Tips to streamline invoicing and get back to running your business

Getting paid on time is important: it makes your cash flow more predictable, cuts down on time spent chasing down overdue payments, and strengthens your customer relationships. One of the best ways to ensure you get paid on time is to build a reliable and efficient invoicing system.

What is invoicing, and why is it important?

Invoicing refers to the process of preparing, sending, and tracking invoices and other payment reminders to your customers.

An invoice can take many forms: a handwritten note delivered in-person, a paper invoice delivered by mail, or a digital invoice delivered by email that includes links to payment options.

Building an efficient system for creating and tracking invoices can help cut down on late payments, improve cash flow, eliminate unnecessary administrative work, and help keep your customers happy.

How to build a seamless and efficient invoicing system

As a business grows, its invoicing needs tend to become more complex. Whether you generate and track invoices manually using spreadsheets or use comprehensive accounting software like Ambrook, you can maximize your chances of success with a few key habits:

1. Communicate payment terms early and clearly

A seamless and efficient invoicing system begins before you send a single invoice. When beginning a relationship with a new customer, communicate payment terms clearly up front, preferably in the form of a detailed written contract spelling out all deliverables, deadlines, rates, and other payment information.

Be sure your customer communicates any preferences they have around payment to you as well, including which format they prefer to receive invoices in, any banking information they need, and also which department or person invoices should be sent to for processing.

2. Send simple, accurate, and easy to read invoices

The invoices you send your customers should clearly communicate what the payment is for, how much the customer is expected to pay, and when. They should also include your contact information and any other details the customer needs to process the payment.

Keep the design of the invoice itself as simple, straightforward, and professional as possible, optimizing for both digital and print in case your customer likes to keep hard copies. You might also include information about available payment methods, your late payment policy if you have one, and a message thanking the customer for their business.

3. Bill quickly and often

Bill your customers as soon as the goods or services agreed to are delivered. Prompt invoicing communicates professionalism and can set the right ‘tempo’ for the customer relationship.

For larger deliveries or projects, consider splitting large fees or payments into installments or charging an upfront deposit to increase invoicing frequency.

4. Bring all of your invoicing information together in one place

Once you’ve sent your customers their invoices, you need some way to keep track of which ones get paid, which ones are overdue, and which customers need a follow up.

Whether you end up using a simple spreadsheet or a software-based system like Ambrook, this system should allow you to organize invoices by due date, customer, payment status, and amount, and help you quickly identify any overdue payments.

5. Stay flexible

Offering your customers multiple ways to pay – via check, ACH transfer, credit card or cash, for example – can give them some much-needed flexibility and increase your chances of getting paid on time.

Remaining flexible when it comes to invoice format and delivery is also important. If you use a digital system, for example, make sure it allows you to print and track physical invoices in case a customer needs you to send them a hard copy.

6. Have a plan for late payments

Late payments might be an unavoidable part of doing business, but you can avoid feeling unprepared when a customer ends up paying late.

Communicate your late payment policy ahead of time by including it in your contracts and invoices, and courteously remind your customers about it if they’re late. If they can’t pay in full, remain flexible and consider negotiating a payment plan with them.

7. Remember the human element

Be sure to always thank your customers for their business and timely payments, and remember that an effective invoicing system is as much about efficiency and cash flow as it is about maintaining strong relationships with your customers.

How Ambrook’s invoicing software can help

As businesses grow and the number of invoices they send increases, many often turn to software-based solutions like Ambrook to manage them all.

These systems go a step further than spreadsheets, allowing team members to collaborate on invoicing workflows, cut down on repetitive tasks, and maximize your business’ chances of getting paid on time.

1. Time-saving invoice automation

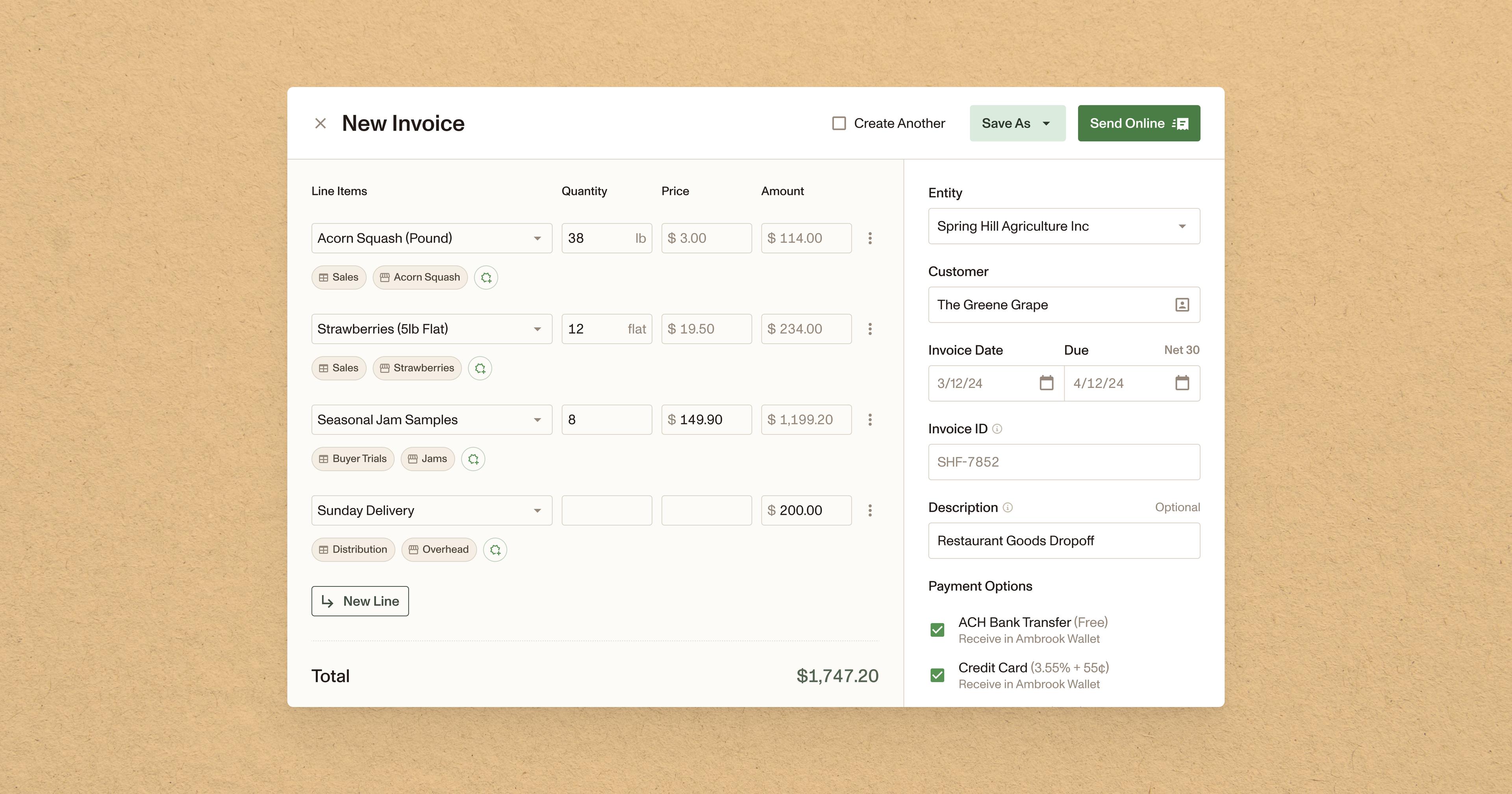

Business owners who invoice at a high volume often find themselves repeating the same tasks over and over again when creating invoices from scratch. Ambrook can automate away much of this work with powerful autofill functions. Line items with and customers can all be saved, allowing users to populate new invoices quickly.

Ambrook also allows users to take care of their bookkeeping at the moment a new invoice is created, eliminating even more administrative work.

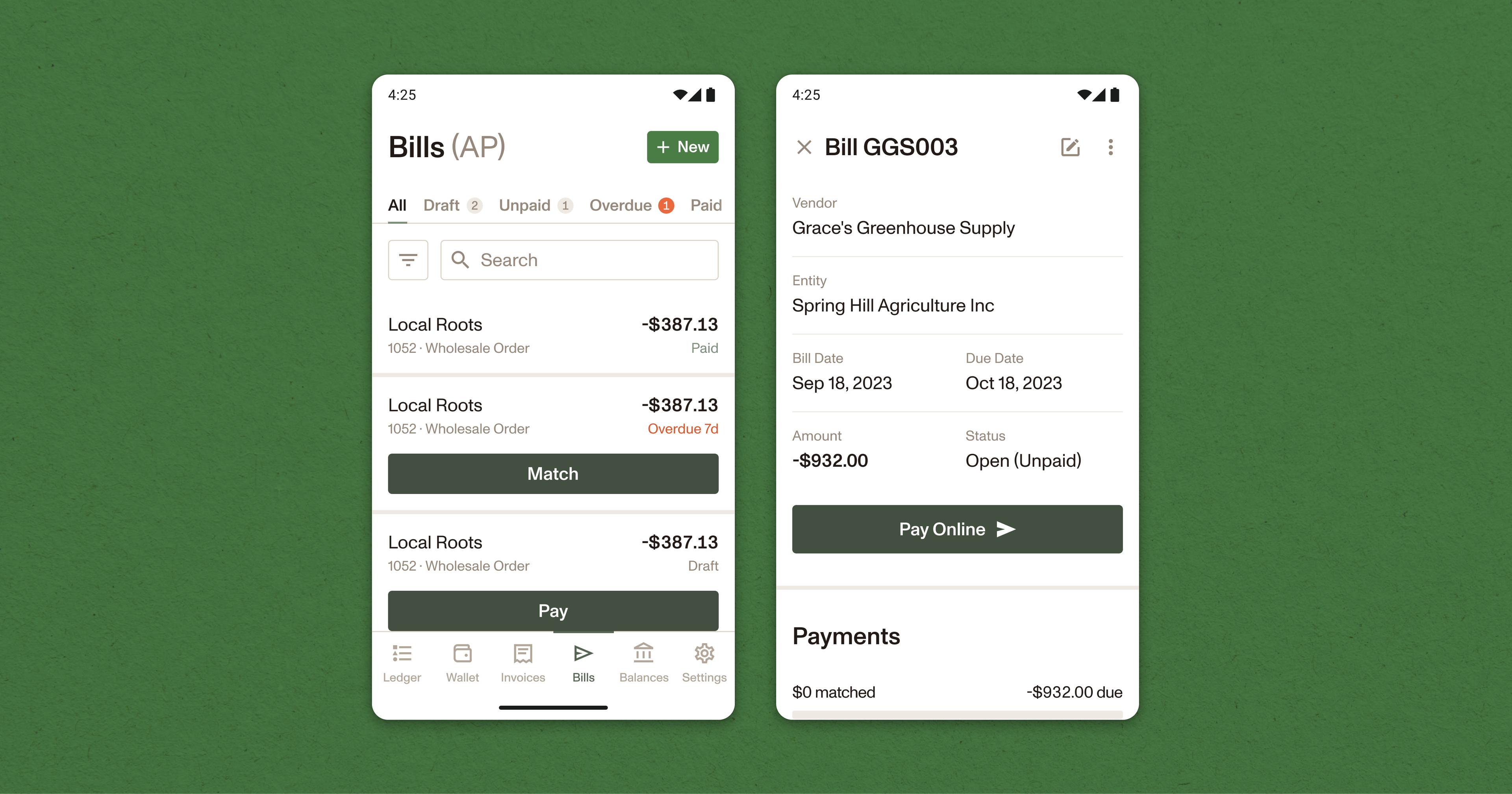

2. A powerful and reliable invoice calendar

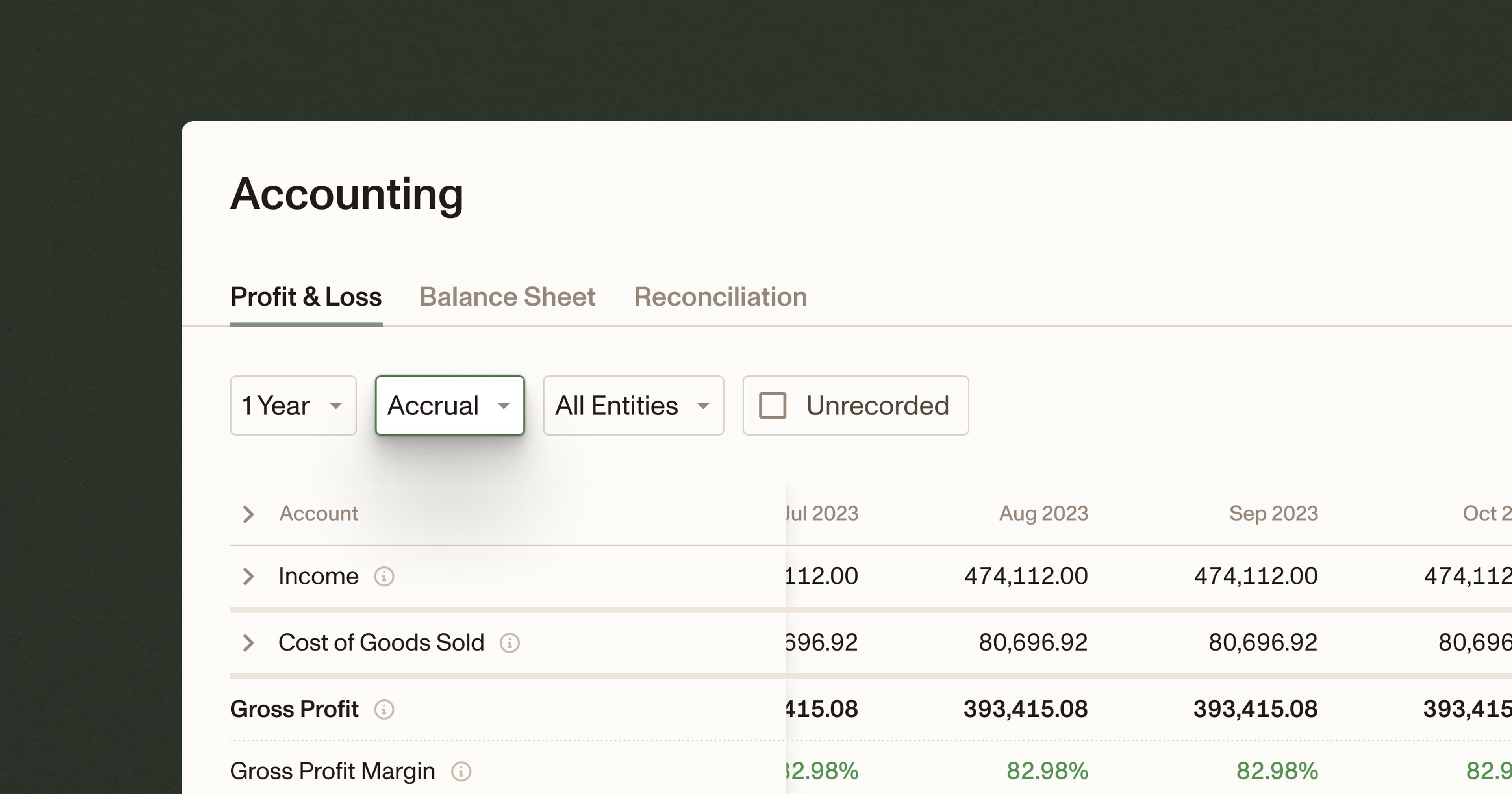

Ambrook allows users to manage draft invoices before they’re sent, find recently created invoices, track unpaid and overdue invoices, and look up paid and canceled invoices. Powerful filters allow users to instantly sort invoices by vendor, due date, amount and status, allowing them to quickly find outstanding or near-due payments.

3. A platform for invoice collaboration

Centralizing invoicing using a single software system makes it easier for multiple team members to collaborate. Ambrook allows team members to share responsibility for different parts of the invoicing workflow.

4. Insightful customer reports

Ambrook’s reporting tools provide a summary of accounts receivable for each customer that includes all outstanding invoices and remaining amounts grouped by days past due, making it easy to identify which customers are driving income and which ones might need a follow up or payment reminder.

5. Complete payment method agnosticism

Ambrook’s payment tools give your customers complete payment flexibility, allowing them to pay invoices in whichever way they prefer, whether it be via check, credit card, ACH transfer, Ambrook card, or Ambrook Pay.

How do I get started with Ambrook?

Ambrook takes your invoicing to the next level, giving you powerful tools for generating and tracking invoices and eliminating hours of repetitive administrative work.

Pre-saved vendor and product information allow users to generate new invoices quickly, and the platform’s intuitive interface and reporting functions make it easy to track down any outstanding or near due payments. Ambrook’s payment tools make your business completely payment method agnostic, giving your customers more flexibility and increasing the chances you’ll get paid sooner.