Free farm finance tools & training

Master your farm finances in 2026

New benefits for MFBF members: Get Ambrook Pro free through January, plus a six-part finance course to start 2026 off strong.

In partnership with Ambrook

Make 2026 your best financial year yet

Montana Farm Bureau has partnered with Ambrook to give members free access to Ambrook Pro through January 31, 2026, plus a six-part farm accounting course taught live by ag finance experts.

What is Ambrook?

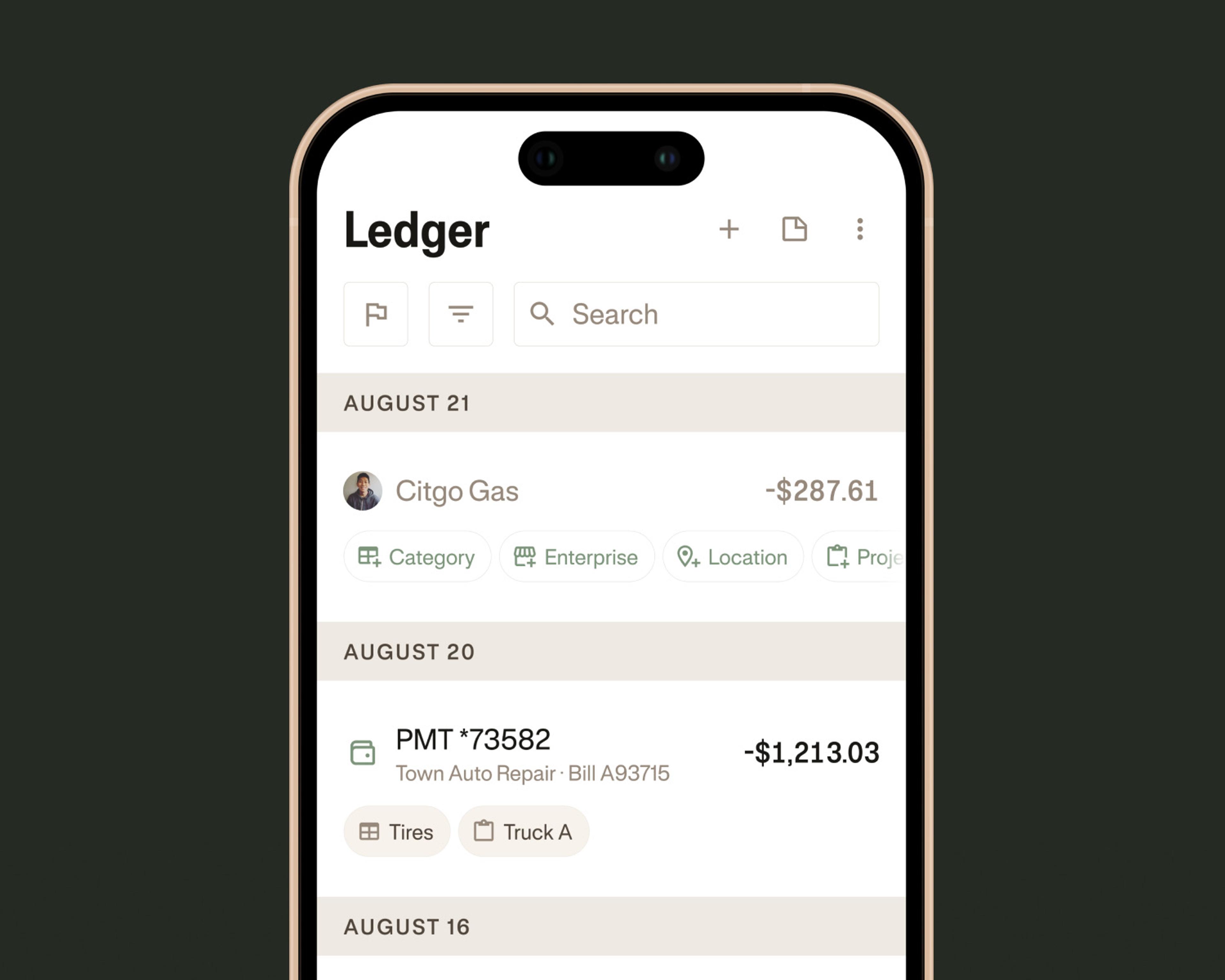

Bookkeeping that's easy but powerful

Ambrook's accounting software makes it easy to manage your books, know your numbers, and run a more profitable farm. MFBF now offers all its members a free Ambrook subscription through January and a 15% off discount.

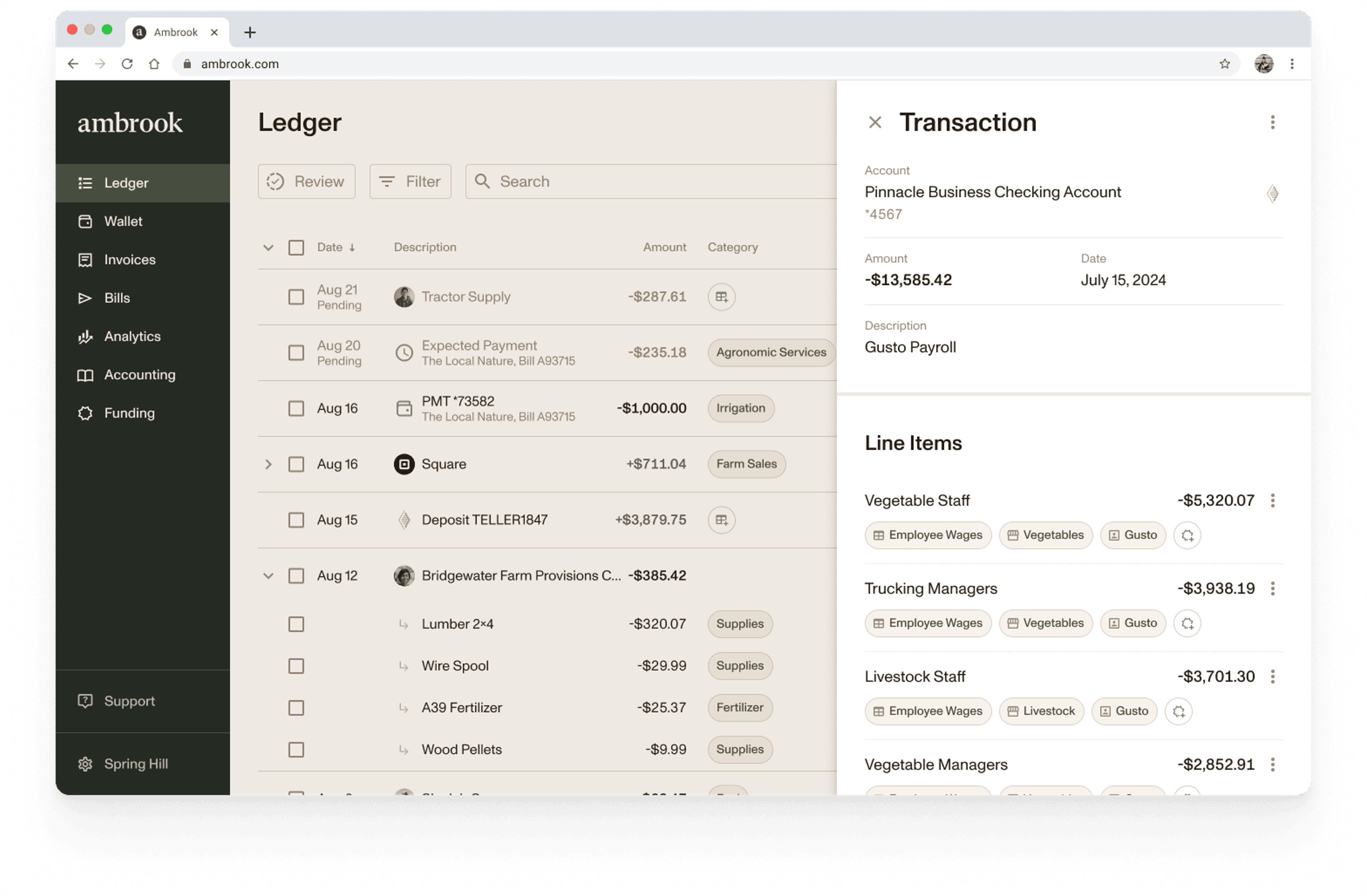

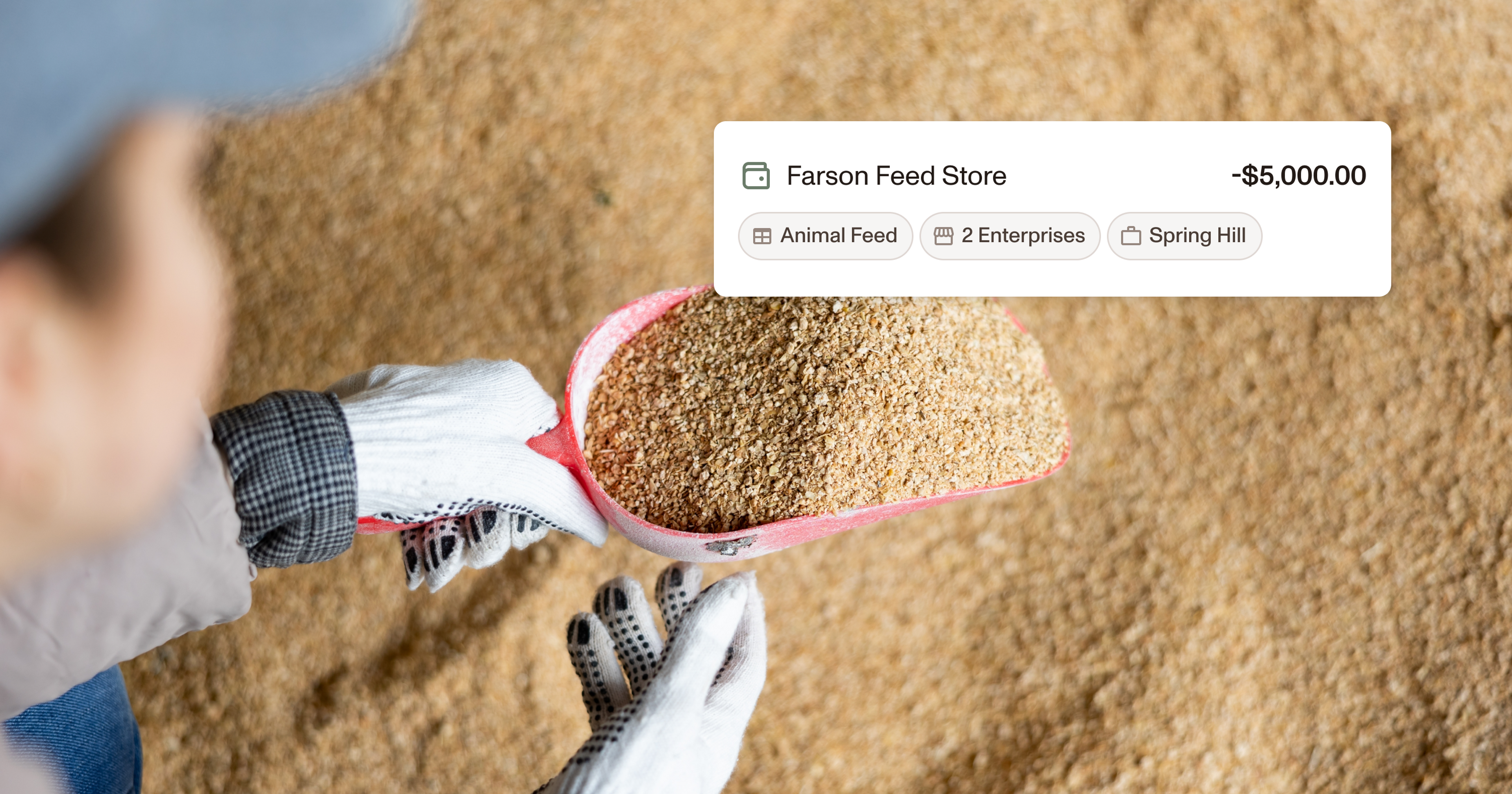

Track profits by enterprise

Break down your numbers by business line. Ambrook makes it easy to run P&Ls that show exactly where you’re making or losing money.

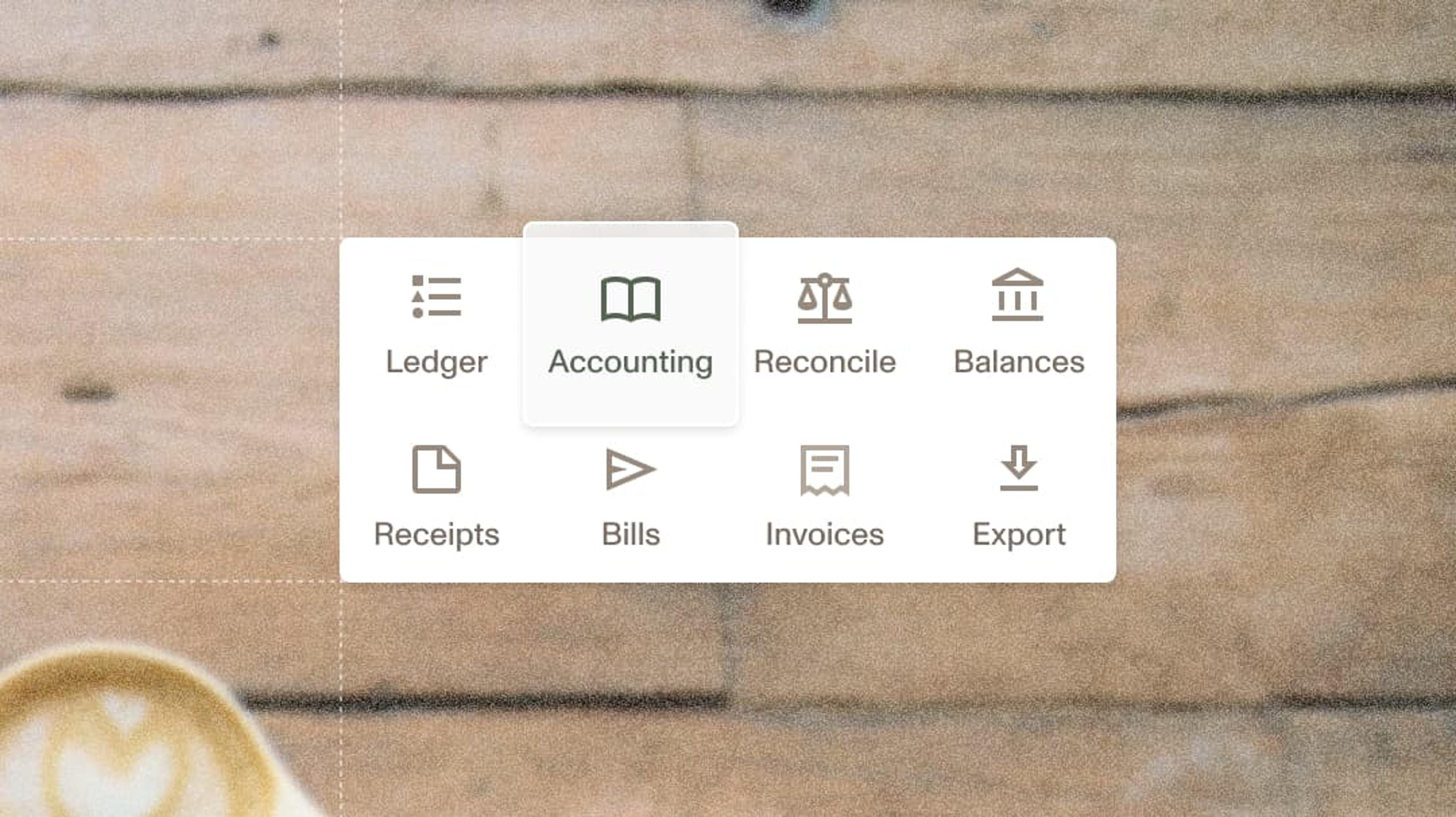

Escape QuickBooks

No duplicate bill pay errors, outdated desktop versions or 5-hour tutorials. Just a modern intuitive platform that’s built for the way you actually work.

Easy to learn and use

Ambrook is so intuitive to use, it's easy to keep up with your books. Tag transactions, manage receipts, and prepare taxes all in one place.

Ambrook and MFBF present

Your free farm finance course

After signing up with Ambrook, you can enroll in a live course taught by an ag finance expert. Learn accounting basics, apply them to your farm, and make stronger business decisions. Course starts December 3.

Sign up with Ambrook to reserve your spot.

Sign up with Ambrook today to secure your place in the education program. MFBF members receive Ambrook free from now until January 31, then get 15% off after the program ends.

Join live or watch anytime.

An ag finance expert will guide you through 6 sessions designed to help you master your finances. Class meets on Wednesdays. Every session is recorded, if you can't join live.

Extra sessions, to apply your skills.

Ambrook's team of experts will help you apply classroom concepts to your own books. These sessions are held live on Thursdays, and will also be recorded.

Part 1: Accounting basics

Learn the fundamentals of bookkeeping: what to track, how to organize records, and how to structure financial statements like a balance sheet, income statement, and cash flow statement.

Part 2: Farm-specific situations

Understand the unique needs of agriculture, from filing a Schedule F to setting up your chart of accounts in a way that reflects your operation. Get clarity on separating farm and household finances.

Part 3: Making better decisions

Go beyond record-keeping. Learn how to interpret your financials, spot opportunities, and use your books to guide stronger business decisions. Know what's making money, what's not and where to invest next.

Take advantage of Ambrook

Start mastering your finances

Trusted by thousands

Your Montana neighbors rely on Ambrook.

Ben Van Dyke

Hyline Angus Ranch

From mental math to enterprise profitability

“Ben Van Dyke went from pen and paper bookkeeping to tracking profitability for his diversified ranch using Ambrook. As a 3rd generation rancher in Montana, Ben knows the importance of evolving his business and growing what matters.”

Caroline Wild

Wild Ranch Solutions

How Wild Ranch Solutions provides insights 33% faster

“Before, all of the input and the data-gathering felt like a mountain. It feels more like a hill now.”

FAQs

Do I need to sign up with Ambrook to take the course?

Yes! First sign up with Ambrook to start your free subscription through January 31. Then we'll email you with a link to register for the course! If you have questions, you can reach out to our team at partnerships@ambrook.com.

Do I need to be an MFBF member to participate?

Yes, you need to be an MFBF member to participate in the course.

You can learn more about membership here.

When does the course begin?

The course runs live on Wednesday evenings from December 3 to January 21. Each session lasts about an hour and is paired with office hours for MFBF Ambrook users – dedicated time to ask platform-specific questions and put the lessons into practice.

Can’t make it live? Recordings will be available to registrants!

What if I can't join live?

No problem! Every session will be recorded and shared with you after class. You’ll be able to watch on your own time, review the material at your own pace, and still follow along with the exercises.

What will I learn in the course?

You’ll learn how to build budgets, cash flow projections, and financial statements so your books are CPA-ready and your business is banker-prepared.

Is the course relevant for all types and sizes of farms?

Absolutely. Whether you raise crops, livestock, or run a mixed operation, the course starts with strong record-keeping foundations useful at any scale. From there, we’ll dig into advanced tools like enterprise-level profitability and balance sheet analysis to give your farm a competitive edge.

How much time should I plan to commit?

Expect about 1 hour per week for the live session (or recording), plus an optional 1 hour of office hours if you want extra support applying what you learn.

How do I attend?

You'll need a computer, tablet, or smartphone with internet access to join the course. We’ll provide simple instructions via email (including a link!) on how to join the live sessions and access recordings.