A carefully calibrated chart of accounts can serve as a business management tool

What is a chart of accounts?

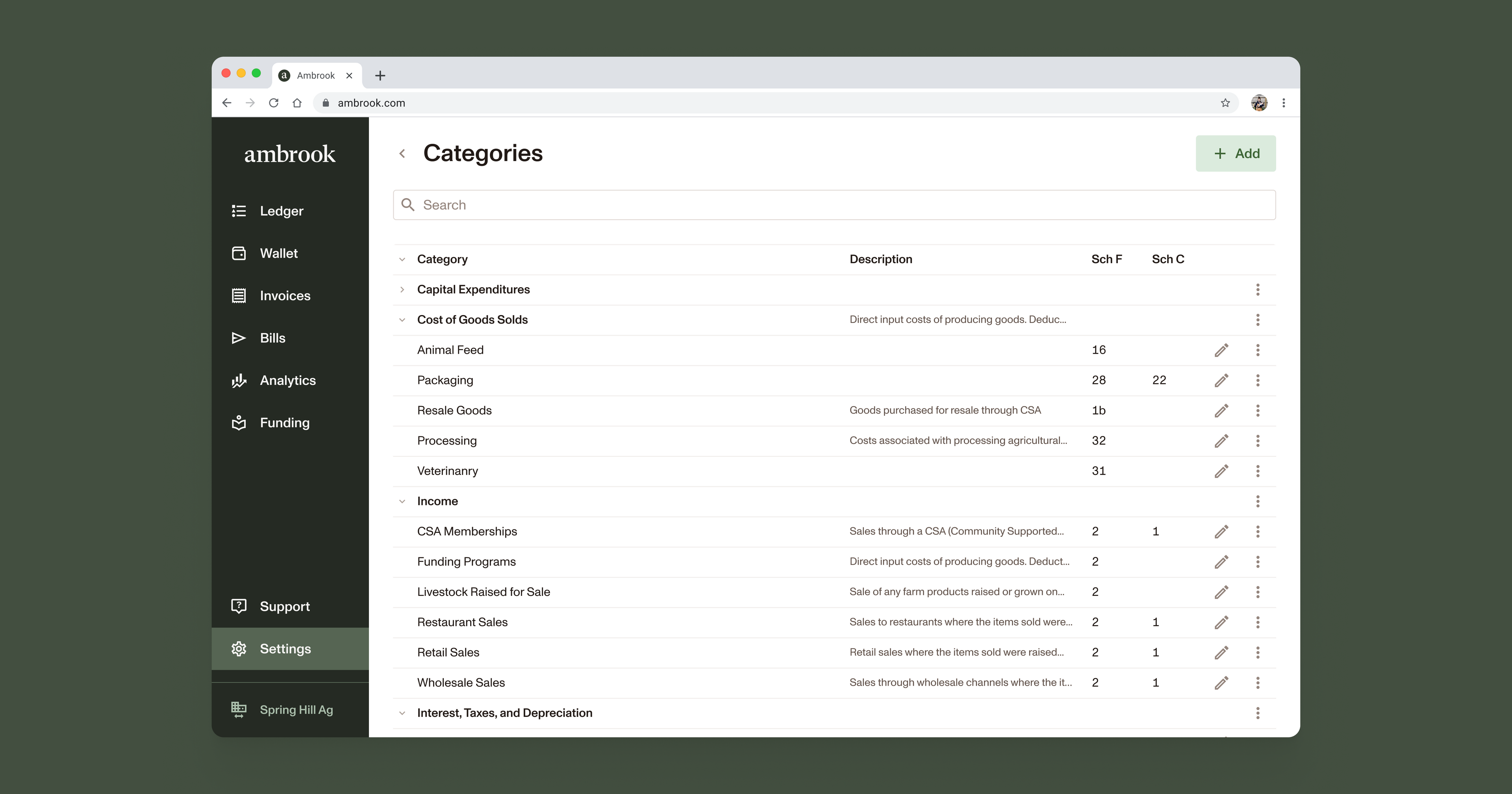

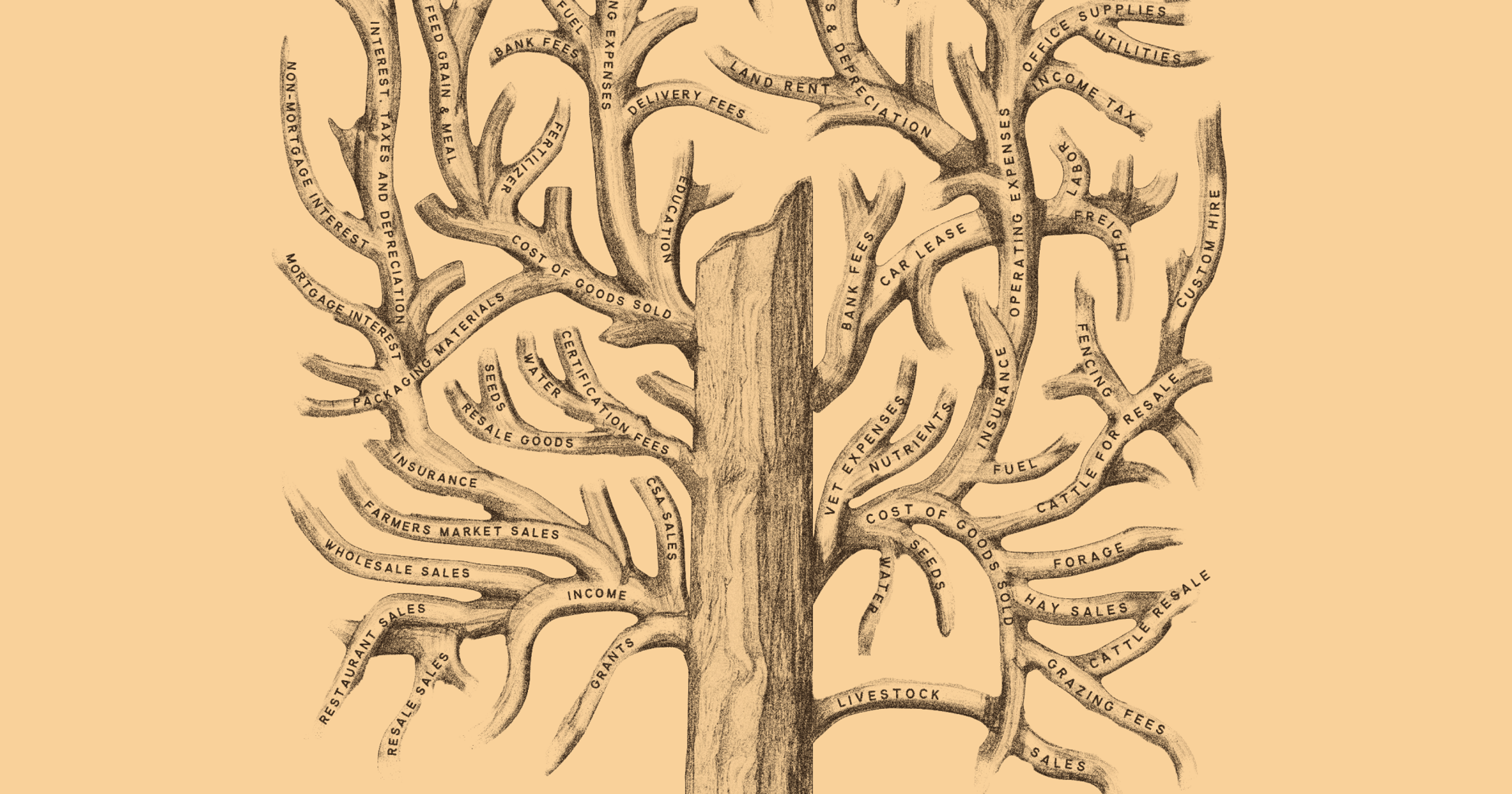

A “chart of accounts” refers to a complete listing of the incomes, expenses, assets, liabilities, and equities that together describe a business’s holdings and activity. People tend to be most familiar with the term’s accounting-related use case. A comprehensive list of accounts (Ambrook calls them “categories”) allows CPAs to more easily prepare financial statements, ensure accurate tax reporting, and minimize a client’s tax burden.

However, a carefully calibrated chart of accounts can also serve as a business management tool for producers. Investing some extra time into set-up will pay dividends via streamlined budget management and business insights.

How do I create an effective chart of accounts?

Below are five tips for establishing and maintaining a chart of accounts that will serve your business beyond tax season.

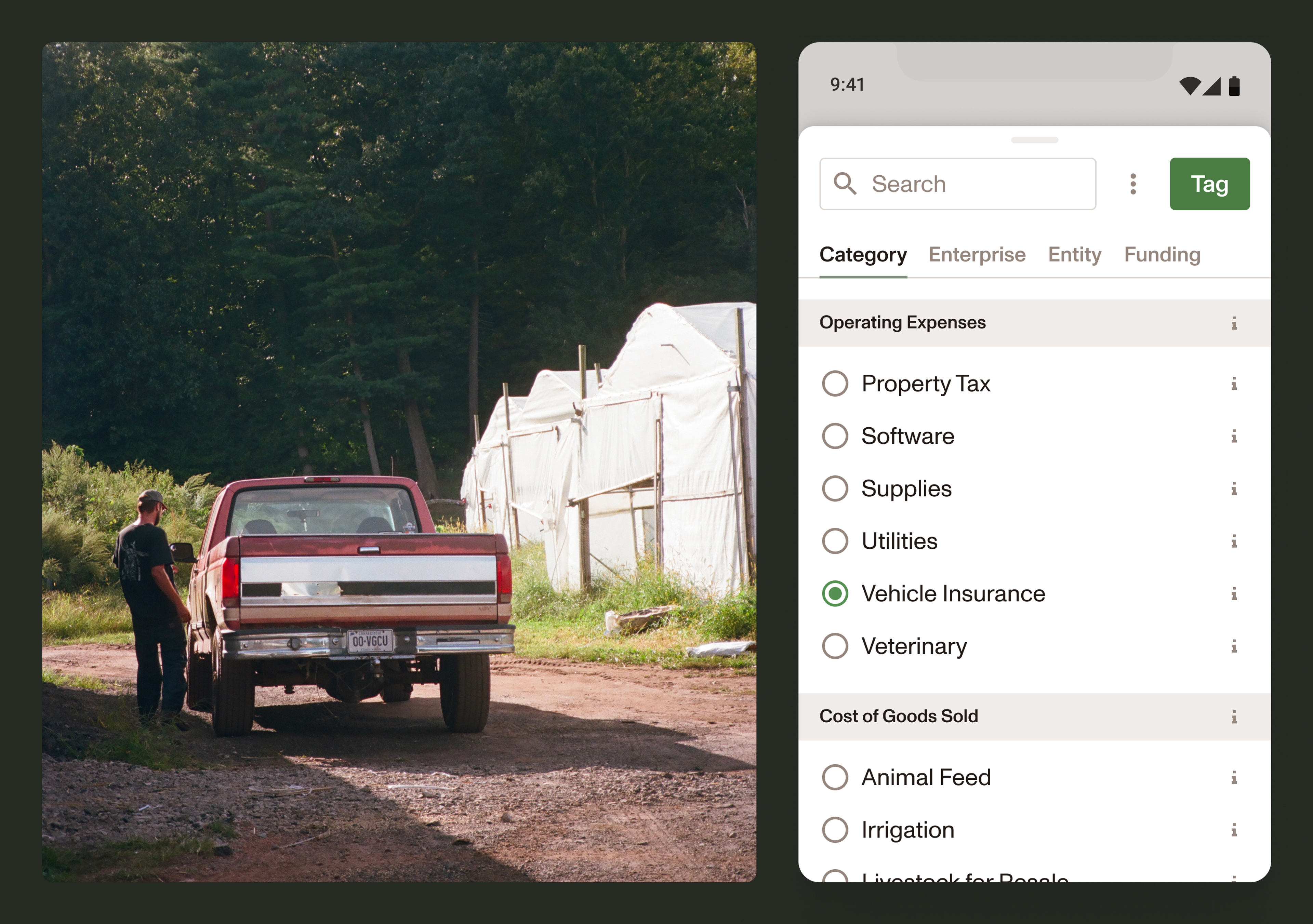

Create account names that are in your own words. Accounting softwares generally have pre-set accounts that you can choose from. Many of these will not be applicable to your business, and others may not have an intuitive name. Choosing the right categories and renaming them as necessary will prevent errors and make tagging transactions more intuitive for you and your team.

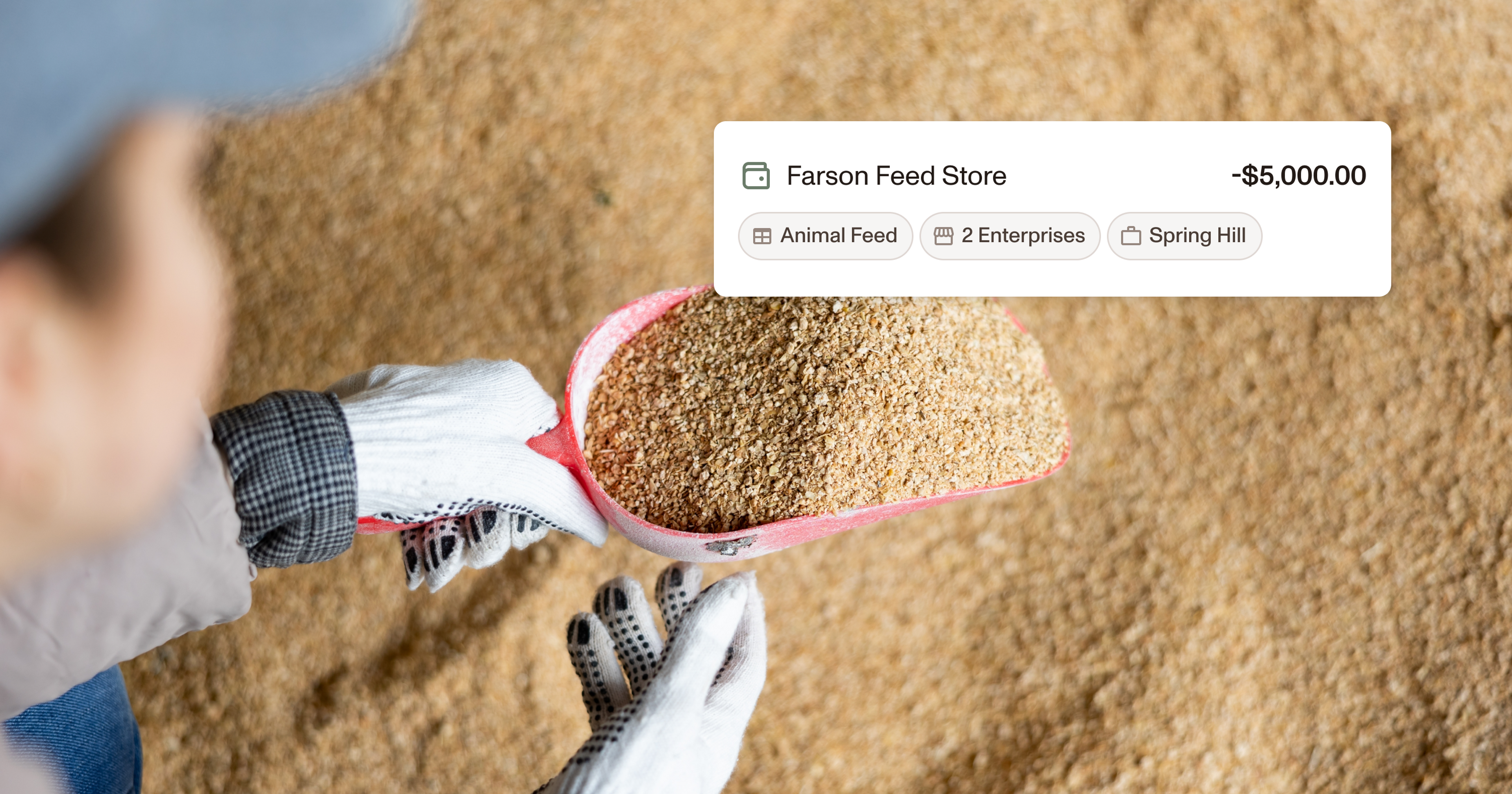

Example: It may be difficult to remember whether a purchase falls under “Cost of Goods Sold.” It’s a lot easier to be confident that you’ve bought “Animal Feed.” Choose the latter, friendlier name for the expense account.

Make your accounts as specific as reasonable. Your chart of accounts needs to be granular enough to file your taxes, but beyond that it is up to you. Increase the specificity of your categories to answer the questions you have about your business. Think of it this way: If you don’t have an account for it, it won’t be tracked – but it’s also not worth your time tracking information that you won’t use.

Example: You purchase two different types of hay to feed your animals. You could have one expense category called “Hay,” or you could create two categories – one for each type. This allows you to compare expenses per hay type within any given time period. If you don’t care to know, then one category is just fine.

Align categories with your operating budget. Many producers are maintaining their books and business budget separately, creating twice the amount of work for themselves. If the expense and income categories in your chart of accounts match the ones in your budget spreadsheet, then you can export category totals from your accounting platform and also use them to view your budget actuals.

Avoid “catch-all” or miscellaneous categories. These are tempting to include in your chart of accounts, and even more tempting to use. But remember that every time you categorize an expense as “Other Operating Expenses,” for example, you lose out on an opportunity to learn something about your business.

Example: Was that $150 I spent on operating expenses related to marketing, or was it vehicle insurance? If you don’t specify, you’ll never know.

Prune your chart of accounts from time to time. It’s easy for that list of categories to balloon as the months go by and your business grows and changes. We recommend setting aside an hour a couple times a year to review your chart of accounts, and make small adjustments that benefit you in the long run.

Example: You check your chart of accounts, and find that you are using two similar categories: “Seeds” and “Seeds & Plants”. Consolidating transactions into just one of them allows you to gain a better picture of how much you’re spending on this important expense, rather than having to add together two separate totals.

How can I get started?

Ambrook has an intuitive onboarding process that ensures you feel confident about your chart of accounts from Day 1. We also made it easy to rename, expand, and simplify your categories as you go, because we know your business is never standing still.

For a limited amount of time, our team is offering free half-hour consultations where we review your existing chart of accounts and share tips and avenues for improvement.

Get a free Chart of Accounts assessment