Streamlining Your Finances: Top Tips for Simplifying Bill Payments

Staying on top of your bills can be a challenge, but it’s also crucial for maintaining strong relationships with your vendors, controlling cash flow, and peace of mind. Here are some concrete steps your business can take to make bill payment more seamless and efficient.

What is bill pay and why is it important?

Bill pay is how your business processes, tracks, and pays all of the bills and other payables sent in by its suppliers and vendors.

Set up correctly, an effective bill pay system should minimize missed or late payments while giving you maximum control over cash flow and cut down on administrative work, all while keeping your vendors happy.

How can you make bill pay more efficient?

Many small businesses don’t have a dedicated system for managing bill payments. As a business grows and the number of bills it receives increases, however, carefully tracking and managing them all becomes more important.

Whether you end up using a simple pen and paper list, a spreadsheet-based system, or a more powerful software solution like Ambrook, your bill payment system should at the very least be able to do the following:

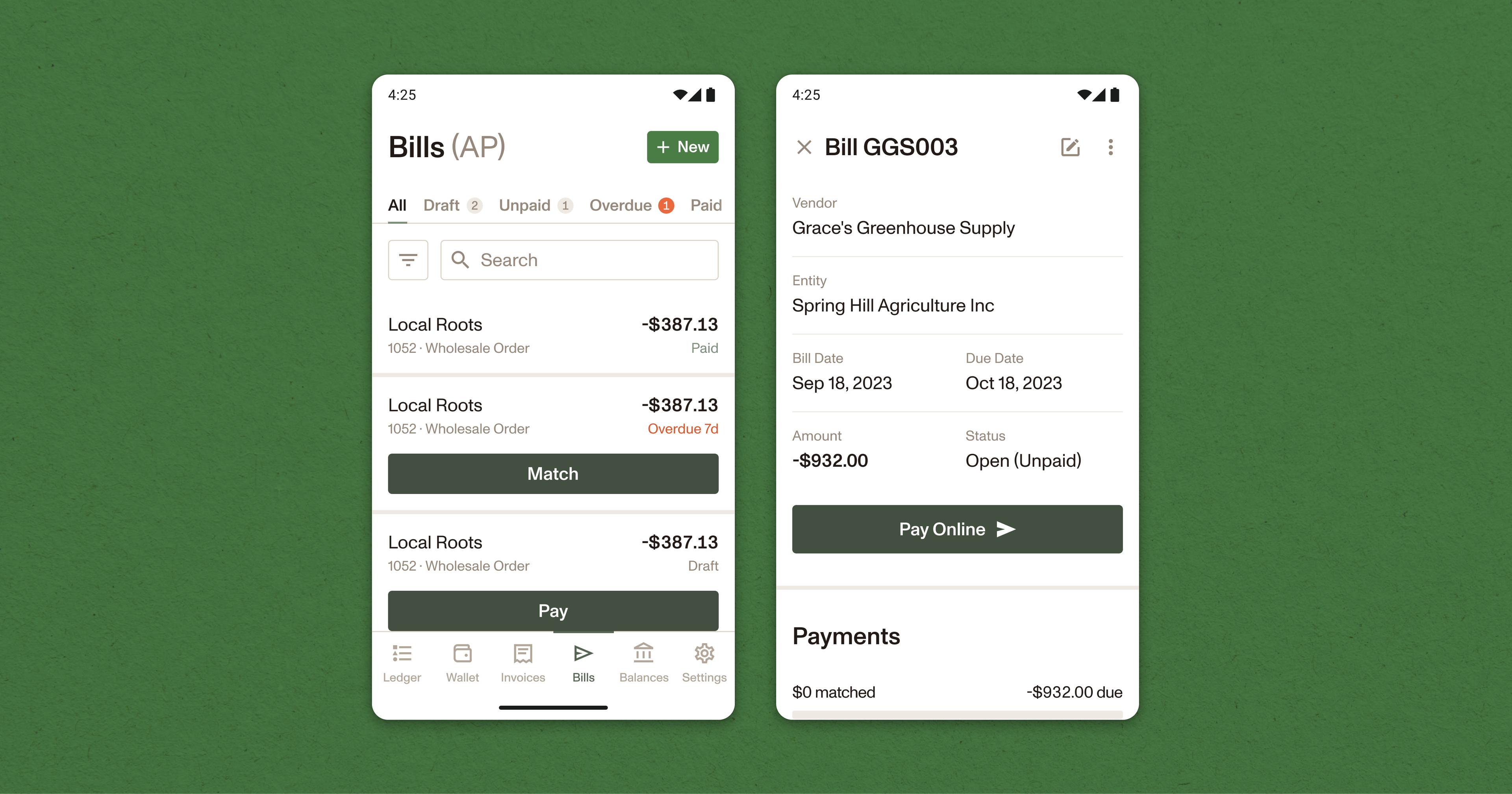

1. Bring all of your bills together in one place

Centralizing bill payment using a list or spreadsheet is one of the single most effective things you can do to stay on top of outstanding bill payments.

This list should be separate from the system you use to track your own outgoing invoices, and should give you a clear idea of the due date, amount, vendor information, and payment status for each outstanding bill.

Software solutions like Ambrook can be particularly powerful in this case, allowing you to filter, sort through and find outstanding bills quickly and easily.

2. Make data capture painless

Bills can be both physical and digital. Your bill payment solution should make capturing the data from either efficient and painless.

If you use a digital system for processing bills, for example, having some method of quickly importing physical bills can save you time and minimize the chances that you might forget to include it in your system.

3. Track and review payment dates often

Once you’ve entered a bill into your system, make it a habit to regularly check outstanding bill payment dates.

Ideally, your system should have some way of clearly labeling bills that are overdue and require immediate attention. Creating a bill payment calendar can also help you make sense of upcoming due dates and visualize which accounts should be prioritized.

4. Designate a bill pay day

If setting aside enough time to handle bill pay every day or week is difficult, designate a single day of the month to take care of bill payments, with an eye on payment due dates.

5. Automate as much as you can

As your business expands and bill payment becomes more complex, you might find yourself repeating many of the same tasks over and over again.

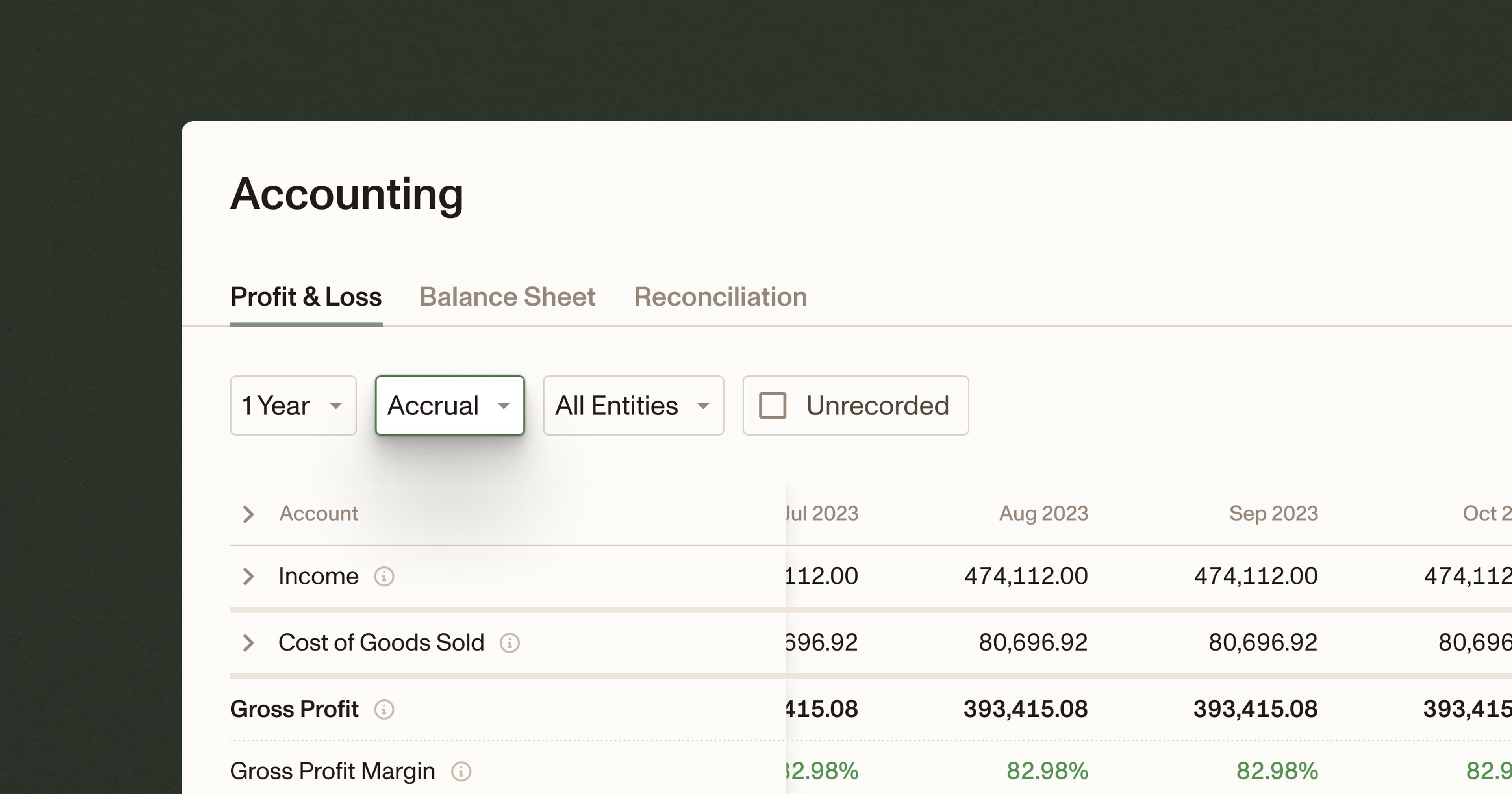

Software-based systems like Ambrook can cut down on repetitive tasks by transcribing paper bills, saving vendor information for easy manual entry, and integrating with your bookkeeping to cut down on administrative work.

6. Control your cash flow

Paying your bills on time is important, but paying them too quickly can also be less than ideal. Many businesses will adopt a “just in time” approach to bill pay as a result, carefully scheduling payments to avoid missing due dates while maximizing control over their cash flow.

Ambrook’s “just in time” payment scheduling function helps automate this process, giving users peace of mind that their bills will be paid on time without having to manually calculate bill payment dates.

7. Become payment method agnostic

Vendors often have different preferences for how to get paid, whether it’s via cash, check, ACH transfer, or credit card. Staying flexible and accommodating these preferences can help you avoid delays, avoid extra administrative work and keep your vendors happy.

How Ambrook’s bill pay software can help

While spreadsheets and physical lists can work in the short term, as businesses grow and their bill payment needs become more complex, they often turn to more sophisticated software-based solutions like Ambrook.

Ambrook can take your operation to the next level, unlocking new opportunities for collaboration, eliminating hours of repetitive administrative work with powerful automation tools, and giving you maximum control over cash flow.

1. Improve bill pay collaboration

As businesses expand, bill payment often becomes a team effort. One team member might take responsibility for administrative tasks like uploading bills into the system or bookkeeping, for example, while another might be responsible for executing the payments.

Centralizing bill payment with software makes it easier for multiple team members to contribute to bill payment this way. With Ambrook, users can share responsibility for different aspects of the bill payment workflow, improving collaboration and efficiency.

2. Save time with powerful automation tools

Ambrook uses automation to maximize flexibility, cut down on repetitive administrative work and remove friction from the bill payment management process.

With Ambrook, users can use a mobile app to scan and import paper bills in the field or onsite with a vendor. Powerful batch uploading tools also make it easy to import multiple bills at once, and soon, bills can be automatically imported via forwarding to a designated bill pay email.

3. Maximize bill payment method flexibility

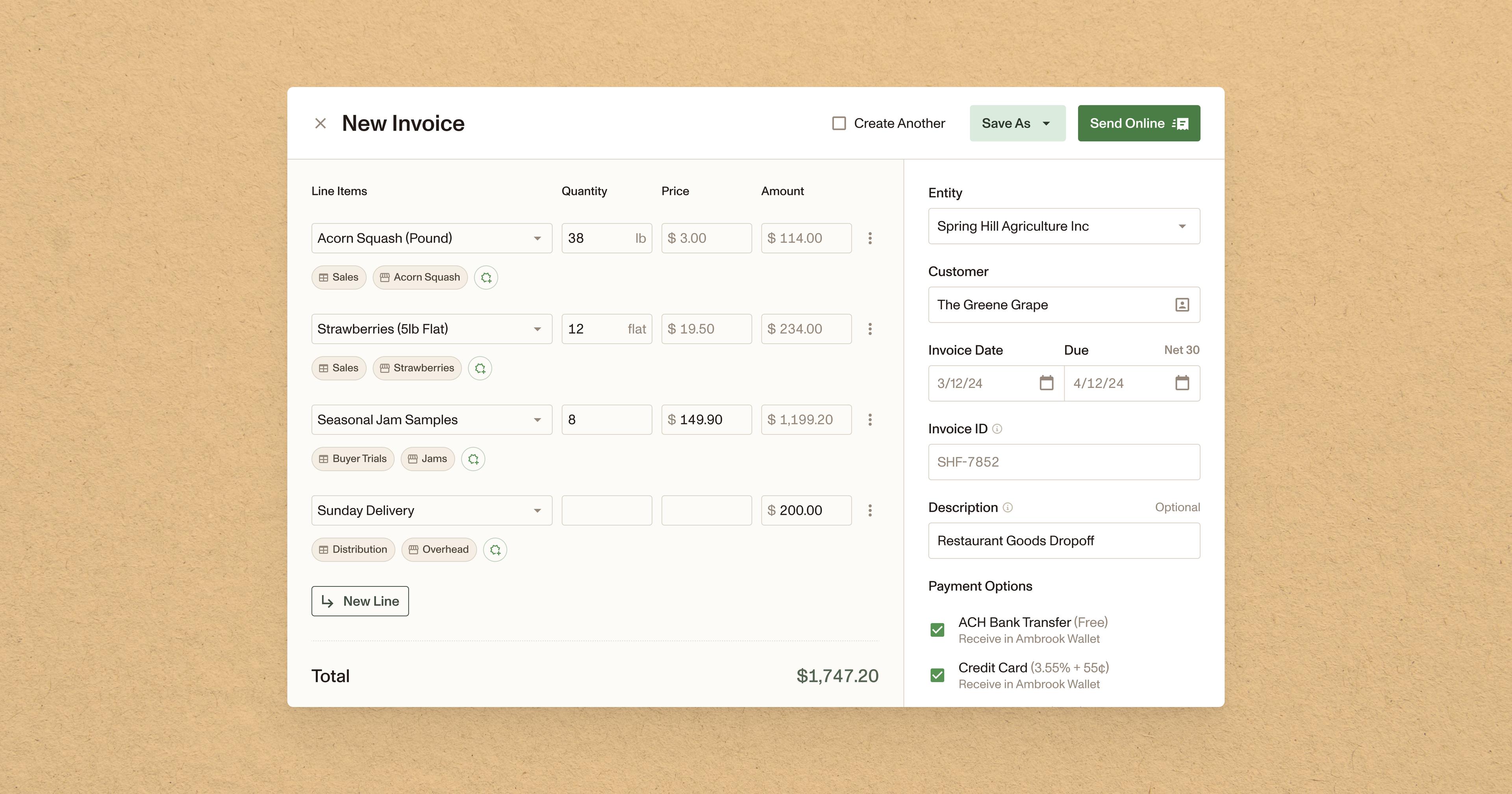

Ambrook’s payment tools give you maximum control over how you pay your bills, giving users the ability to:

Have Ambrook mail their vendor a check on their behalf

Print a check themselves via an external bank account

Pay via ACH transfer, credit card, or Ambrook card

Pay instantly in-network via Ambrook Pay

Pay off-platform

Bookkeeping for ACH payments, mailed check, and Ambrook Pay is also processed automatically, eliminating even more administrative work and saving users time.

How do I get started with Ambrook?

Ambrook takes your bill pay system to the next level, allowing you to track and manage your bills in one place while eliminating hours of repetitive administrative work every month with powerful automation tools.

Team members can capture and import bills in the field, batch upload multiple bills, and use powerful automation tools to save time on manual data entry and bookkeeping. Ambrook’s powerful payment tools also help businesses become payment method agnostic, allowing them to pay vendors how they’d like to be paid without the hassle.