You generally have to pay taxes on forgiven debts, which is why your lender might send you a Form 1099-C. Here’s how it works.

The IRS generally considers forgiven debts as taxable income, which is why when a creditor forgives your debts of $600 or more, they’ll send a copy of Form 1099-C to report those amounts to the IRS.

They’ll also send you a copy (Copy B), which you’ll use to figure the taxes you need to pay on the forgiven debt. 1099-C will also contain amounts you’ll have to enter on other tax forms like Schedule F (Form 1040), Form 4835, Schedule E (Form 1040), Schedule C (Form 1040) or Schedule 1 (Form 1040).

What is IRS Form 1099-C?

When a bank, credit union or other lender forgives your debts and the total amount forgiven equals or exceeds $600, they’ll have to report it to the IRS by filing a copy of Form 1099-C (Copy A).

They’ll also have to send you a copy of the form (Copy B) by January 31st of the following year, which might contain amounts that you’ll then have to enter on Schedule F, Form 4835, Schedule E, Schedule C or Schedule 1.

While you always have to report cancellation of debt income on your tax return, there are a few situations in which the income isn’t taxable. Those exceptions include:

Debts canceled as a gift, bequest or inheritance

Student loans canceled under qualifying federal loan forgiveness programs

Canceled debt that would be deductible if you’d paid it

Cancellation of qualified farm indebtedness

Debt canceled in a Title 11 bankruptcy case

If you believe any of these exceptions might apply to you, you’ll need to file Form 982 with your tax return to report the amount qualifying for the exception to the IRS. This form is complex, so it’s a good idea to get help from a tax professional.

Remember that forgiven debts and settled debts aren’t the same thing. If you pay off a debt in full, you don’t have to pay taxes on that and you won’t receive a Form 1099-C.

What’s the difference between 1099-C and 1099-A?

Form 1099-A is a similar tax form used by lenders to report foreclosures and repossession.

If the debt your lender is canceling is connected to a foreclosure or abandonment of secured property, the lender or creditor only has to file one form: either 1099-C or 1099-A.

For more on reporting gains resulting from foreclosure, repossession or abandonment, consult our guide to Form 1099-A.

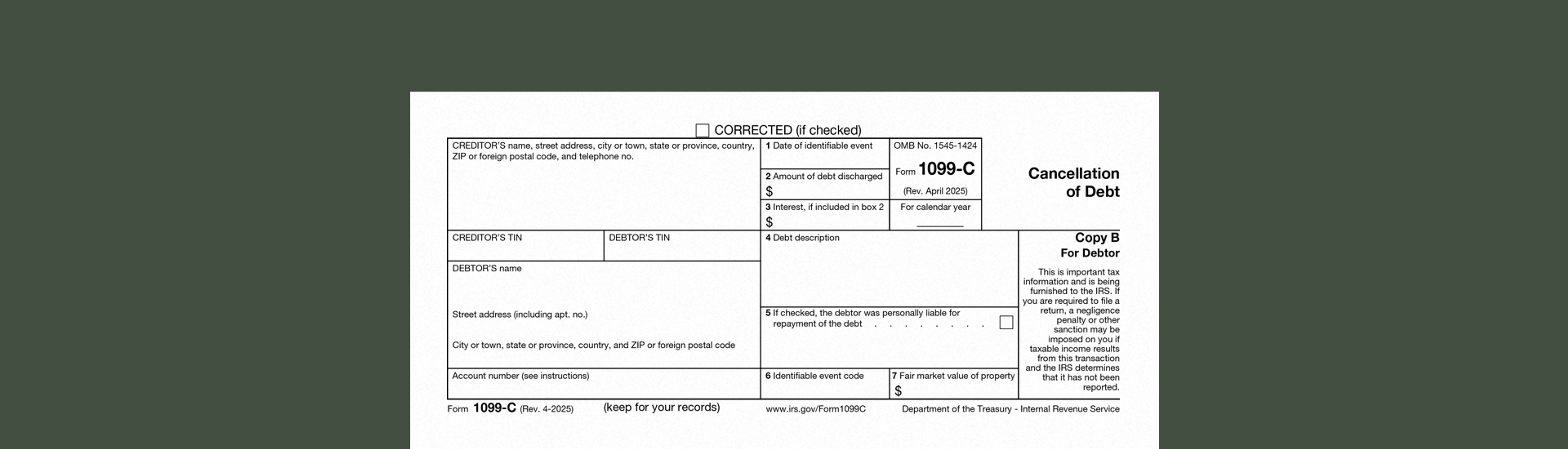

Form 1099-C: a Box-by-Box Breakdown

Box 1: Date of identifiable event

Here the creditor will record the date they decided to cancel or forgive the loan.

Box 2: Amount of debt discharged

This is how much of the initial loan amount was outstanding when the lender decided to cancel or forgive the debt. You’ll need this number to calculate the taxes for the resulting income, and you’ll also have to report it on some other tax forms, including:

Schedule F (Form 1040), line 8, if the debt is farm debt and you are a farmer.

Form 4835, line 6, if the debt is related to a farm rental activity for which you use Form 4835 to report farm rental income based on crops or livestock produced by a tenant.

Schedule 1 (Form 1040), line 8c, if the debt is a nonbusiness debt.

Schedule C (Form 1040), line 6, if the debt is related to a nonfarm sole proprietorship.

Schedule E (Form 1040), line 3, if the debt is related to nonfarm rental of real property.

Box 3: Interest, if included in box 2

Here the lender will record any interest they included in the canceled debt in box 2.

Box 4: Debt description

Here the lender will provide a description of the debt, i.e., credit card, mortgage, auto loan, medical debt, student loan, etc.

Box 5: Was the borrower personally liable for repayment of the debt?

The creditor will check this box if the person receiving this 1099-C was personally liable for repaying the loan.

Box 6: Identifiable event code

Here the lender will enter a code to report the nature of the event, like code A (bankruptcy), code D (foreclosure election), or code E (debt relief from probate or similar proceeding).

Box 7: Fair market value (FMV) of property

If the lender filed a combined Form 1099-C and 1099-A for a foreclosure, they’ll enter the property’s fair market value here, which is how much you would get for it if you sold it on the market. (Check out our guide to Form 1099-A for more on reporting gains resulting from foreclosure.)

Avoid the end-of-year rush with Ambrook

Ambrook’s Schedule F category tags are tailor-made for farming businesses, saving you hours on tax prep and making it easy to collaborate with your accountant at tax time.

With features like automated financial reporting, simplified bookkeeping, and effortless bill pay and invoicing, Ambrook is more than just a farm tax and accounting tool: it takes the guesswork out of running your business. Want to learn more? Start your 7 day free trial today.

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.