By filing Form 8832, you can elect to have your LLC treated as a C Corporation for tax purposes. Here’s what that means for your business.

If you’ve set up your business as a limited liability company (LLC), you’ve already taken a smart step toward protecting your assets and gaining flexibility. But there’s another important decision you may still need to make: how your LLC should be taxed.

By default, the IRS assigns a tax classification to your LLC based on the number of members it has. But that default isn’t always the best fit. That’s where Form 8832, Entity Classification Election, comes in.

In this guide, we’ll cover what Form 8832 is, why it matters for farm businesses, and how to use it to elect the tax structure that supports your goals.

Understanding the Default Tax Classification for LLCs

When you register your business as an LLC, the IRS classifies it as one of the following by default:

Single-member LLC

If you’re the business’s sole owner, you’re considered a single-member LLC. In some states, if you are married, you and your spouse are considered one owner, and you can elect to be treated as a single-member LLC.

A single-member LLC is considered a “disregarded entity” for tax purposes. This means the IRS doesn’t treat it as a business entity separate from you as an individual. Instead, you report all income and expenses from operations on Schedule F, Schedule C, or Form 4835, just as you would if you operated as a sole proprietorship.

Multi-member LLC

If your business has multiple owners, you do not live in a state that allows you to elect you and your spouse as one owner, or you do not elect to for you and your spouse to be treated as a single owner in the states that allow it, you’re a multi-member LLC.

You’ll have to file a separate tax return to report business income and expenses: Form 1065, the same form used by partnerships. You’ll receive a Schedule K-1 from the partnership with your share of the business profits or losses and use that form to file your individual tax return.

Electing Corporate Taxation

Structuring your business as an LLC gives you some flexibility because you can either accept the default classification to be taxed as a partnership or elect corporate tax treatment.

By filing Form 8832, you elect to have your LLC treated as a C Corporation for tax purposes. When you elect C Corporation status, you’ll pay tax on business profits at the corporate level (currently a flat 21% federal tax rate). Any distributions to owners (also known as dividends) are taxed again at the shareholder level.

While this creates two layers of taxation of business profits (at the corporate level and again at the individual shareholder level) and a bit more compliance work, it can make sense in some tax situations.

For example, some of the advantages of choosing to be taxed as a C Corporation include:

Potential tax deferral by retaining earnings in the business rather than paying out dividends to shareholders

The business can fully deduct health insurance premiums paid for employee-owners as a fringe benefit

Shareholders don’t owe self-employment tax on retained earnings

No restrictions on who can own stock and readily transferable shares

Existence separate from its shareholders

Before filing Form 8832, it’s a good idea to discuss the decision with your tax advisor and see which tax status makes the most sense in your situation.

Remember that corporations also have additional compliance standards that require them to adopt bylaws, issue stock, hold regular meetings, and file annual reports, whereas partnerships generally have fewer requirements.

Another Option: Electing S Corporation Status

LLCs have another option for federal tax purposes, and that’s to elect to be taxed as an S Corporation. In an S Corporation, business profits, losses, deductions, and credits pass through to each owner’s individual tax return on a Schedule K-1, just like they do for a partnership.

However, the advantage of electing S Corporation status is that the owners only pay FICA (self-employment) taxes on taxable income paid out to the owners as reasonable salary (wages). The owner’s remaining share of the profits are only subject to income taxes, not self-employment taxes, avoiding the double taxation of a C Corporation. Contributions to shareholder/employee’s retirement accounts are also tax exempt.

If you want to be taxed as an S Corporation, you won’t use Form 8832 to make the election. Instead, you’ll file Form 2553.

Again, it’s a good idea to discuss this decision with your tax advisor to see which option makes the most sense for you.

Who Needs to File Form 8832?

To recap, you must file Form 8832 if:

You want to change your LLC’s default classification (for example, to change from a partnership to a C Corporation)

You are changing classification again, having already made a previous election (for example, you previously elected to be taxed as a C Corporation, but now want to change back to an LLC). Keep in mind you can’t change your election again for 60 months unless there’s a substantial change in ownership or circumstances.

Don’t file Form 8832 if:

You’re electing S corporation status (use Form 2553 instead)

You accept the IRS’s default classification

Some foreign entities also file Form 8832 to choose U.S. tax treatment. Check out the IRS’s Form 8832 Instructions if you need more information on options for foreign entities.

How to File Form 8832

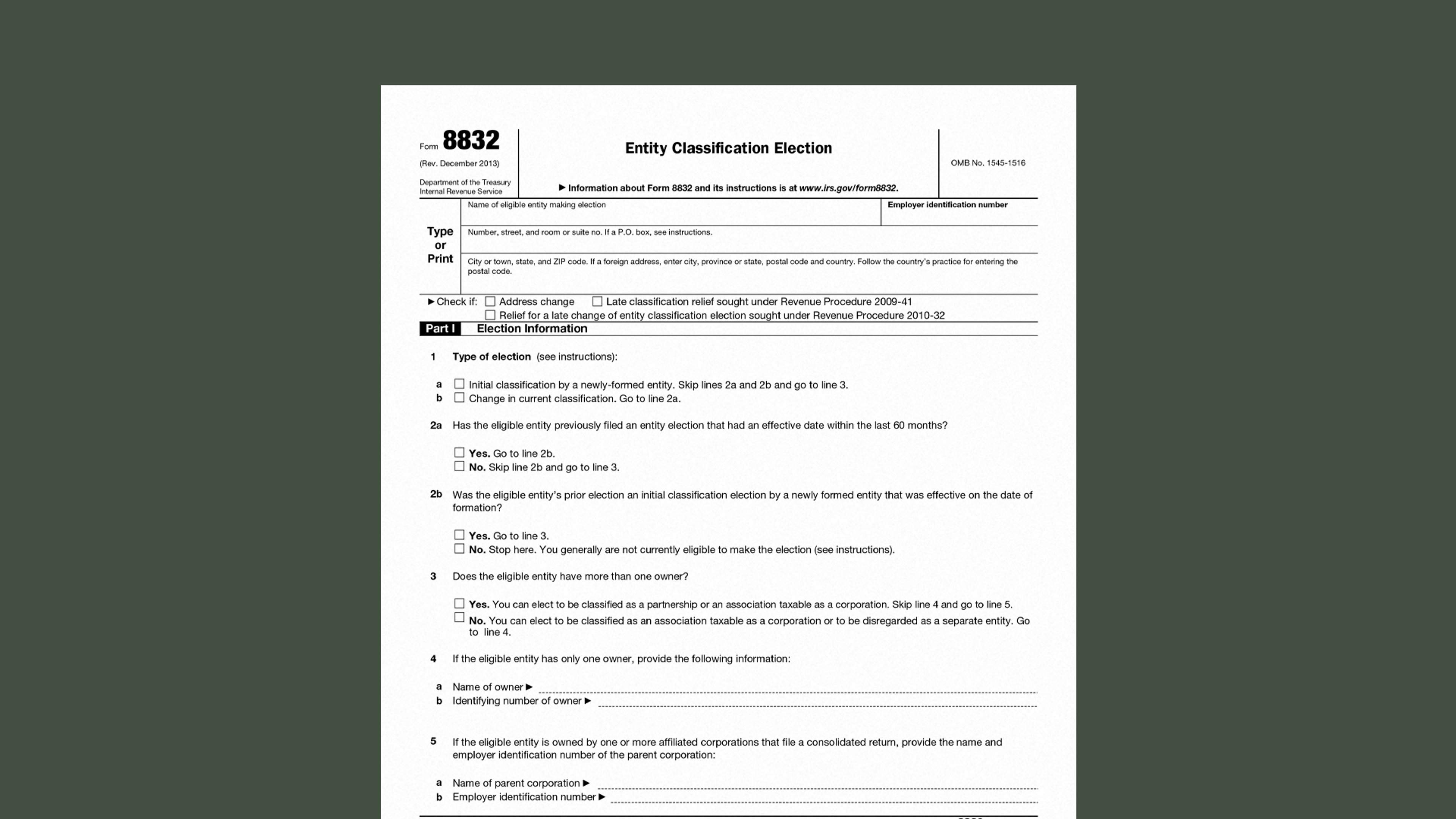

Once you decide to change your federal tax classification, you’ll have to file Form 8832, Entity Classification Election.

Keep in mind that while the questions on the form are fairly straightforward, you might want to work with a tax advisor to answer them and file the form itself.

1. Identify the entity

At the top of Form 8832, you need to identify the eligible entity. Enter the business’s full legal name as registered with the IRS, employer identification number (EIN), and address.

You’ll also need to check a box if you’re changing your address or asking for late election relief because you missed the deadline to make an entity classification election for the current tax year. In general, you can make the election retroactive up to 75 days prior or as far as 12 months forward.

2. Complete Part I

This section asks several questions about the kind of election you’re making. For example, it asks whether this is a new election or a change to a previous election. It also asks about other owners of the business.

If you have trouble answering any of these questions, discuss them with a tax professional or consult the instructions at the bottom of the Form 8832 PDF file.

3. Complete Part I (Page 2)

In this section, check a box to indicate the type of eligible entity you are and which tax status you’re electing. You’ll also need to provide the election’s effective date and your name and contact information. It’s a good idea to use the first day of your entity’s current tax year as the effective date to avoid having to file partial-year returns.

4. Obtain member consent

All members must sign unless the LLC has only one owner.

5. Complete the late election relief section (if necessary)

If you’re making the election outside the standard window, complete this section explaining why you couldn’t file it on time.

6. Mail the form. The Form 8832 instructions include the address for the IRS service center that will process your form.

Choose the Right Path for Your Farm’s Future

Being able to change your tax classification is a unique perk available to limited liability companies, but it’s not a decision to be taken lightly. Your entity classification election affects everything from which tax forms you need to file to your self-employment tax exposure, compliance filings, payroll reporting requirements, and access to fringe benefits.

Make sure you discuss the decision with a tax professional and carefully weigh the pros and cons, considering your farm’s size, goals, profit consistency, asset ownership mix, and reinvestment needs.

Simplify Your Tax Season with Ambrook

Ambrook’s farm-friendly category tags make it easy to compare your tax return to your records, saving you hours of work during tax season.

With time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make filing your taxes easy: it takes the guesswork out of running your business.

Want to learn more? Schedule a demo today.

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.