Our customers, Chris Carlough and Jacob Gilley, helped us turn manual steps into new tools. By sharing their invoicing routines with us, they guided how taxes, discounts, and fees now work in Ambrook.

Learn more: Taxes, Discounts & Fees

What we learned from Chris

Chris runs Tennessee Valley Archery in Tennessee, where at the close of each month his routine involves calculating sales tax.

When we approached him for feedback on the new features we were building, he walked us through his monthly routine. Throughout the month, Chris categorizes each sale in Ambrook, marking bows and arrows as taxable, flagging horse rentals as ag-exempt, and tracking out-of-state sales separately. He also applies Tennessee’s 9.25% tax rate and tags items to “Tennessee Valley Sales Tax Payable.”

At the end of the month, he opens Ambrook in one tab and his custom spreadsheet in another. He exports his invoices, reconciles the totals against his P&L, and uses the spreadsheet to confirm the amount owed. With that number in hand, Chris files the state report and logs the payment in Ambrook as a bill, fine-tuning with a rounding adjustment if needed.

His process certainly worked, but we could see that it involved more manual steps than necessary. Together, we identified opportunities for Ambrook to make it simpler and more automatic.

What we learned from Jacob

Jacob runs Heaven’s Hollow Farm in Virginia, where much of his business is selling beef in bulk. He was looking for ways to support the people who helped grow his business. If a customer bought half a beef and brought in a friend for the other half, he wanted to reward them with a discount. For interns or helpers spreading the word, he imagined offering a kickback.

He’d seen other businesses run rewards programs and thought it would be helpful to have something similar in Ambrook: simple, built-in tools for adding fees and discounts without any extra steps.

What we built: Taxes, discounts & fees in Ambrook

Ambrook is about turning the manual, clunky steps you used to handle outside the product into something simpler and faster inside it. The time we spent with Chris and Jacob helped us fine-tune our new feature for taxes, discounts, and fees.

From Chris’s workflow, we built in his precision around line-item accuracy, liability tracking, and monthly reconciliation, but made it faster and automatic in Ambrook. From Jacob’s feedback, we made fees and discounts simpler to apply and easier to see.

After all, if Ambrook is here to save you time at your desk, then the math should be on us — not y’all.

Here’s what’s new:

When you create an invoice in Ambrook, you can now add taxes, discounts, or fees with just a couple of clicks. Those rates show up automatically on the PDF your customer receives, no calculator required.

You have full line-item accuracy. Just like Chris’s invoices — where bows and arrows were taxable but horse rentals were exempt — you can apply rates to specific items or across the whole invoice.

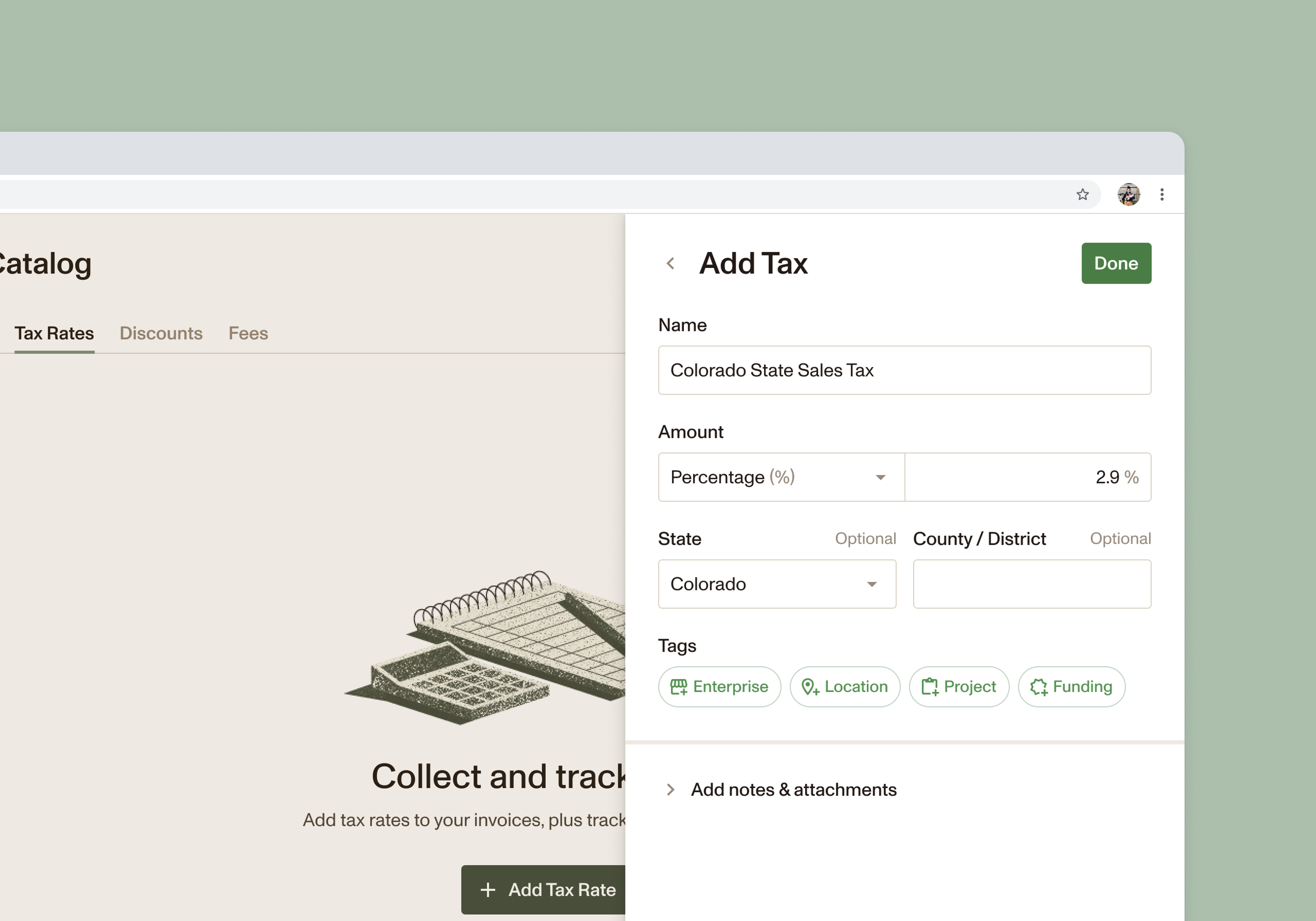

You can store common taxes, fees, and discounts in your Catalog. A state sales tax, delivery fee, or referral discount can be set once and applied automatically whenever those products are invoiced.

Taxes are automatically tagged as liabilities and routed to the right account on your balance sheet. At the end of the month, Ambrook shows you exactly what you owe so you can map payments to the state directly.

Looking ahead

Chris and Jacob showed us where extra steps were getting in the way, and their input led to tools that make invoicing quicker and more reliable in Ambrook.

With every update, we aim to make Ambrook do more of the heavy lifting so you can step away from the office, put away the calculator, and get back to the field.

Please keep sharing your ideas with us. They help us make Ambrook better for everyone.