Installment sales are a great way improve cash flow and minimize your tax burden. Here’s how to file for them properly.

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.

Selling the farm’s second tractor? Transferring a parcel of land to your neighbor over time? Offloading used machinery or breeding livestock as part of your retirement plan? In any of these cases, you might not get paid all at once—and that’s where the Internal Revenue Service (IRS) installment sale rules come into play.

For farmers, installment sales are a practical way to turn large, infrequent asset sales into manageable income streams. The installment sale rules let you spread the tax burden over multiple years instead of recognizing the entire gain in the year of the sale, ensuring you don’t pay taxes until you have the cash in hand.

This guide explains Form 6252, which is used to report installment sale income, and walks through how installment sales can improve cash flow and manage major transitions like scaling down, passing the farm to the next generation, or cleaning up the equipment shed.

What is IRS Form 6252 used for?

You use Form 6252 to report income from property sales when you receive at least one payment after the tax year in which the sale occurs. The IRS defines this as an installment sale under Internal Revenue Code (IRC) Section 453.

For example, say you’re a pig farmer and sell a breeding sow for $10,000 on December 1, 2024. The buyer pays $2,000 upfront and agrees to pay the remaining $8,000 over four years. For simplicity’s sake, let’s assume no selling expenses and a zero tax basis (original purchase price minus depreciation) in the sow, so your gain on the sale would be the whole $10,000.

Without an installment sale, you would have to pay taxes on the entire $10,000 gain on your 2024 tax return, even though you only received $2,000 in cash from the sale so far.

However, using Form 6252 to report the transaction as an installment sale lets you pay taxes on the $2,000 received in 2024 and the remaining $8,000 in gain as you receive payments over the next four years.

What qualifies for installment sale treatment?

An installment sale generally involves the sale of tangible assets, like real estate, machinery, or livestock.

However, a few types of sales don’t qualify for installment sale treatment. These include inventory items like harvested grain, market-ready produce, or chickens; sales of publicly traded securities, property sold at a loss, and sales using the accrual accounting method.

Who benefits most from an installment sale?

Installment sales are especially beneficial for:

Cash-basis farmers who prefer to match income with future payments

Retiring farm owners selling their operation and seeking to spread out capital gains

Family farms transferring assets to children or successors over time

Farmers selling high-value land or equipment, which could result in large capital gains

Spreading out income can help you avoid being pushed into a higher tax bracket in a single year.

Do you need to file Form 6252?

You must file Form 6252 if you sold real or personal property, will receive at least one payment in a later year, and elect to report the gain as an installment sale. You must file one Form 6252 for each separate sale, so you might have to file multiple copies in the same year.

Returning to the example above, you would file Form 6252 with your 2024 tax return to report the initial sale and pay tax on the $2,000 of gain received that year.

In 2025, the buyer makes another $2,000 installment, so you file Form 6252 with your 2025 return to report another principal payment.

However, let’s say the buyer has financial problems in 2026 and doesn’t make a principal payment; they only pay you interest on the outstanding balance. In that case, you still file Form 6252, even though you don’t have any installment sale income to report. You also report the interest income on Schedule B.

In 2027, things turned around for the buyer, so they paid the remaining balance of $6,000. You would file Form 6252 again to pay tax on the remaining $6,000 of gain.

You don’t need to file Form 6252 if:

You received the full payment in the same year the sale occurred

The sale does not qualify (such as inventory sales)

You elected out of the installment method and reported the entire gain upfront on a different form such as Form 4797 or Schedule D and Form 8949.

The sale resulted in a loss rather than a gain

Can you avoid capital gains tax on an installment sale?

Electing to treat a sale as an installment sale doesn’t eliminate capital gains tax. Instead, it spreads your gain out over two or more years. This may keep you in a lower tax bracket, minimizing your overall tax burden.

There are other ways to minimize capital gains taxes. For example, you can ensure you own the property for over one year so the sale qualifies for the lower, long-term capital gains tax rates. Or you can take advantage of tax-loss harvesting, which involves selling certain assets at a loss to offset gains from other sales.

If the total sales price of your property is greater than $150,000 and your outstanding installment obligations are more than $5 million at the end of the year, the IRS may require you to pay interest on the deferred tax from your installment sale. While this rule doesn’t apply to all sales, it’s something to keep in mind when structuring large transactions like real estate sales on the installment basis.

It’s generally a good idea to discuss these strategies with your tax advisor.

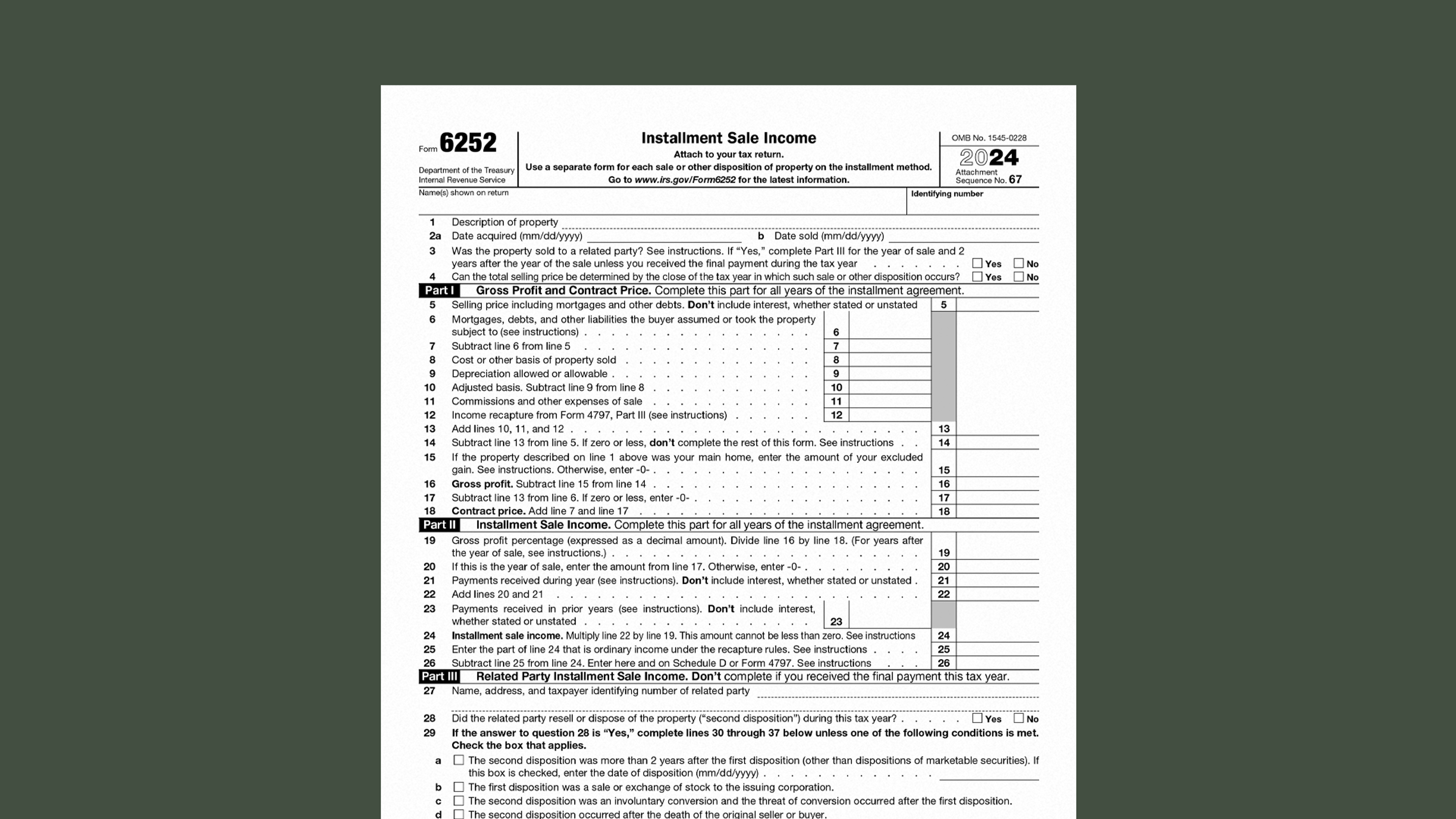

How to fill out Form 6252

Now, let’s walk through the step-by-step process of reporting installment sale income on Form 6252.

Step 1: Identify the sale

To complete the form, you’ll need information about the sale. Have your sales contract, payment schedule, a description of the property sold, and your adjusted basis in the property handy.

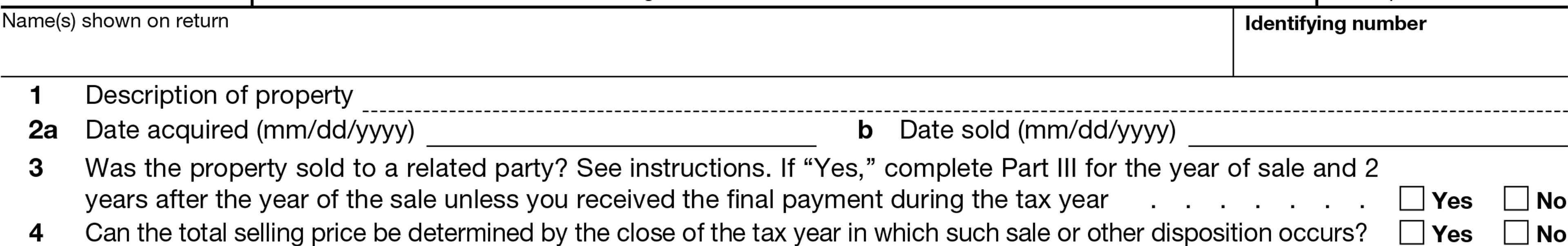

At the top of Form 6252, you’ll need to enter information identifying the sale, including:

Description of property

The date you acquired it

The sale date

You’ll also need to check boxes confirming whether you sold property to a related party and whether you can determine the total sales price as of the end of the tax year. For more information on answering these questions, check out the Form 6252 Instructions or Publication 537.

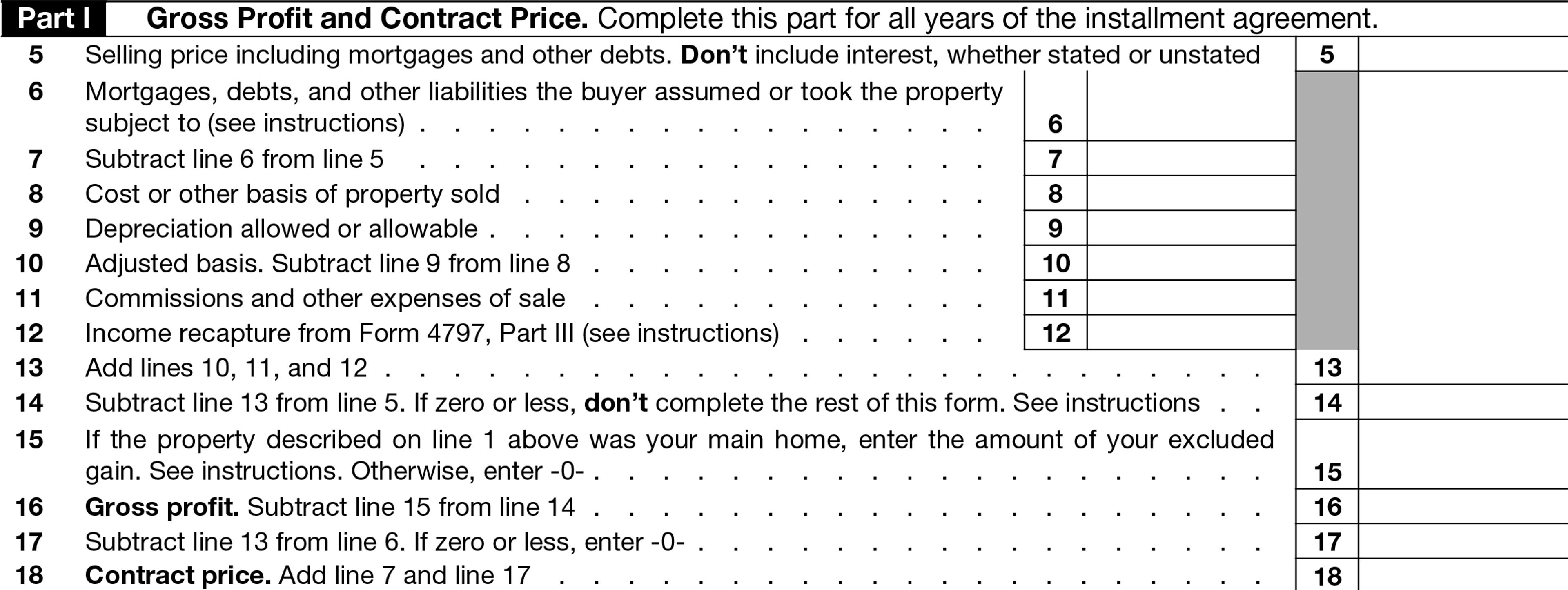

Step 2: Calculate gross profit

Part I of Form 6252 is where you calculate the gross profit from the sale. You’ll need to know:

The selling price

Any debts attached to the property and assumed by the buyer

Your basis in the property sold (i.e., what you paid for it, plus improvements, minus casualty losses and credits claimed)

Depreciation claimed on the property (including Section 179 expenses)

Any Section 179 or bonus depreciation allowed that may need to be recaptured as ordinary income taxed at your ordinary tax rate. This is not eligible for installment sale treatment. (calculate this in Part III of Form 4797, or have your tax advisor calculate it for you)

Commissions or other expenses of the sale

If you come up with zero or a negative number on Line 14, you cannot file Form 6252 for the sale. Instead, report it on Form 4797, Form 8949, or the Schedule D attached to your tax return.

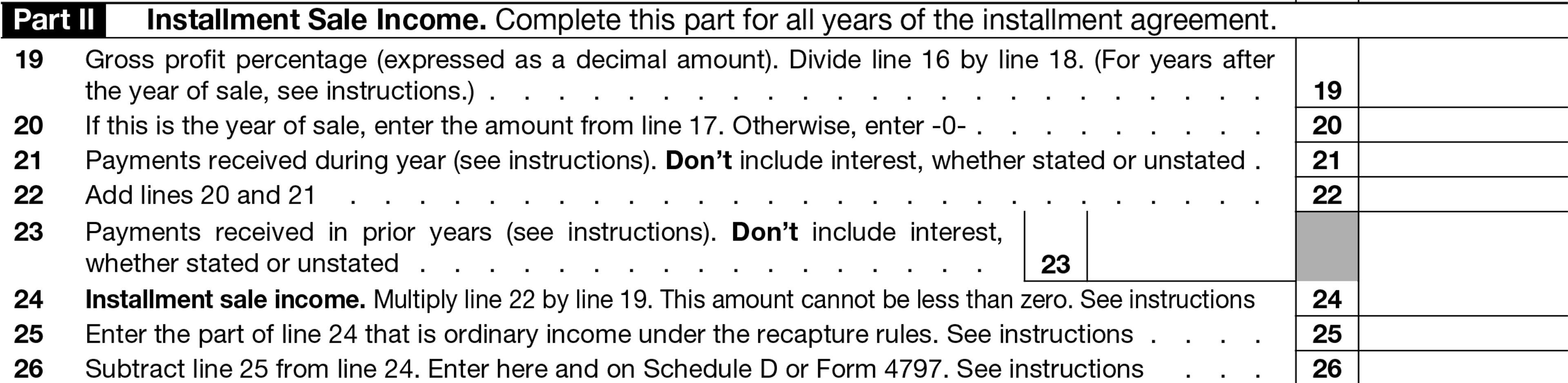

Step 3: Calculate installment sale income

In the next section, you calculate the income you’ll recognize in the current tax year. Enter the gross profit percentage you calculated in Part I and principal payments received during the year. Multiply the gross profit percentage by the payments received in the current year to calculate your installment sale income.

Don’t include any interest received on the sale; you’ll report that on Schedule B instead.

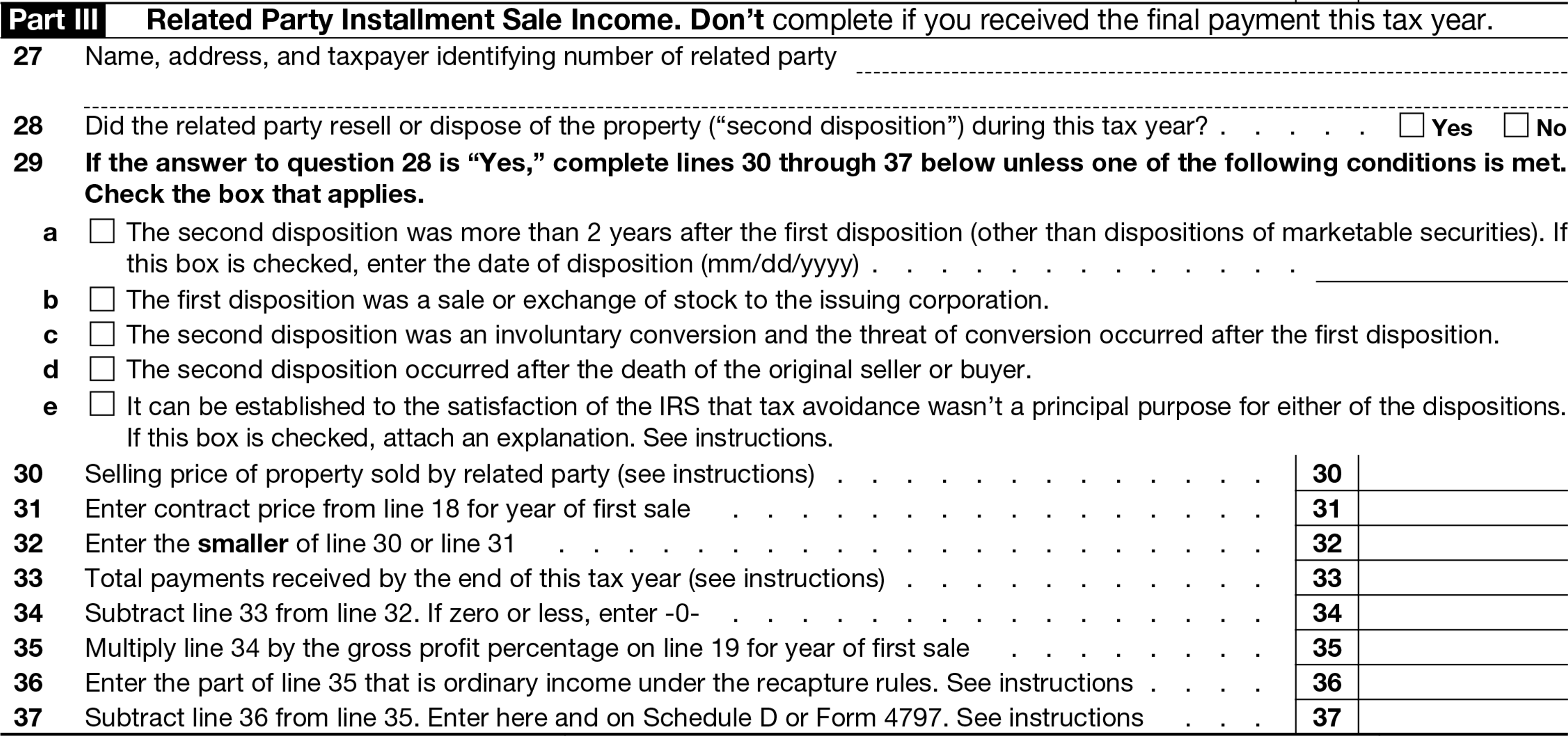

Step 4: Complete Part III (if necessary)

You only need to fill out Part III if you sold the property to a related party, such as your spouse, a child, grandchild, sibling, parent, or a related business entity.

You can find more information on the special rules for related party sales in the Form 6252 instructions or discuss them with your tax advisor.

Making the most of installment sales

Installment sales can be a tax-smart strategy for farmers transitioning operations or selling capital assets. Form 6252 is the tool the IRS requires to track and report this income properly.

While the concept is straightforward, like many IRS forms, filling out Form 6252 can be confusing. Plus, you need to pay attention to the IRS’s rules on interest income and keep records of the installments you receive over multiple years.

A good accountant or tax professional and a quality farm accounting system can help you establish reliable and transparent financial records and avoid penalties.

Simplify Your Tax Season with Ambrook

Ambrook’s farm-friendly category tags make it easy to compare your tax return to your records, saving you hours of work during tax season.

With time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make filing your taxes easy: it takes the guesswork out of running your business.

Want to learn more? Schedule a demo today.