Donations can benefit the local community while potentially allowing farmers to reduce their tax bill. Here’s how to file for them properly.

If you’d like to support a worthy cause, one of the best ways to do it is by donating agricultural products. Not only do you put your ag production to work for the greater good, but you enjoy tax advantages by deducting noncash charitable contributions from your taxes.

Here’s what you need to know about donating noncash property like crops or livestock, and how to claim your deduction with the help of Form 8283.

What is a noncash donation?

A noncash charitable contribution is any donation to a qualified organization that does not take the form of cash transfers, checks, credit card payments, or out-of-pocket expenses for volunteer work.

As an agricultural producer, you may choose to donate, to a qualified organization:

Raised commodities like harvested crops or livestock

Farm equipment or vehicles (but only qualified vehicles, intended primarily for use on public roads, are deductible)

In either case, you are donating a noncash asset, and you need to go through extra steps to deduct its value from your taxes.

Tax benefits of donating raised commodities

Donating raised commodities gives you a tax advantage that donating cash does not.

For example, if you raise hogs, sell them, and then donate the cash to a charity, you can deduct the amount in cash from your taxes provided you itemize your deductions. But having paid income tax and self-employment tax on the money earned from the sale, you will be able to donate—and deduct—less than the full value of the hogs.

You might sell the hogs for $2,000, but after paying taxes, have just $1,400 to donate and use to figure your deduction.

On the other hand, if you transfer ownership of the hogs to a charity, the charity can then sell them for the full $2,000 value.

This benefits you especially if you do not itemize your deductions, because you don’t incur any income or self-employment tax on the value of the donation. At the same time, you are able to write off expenses incurred raising the commodity.

This reduces your income tax burden without paying self-employment tax on their sale.

Transferring ownership of raised commodities

For any donation of raised commodities, you must transfer ownership of the commodity to the qualified organization in order to report it as a noncash donation.

If you are donating crops, that may mean registering them with the Farm Service Agency (FSA). For livestock, you should follow the procedures required by your state.

Be sure to complete a bill of sale, and send a letter to the charity you’re donating to that explicitly states the transfer of ownership, and specifying that any choice they make to sell the commodity is theirs alone.

If you don’t do this, you could run into trouble. For instance, if grain you have donated is being held in an elevator, and you then sell the grain on behalf of the charity, it may be difficult to prove to the IRS that the grain did indeed belong to the charity and not to you. That’s what it’s important to create a paper trail proving transfer of ownership

Who can donate raised commodities?

Tax deductions for donating raised commodities are only available to ag producers who:

Use the cash basis (not the accrual basis) method of accounting

Donate inventory that belongs to them (ie. it’s not part of a crop share agreement)

Can prove that ownership of the commodity was transferred to the charity

Sole proprietors, corporations, and partnerships may all make noncash donations to charity. However, there may be contribution limits. For example, sole proprietors and owners of pass-through businesses are limited to deducting 60% of their adjusted gross income (AGI). They can carry any unused deductions forward to claim in a future tax year for up to five years.

Corporations cannot deduct more than 10% of their pretax income in any tax year, but can carry unused deductions forward for up to five years.

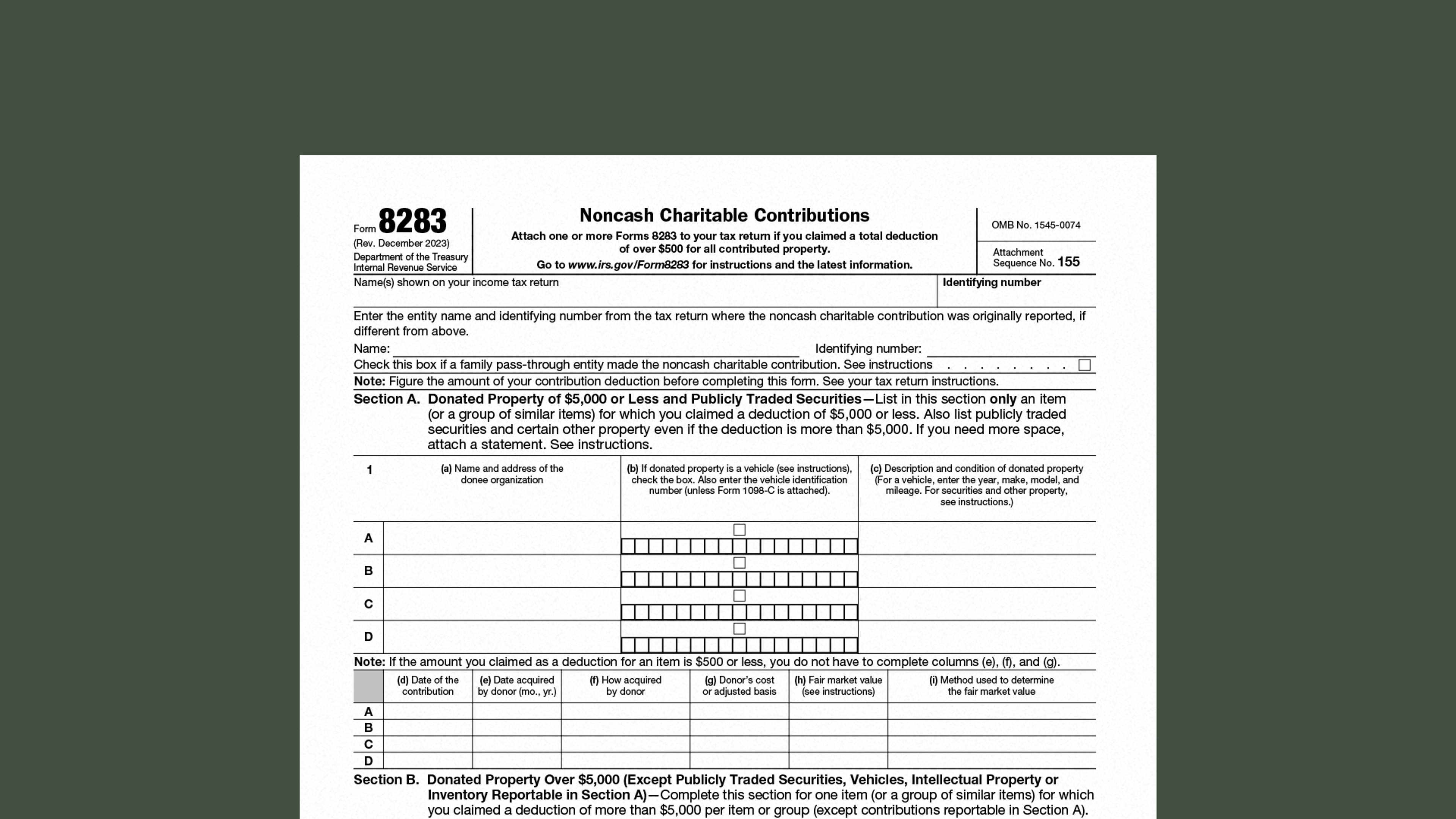

What is Form 8283?

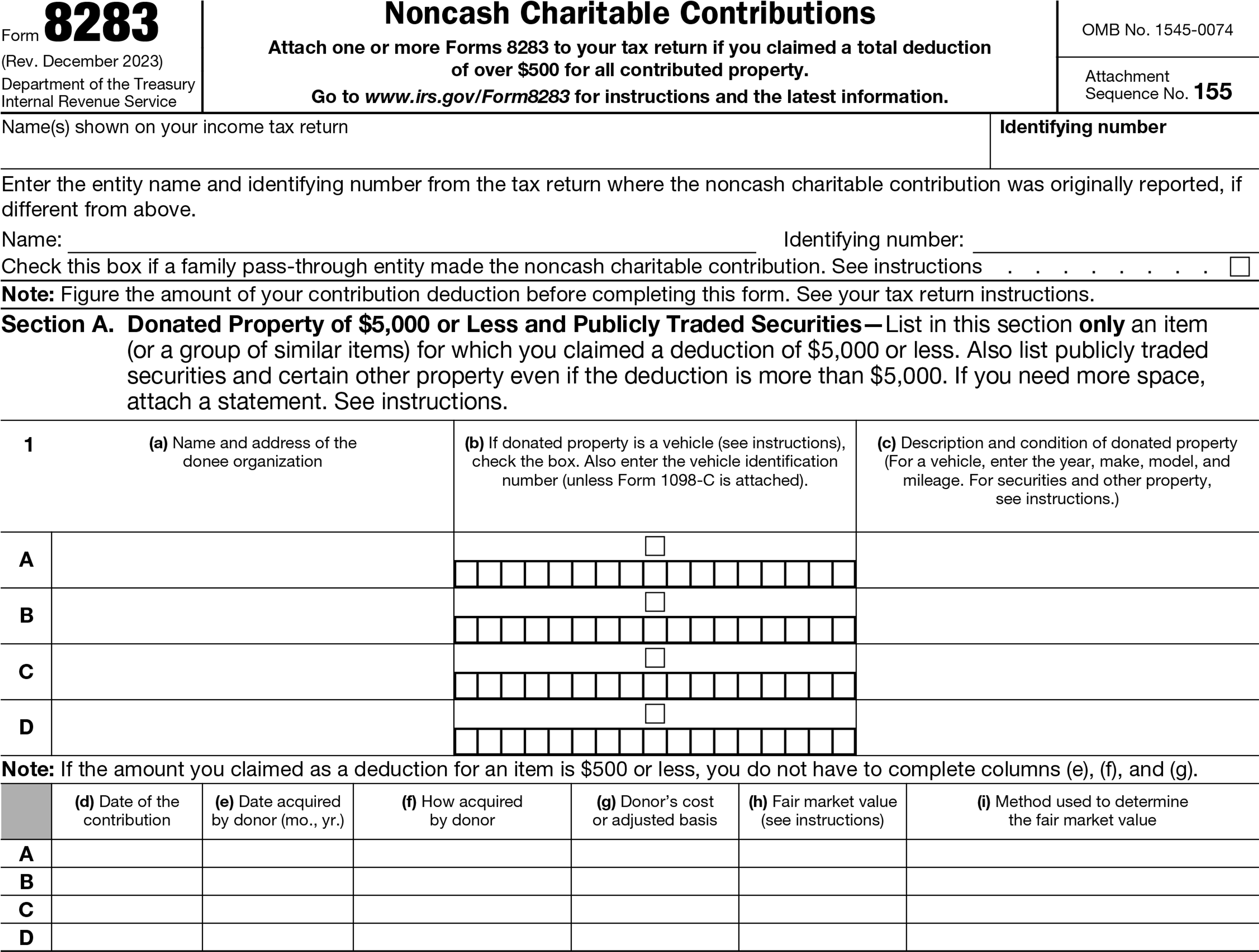

If you donate a noncash asset or a group of similar items of property and the amount of your deduction is over $500, you must report it by filing Form 8283, Noncash Charitable Contributions.

‘Similar items of property’ in this case might include multiple heads of livestock.

This applies both to business property (owned by your ag operation) and personal property (owned by you personally).

Who signs Form 8283?

Before it’s filed, Form 8283 must be signed by:

You (the donor)

The organization to which you are donating (the donee) if the donation exceeds $5,000 in value

An appraiser, if the donation exceeds $5,000 in value

If your business is a pass-through entity like a partnership or an S corporation, each partner or shareholder receives a copy of the entity’s Form 8283 reporting noncash donations. They then complete their own copies of Form 8283, reporting how the noncash deductions pass through to their personal taxes, and file the two forms together.

What is Form 1098-C?

If you or your business donate a motor vehicle, the donee is required to send you a Form 1098-C including details of the contribution. You file this form along with Form 8283 as part of your tax return.

How do you value donations reported on Form 8283?

Charitable contributions you report on Form 8283 must include the fair market value (FMV) of each item or group of similar items you’re donating. The FMV is the amount in cash you could reasonably expect to earn for the sale of the item.

For raised commodities, you can get the FMV by referring to commodities markets or recent local sales prices. Vehicles and other equipment may be valued based on buyers’/sellers’ guides (eg. based on the Blue Book value).

How do you value your deduction?

The deduction you can claim for each noncash donation depends on whether the item is ordinary income property or capital gain property.

Ordinary income property includes assets you would normally sell in the course of earning an income for your ag production. This type of property is held for no longer than 12 months before sale. To calculate your deduction, subtract the ordinary income you would expect to earn from the sale of the item from its FMV.

Capital gain property is property you would be able to sell and earn long-term capital gain on if you sold it at the time of the donation. This includes real property and depreciable property you might use in the course of running your business—farm equipment, for example. In most cases, you can write off the FMV of this property, but certain exceptions apply.

When do you need an official appraisal?

You must hire an appraiser to value the property you are donating if its value is $5,000 or more.

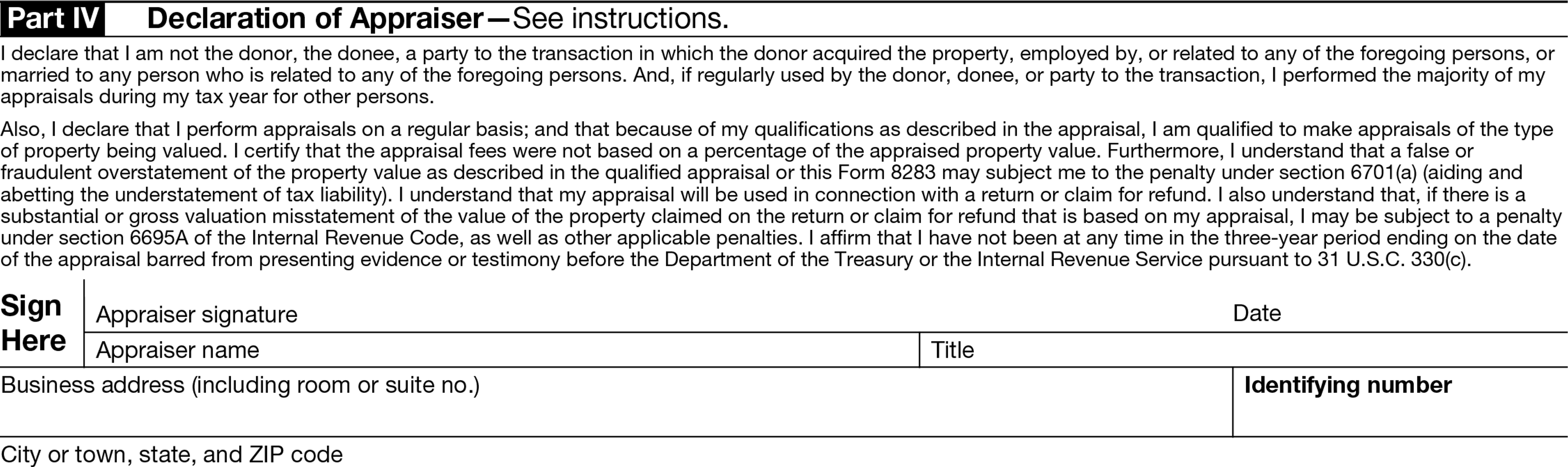

That means hiring an appraiser and having them complete Section IV of Form 8283 testifying to their qualifications.

A qualified appraiser is someone designated by an appraiser organization who is competent to appraise the type of property you are donating. They need to meet minimum education requirements and have at least two years’ experience appraising the relevant type of property, and to be regularly paid for performing appraisal services.

The IRS instructions provide a more detailed breakdown of who qualifies as an appraiser.

You don’t need an appraisal if you’re donating publicly traded securities, like stocks, even if they’re worth over $5,000. For donations of stocks, you can simply use the average of the stock’s highest and lowest selling price on the day you donated it.

How to file Form 8283

Form 8283 is divided into two sections:

Section A reports all noncash donations deducted for more than $500 but less than $5,000 (and publicly traded securities)

Section B reports all noncash donations deducted for more than $5,000

You can complete Section A on your own, but Section B requires the signature of the donee and an appraiser.

Section A

The top part of Form 8238 is where you enter your name and tax ID number, or your business’s name and tax ID number if your business is filing the form.

In the first table of Section A, enter:

In column (a), the name and address of the organization to which you made a noncash contribution

In column (b), the vehicle identification number if you donated a vehicle (but only if you are not including a Form 1098-C given to you by the donee)

In column (c), a brief description of the donated property, including its condition

Each lettered row of the first table corresponds to a row in the second table where you provide details about the deduction:

In column (d), note the date of the contribution

In column (e), note the date when you acquired the property (this may be the harvest date for a crop, or the date at which raised livestock became saleable)

In column (f), describe how you acquired the property (eg. by growing or raising it)

In column (g), enter the cost or adjusted basis (what you paid for the property, or the expense of producing it)

In column (h), enter the FMV

In column (i), describe how you determined the FMV (eg. average local sales price)

If you exclusively donated items for which you are claiming a deduction less than $5,000, you’re now done filling out Form 8283. If you donated property that you’re writing off for $5,000 or more, complete Section B.

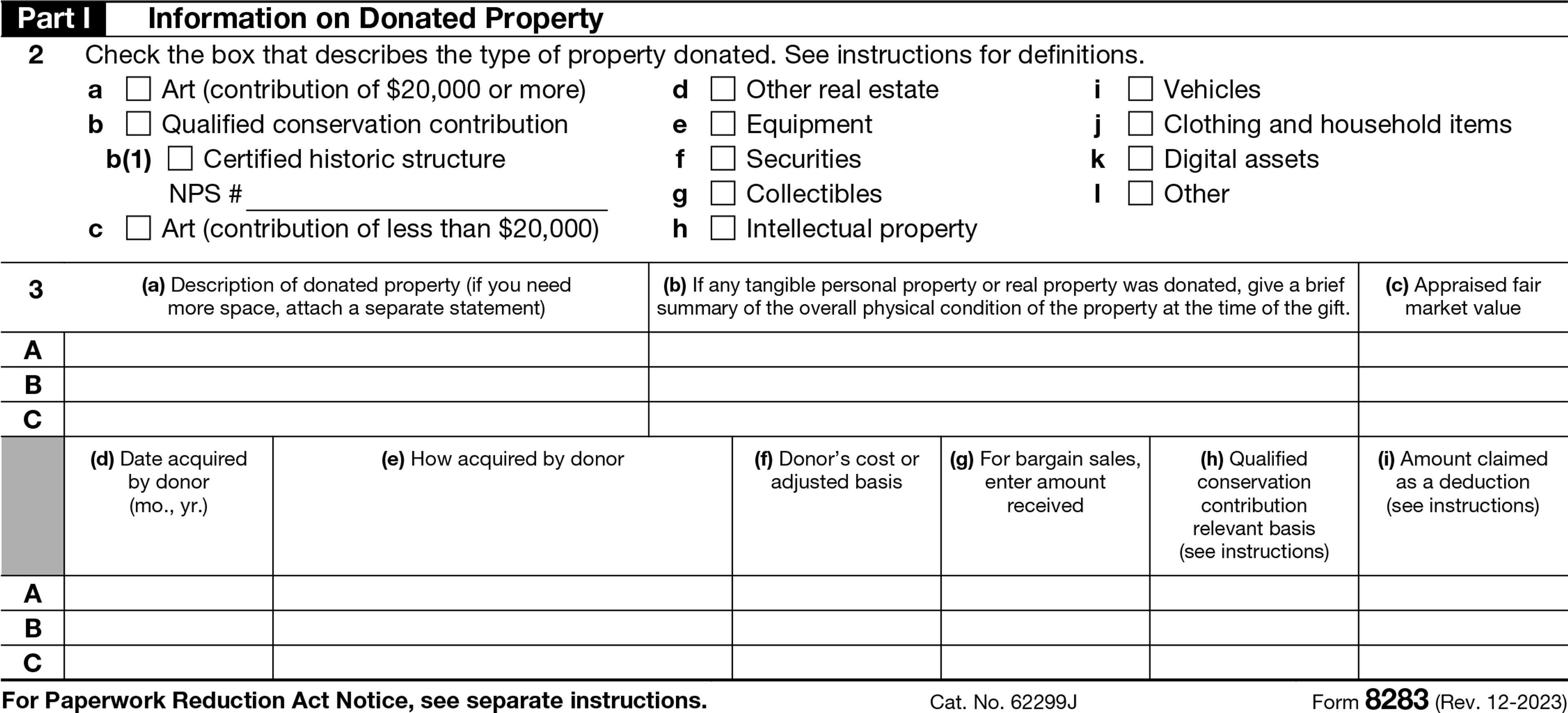

Section B, Part I

You must file one copy of Section B for each deduction of $5,000 or more you are claiming.

On line 2 of Part I, indicate what type of property you are donating. Raised commodities qualify as “Other”.

On line 3, fill out the table describing:

In column (a), the donated property

In column (b), its condition if it is tangible personal property or real property (eg. equipment)

In column (c ), the FMV as determined by an appraise

For the second table on line 3, each lettered row corresponds to a row in the first table.

Fill out:

Column (d), the date you acquired the property

Column (e), how the property was acquired

Column (f), the amount you paid for the property or the cost of producing it

Column (g), — if you sold the property to the donee at a bargain rate, enter the amount you received

Column (h) only if you are donating land for conservation purposes (for this, work with a lawyer and/or accountant rather than completing the form yourself)

Column (i), the amount you are claiming as a deduction

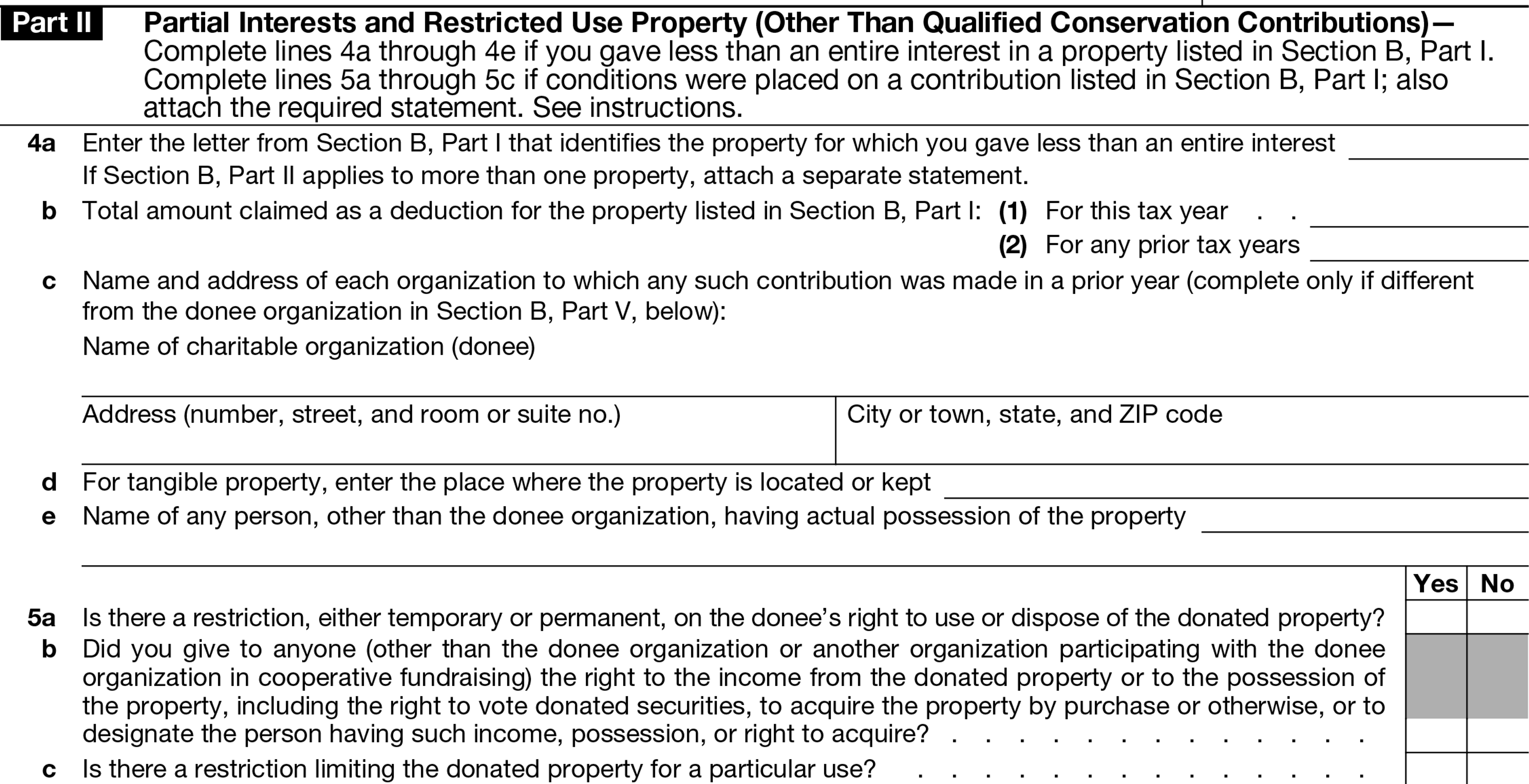

Section B, Part II

Part II of Section B is where you provide information on contributions you are making:

Only partially, while retaining some ownership of the property, and/or

With restrictions on how the property may be used by the donee

On line 4a, enter the letter corresponding to the contribution as listed in Part I.

On line 4b, enter the total amount you are claiming for the deduction, including any claimed for prior tax years.

On line 4c, enter the names and addresses of any other charitable organizations to which you donated portions of the property in prior years.

On line 4d, if you are donating tangible property (e.g. equipment), note where the property is being stored.

On line 4e, list anyone besides the donee who owns an interest in the property.

Line 5 is where you indicate any restrictions on donated property.

On line 5a, indicate whether there is a restriction on the property.

On line 5b, indicate whether anyone besides the donee has the right to use the property, earn an income from it, sell it, vote on its use, etc.

On line 5c, indicate whether and restrictions specify how the property will be used. If you signed an agreement with the donee indicating how the property may be used, attach a copy to Form 8283.

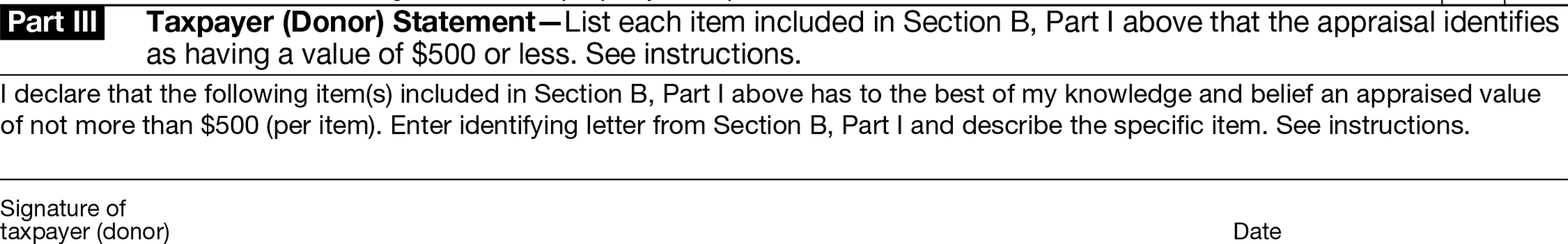

Section B, Part III

In Part III, you sign your name testifying to the accuracy of the information you have provided in Section B, Part I.

Section B, Part IV

In Part IV, the appraiser provides their personal details and attests to their qualifications to appraise the property.

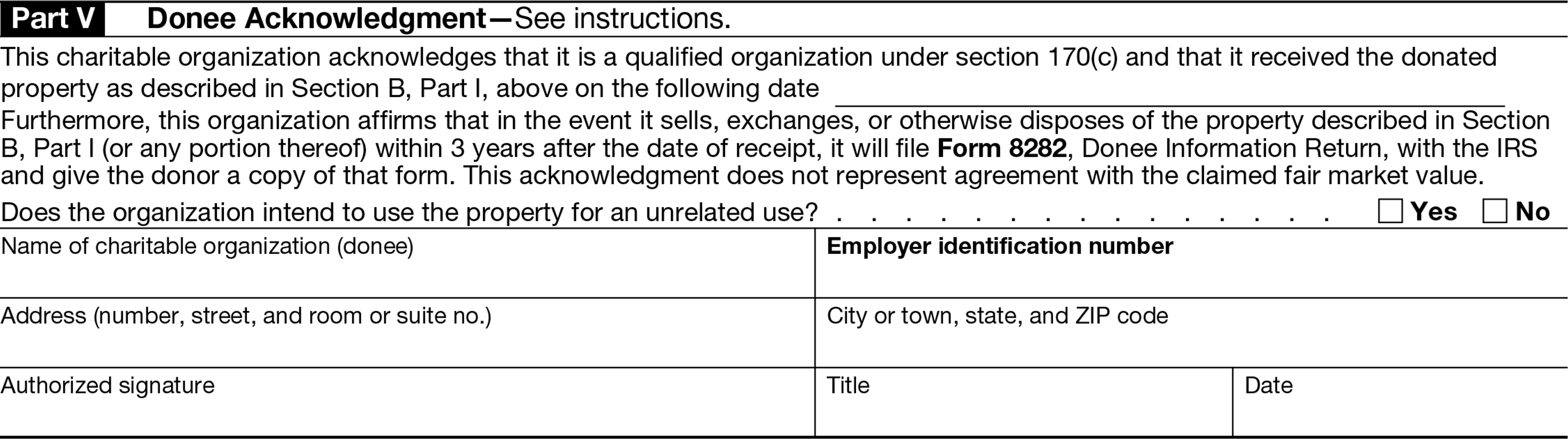

Section B, Part V

In Part V, the donee provides their information.

Form 8283 filing deadlines

File Form 8283 as part of your regular tax filing for the year when you made the contribution.

If you are filing on behalf of an S corp or partnership, you must distribute a copy to each shareholder or partner.

If you file Form 8283 electronically, complete all of the necessary sections, except for the signatures, in your electronic filing. Then upload a scanned copy of a paper version of Form 8283 that includes signatures.

Ambrook makes giving (and saving) easier

When you use Ambrook, all of your business expenses are automatically uploaded and categorized in your books. That makes it easy to track your cost basis in donated property when it comes time to file Form 8283 and claim a tax deduction.

Plus, with time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make expense and revenue tracking simple: it takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

Want to learn more about Ambrook?

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.