Mixing business and personal transactions can create financial blind spots, run up your tax bill and make it difficult to plan for the future. Here’s how to separate them properly.

Farmers often run their businesses and lives out of the same checking account, with mortgage payments, grocery bills and school supplies intermingling with fuel, fertilizer and vehicle maintenance bills.

But mixing your finances can quickly turn into a headache, making it difficult to budget and plan for the future, measure cash flow, know your working capital, and file your taxes. It can also create legal issues if you ever run into problems with your creditors and make succession planning difficult.

Thankfully, untangling your finances isn’t rocket science: it just takes a bit of legwork, some of which you might have already done. Here’s what you need to do.

1. Open a separate business bank account

Open a separate checking account for the business, order business checks, and avoid using your new bank account for anything that isn’t farm-related.

Your bank might ask you for your articles of incorporation, a business license or your state business registration information before opening a business account for you, so this might require some up-front work on your part.

While the extra effort might not be worth it if you’re running a hobby farm, a dedicated business bank account is a non-negotiable for an established farming business.

2. Get a dedicated payments card

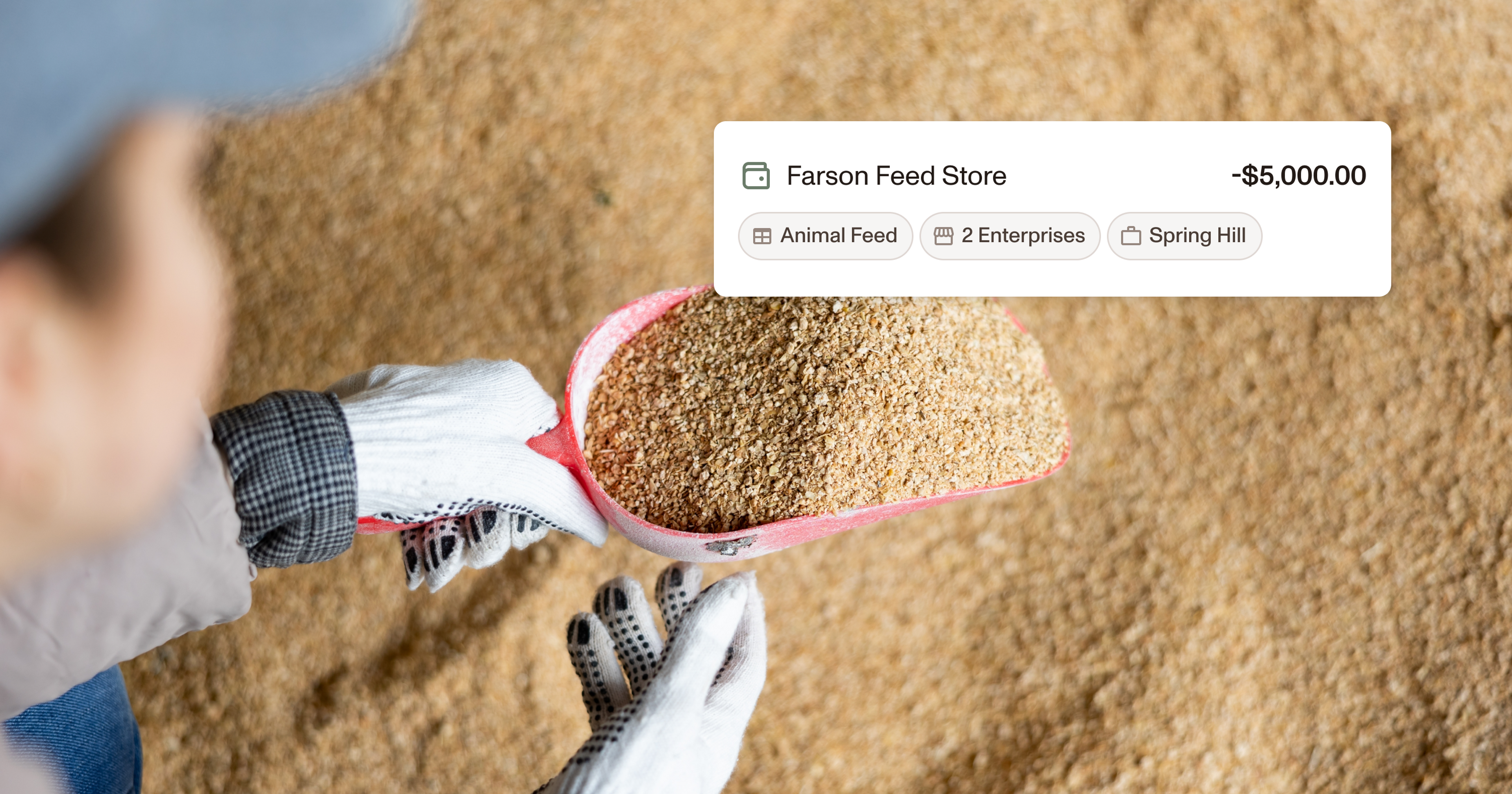

Get a separate credit card for your business, or a dedicated business spending card like the Ambrook card, and only use it for farm-related purchases.

Be wary when using your card to make purchases that commonly overlap, like gas, utilities, renovations and maintenance. When there’s substantial overlap—like when the farm and family vehicle are one and the same—consider keeping usage or mileage logs to bulletproof your expense records.

Bookkeeping built for American ag.

3. Track farming and non-farming income separately

While separating business from personal, there’s another distinction worth thinking about: Schedule F (farming) vs. Schedule C (non-farming) income.

If you earn income off the farm or receive any other income that isn’t directly related to farming, track that income separately from your Schedule F income to avoid paying more tax than you need to.

Remember that processing farm commodities in any way (e.g., wine and cheese-making, butchery, canning) or providing farm-related services like custom harvesting, agritourism and event rentals is considered non-farming Schedule C income, and needs to be recorded and tracked separately, even if it contributes to your business‘ bottom line.

Using farm accounting software with built-in support for Schedule F like Ambrook categories can be particularly helpful here, helping automate a lot of the work involved in separating farm and non-farm income.

Read more: Who’s Considered a ‘Farmer’ for Tax Purposes?

4. Formalize the business

Register your business with your state and get an employer identification number (EIN) from the IRS. Consider the benefits of forming a partnership, corporation or limited liability company (LLC), filing for S corporation status, or filing a fictitious business name (DBA) with the county recorder.

5. Pay yourself a salary or owner’s draw

Drawing income directly from your business bank account and paying yourself a salary might not seem that different, but how you pay yourself matters.

Taking a salary can make financial planning easier and offer tax benefits, for example, while taking an owner’s draw is generally simpler and offers more flexibility in the short run.

Remember that the business structure you select when you formalize will affect how you pay yourself. If you incorporate, you’re considered an employee of the business and must pay yourself a reasonable salary while withholding FICA taxes. If you remain a sole proprietorship, partnership, or LLC, you take an owner’s draw instead of a salary. Pick a compensation method that works best for you, and stick to it.

Read more: Owner’s Draw or Salary: How Should I Pay Myself?

6. Use farm accounting software

Accounting software can make it easier to tag and track personal transactions when they do end up overlapping with your business. Ambrook’s personal expense categories can be a huge help in these cases, giving users the ability to tag any personal expenses that do make it into the system and keep a close eye on any funds moving in and out of the business.

If you find yourself transferring money between the business and your personal accounts often, setting up an owner’s equity account can also help. This account will show up on your balance sheet, and the balance of the account at any point in time will show you the net amount you’ve contributed (or drawn) from the business.

Get financial clarity with Ambrook

Ambrook is purpose-built for farm accounting, making it easy to categorize and track personal and business expenses while giving you unparalleled insight into your operation’s performance.

With powerful bookkeeping and smart tagging functionalities, dedicated payment cards, automatic expense reporting, and a custom chart of accounts that grows with your business, Ambrook gives busy operators everything they need to get financial clarity now. Interested in learning more? Start your 7 day free trial today.

Want to learn more about Ambrook?