Ambrook Tax

Strategic tax guidance, built right into Ambrook

Get tax prep, strategic advisory, and financial guidance to make smarter decisions—all for one flat price.

3,000 operations across

America trust Ambrook

Key Benefits

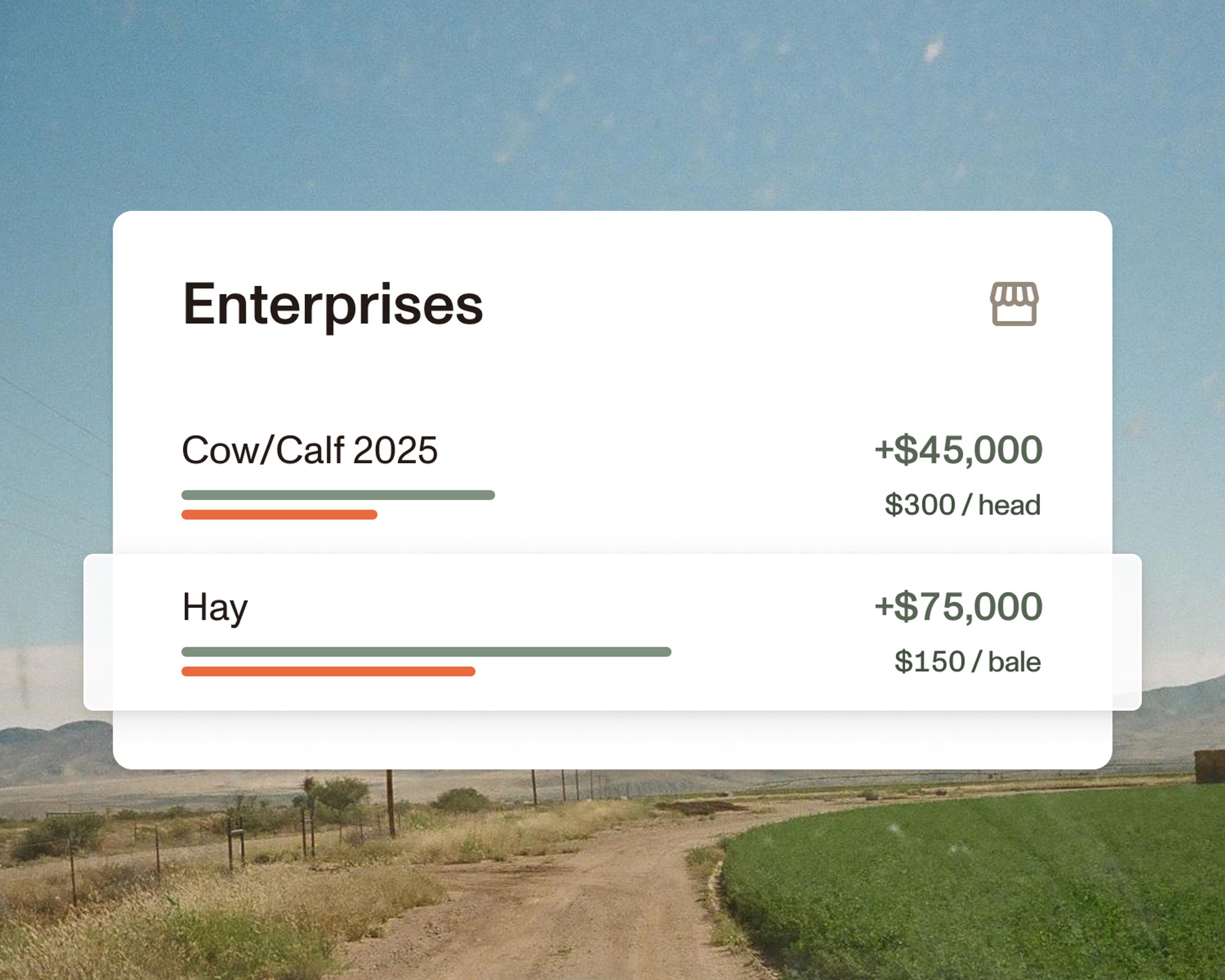

Tax planning that sees your whole picture

Ambrook Tax brings tax strategy, entity planning, and long-term financial modeling directly into your Ambrook account.

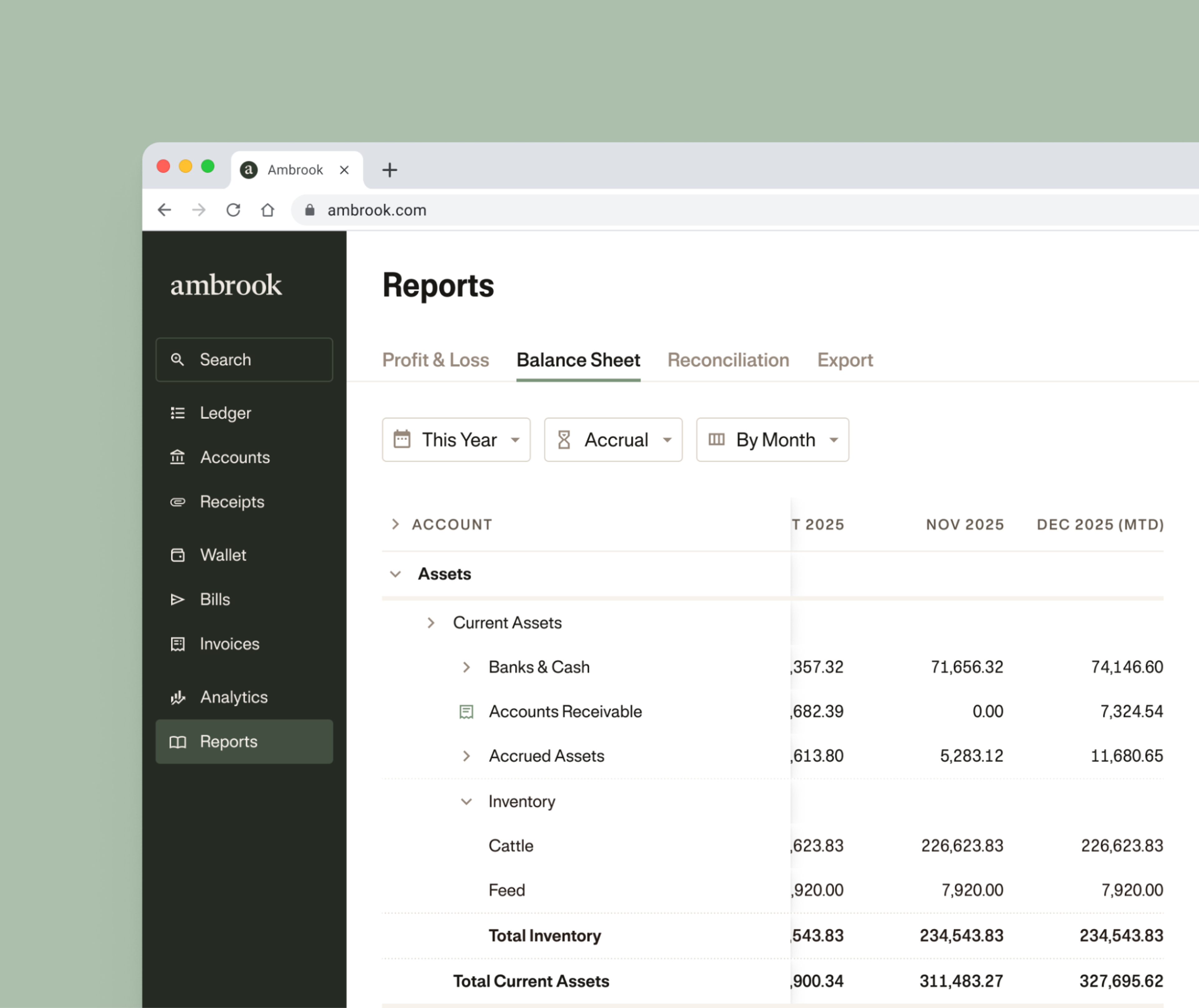

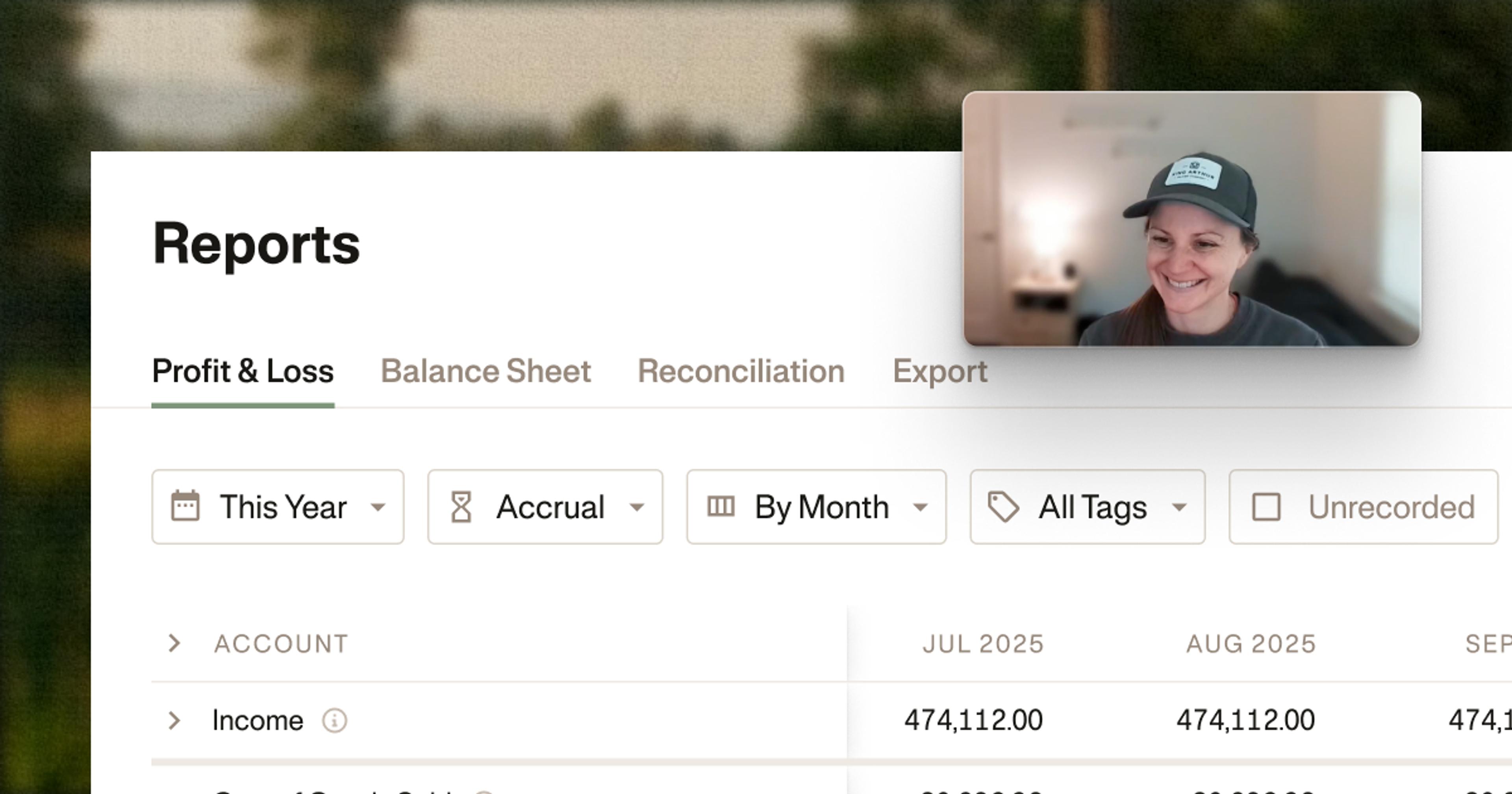

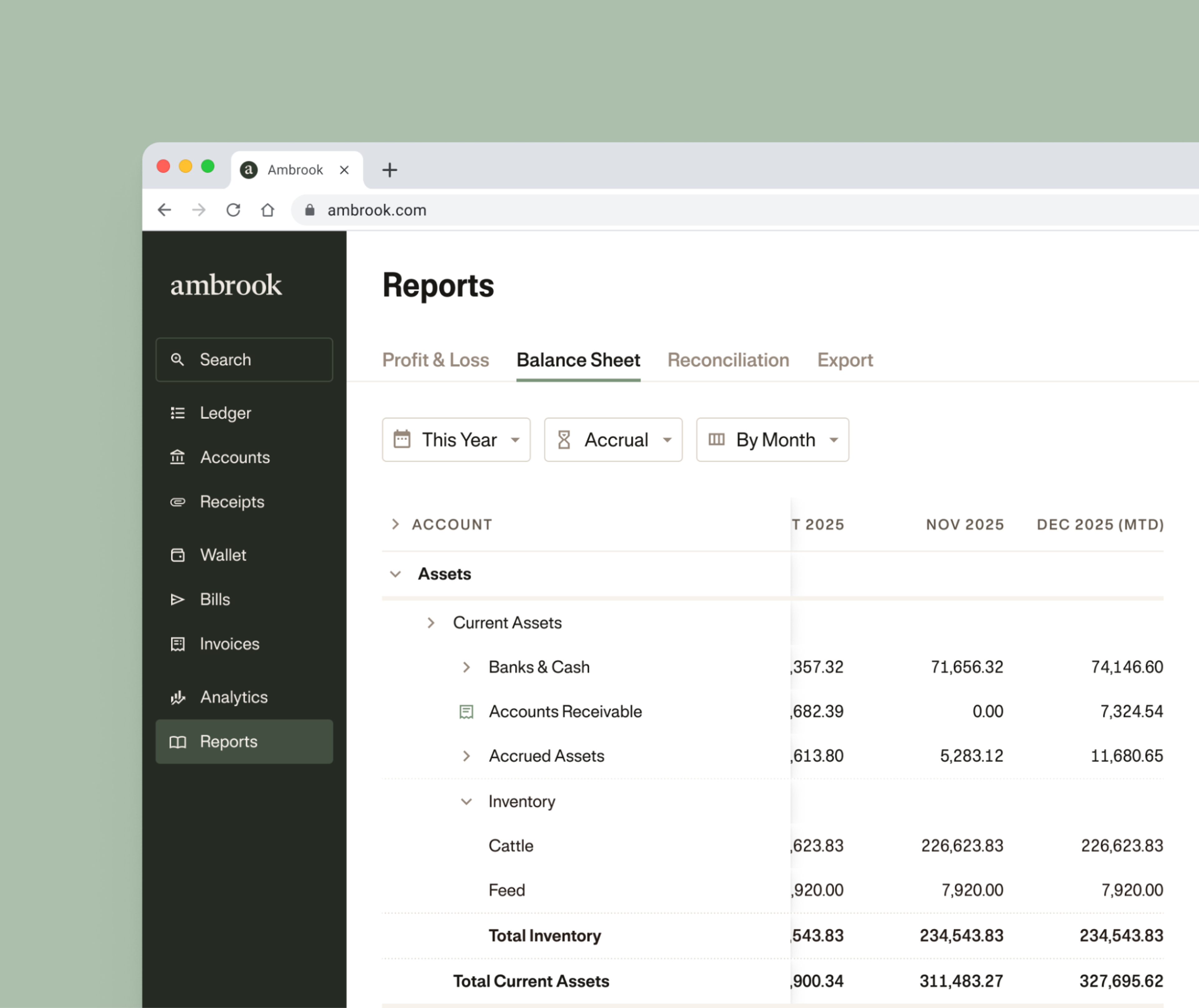

Works inside Ambrook

Your tax advisor already knows Ambrook and sees exactly what you see.

Flat, transparent pricing

Know exactly what you'll pay. No hourly billing, no surprise invoices.

Human advisors, not just software

Get real CFPs and CPAs who answer your questions whenever you need.

Tax Advisory

Year-round strategic tax planning, scenario modeling, and proactive tax strategies

+ Unlimited advisory sessions (no hourly fees)

+ Guidance on entity structure, retirement, succession

+ Proactive tax optimization

Tax Filing

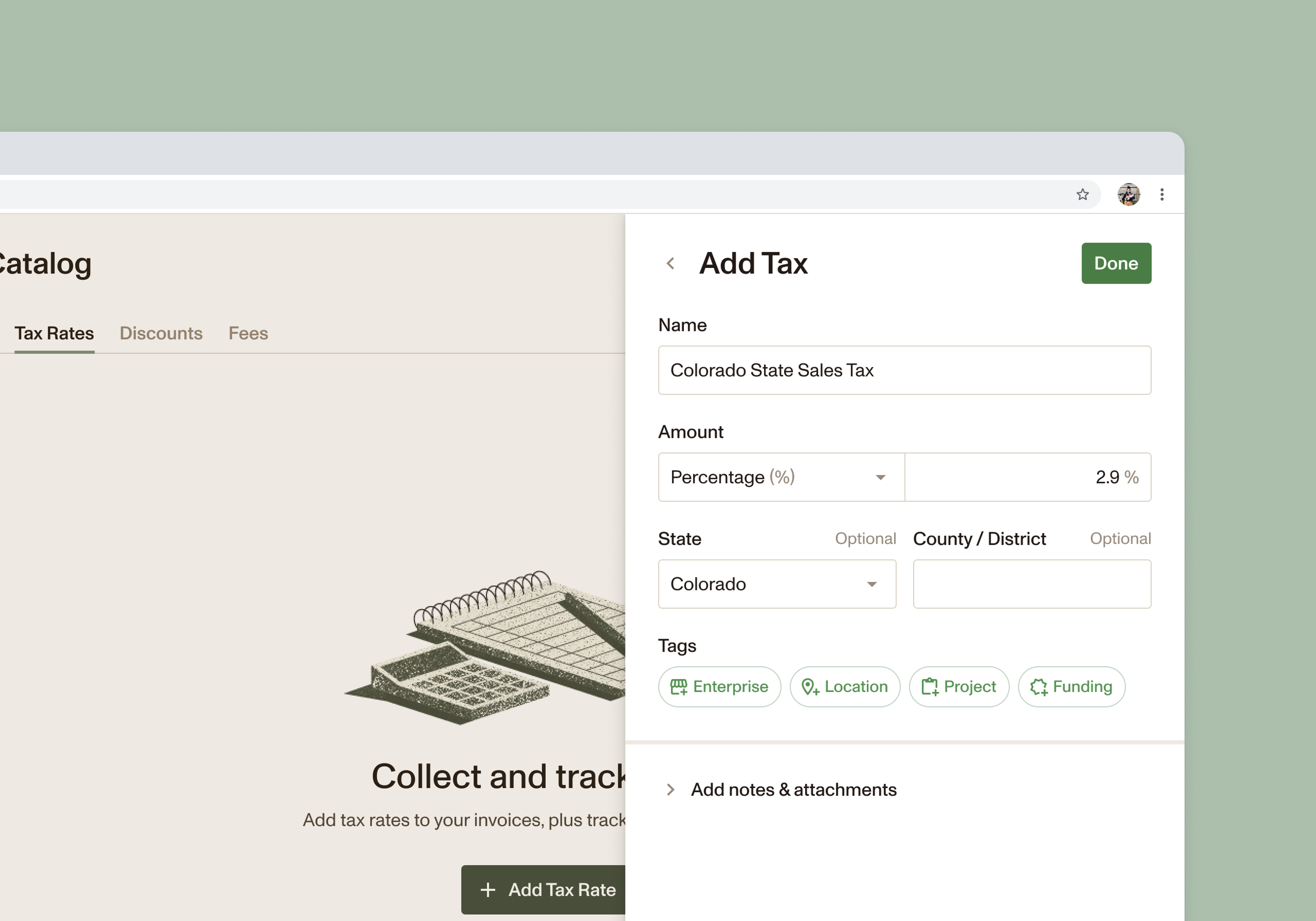

Professional tax prep, connected directly to your books.

+ Annual federal and state preparation

+ Quarterly estimated tax calculations

+ Documents and messaging in-app

““With Ambrook, I feel like that hole in the ship has been patched and there's a pump pumping the water out, and it's starting to come back up again. I really feel like it's a turn in the right direction for all of my operations.””

Jo Ellen and Lee Carey

Owners

Lee Carey Farms

How to Start

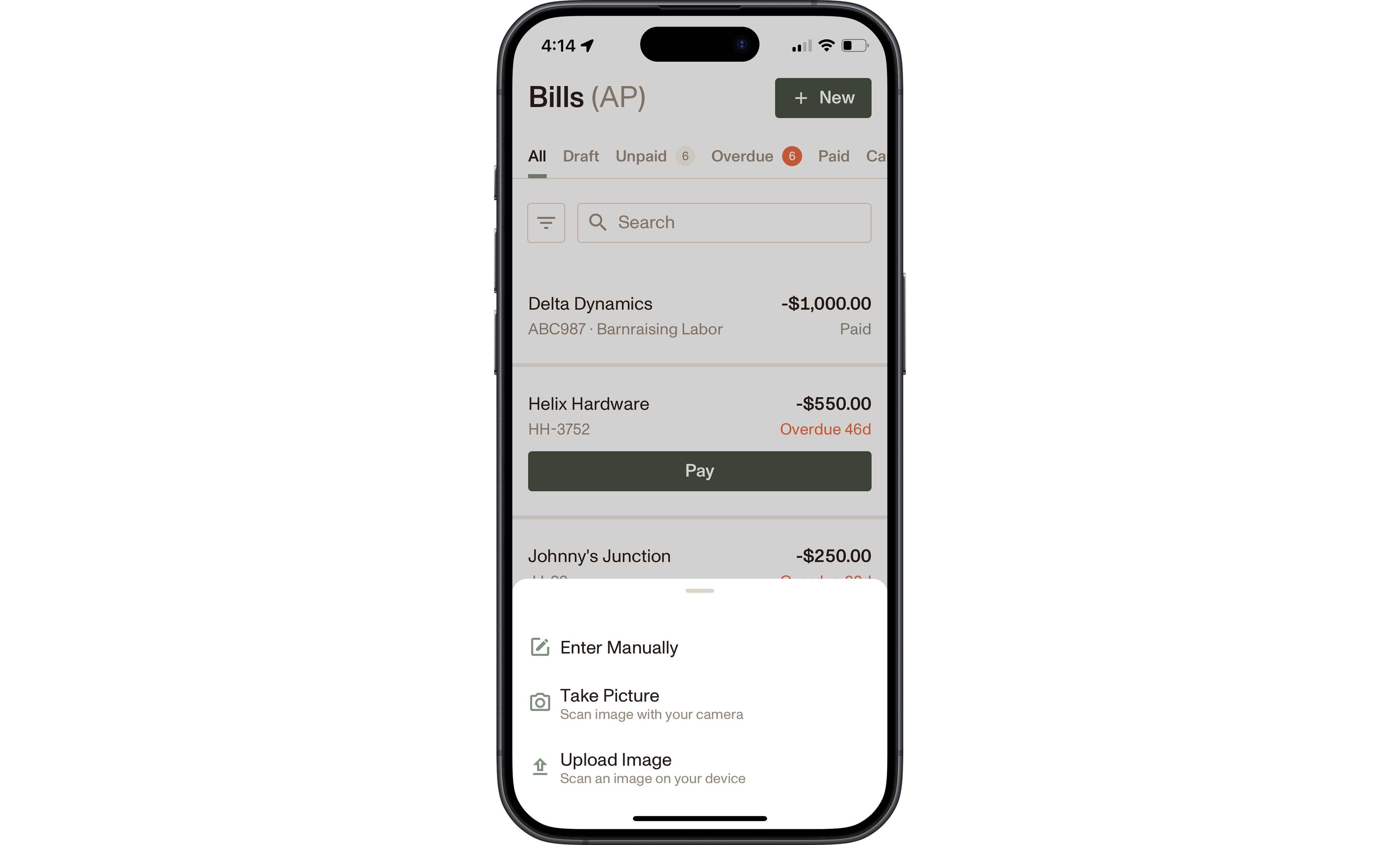

Everything happens inside Ambrook

Step 1: Book your intro call

We'll help you figure out if Ambrook Tax is the right fit, or point you to a Certified Advisor if your situation is more complex.

Step 2: Your tax advisor reviews your books

No exports needed. Your advisor works directly inside Ambrook, seeing your data the way you see it.

Step 3: Get tax guidance and file with confidence

Whether it's entity restructuring, retirement planning, or quarterly estimates, you’ll get what you need all in one place.

Frequently Asked Questions

Do I need to have my books caught up before using Ambrook Tax?

Yes, Ambrook Tax works best when your books are already in good shape. If you need help getting current, our Full Service plan offers hands-on bookkeeping support to get you there first.

What if my tax situation is complex?

On your intro call, we'll assess fit together. If you have advanced needs—like Schedule J elections, crop insurance deferrals, or multi-entity structures—we'll connect you with a Certified Advisor who specializes in ag tax.

Can I get just filing, or just advisory?

Yes. You can purchase either service separately, or bundle them together and save $250.

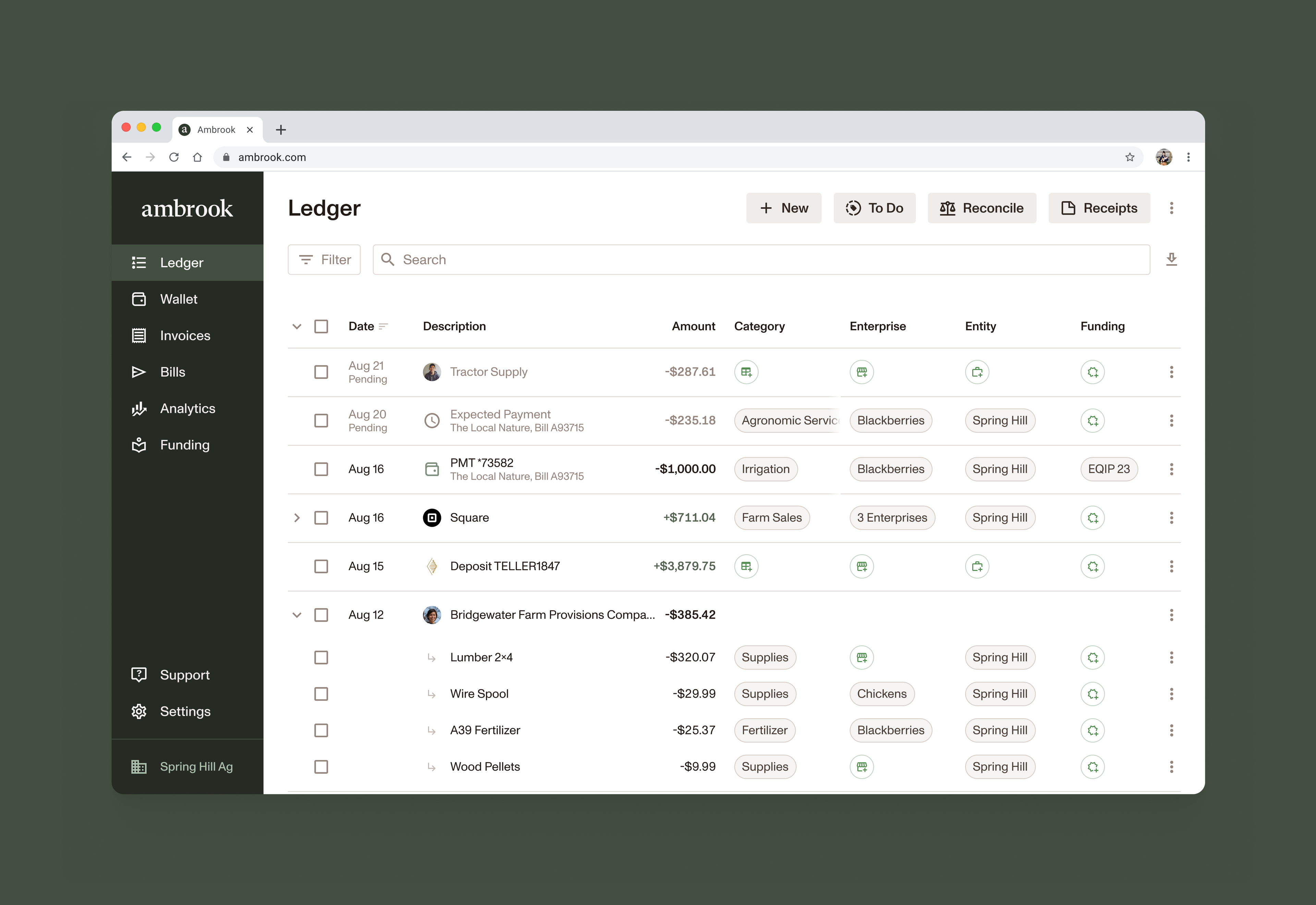

How do your advisors work inside Ambrook?

Your advisor accesses your books directly in Ambrook—no exports or file sharing needed. Documents, messages, and deliverables all stay in one place under the Taxes tab.

What's the difference between Ambrook Tax and working with a Certified Advisor?

Ambrook Tax is best for straightforward situations where you want proactive planning and seamless filing. Certified Advisors are independent CPAs with deep ag specialization—ideal for complex scenarios. Not sure? We'll help you decide on the intro call.

Is there a contract or commitment?

Services are billed annually. There's no long-term contract, if Ambrook Tax isn't the right fit after a year, you're free to explore other options.

What if I already have an accountant?

Many customers keep their existing accountant for certain tasks and use Ambrook Tax for strategic advisory. On your intro call, we can discuss how the services might complement each other.

Ready to make your books work harder?

30-day trial

Live training

US-based support