Choosing the right balance sheet value for your assets can help you make better decisions, plan for growth, prepare for succession and save you time when applying for loans or grants.

Understanding how to value your farm’s assets on your balance sheet is one of the most important steps in running a financially healthy agricultural operation. Should you use cost (book value) or market value?

The short answer is: it depends on your purpose—whether it’s internal management, tax reporting or communicating with lenders or investors. Getting this right helps you make better decisions, plan for growth, prepare for succession, and have clearer conversations with banks and advisors.

What is book value, and when should you use it?

Cost, also known as book value, generally refers to what you originally paid for an asset, adjusted over time for depreciation (in the case of depreciable assets) or other adjustments. For example:

Machinery and equipment remain on the books at their original cost less accumulated depreciation.

Buildings and improvements show historical costs less depreciation.

Cost value is useful for internal accounting, tax reporting, and tracking investment over time because it reflects the actual amount you invested and have recovered through depreciation. It doesn’t fluctuate with market conditions, providing consistency year to year.

Read more: What is a Balance Sheet?

What is market value, and when should you use it?

Market value represents what the asset would reasonably sell for today under current market conditions. This is particularly relevant for items like:

Farmland and land improvements

Breeding livestock

Harvested crops, grain, and marketable livestock inventories

Used equipment with an active resale market

Market value is important when you are:

Applying for financing or refinancing and your lender wants to see what your assets are worth now.

Planning succession or estate transfers and want to know your operation’s fair valuation.

Considering strategic decisions, such as selling some assets or restructuring.

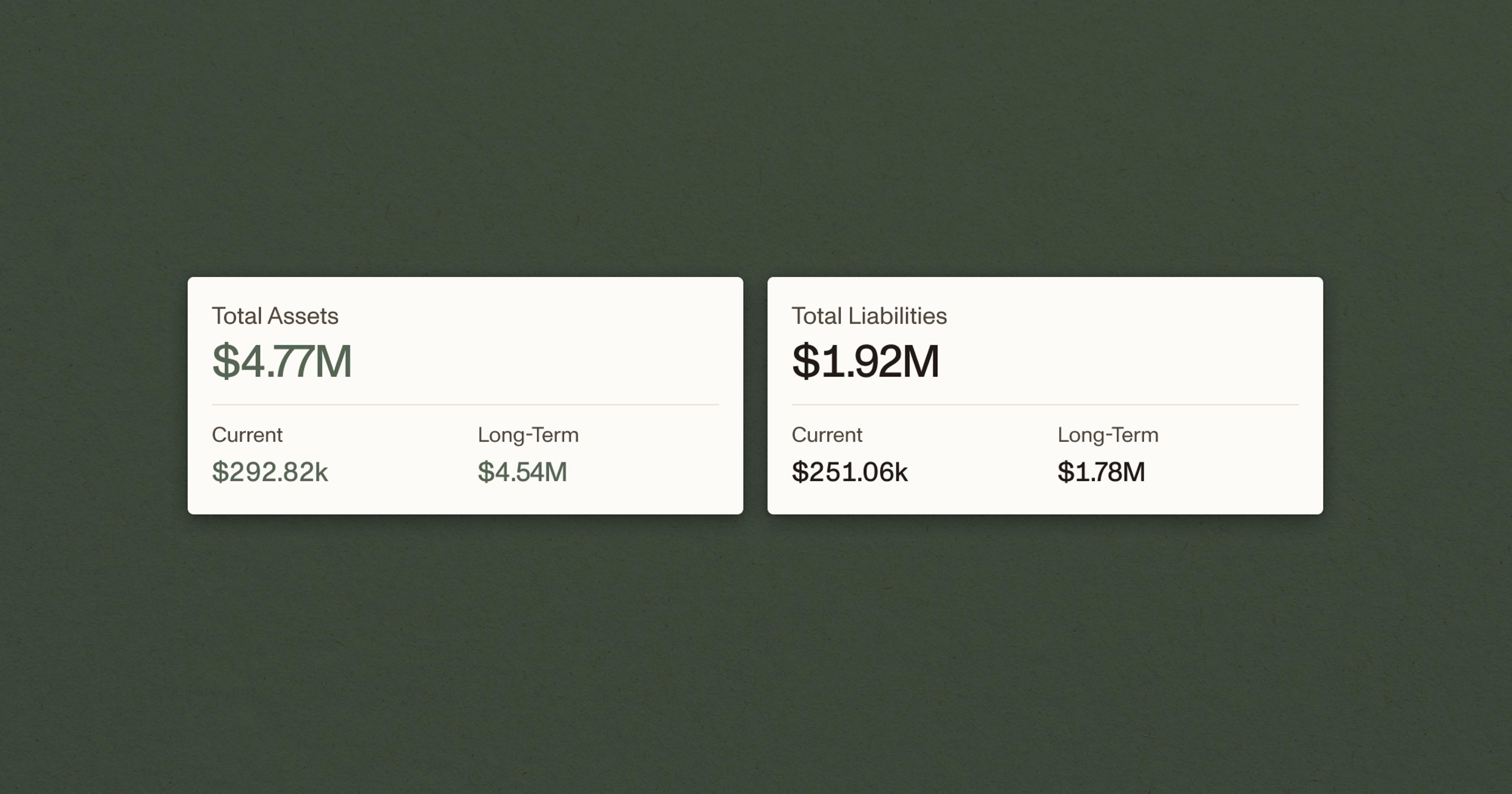

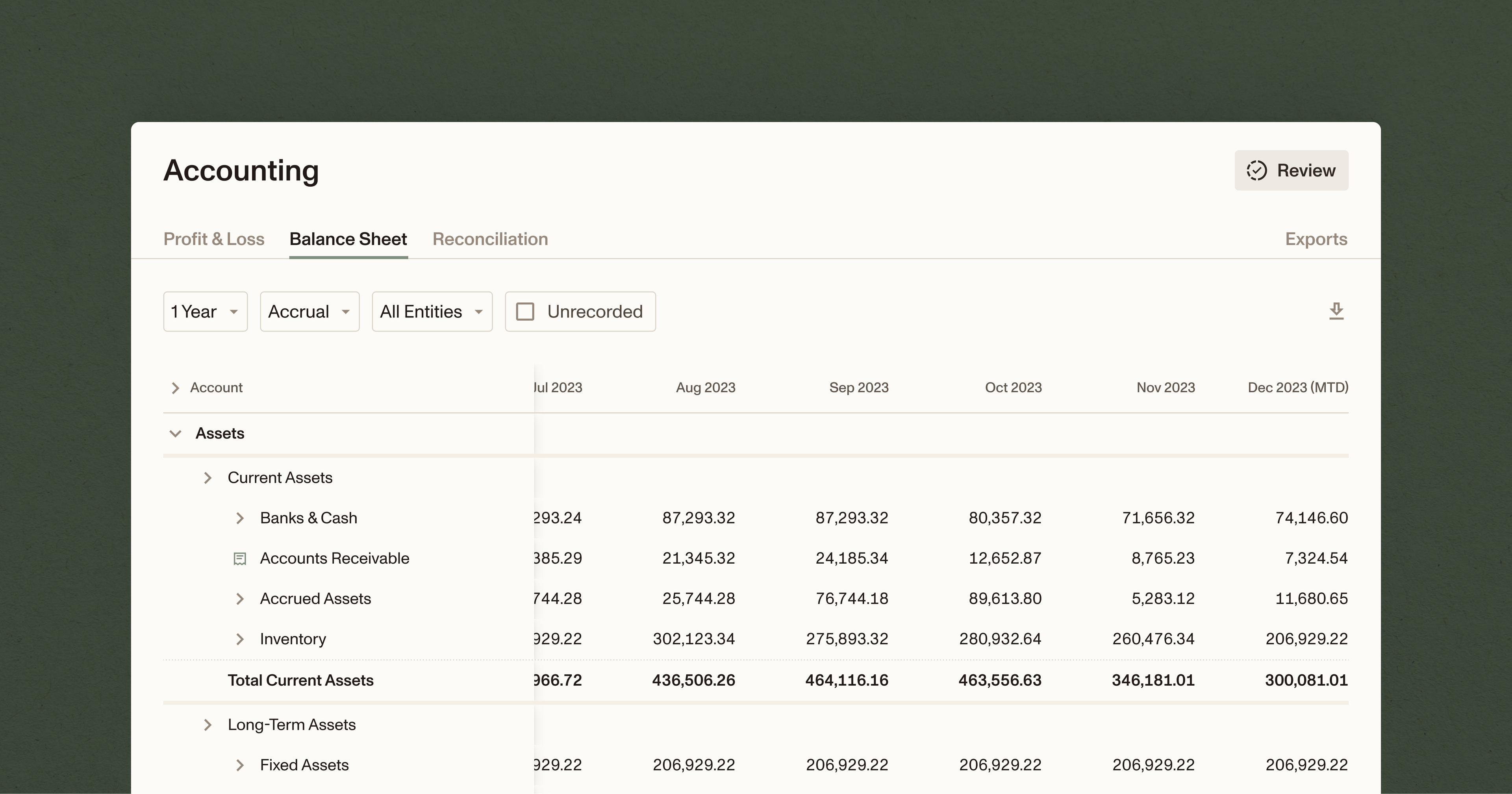

Current assets vs. fixed assets

Your farm balance sheet includes both current assets and fixed assets, and the valuation method for each can differ:

Current assets (like inventory, cash, accounts receivable) are typically valued at market value when shown to lenders because they will be converted to cash within a year. This often applies to produce, feed, and other inventory items.

Fixed assets (like land, buildings, long-term equipment) are more commonly held at cost (book value) for tax and depreciation purposes, but market value is often shown in supplemental reporting for planning or lender purposes.

Inventory valuation: a special case

Inventory deserves extra attention because it appears in both your balance sheet and your profit and loss statement (through cost of goods sold). Inventory can be valued using cost basis (the price you paid or the cost to produce) or market value (what it could sell for today). Both methods are acceptable as long as you document your approach and apply it consistently from period to period. If you prepare your financials for lender review or sale negotiations, a market value view may give a more accurate picture of your operation’s liquidity and net worth.

How this affects your farm’s financial picture

Choosing cost vs. market value can significantly affect metrics like:

Net worth or owner’s equity

Working capital and current ratios

Debt service coverage calculations

Strategic decisions relating to growth or succession

For example, high-value land recorded at cost may understate your farm’s true value if prices have appreciated significantly. Conversely, showing assets at market value could make your farm appear stronger to lenders or partners, but might not reflect tax position or depreciation history.

Practical tips for producers

Decide on the purpose of your report: lenders, tax prep, internal planning, or succession.

Be consistent: use the same valuation approach year to year unless there’s a good reason to switch.

Document your method so that anyone reviewing your financials understands how values were determined.

Consider dual reporting: a cost-based sheet for internal/tax use and a market-value sheet for external stakeholders.

Your balance sheet tells the story of your farm’s financial strength. Choosing the right valuation method for each asset helps ensure that story is both accurate and useful.

Ambrook makes it easy to stay on top of current assets

Ambrook‘s real-time, interactive reports and easy-to-use workflows help you build habits around balance sheet maintenance, ensuring your financial data is always ready.

Plus, with time-saving bookkeeping automation features, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make staying on top of your numbers easy: it takes the guesswork out of running your business. Curious to learn more? Schedule a demo.

Want to learn more about Ambrook?

This resource is provided for general informational purposes only. It does not constitute professional legal advice and may not apply to your specific situation. Consult with professional legal counsel before making any decisions about your business.