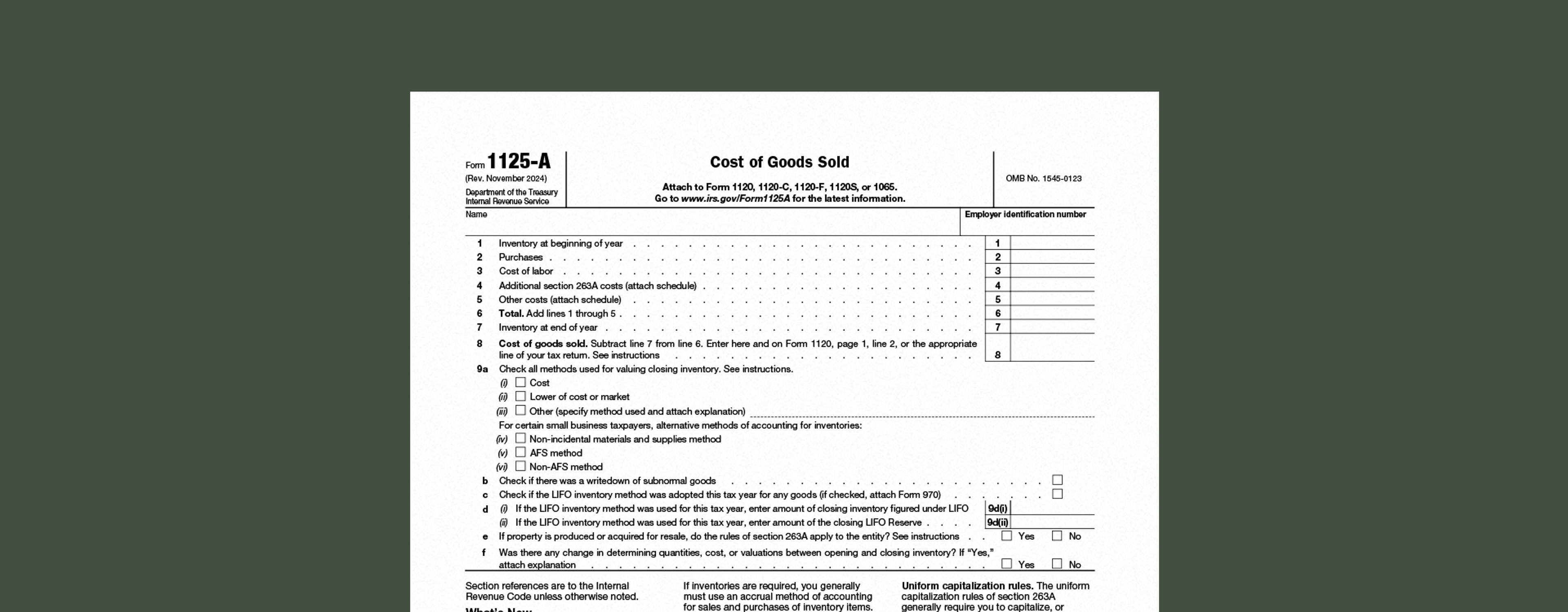

Form 1125-A, Cost of Goods Sold

Form 1125-A: A line-by-line breakdown

Line 1: Inventory at Beginning of Year

Enter the value of your inventory at the start of the tax year. If you changed your method of accounting for this tax year, you must refigure last year’s closing inventory using the new method and enter that amount here.

Line 2: Purchases

Enter purchases for the year, minus items withdrawn for personal use. For a partnership, personal-use withdrawals should be shown on Schedule K and K-1.

Line 3: Cost of Labor

Enter the cost of labor directly connected with production of goods, excluding any labor costs not allocable to inventory.

Line 4: Additional Section 263A Costs

If you elected a simplified method of accounting (or otherwise have section 263A costs) that are not already included on lines 2, 3 or 5, enter those here. Examples: warehousing, handling, purchasing, general and administrative costs under simplified resale method.

Line 5: Other Costs

Enter costs paid or incurred during the year that were not included on lines 2-4. You must attach a schedule explaining these costs. For cooperatives, per-unit retain allocations get entered here (with statement attached).

Line 6: Total

Add lines 1 through 5. This gives your total cost of goods available for sale or manufacturing throughout the tax year.

Line 7: Inventory at End of Year

Enter the value of your inventory at the end of the year. If section 263A costs apply to ending inventory, include them here.

Line 8: Cost of Goods Sold

Subtract line 7 (ending inventory) from line 6 (total cost of goods available). Enter this result here and also on your tax return on the appropriate line.

Line 9: Inventory Valuation Methods

You must complete this section describing how inventory is valued and other inventory-accounting issues:

Line 9a: Check method(s) used – “Cost,” “Lower of cost or market,” or “Other (method).” For certain agricultural producers, alternative methods include the “Farm-price method” and the “Unit-livestock-price method.”

Line 9b: Check if there was a write-down of subnormal goods.

Line 9c/9d: If you adopted or used the LIFO (Last-In First-Out) inventory method this year for any goods, check the box. Then on 9d(i) enter the closing inventory under LIFO; on 9d(ii) enter the closing LIFO reserve (or in parentheses if negative).

Line 9e: Check Yes or No to indicate if the rules of section 263A apply to the property produced or acquired for resale.

Line 9f: Check Yes or No if there was any change in determining quantities, cost, or valuations between opening and closing inventory. If Yes, attach an explanation.

Tips & common pitfalls to watch out for

If you change your accounting method (e.g., for inventory valuation) you must refigure the prior year’s closing inventory and include any adjustment under section 481(a) as appropriate. Missing this can lead to mistakes.

Make sure you attach detailed schedules for line 5 (Other Costs) and for any explanation required on line 9f. Failure to attach can trigger IRS questions.

If you check LIFO on line 9c and 9d, keep in mind you may need to file Form 970 or attach a statement — and there could be LIFO reserve implications if you later elect S-corporation status.

For small business taxpayers: If you’ve adopted an alternative inventory accounting method (lines 9a(iv)-(vi)), ensure you understand the exceptions.

Keep clear books and records of how you value your inventory, how you account for section 263A costs (if applicable), and how you compute your beginning and ending inventories — the IRS may ask to review this.

Double-check the tax return where you carry the COGS from line 8; make sure it’s entered on the correct line for your return type (e.g., Form 1120 page 1 line 2, or Form 1120-F Section II line 2).

Filing Form 1125-A: In a nutshell

Determine your beginning inventory (Line 1), purchases (Line 2), labor (Line 3), section 263A costs (Line 4), and other costs (Line 5).

Add them to get the total cost of goods available (Line 6).

Subtract your ending inventory (Line 7) to arrive at cost of goods sold (Line 8).

Then describe how you handle inventory valuation and accounting methods (Line 9).

Attach schedules and explanations as required.

Make sure you transfer your cost of goods sold to your main tax return.

Filing Form 1125-A correctly helps you support your deduction for cost of goods sold and avoid issues with the IRS. If you’re unsure about inventory valuation methods, section 263A, or changing accounting methods, it’s worth consulting your tax professional.

Know your costs, from field to bin to sale

Ambrook makes it easy to track what you produce, tie costs to your herds and fields and get the numbers you need to make better decisions. It doesn’t just help you do your accounting: it takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

Get a fresh start on your bookkeeping in 2026.

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.