Making a Living on Cattle

"Everyone would say that you can't make a living on cattle anymore," says Josh McKinney. "I believed them to a certain extent, but not enough to not try it."

He's standing at his feedyard processing facility in the Oklahoma Panhandle on a bright November afternoon. Behind him, cottonwoods glow yellow against a pale sky. Dust rises from the pens where his crew is running cattle through the chute.

It’s 2025, and McKinney Land & Cattle now spans 30,000 acres across three states, running more than 2,000 cows alongside a growing mix of enterprises: cow-calf, backgrounding, custom feeding, trading, and, more recently, a feedlot.

But five years ago, there were no cattle. No land. Just a plan.

“We were in a bind. We came out of a deal pretty short on equity,” Josh recalls. “A local bank decided to take us on. That’s when I started trading cows.”

What followed was disciplined growth: buying open heifers, breeding them, reselling them, reinvesting. Developing irrigated ground. Finding good water. Making smart trades. “We just kept saying, ‘Let’s do a little more. We’re doing great. We can keep doing a little more.’”

The feedlot went up only in the last year. When asked what challenges he encountered getting it standing it up, Josh pauses.

"None, really,” he admits. “It's only made things more efficient."

That confidence, that ability to take on new growth, doesn't come from luck. It comes from putting the things in place to know exactly where you're at and make expansion decisions from a place of strength.

That calm confidence—the ability to take on new growth from a place of clarity and strength—didn’t come from luck. Josh built it over time, shaped by a series of challenges that pushed him to get more precise about the business behind the cattle.

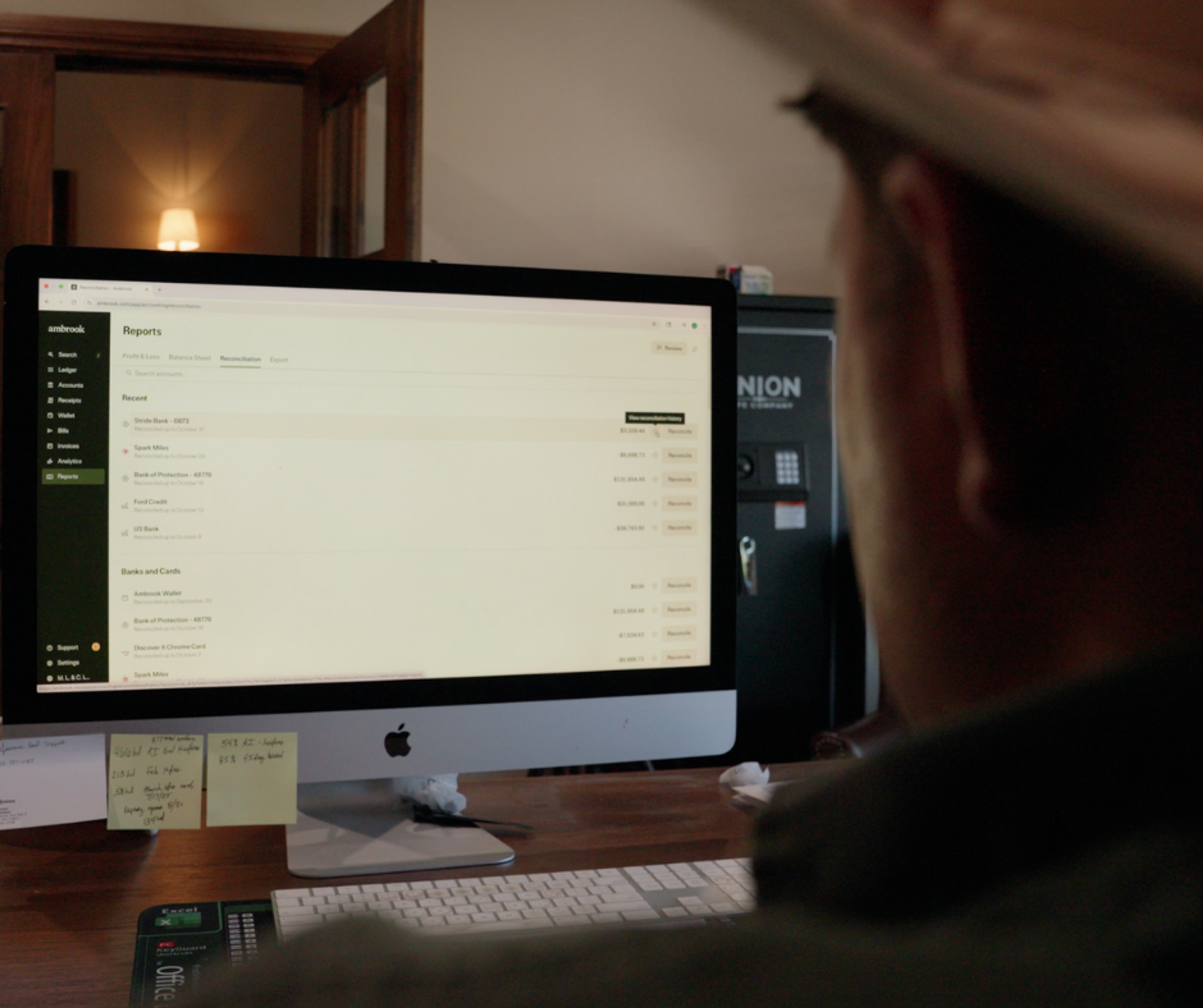

Josh McKinney at McKinney Land & Cattle in the Oklahoma Panhandle, walking through his feedlot operations.

Challenge: When the numbers don’t keep up

Josh has always believed that strong operations run on data. “The more information you know, the better you’re going to be.”

Early on, that meant notebooks and spreadsheets. “We wrote everything down by hand,” he says.

But as the operation scaled, the production data only got more sophisticated. Today, tractors are outfitted with RFID scanners that sync ear tags directly to the scale and feed system. Feed deliveries are logged in real time. Every ration is weighed. Every gain is recorded.

“We had data on everything,” Josh remembers. “But we didn’t have a good way to tie it all together. We had an idea, but we weren’t accurate.”

“We had data on everything. But we didn’t have a good way to tie it all together. We had an idea, but we weren’t accurate.”

On the financial side, pen and paper stop being able to keep up. Records moved into increasingly complicated spreadsheets and lengthy, end-of-year reconciliation periods.

The problem wasn’t a lack of information—it was a lack of connection between the production data he was tracking in herd management software and the numbers he was keeping in his books. Inventory lived in one system. Costs lived in another. Reconstructing financial statements after the fact meant re-entering the same information in multiple places, which was time-consuming and prone to error.

That gap mattered most when it came to growth. Like any capital-intensive business, McKinney Land & Cattle runs on equity. And despite having strong production data, Josh lacked a balance sheet that showed the complete picture of his business and held up at the bank.

“As an industry, we’re probably some of the worst record keepers,” Josh admits. But when you’re going to the bank asking for the credit you need to grow, estimates and gut aren’t enough. “Sometimes had to be pretty creative with my pitch on why I needed new capital,” he remembers.

He says that’s been the biggest learning curve for him: ”figuring out the financial side, how to source funding. "I think that's where we've had trouble as an industry,” he says. "The margin's not there."

And making decisions—or taking on debt—based on an inaccurate or incomplete financial picture can be costly.

"That's been the biggest learning curve for me. Figuring out the financial side, how to source funding."

Josh runs the operation on precise production data: cattle weights, feed usage, and daily gains.

Discovering Ambrook: Finding the Right Help

Josh found Ambrook on Facebook. “You could tell it was built for ag,” he says, remembering the ad. “I think there was a cow on it. I thought, well—maybe we can relate.”

But for operations as complex as Josh’s, getting the books organized wasn’t just about finding the right software. It took hands-on guidance from someone who understood agriculture.

That’s why he explored Ambrook’s offerings and chose the Full Service plan.

Josh started working with Katie Ellig, his dedicated account manager on Ambrook’s Full Service team, in the summer of 2025. Full Service pairs Ambrook’s ag-specific accounting software with one-on-one support: expert setup, regular check-ins, and hands-on guidance. Katie started learning Josh’s operation inside and out.

“We had quite a few meetings that summer, and she helped me a lot,” Josh says. “That’s when the big changes started to happen.”

For Josh, that meant cleaning up years of scattered records and structuring his books to reflect a multi-enterprise operation. Katie helped him set up enterprise tracking across cow-calf, backgrounding, and feeding. She worked through his balance sheet—loans, equipment, assets—so it reflected the full scope of what he owned and owed. And she helped him build projections grounded in real numbers.

“We started to really understand what we spent on our feed costs,” Josh explains. “So we could predict what we were going to need: how many head we could run and what those feed costs were going to be.”

With Ambrook’s team helping keep his books accurate and up to date, Josh could spend less time reconstructing the past and more time planning ahead.

Full Service isn’t about outsourcing the books. It’s about strengthening your ability to manage them—with a partner who understands agriculture and meets you where you are. Katie Ellig, a fourth-generation Montanan with deep family ties to ranching, came to Ambrook to help operators like Josh see their businesses more clearly and grow with confidence.

“We could finally start seeing the value in what we were doing,” Josh agrees, “and where we could put that value to further grow.”

"We could predict how many head we could run and what those feed costs were going to be. That's when the big changes started happening."

Regular check-ins and expert guidance from Ambrook help Josh stay close to his numbers and plan ahead with confidence.

Bringing Inventory Into the Books

As Josh’s books came into focus, one gap remained: inventory.

Even though his feedlot management system tracked every animal and every ration, feed in storage and cattle on hand still weren’t showing up as assets on his balance sheet. The financial picture hadn’t fully caught up with what was actually happening in the field.

That’s why Josh was a natural fit to be one of the first ranchers to try Ambrook Inventory, when it first launched to a small group of customers in early fall 2025. Ambrook Inventory is an inventory-integrated accounting system designed to do what Josh had been piecing together on his own: connect production directly to the books.

Step 1: Accounting for Cattle

Getting started meant setting up the items Josh tracks every day: calves, hay bales, rolled corn, distillers grain, silage. Each item includes a name, unit of measure, and costing method.

Critically, for anything Josh produces himself—like calves born on the operation or hay he puts up—he marks it as self-produced. That tells Ambrook the item wasn’t purchased from a vendor; it came off his ranch, and its value should be tracked accordingly.

That distinction matters. Most accounting systems force livestock into “purchased goods” workflows built for retail. They can’t represent a calf crop as an asset you produced. Ambrook makes that foundational.

“With Ambrook Inventory, we’ve been able to get really accurate on what it costs us to raise a calf."

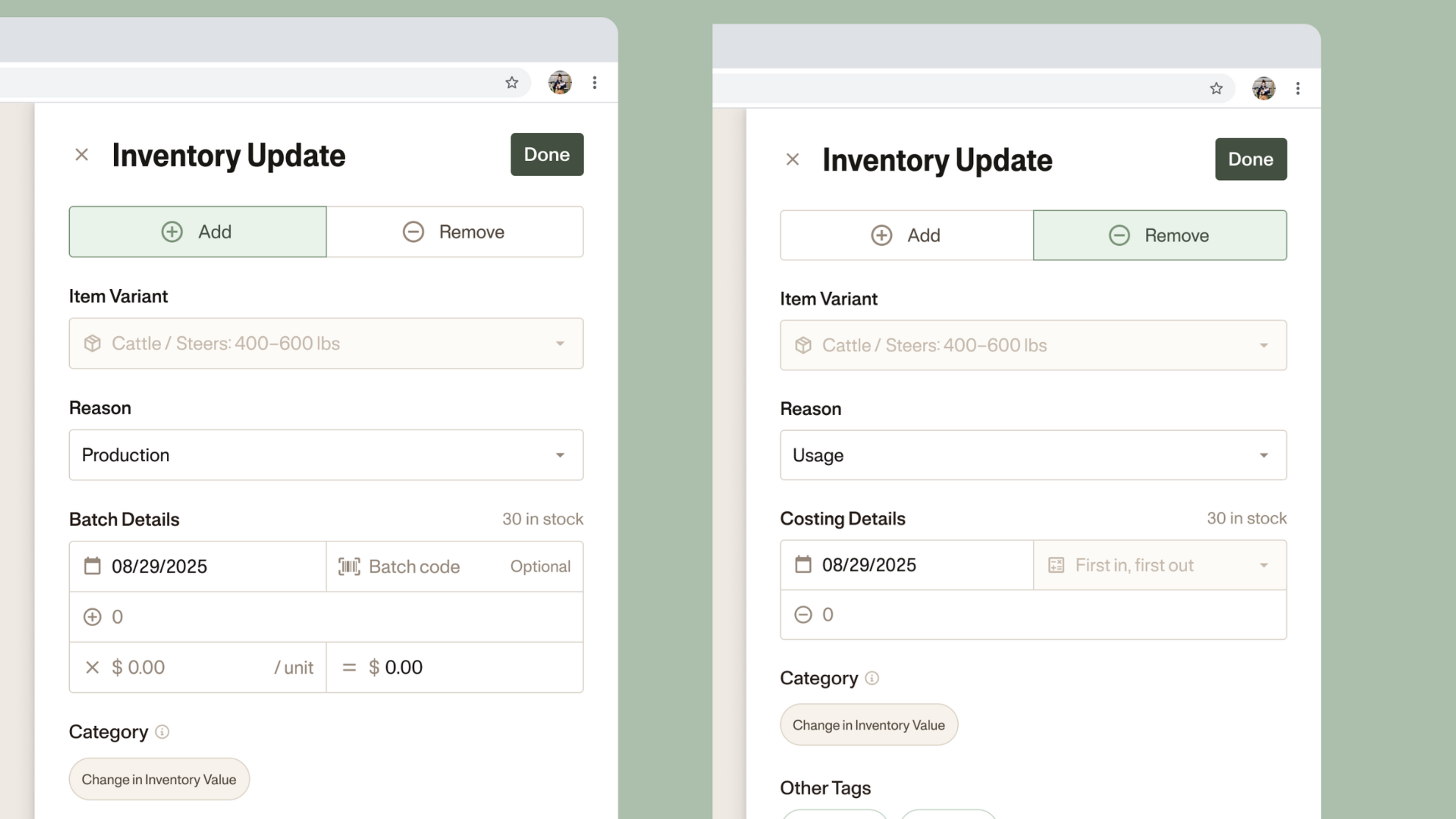

By distinguishing purchased goods from self-produced inventory in Ambrook, costs and asset values are tracked accurately from the start.

Step 2: Capturing Usage as It Happens

“Every time we get a load of commodity in, we just add that to the inventory,” Josh explains. Feed purchases flow into Ambrook through bills. As feed is mixed and delivered, inventory quantities are reduced to reflect usage. For events that aren't tied to a transaction—births, death loss, sales—he records an inventory change directly. Enter the quantity and reason, and Ambrook assigns or removes value accordingly.

"Ambrook inventory gets us even more accurate on our costs and projection," Josh says. "What went into my inventory side and what came out of it—it gives us a better idea."

Inventory updates automatically through bills and invoices, or can be adjusted easily to account for births, harvests, usage, or loss.

Step 3: Seeing the Full Picture

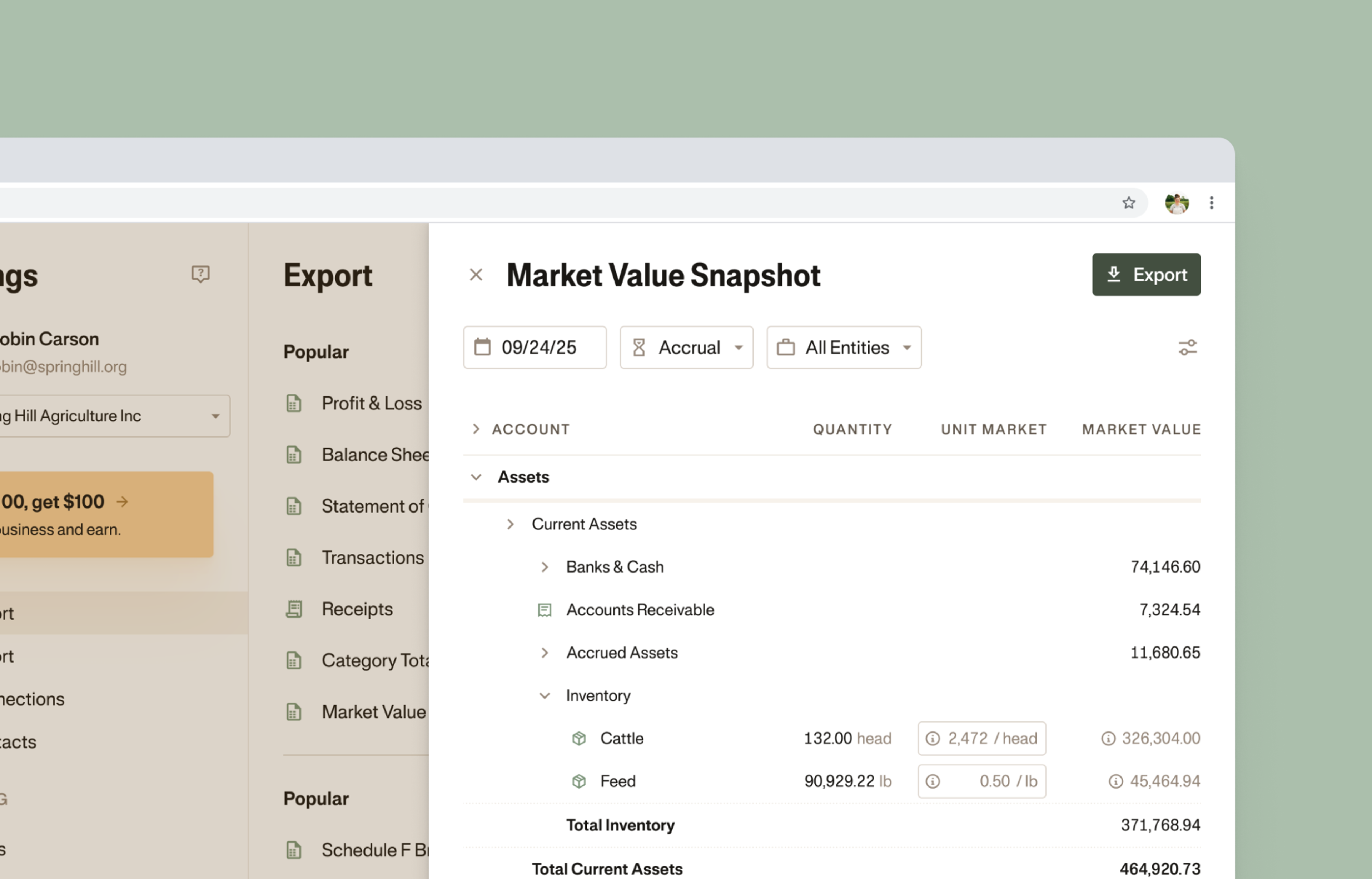

The difference shows up in the reports.

Before, Josh’s balance sheet told only part of the story. Cattle on hand and feed in storage weren’t represented as assets—only the cash that had moved in and out. His P&L reflected when he bought inputs, not when those inputs were actually used. Preparing numbers for the bank meant manual cleanup and reconstruction.

Now, his balance sheet shows the full picture: inventory listed as assets, valued at cost—or updated to market value for lender conversations. His P&L reflects true production costs, with feed expenses recognized when cattle sell, not when the corn is purchased. And he can generate a Market Value Balance Sheet that shows what the operation is worth today, not what it cost months ago.

“With Ambrook Inventory, we’ve been able to get really accurate on what it costs us to raise a calf,” Josh says. “That accuracy has been a game-changer. We were able to increase credit lines. It’s helped us earn our bank’s trust.”

For Josh, Ambrook isn't replacing his herd management software—it's adding the financial layer those systems can't provide. His operational tools still give him the production data he needs, telling him what happened with his cattle. Ambrook now tells him what it cost and what it's worth.

"Ambrook helps us tie it all together. We've grown a lot, just from the accuracy of financial reports. It's a game-changer. We were able to increase credit lines. It’s helped us earn our bank’s trust.”

A Market Value Balance Sheet shows what the operation is worth today—giving lenders a clear, current view of assets and collateral.

Impact: $12M in New Credit

Since adopting Ambrook, Josh has secured $12 million in additional lines of credit.

“From a sourcing-funding standpoint, I wouldn’t be where I’m at,” Josh says.

That access isn’t just bigger—it’s better. Josh estimates he’s saved roughly 2% in interest, which across millions in annual operating credit adds up to nearly $360,000 a year for Josh.

But the more important shift wasn’t financial. It was confidence.

“Ambrook has put the ball in my court,” Josh says. “Now I can walk into any bank knowing exactly what’s going to happen with the capital I need. I just say, ‘Here’s what I’m doing. What do you think?’

Josh’s financials now show the full picture: inventory listed as assets at market value, and enterprise-level profitability grounded in real production costs. He can say how much capital he needs today—and how much he’ll need in three years—and prove it.

For Josh, accurate financials aren’t about chasing credit. They’re about using it responsibly in a low-margin, volatile industry.

“It’s all about being able to show the bank what we need and back it up,” he says. “We work in a low-margin industry, so anytime you can maximize efficiency, it helps a lot. That’s where we’ve struggled as an industry. The margin’s not there.”

Then he adds, “But we’re changing that.”

“With Ambrook, I feel like we’re in a good spot knowing where we’re at. That’s the whole deal. You’ve got to know where you’re at.”

Back at the processing facility, the sun drops low, turning the dust gold as the crew moves cattle at sunset. Josh’s four-year-old son, Clayton, dances around with a handful of chips. His grandfather grins. “His energy doesn’t stop,” he says. “His momma told him the chips in the barn were just for the cowboys, and he said, ‘I’m a cowboy.’”

Five riders on horseback guide cattle from the pens out to pasture. Nearby, hay bales disappear into the grinder while tractors idle along the silage pile, iPads mounted in the cabs, logging usage in real time.

Josh looks out over the operation: the feed bunks, the equipment, the system humming along.

“Rural America” he says. “That’s what I’m passionate about. I just want to get rural America back to making a living.”

Explore Ambrook Inventory

McKinney Land & Cattle in the Oklahoma, where Josh McKinney and his family manage cattle, land, and a growing business together.