Streamline your books and learn more from your financial data by avoiding these common chart of accounts problems. Learn how to customize, simplify, and maintain a CoA that works for your operation.

A chart of accounts, or CoA, is the blueprint of your business. The chart of accounts allows you to record business activities across five major categories: assets, liabilities, equity, expenses, and income. This organized system of naming accounts allows you to easily prepare financial statements and helps guide financial decision-making.

Common pitfalls in creating an effective chart of accounts

If your chart of accounts is well-constructed, it will guide decision-making and answer questions about your business. Avoid these common pitfalls to create an efficient, streamlined chart of accounts.

Problem #1: Using a template without customizing it for your business

A template is a helpful starting point when creating a chart of accounts, but templates are – by nature – generic. The chart of accounts for a farm will look different than a chart of accounts for a trucking company.

The solution: Ask yourself:

What are my key income sources and expenses?

What questions do I want to answer with my financial data?

Then update the template to be specific to your needs. There will be many categories that don’t apply to your business, such as Professional Fees or Returns & Allowances. You can remove these to avoid misusing them or letting them clutter your CoA. For the remaining template categories, put them into your own words so you use them correctly. Finally, add specificity to track areas of your business that matter to you, such as the rising costs of certain fertilizers.

Problem #2: Using tax buckets as accounts

Trying to use the fields in tax forms as your chart of account categories is ineffective as there is often a mismatch between what you need to track for tax filing and what matters to your business.

The solution: Use your own words to name your categories. Labeling a transaction correctly will be easy if the category name is familiar to you. For example, will you remember that your fertilizer expenses go into the Cost of Goods Sold category? Or are you better off calling it Fertilizer?

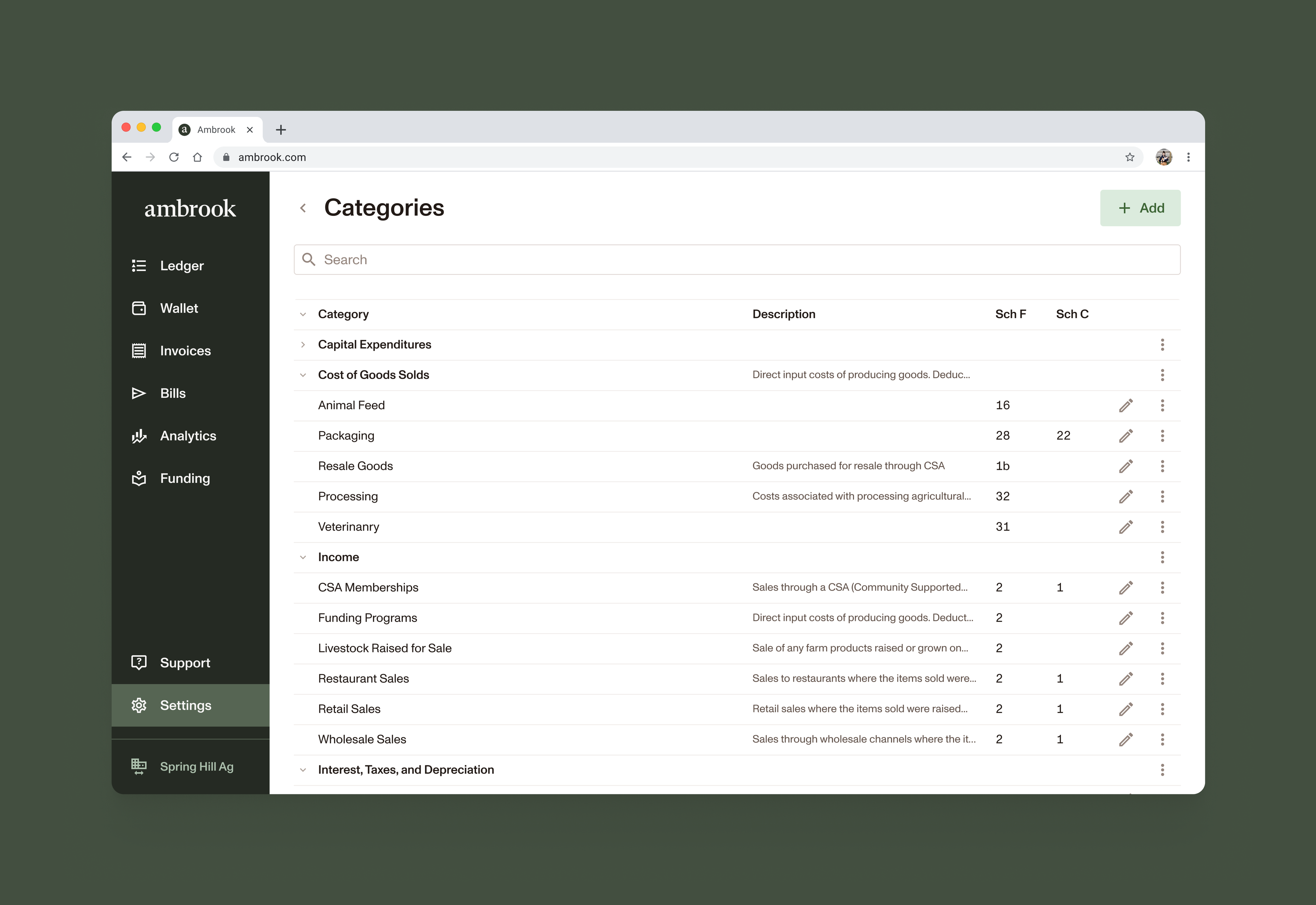

If you’re worried about mapping your custom chart of accounts to the appropriate tax fields for Schedule F, Schedule C, or other forms, you can do this easily with accounting programs like Ambrook.

Problem #3: Your accounts are too granular

While there is value in personalizing your chart of accounts, being too specific can lead to clutter and extra work. For example, if you purchase various types of hay for your cattle, but don’t care to monitor the cost of each, then it’s likely not worth the extra record-keeping.

The solution: When designing your chart of accounts, start with broad categories. As you move forward and realize you have questions your current categories can’t answer, you can easily split broad categories into more specific ones.

For example, a broad category of Soil Treatment doesn’t give you specifics about how much you’ve spent on peat moss versus compost. If you wanted to start tracking your spending on peat moss, you could simply split the broad category into Peat Moss and Compost.

The opposite is also true. If you realize you have similar categories or no longer care to track specifics within a category, you can combine those narrow categories into a broader one. This keeps your books as simple and relevant as possible.

Problem #4: Using legacy accounts

Keeping accounts that are no longer used creates the same problem as overly granular accounts. They contribute to a messy tracking system.

The solution: At the end of the year, review your financial data to determine which categories are still in use and which are not. Use your profit and loss statements by month to guide you. Then consolidate, remove, and edit your accounts in preparation for the new year. This will also ensure your chart of accounts is fresh and not overwhelming.

Problem #5: Creating categories that you can’t track

Setting up more detailed accounts enables you to answer more granular questions about your business, but only if your systems allow you to track data to that level of detail.

For example, you want to know how much you’re making from selling value-added goods. You create a category in your chart of accounts for ‘value-added goods’, but your cash register records prices only, not the types of items sold. If you can’t itemize each sale of value-added goods and separate them out from other products, you can’t effectively track revenue from value-added goods using your chart of accounts.

The solution: These issues are common when trying to track specific areas of income. Consider how you receive income data, perhaps through a credit card reader, paper check, or cash payments. Then evaluate how you can identify the necessary level of detail for all income types. The same goes for expenses – what information are you receiving on a receipt of sale from your vendors? If you want to get more granular than these systems allow, design a manual tracking process you can commit to.

How to create an effective chart of accounts

When set up properly, your chart of accounts is a guide to decision-making. As you are setting up or revising your books, consider the following:

What information do you want to see represented on your profit and loss statements?

What financial areas are you concerned about?

What questions do you have about your business?

This is your opportunity to build an efficient system that will generate useful answers.

If you need help thinking through your categories, Ambrook can help.

Getting started is simple in Ambrook. Import your existing chart of accounts or use our wizard to generate a template that works for your business. Once you have a first draft, add, remove, nest, and rename at will. Under the hood, each category ties back to the appropriate fields in your tax forms (Schedule F, Schedule C, and more), so there are no nasty transformations and extra hours come April. Prepare your data for your business and for tax season all at once.