The April 15th IRS deadline is important, but for many farmers tax-related paperwork is a year-round affair. Keep these important dates in mind for 2025.

January 15

Farmers. Pay your estimated tax using Form 1040–ES. You have until April 15, 2025 to file your income tax return (Form 1040). If you do not pay your estimated tax by January 15, you must file your return and pay any tax due by March 3, 2025 instead.

January 31

Employers. Give your agricultural employees their copies of Form W–2 for 2024. File Form W–3 along with Copy A of all the Form W–2s you issued for 2024.

Farm employers. File Form 943 to report social security and Medicare taxes and withheld income tax for 2024. Deposit any undeposited tax. If you have deposited the tax you owe for the year in full and on time, you have until February 10, 2025 to file this return. (Do not report wages for nonagricultural services on Form 943.)

All farm businesses. Send annual information statements like Form 1099 to payees. Send 1099-NEC to non-employees and contractors and 1099-MISC for other payments. Your own copy of 1099-NEC is also due to the IRS on this day, whether you’re filing by paper or electronically.

Federal unemployment (FUTA) tax. File Form 940 for 2024. If you’ve deposited the tax you owe for the year in full and on time, you have until February 10 to file this return.

February 10

Farm employers. File Form 943 to report social security, Medicare, and withheld income tax for 2024. This due date applies only if you had deposited the tax for the year in full and on time.

Federal unemployment (FUTA) tax. File Form 940 for 2024. This due date applies only if you had deposited the tax for the year in full and on time.

February 28

All farm businesses. File the 1099-MISC and Form 1099-PATR information returns with the IRS if you’re filing via paper.

March 3

Farmers. File your 2024 income tax return (Form 1040 or Form 1040-SR) and pay any tax due. However, you have until April 15, 2025 to file if you paid your 2024 estimated tax by January 15, 2025.

March 17

Partnerships. File a 2024 calendar year return (Form 1065). File Form 7004 for a six month extension to file Form 1065. File Form 4797 to report gains or losses from the sale or exchange of property, Form 4562 to claim deduction for depreciation and amortization, and Form 6252 for installment sale income..

S Corporations. File a 2024 calendar year income tax return (Form 1120–S) and pay any tax due. File Form 7004 for a six month extension to file Form 1120-S. File Form 4797 to report gains or losses from the sale or exchange of property, Form 4562 to claim deduction for depreciation and amortization, and Form 6252 for installment sale income.

March 31

All farm businesses. File the Form 1099-MISC and Form 1099-PATR information returns with the IRS if you’re filing electronically.

April 15

Individual farmers. File an income tax return (Form 1040 or Form 1040-SR) for 2024 and pay any tax due if you did not file by March 2. File Form 4868 for a six month extension to file Form 1040 (but not to pay taxes owed). Pay first installment of 2025 estimated tax. File Form 4797 to report gains or losses from the sale or exchange of property, Form 4562 to claim deduction for depreciation and amortization, and Form 6252 for installment sale income.

Corporations. File a 2024 calendar year income tax return (Form 1120) and pay any tax due. File Form 7004 for a six month extension to file Form 1120 (but not to pay taxes owed). Pay first installment of 2025 estimated tax. File Form 4797 to report gains or losses from the sale or exchange of property, Form 4562 to claim deduction for depreciation and amortization, and Form 6252 for installment sale income.

April 30

Federal unemployment (FUTA) tax. If you are liable for FUTA tax, deposit the tax owed through March if more than $500 using the IRS’s EFTPS (Electronic Federal Tax Payment System).

May 1

Farmers. Special filing deadline for disaster-area taxpayers in Alabama, Florida, George, North Carolina, South Carolina, Alaska, New Mexico, Tennessee, Virginia and West Virginia.

June 16

Individual farmers and corporations. Pay second installment of 2025 estimated tax.

July 31

Federal unemployment (FUTA) tax. If you are liable for FUTA tax, deposit the tax owed through June using the IRS’s EFTPS (Electronic Federal Tax Payment System). No deposit is necessary if the liability for the quarter, plus undeposited FUTA tax for the first quarter, does not exceed $500.

August 31

All farm businesses. File Form 2290 and claim the Farm Vehicle exemption from the Heavy Vehicle Use Tax for agricultural vehicles used 7,500 miles or less annually.

September 15

Individual farmers and corporations. Pay third installment of 2025 estimated tax.

Partnerships. File a 2024 calendar year return (Form 1065) if you filed Form 7004 for a six-month extension.

S Corporations. File a 2024 calendar year return (Form 1120-S) if you filed Form 7004 for a six-month extension.

October 15

Individual farmers. File an income tax return (Form 1040) for 2024 if you filed Form 4868 for a six month extension.

Corporations. File an income tax return (Form 1120) for 2024 if you filed Form 7004 for a six month extension.

October 31

Federal unemployment (FUTA) tax. If you are liable for FUTA tax, deposit the tax owed through September. No deposit is necessary if the liability for the quarter, plus undeposited FUTA tax for previous quarters, does not exceed $500.

December 15

Corporations. Pay fourth installment of 2025 estimated tax.

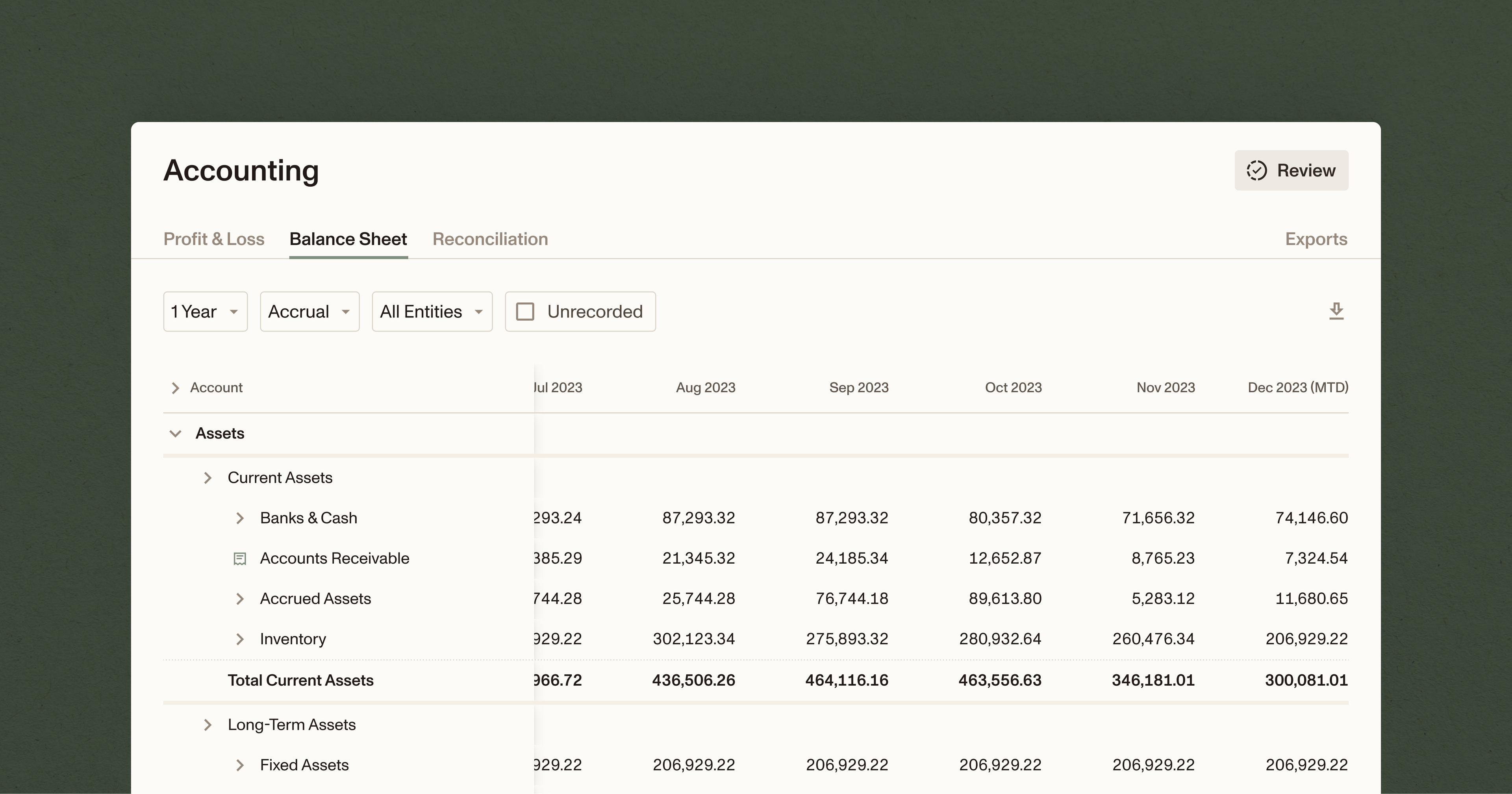

Make Tax Season Less Taxing with Ambrook

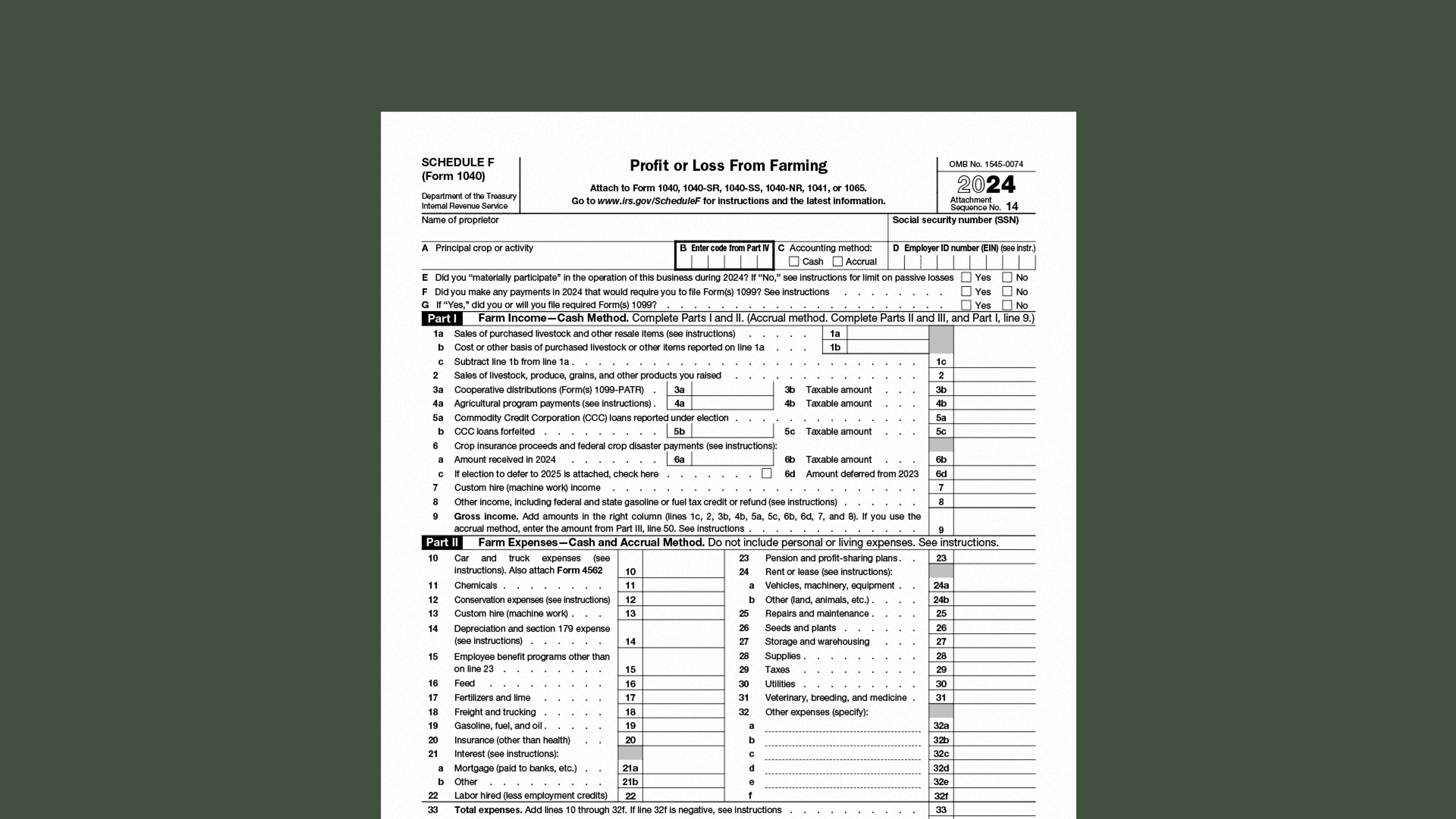

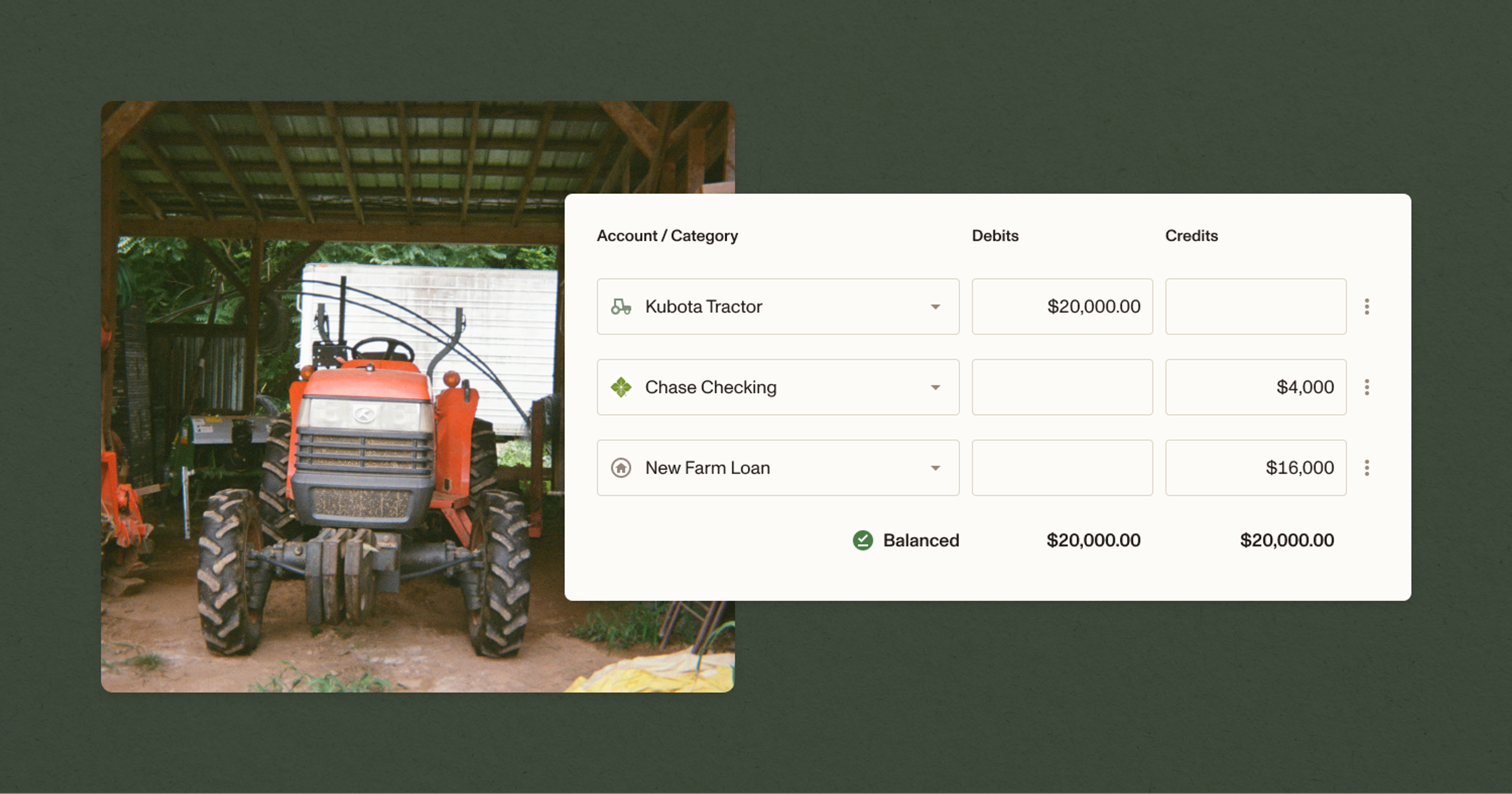

Ambrook’s category tags correspond directly to each line on Schedule F, making it easy to compare your tax return to your records and saving you hours of work during tax season.

With time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make filing your taxes easy: it takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.