Why Adopting the Accrual Method Can Transform Financial Management in Farming

Many farms use the cash method because it’s simpler, less time-consuming, and makes it easier to file their taxes without the help of an accountant.

While the cash method can save time in the short run, almost all businesses can benefit from switching to accrual accounting in the long run, because it allows them to more accurately measure their financial health and profitability.

Here we’ll break down the pros and cons of both methods, why cash accounting is so popular in agriculture (and sometimes makes sense in the short run), and why accrual accounting is ultimately a better long-term solution.

What are the ‘cash’ and ‘accrual’ accounting methods?

Accounting methods are sets of rules for when and how income and expenses are recorded in your books, on your financial statements, and on your tax return.

Most businesses in the U.S. use either the ‘cash’ or ‘accrual’ accounting methods, which treat income and expenses differently:

The cash method of accounting records income when cash enters a business’ bank account, and records expenses when cash leaves their bank account.

The accrual method of accounting records income at the moment it is actually earned, and records expenses when they’re actually incurred.

If you invoice someone for a sale in December 2023 but don’t receive payment until January 2024, for example, the two methods will record that income differently: the accrual method will record it in 2023, while the cash method won’t record it until 2024.

Why are they important?

Switching from one accounting method to another can change how you measure your profitability, how you file your taxes, and even how you make important business decisions.

For example, farms that use the cash method will often delay sales until January 1st to minimize the taxable income they have to report for the previous year, and purchase supplies and equipment before December 31st to maximize the number of deductions they can claim in the current tax year.

Why is cash accounting so popular in agriculture?

Cash accounting is popular in agriculture because 1. it’s simpler and less time consuming than accrual, 2. the IRS allows farms to use the cash method to file their taxes, and 3. it’s easier to do without hiring an accountant.

It saves time and accountant fees

Cash accounting is simpler and easier because it only records cash transactions, which represent only a fraction of what goes on in your business.

You don’t have to record accounts receivable, accounts payable, or changes in inventory, for example, which you might need help from a professional to account for. All you need to keep your books up to date are the cash transactions from your monthly bank statement.

Tax prep is easier

The cash method makes it relatively easy to calculate your taxable income by yourself, without help from a professional accountant or tax expert.

Filing your taxes using the cash method can also occasionally decrease your tax burden in the short term by allowing you to claim certain deductions earlier and deferring some taxable income until the following year.

It might be good enough for now

Accrual basis bookkeeping and record keeping can be tricky to do on your own without the help of an accountant. If you aren’t comfortable with accrual and don’t plan on hiring professional help any time soon, sticking with the cash method can be the more practical and realistic solution.

Why is accrual accounting important for agricultural operations?

While the cash method might make sense in the short run, it often makes sense to switch to the accrual method in the long term. This is mainly because:

1. The tax advantages of the cash method aren’t sustainable

While running your business on a cost basis might mean a lower tax bill this year, the benefits of doing so tend to decrease the longer a farm stays in business, and might even prevent you from making good management decisions down the road.

There’s also a legal limit to how long you can use the cash method for your taxes. If you reach annual gross receipts of $29 million or more, the IRS will require you to start filing your taxes using the accrual method.

2. The cash method distorts profitability

The net income you report using the cash method of accounting will often differ from the actual economic profit your business earned that year, making it difficult to gauge and understand your business’ actual performance.

3. The accrual method helps you see profitability more clearly

Because it records your income and expenses when they’re actually earned and incurred, the accrual method gives you a better idea of your actual economic performance and profitability for the year.

This in turn allows you to generate accurate financial statements and calculate important metrics like profitability, liquidity, solvency, and also makes it easier for other people to understand the profitability of your business.

How does accrual accounting work?

There are many non-cash transactions that happen in a business. Tracking them all with accrual accounting can seem daunting at first, but it’s worth it, because it gives you a more accurate view of what’s actually going on in your business.

The accrual method works based on two main principles: the revenue recognition principle, and the matching principle.

1. The revenue recognition principle

The revenue recognition principle states that income must be ‘recognized’ or recorded when it’s actually realized or earned, rather than when cash is deposited into your bank account.

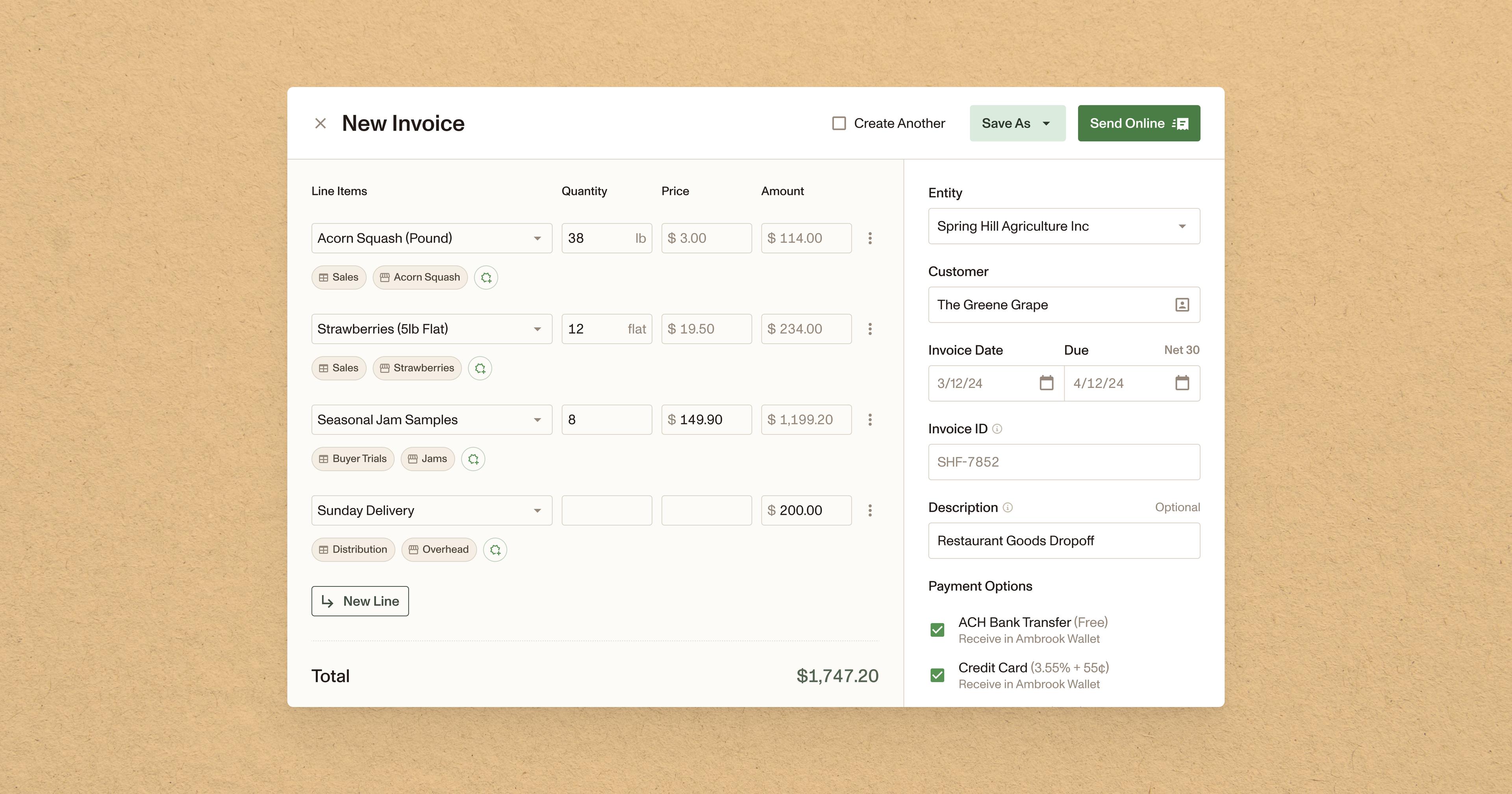

This means that instead of waiting to record income until cash is received, businesses record income the moment they invoice a customer and create a corresponding IOU in the form of an account receivable.

An example of revenue recognition in action

Let’s say that after harvesting your grain crop for the year, you decide to sell $25,000 of it in November to a customer and store the rest of it until next year. In our example, you invoice that customer in November but don’t receive payment until February.

Under the revenue recognition principle, the $25,000 in grain you invoiced your customer for in November is considered sold at that moment, so $25,000 in sales income is recorded in November and an account receivable for $25,000 is created.

What about the grain you didn’t sell? Under accrual accounting, you would also record that income as being earned this year, because it increases the value of your inventory. In a way, you’re selling that grain to yourself. (Farmers generally use the market price to figure out the amount of the inventory increase, and adjustments are made later if the inventory is eventually sold at a lower price.)

2. The matching principle

Another important part of accrual accounting is the matching principle, which states that expenses should only be recorded in the period when they’re used to actually earn revenue – or as the IRS puts it, when “economic activity” has occurred.

An example of the matching principle in action

Let’s say you buy $10,000 in fuel on December 1st and only use $1,000 of it in December, storing the rest of it until next year. Because you didn’t use all of the fuel this year, the matching principle states that you can only record $1,000 in fuel expenses this year.

Under the matching principle, businesses record investments like the $10,000 fuel purchase as assets on the balance sheet, and expenses aren’t recorded on the income statement until a business starts to actually ‘use up’ those assets.

In this case, on December 1st you’d create a $10,000 fuel asset on your balance sheet. Assuming you use $1,000 in fuel every month afterwards, you would record $1,000 in fuel expenses each month, decreasing the value of the fuel asset account accordingly.

How does accrual accounting look different in agriculture?

Accrual accounting is particularly important in agriculture because much of the value produced on farms isn’t reflected in cash transactions. Successfully getting through the calving season doesn’t produce many cash transactions, for example, but it still creates a lot of value for your business.

The accrual method is crucial for managerial accounting, which is the type of accounting we do when we use financial statements to analyze profitability and make important decisions about a business’ future.

How can I start leveraging accrual accounting for my business?

If you currently use the cash method for your business, you have a few options when it comes to switching over to accrual.

Manually adjust your books to accrual basis

One option is to manually adjust your income and expenses to bring them in line with the revenue recognition and matching principles we discussed above. This involves:

Removing any income that was recorded this period but not actually earned, and adding in income that was earned this period but not recorded.

Removing expenses that didn’t result in economic activity this period, and adding in expenses that resulted in economic activity but weren’t recorded.

While inexpensive, manually adjusting your books in this way is also the most time-consuming option, and can be tricky to do properly without the help of an accountant.

Hire an accountant

If you already have an accountant, they will probably be more than happy to adjust your books to an accrual basis for you. While expensive, a good accountant can help you set up your books properly, help you interpret your financial statements, and provide valuable input when making important business decisions.

How Ambrook can help

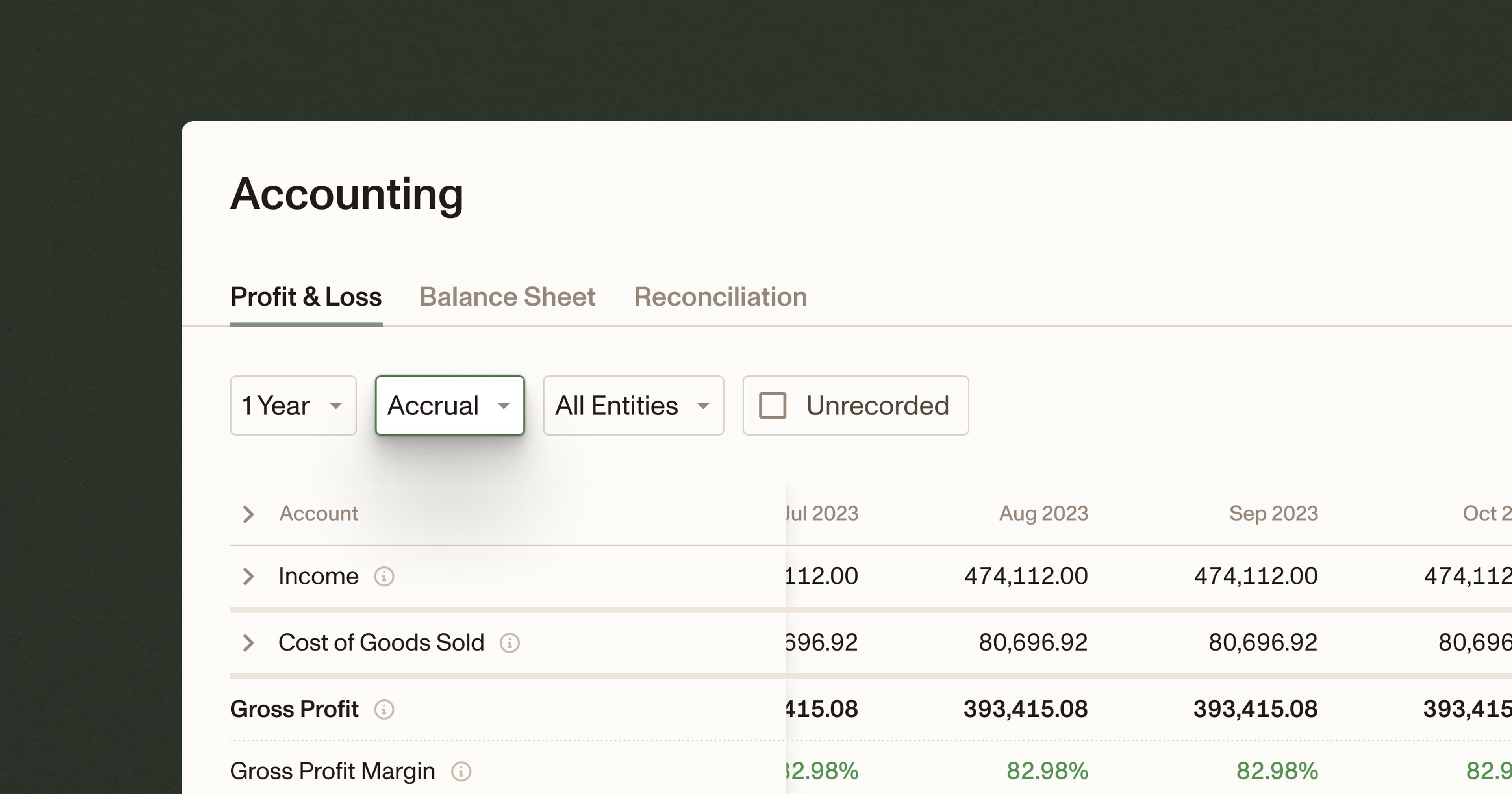

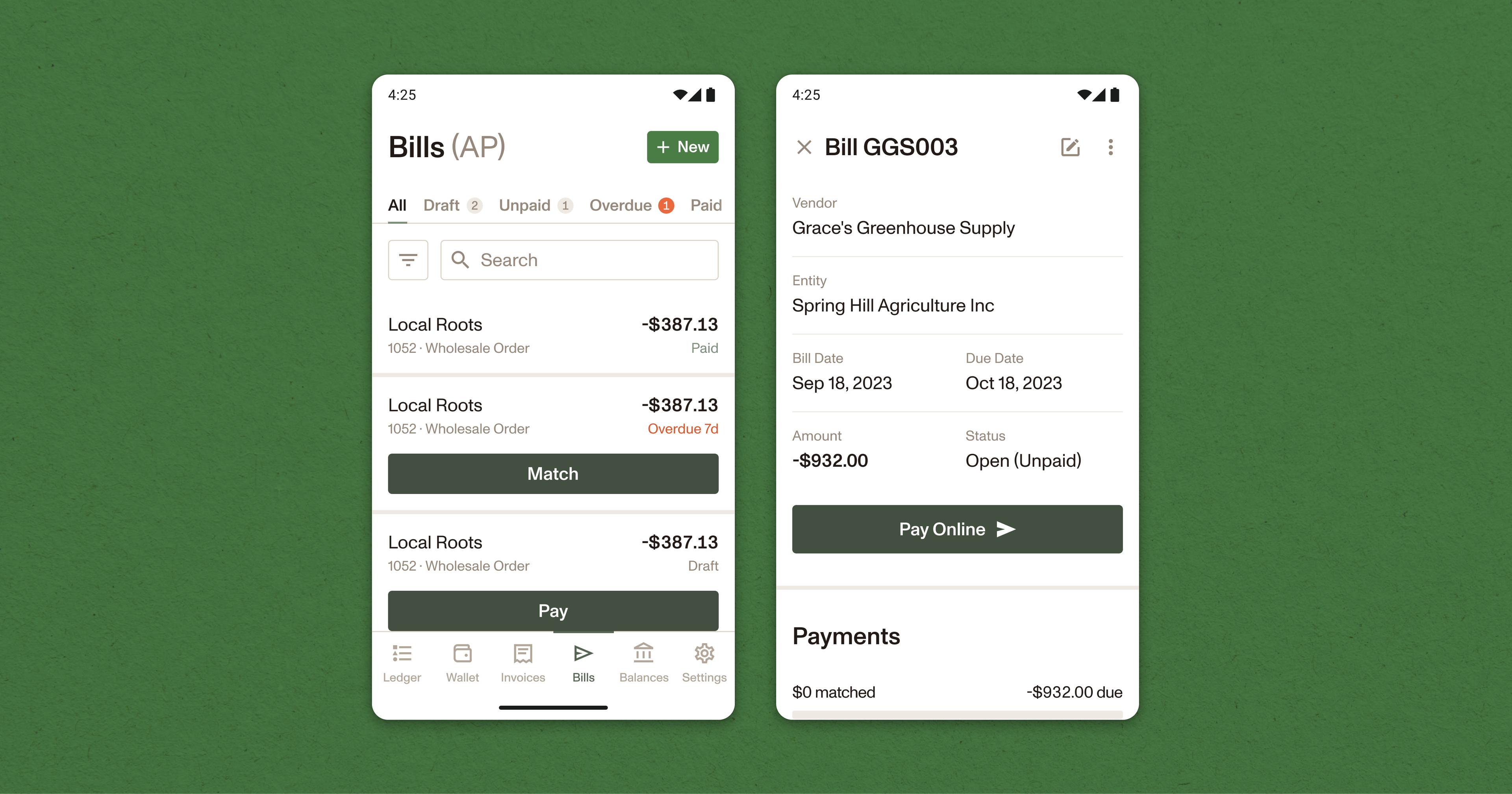

Ambrook’s powerful financial reporting tools allow users to toggle between accrual and cash basis, depending on which method their business uses to file their taxes or manage their business. Coupled with income and expense tracking, automatically-generated financial statements, and other features custom-built for agribusiness, Ambrook’s easy-to-use workflows help users get new insights into their business and make better decisions for the future. Curious to learn more? Schedule a demo today.