The Ambrook Team has been crossing state lines and visiting farms of all acreages to ensure that the product we’re building is easy to use and solves real problems. Every feature update below was requested by one or more pilot partners.

Book Transfers

We also heard that you need to track how revenues and costs are passed between your distinct enterprises. This inspired book transfers. An internal book transfer won’t affect your tax return, but will show how each enterprise is performing individually.

For example, transfer funds for milk at market price over to your dairy enterprise from your cheese processing enterprise. Your dairy enterprise sees it as a revenue, while your cheese enterprise sees it as a cost.

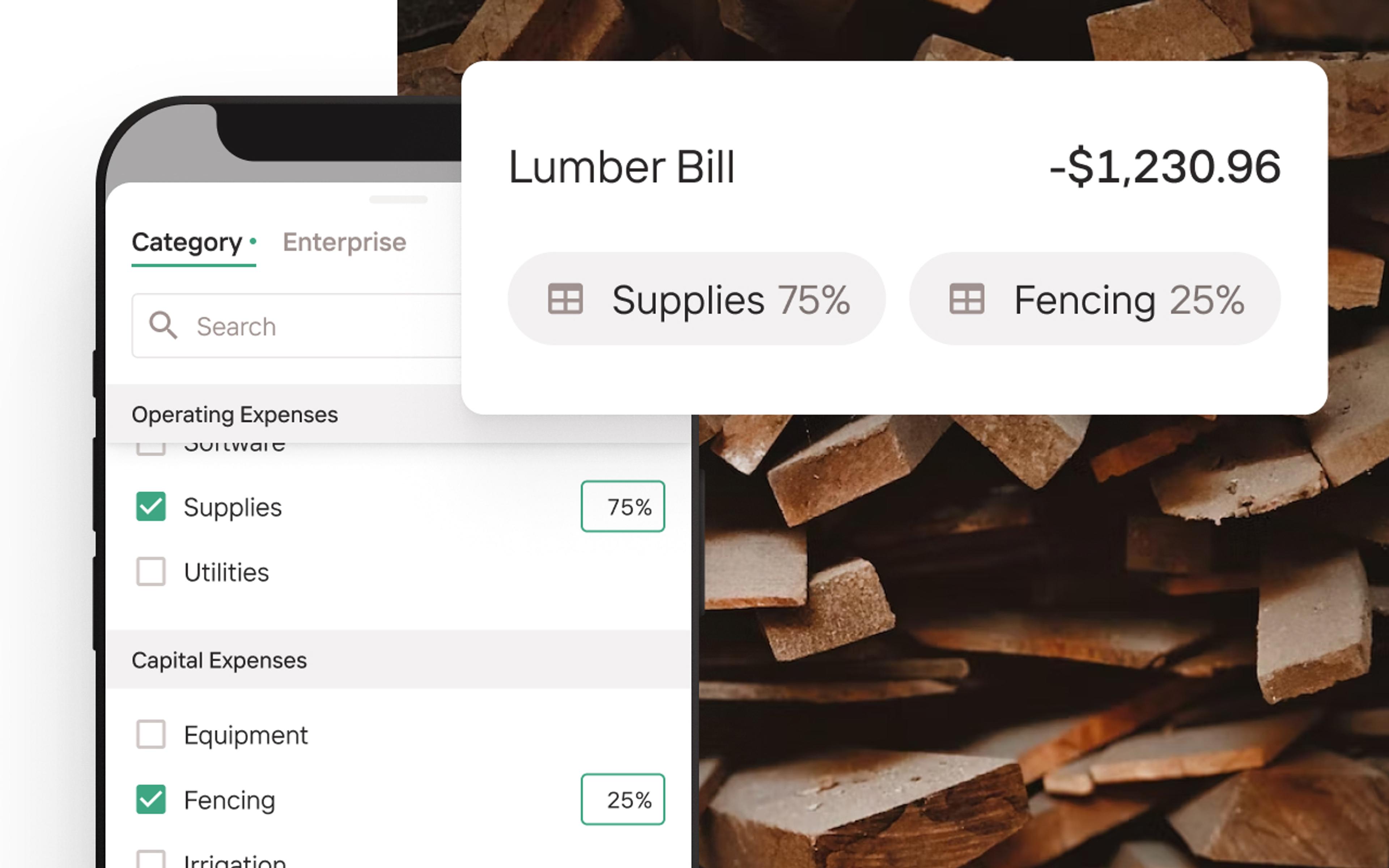

Split Categorization

Sometimes one purchase needs to be split between multiple categories for Schedule F reporting. Now you can easily split when categorizing—evenly or unevenly.

Products are now called Enterprises

We have learned from all of you that running a profitable ag business means leaning into multiple business opportunities like value-added processing, on-farm energy, educational programming, events, or vacation rentals. We’ve broadened our Enterprise (formerly Product) tagging system so you can accurately represent every form of your income.

Thanks as always for reading. In case you missed our last update, you can read our Teams announcement here. We’re always eager to hear your feedback and new requests!