Fixed assets are the backbone of many agricultural operations, providing the tools and resources farmers and ranchers need to keep operating day-to-day.

Fixed assets are long-term, tangible assets used in a business to produce income and not intended for sale within one year. They’re often recorded on the balance sheet at cost and expensed over time through depreciation, reflecting their gradual use in operations. Some common examples of fixed assets include:

Buildings, fences and land improvements

Tractors and combines

Planters, sprayers, and tillage equipment

Grain bins and on-farm storage facilities

Barns, machine sheds, and livestock housing

Fencing, corrals, and working facilities

Irrigation systems and wells

Fixes assets vs. current assets

Fixed assets are long-term resources used in farm operations for more than one year and not held for resale. Current assets on the other hand are short-term assets expected to be converted to cash, sold, or used up within one year. For agricultural operations, these can include things like cash, inventories, market livestock, prepaid inputs, supplies and accounts receivable.

What is liquidity?

Liquidity is a business’s ability to meet short-term obligations using assets that can quickly be converted to cash without significant loss of value.

Fixed assets are generally illiquid. Equipment, buildings and land improvements support long-term production, but are more difficult and slower to sell. If a business finds that too much capital is tied up in fixed assets, it can sometimes find itself in a situation where it is asset-rich but cash-poor.

Current assets on the other hand are considered more liquid, because they’re expected to be used up or sold within a year. These assets fund operating expenses and seasonal cash needs, are used up in the course of raising or harvesting agricultural commodities, and generally keep the business going day-to-day.

Capitalization and initial cost

Capitalization means recording assets on the balance sheet rather than expensing them immediately. Agricultural producers capitalize assets that provide more than one year of benefit or use and exceed a reasonable cost threshold.

The initial cost of a fixed asset includes the purchase price, freight, installation, setup, sales tax and costs required to place the asset into service. For example, a tractor’s capitalized cost may include delivery fees and required attachments, while a grain bin may include site preparation and construction labor. Capitalized costs are recovered over time through depreciation (except land).

Depreciation methods and calculations

Depreciation allocates the cost of a fixed asset over its useful life, reflecting wear, use and obsolescence. Most farm fixed assets—such as buildings, vehicles and equipment—are depreciated; land is not. Common depreciation methods for agricultural producers include:

Straight-line: Cost minus salvage value ÷ useful life. Simple and widely used for financial reporting.

MACRS: IRS-required method for tax depreciation, using accelerated recovery periods for farm assets.

Section 179: Allows immediate expensing of qualifying fixed assets, subject to limits.

Bonus depreciation: Permits a percentage of cost to be expensed in the year placed in service.

Depreciation affects taxable income, cash flow planning, and long-term asset management decisions.

Read more: A Simple Guide to Depreciation and MACRS

Tracking and managing fixed assets

Effective fixed asset management helps farmers control costs, plan taxes, and support financing decisions. Producers should maintain a fixed asset register listing purchase date, cost, asset class, useful life, depreciation method, and accumulated depreciation.

Good tracking separates tax depreciation (MACRS, Section 179, bonus) from book depreciation used for financial analysis. Assets should be reviewed annually for disposals, trades, casualties or major improvements that require capitalization.

Accurate records support lender balance sheets, insurance claims, and succession planning—and prevent over- or under-depreciation as equipment and facilities age.

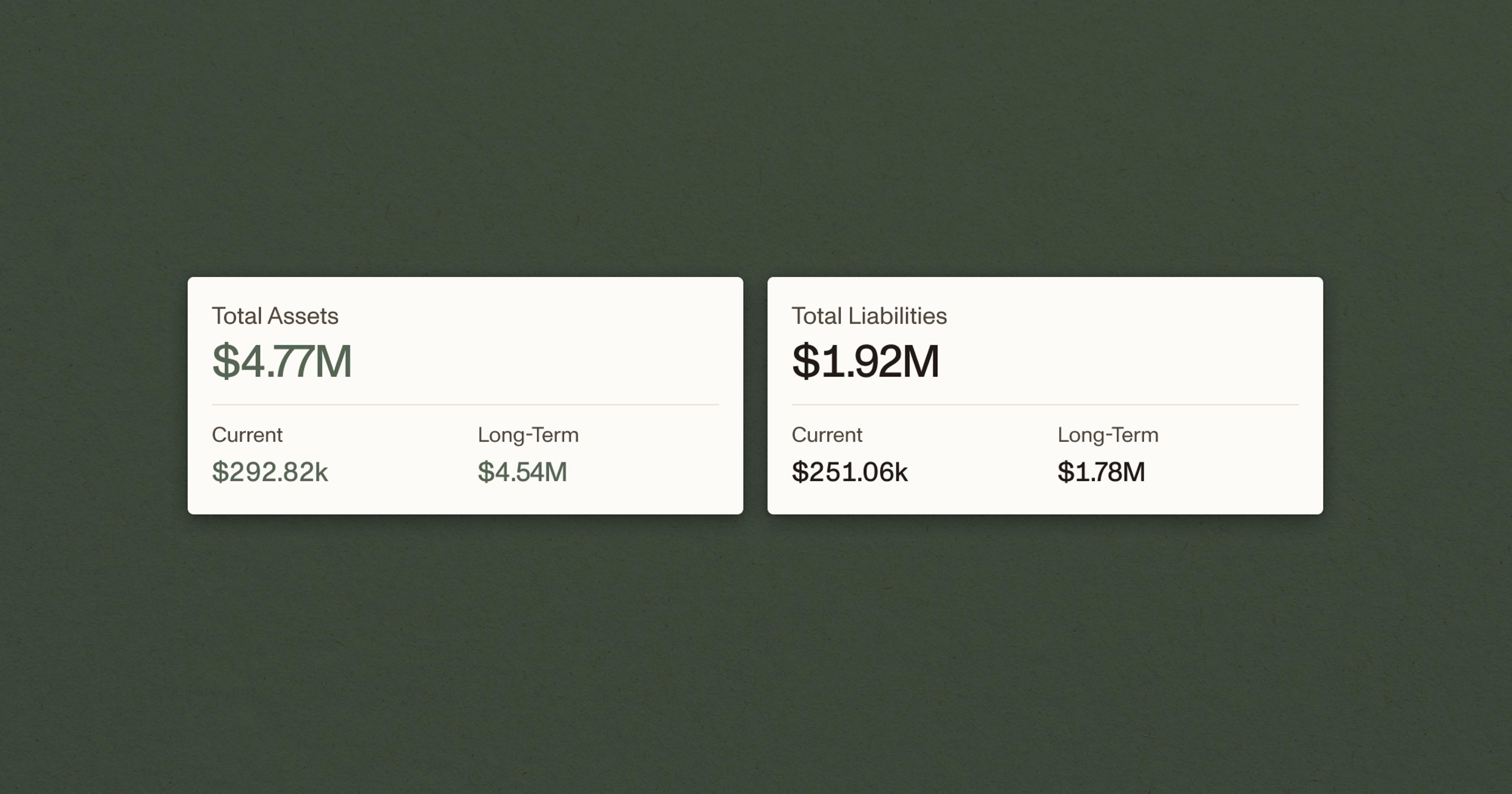

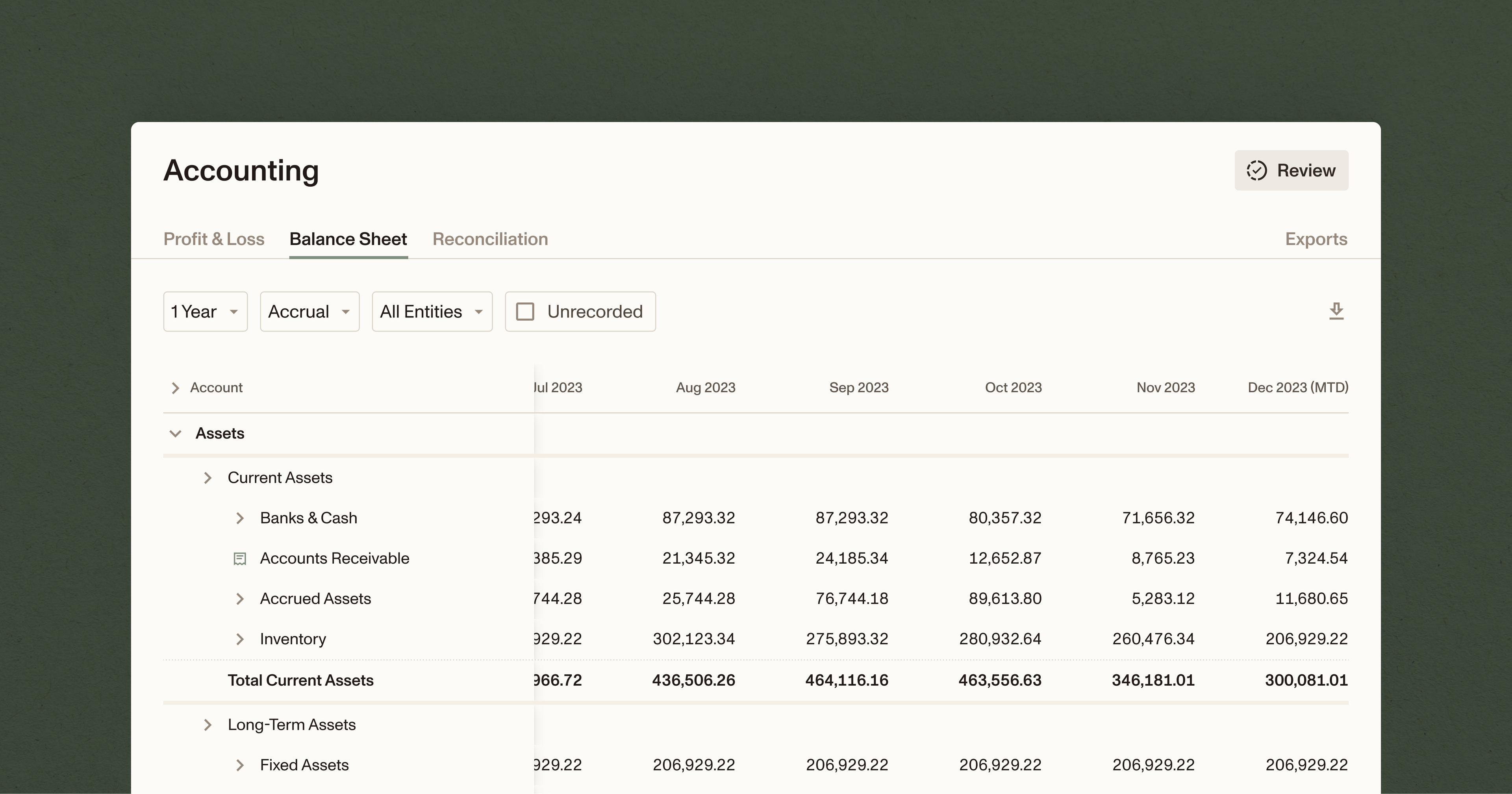

Ambrook makes it easy to stay on top of your assets

Ambrook‘s real-time, interactive reports and easy-to-use workflows help you build habits around balance sheet maintenance, ensuring your financial data is always ready.

Plus, with time-saving bookkeeping automation features, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make staying on top of your numbers easy: it takes the guesswork out of running your business. Curious to learn more? Schedule a demo.

Want to learn more about Ambrook?

This resource is provided for general informational purposes only. It does not constitute professional legal advice and may not apply to your specific situation. Consult with professional legal counsel before making any decisions about your business.