To elect S corp tax status, you’ll need to file Form 2553, ‘Election by a Small Business Corporation,’ first. Here’s how it works.

For agricultural producers, S corporation status may mean lower tax bills and simpler succession planning. To elect S corp status, you file Form 2553 with the IRS.

Here is everything you need to know to file Form 2553 accurately, including how it relates to other important forms (like Form 8832 and Schedule K-1 of Form 1120-S) and what to do if you miss the filing deadline.

What is Form 2553?

Form 2553, Election by a Small Business Corporation, is the form business entities must file with the IRS in order to be taxed as an S corporation.

Individuals cannot file Form 2553. Which means that, if you operate your farm or ranch as a sole proprietor, you will first need to register your business as a separate legal entity, such as a limited liability company (LLC) or corporation, before filing.

For ag producers, the typical route to electing S corp status consists of:

Registering your operation with your state as a limited liability company (LLC)

Filing Form 8832 with the IRS in order to be treated as a corporation for federal tax purposes

Filing Form 2553 with the IRS in order to be treated as an S corporation specifically

You must file Form 2553 within two months and 15 days of the beginning of the tax year to elect to be treated as an S corporation that year. Or you may file Form 2553 at any point during the year if you want your S corporation status to take effect the following year.

In some cases, it’s possible to make a late election, but you may need help from a tax professional.

Form 2553 vs. Form 8832

Form 8832 is similar to Form 2553; you file it with the IRS in order to elect a certain tax treatment. However, Form 8832 does not allow you to elect S corp status.

When you file Form 8832, you elect to be taxed either as a partnership, a corporation, or a disregarded entity (similar to a sole proprietorship). In order to file this form, you need to have already formed a business entity—typically an LLC, which you register with your Secretary of State.

On the other hand, when you file Form 2553, you elect to be taxed as an S corporation specifically.

Unless your business is already incorporated, you cannot file Form 2553 without also filing Form 8832. Form 8832 tells the IRS that you would like to be treated as a corporation for tax purposes. Form 2553 tells them that, specifically, you would like to be treated as an S corporation.

What is an S corporation?

An S corporation is a tax filing status that allows your business to behave, in many ways, like a regular corporation (or C corporation) while remaining a pass-through entity.

As a pass-through entity, an S corporation doesn’t pay federal income taxes directly on its earnings. Rather, that income tax liability ‘passes through’ to the shareholders, who are each responsible for paying income tax on the S corp’s earnings based on their share of ownership.

For a detailed breakdown of how S corps work, check out S Corporation Status: A Decision Guide for Agricultural Producers.

S corps vs. LLCs

In order to be taxed as an S corporation, you first form an LLC.

You form an LLC at the state level. That is, you file articles of organization with your state, which then regards you as a separate business entity.

If your LLC has only one owner, then your default status with the IRS is a single-member LLC. The IRS considers a single-member LLC to be a disregarded entity (similar to a sole proprietorship). You file taxes using Schedule C attached to your individual tax return.

If your LLC has more than one ownership, your default status with the IRS is similar to a partnership. You file taxes using Form 1065, the same form used by partnerships.

LLCs can also elect to be treated like an S corporation by filing form 8832 and Form 2553. In some cases, you can reduce your tax liability by making an S Corp election for your LLC.

For more, see Limited Liability Companies (LLCs): A Decision Guide for Farmers.

S corps vs. C corps

You can think of a C corporation as a ‘traditional’ corporation. An S corporation is similar to a C corporation:

Both are owned by shareholders

Both are regarded by the IRS as business entities separate from their shareholders

Both may pay their shareholders in the form of dividends (C corps) or distributions (S corps)

But C corps and S corps are taxed differently. A C corporation pays corporate income tax on all its earnings. Shareholders and employees who earn dividends or salaries then pay taxes on their individual earnings.

S corps, on the other hand, do not pay corporate income tax. Each shareholder is responsible for paying a portion of taxes on the S corp’s earnings according to their ownership percentage of the S corp.

Should ag producers elect S corp status?

Many ag producers elect S corp status for their farm or ranching operations because of the benefits that come with it.

The most important of these are:

Beneficial tax treatment. If you are the sole shareholder in your S corp, you pay income tax on 100% of its income, but you only pay self-employment tax on the portion of that income you receive as a salary.

Succession planning. It is simpler to pass on ownership of an S corporation to someone else than it is to transfer the various individual assets that may make up a farm or ranching operation.

Also, by registering your operation as an LLC prior to election S corp status, you enjoy the liability protection an LLC business entity provides.

For more on the benefits of S corp status, see S Corporation Status: A Decision Guide for Agricultural Producers.

How to file Form 2553

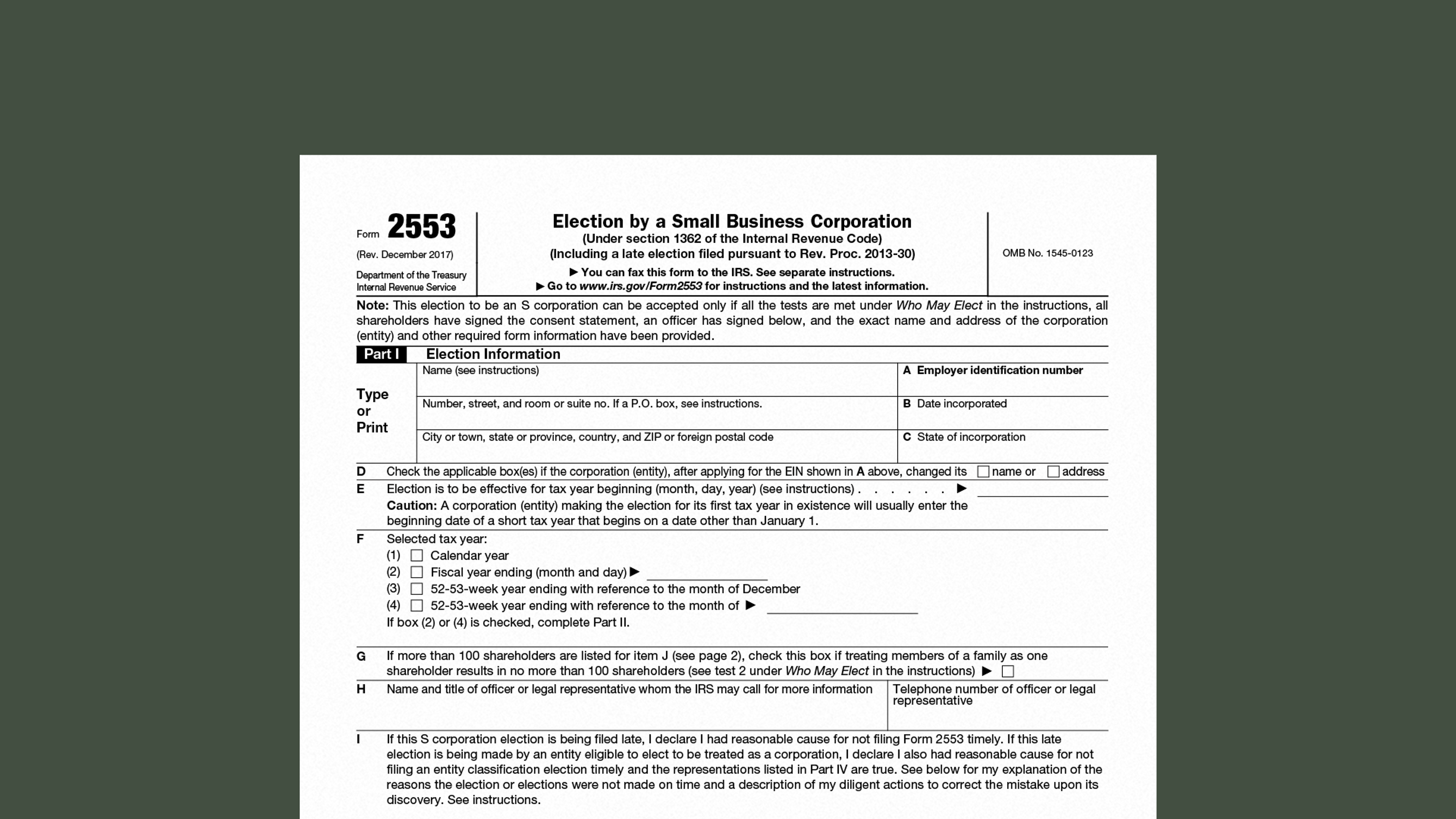

Form 2553 consists of four parts, numbered I through IV.

You only need to concern yourself with Part I provided that:

You file Form 2553 on time

Your fiscal year is the same as the calendar year

Your ag production business does not operate as part of a trust

If you are filing Form 2553 late, there are some extra steps to take in Part I, and you will need to review the information covered in Part IV.

If you are electing a fiscal year different from the calendar year, or if your business operates as a part of a trust, then you need to complete Parts II and III of Form 2553. In that case, seek help from an accountant or professional tax preparer. These sections need to be completed carefully, taking into account all the specifics of your particular situation.

Part I

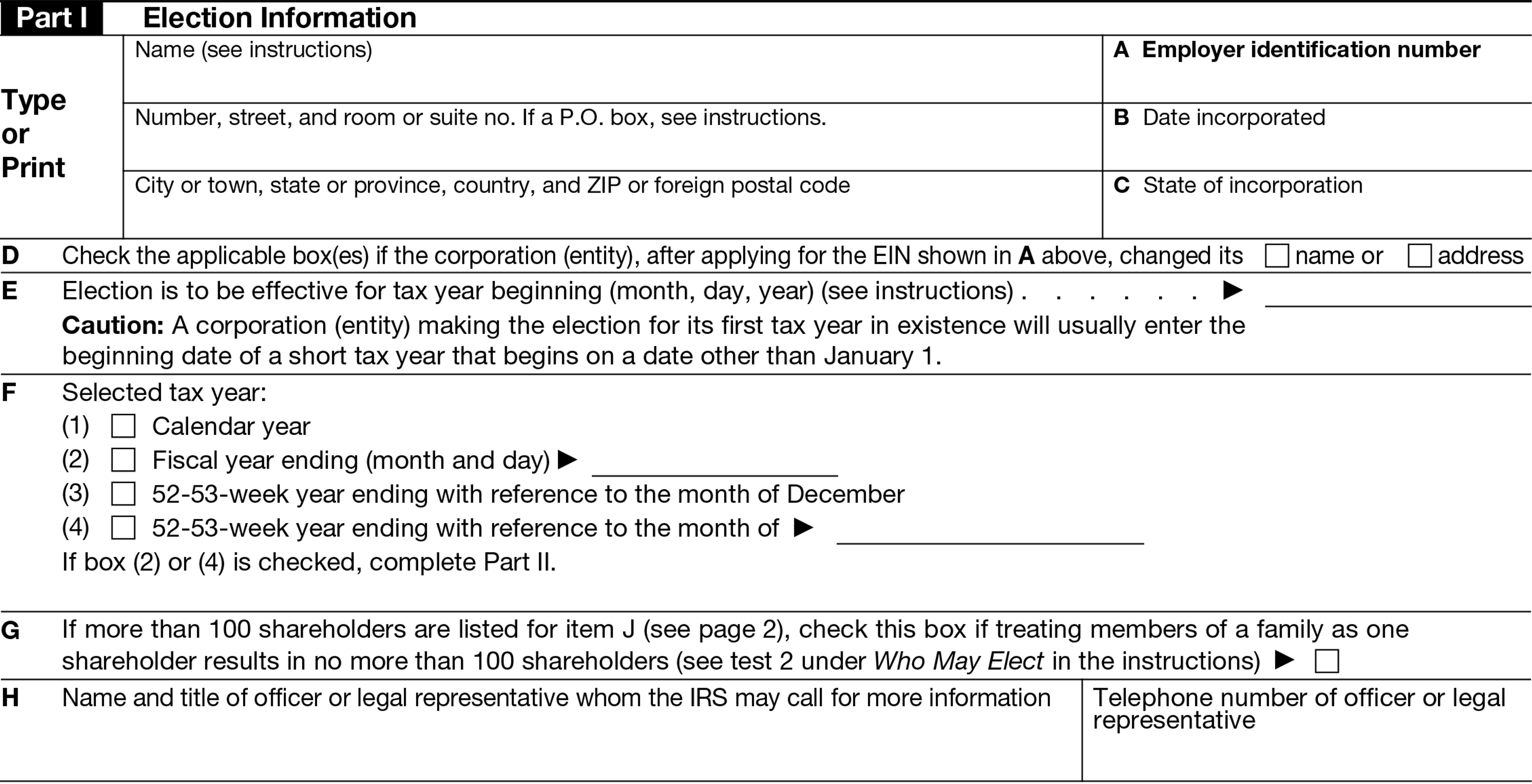

The top of Part I includes space to enter your contact information.

Line A. Enter your employer identification number (EIN).

Lines B and C. Enter the date you registered your LLC with your Secretary of State, and the state where you registered.

Line D. If you changed your business’s name or address after you registered your EIN, indicate the fact here.

Line E. In most cases, the date you enter here will be 1/1/[YEAR], where [YEAR] is the first year for which you would like your business to be treated as an S corporation for tax purposes. However, if you registered your LLC in the same year for which you would like to elect S corp status, you enter the earliest of: the date your LLC first had shareholders; the date your LLC first had assets; or the date your LLC first began doing business.

Line F. If your tax year is the same as your fiscal year, check box (1). If your fiscal year differs from the calendar year, seek help from a professional tax preparer completing the rest of the form.

Line G. This line is only relevant if your corporation has more than 100 shareholders. Typically, an S Corp can’t have more than 100 shareholders. However, you may be able to treat two or more members of a family as one shareholder to get around this limitation.

Line H. In most cases, if you are the sole or majority shareholder in your business, you can put your own name and contact information here. But if you employ a legal representative, consult with them—you may need to enter their information instead.

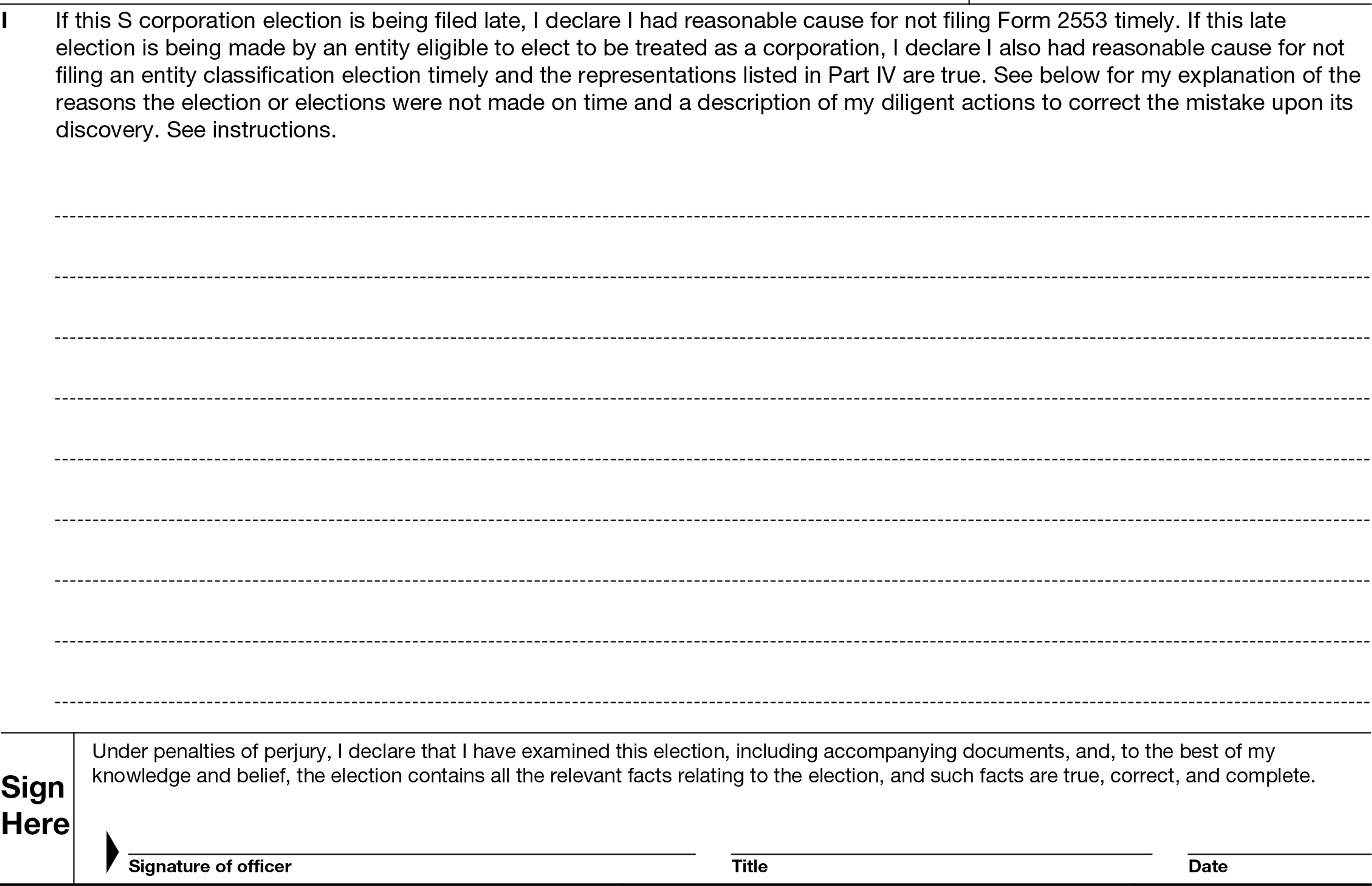

Line I. If you are filing Form 2553 late, this is where you explain the reason for your late filing. For more on how to fill out this section, see ‘How to make a late election with Form 2553’ below.

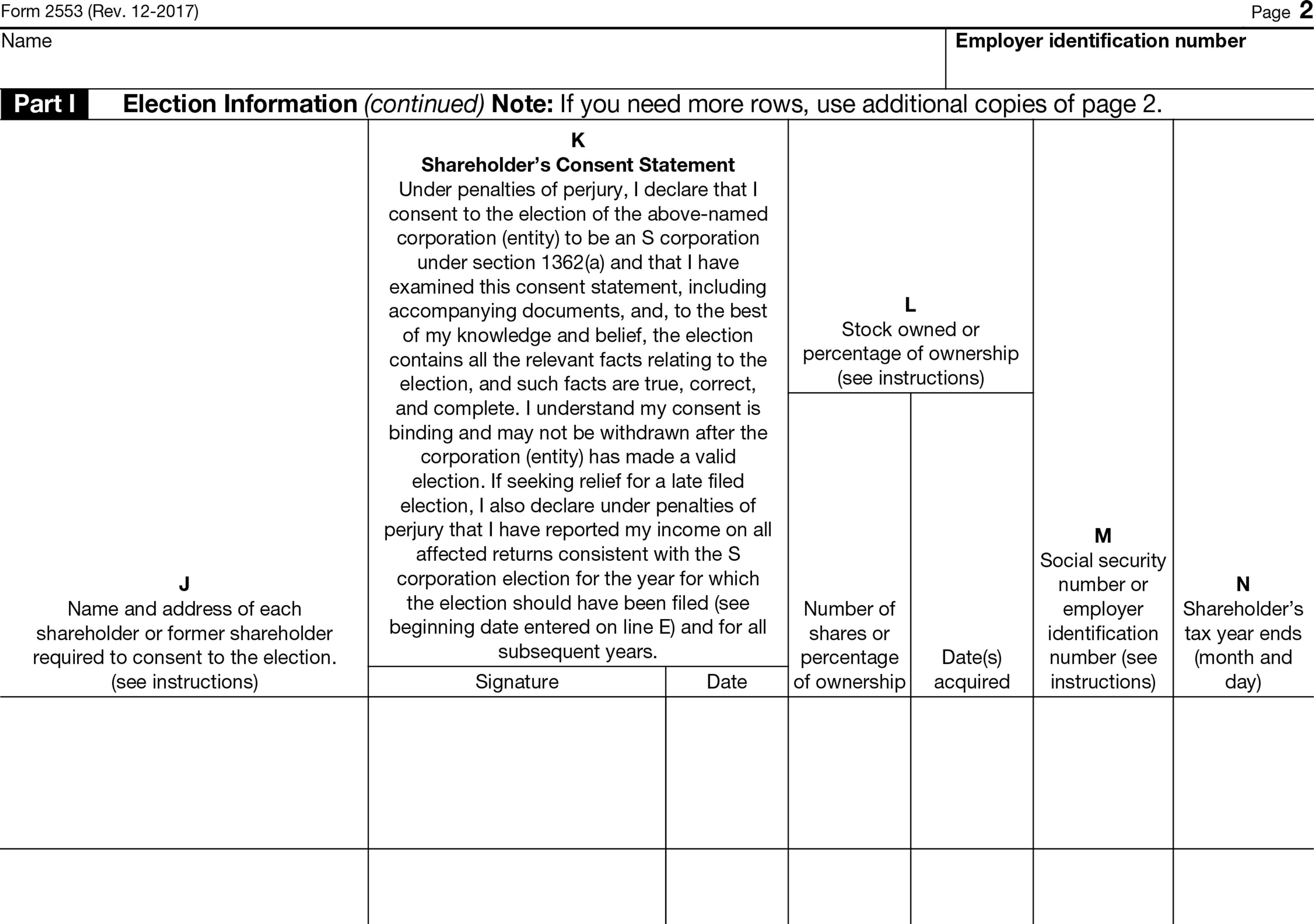

Line J. This is where you list all the shareholders in your S corporation. If you are the only shareholder, then only your name and information goes here.

Line K. This column is where each shareholder signs, legally consenting to being treated as a shareholder and representing that they have correctly reported their income from the corporation to the IRS.

Line L. This column is where each shareholder’s ownership percentage in the S corporation is listed, as well as the date they came into ownership.

Line M. Enter the tax ID number for each shareholder.

Line N. Specify the end date for each shareholder’s tax year. Unless a shareholder has elected a fiscal year different from the calendar year, this date is December 31.

Part II

Part II is used to specify a fiscal year different from the calendar year. When electing S corp status, you may elect a particular fiscal year that you already follow, or a new fiscal year that you plan to adopt once your business operates as an S corp.

Unless your accountant had advised you to elect a non-calendar fiscal year, there is no need to complete this section. If you do need to complete Part II, consult with an accountant to make sure you do so correctly.

Part III

If your farm or ranch operates as part of a trust, and you are using Form 2553 to elect Qualified Subchapter S Trust (QSST), then you may need to complete Part III.

In that case, seek help from a qualified accountant and to complete the form and consult with legal professionals as needed. Trusts, estate planning, and QSSTs are complex, and any mistakes you make could have serious consequences.

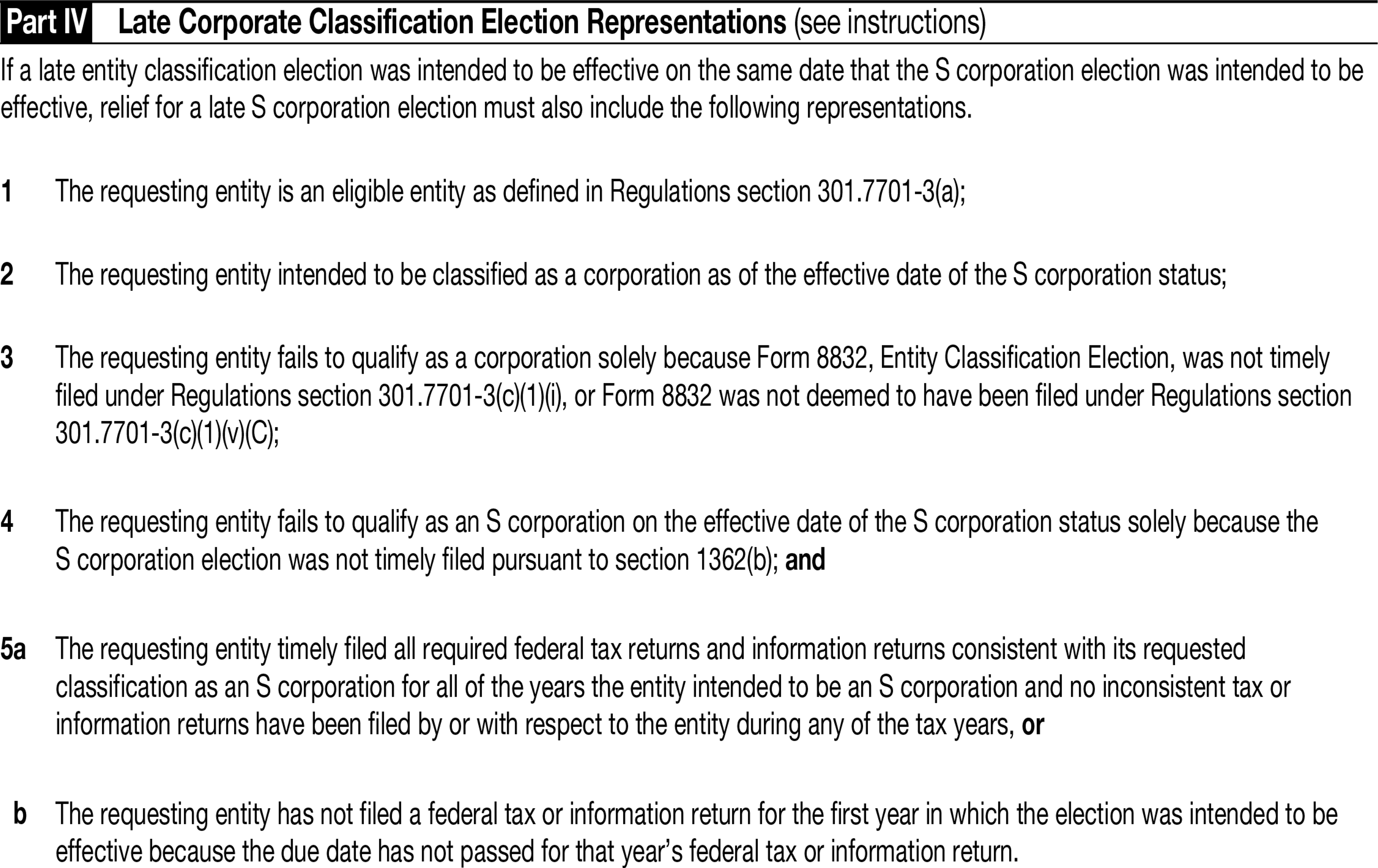

Part IV

You are not required to enter any information in Part IV. Rather, this part of the form lists the representations you agree in the event you file a late Form 2553.

Namely, you represent that your failure to elect S corp status by the effective date entered in Part I is due to your having failed to file Form 8832 and Form 2553 on time. You also represent that you have either filed your taxes as though you had S corp status (filing Form 1120-S, your S corp tax return) or else failed to file an S corp return because you did not have S corp status at the time.

How to make a late election with Form 2553

If you have already filed your taxes for the prior year but would like to elect S corp status after the fact, you can do so by completing Line I of Part I and making sure you’re in accordance with all the representations in Part IV.

Here’s how to do it:

Complete Form 2553 for the year in which you would like to elect S corp status

Write “FILED PURSUANT TO REV. PROC. 2013-30” at the top of Form 2553 and enter a reasonable cause statement on Line I.

Submit Form 2553 to the IRS. Do this by USPS registered mail. This allows you to confirm that the IRS has received the form, and also gives you a document proving the date on which you mailed the form. You may also file Form 2553 as part of your regular tax filing. In that case, write “INCLUDES LATE ELECTION(S) FILED PURSUANT TO REV. PROC. 2013-30” at the top of your tax return.

Wait for IRS confirmation. If your election is approved, you will receive Notice CP261 in the mail, and it will include the effective election date. If you are not approved, you will receive CP 264, which will include an explanation of why you were not approved.

After approval, file Form 1120-S, an S corporation tax return. Also, distribute Schedule K-1s to all shareholders and file copies with the IRS.

What counts as reasonable cause for late S corp election?

Under Revenue Procedure 2013-30, reasonable cause for a late S corp election include:

Being unaware of how and when to make a timely S corp election; or

The failure of your tax filer (e.g. your accountant) to make the election after you had asked them to do so.

If you have already filed your taxes and you decide after the fact that you would like to elect S corp status so as to reduce your tax liability, be aware that this is not a justifiable reasonable cause, and you should not specify it on Line I.

Sample reasonable cause

As a guideline, the sample reasonable cause you enter on Line I might look something like this:

I, the taxpayer, was unaware that I was required to make a separate election to treat a single-member LLC as an S corporation for federal tax purposes. I intended to be treated as an S corporation effective January 1st, 2025, and I began paying the LLC’s shareholders as employees on January 1st, 2025. Once I discovered the oversight, I prepared Form 2553 to request late election relief.

Specific details, including details about the LLC and the effective date for the election, will vary according to circumstance. But, generally speaking, this is a concise format for reporting reasonable cause.

Form 2553 filing deadlines

The filing deadline for Form 2553 is 75 days after the beginning of the year for which the election is to become effective.

In most years, that makes the deadline March 15th of the effective year of the S corp election.

After March 15th, you may file Form 2553 any time during the present year to elect S corp status for the following year. For instance, in 2026, you could file Form 2553 in August, electing S corp status for the year starting January 1st, 2027.

Where to file Form 2553

Form 2553 may not be submitted electronically. You must file it by mail or fax. The IRS lists mailing addresses and fax numbers for Form 2553 depending on where your business is based.

Form 2553 vs. Schedule K-1

Whereas you file Form 2553 to elect to have your business treated as an S corporation for tax purposes, you distribute Schedule K-1 as part of the process of filing your S corp taxes after you have made your election.

Schedule K-1 is a part of Form 1120-S. Every year, each shareholder in an S corporation receives a Schedule K-1. This schedule lists their ownership share in the S corporation, as well as their total share of its income and losses.

The S corp files copies of each Schedule K-1 distributed to shareholders with the IRS.

Ambrook keeps your finances in perfect form

Ambrook is the complete bookkeeping solution for your farm or ranch. With Ambrook, every transaction is automatically imported from your bank account and categorized by bookkeeping professionals. And Ambrook integrates with major payroll platforms, making it easy to pay yourself—and take advantage of tax savings—when your business is an S corp.

Plus, with time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make expense and revenue tracking simple: it takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

Want to learn more about Ambrook?

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.