Self-employed people and business owners use Form 8829 to deduct expenses related to the business use of part of their home. Here’s how to file it properly.

Farmers and agribusiness owners wear multiple hats. On any given day, you might be a field operator, a livestock handler, a bookkeeper, and a business manager. While juggling these responsibilities, it’s not uncommon to use a portion of your home as an office for planning crops, maintaining records, ordering supplies, or managing payroll.

If this applies to you, the IRS allows you to deduct certain expenses related to the business use of your home. To claim these deductions, you may need to file IRS Form 8829, Expenses for Business Use of Your Home.

What is IRS Form 8829?

Self-employed people and business owners use Form 8829 to deduct expenses related to the business use of part of their home. The form allows you to allocate costs like rent or mortgage interest, real estate taxes, utilities, repairs, insurance, and depreciation between personal and business use.

This could apply to you if you:

Use a dedicated room in your home for managing finances, maintaining herd records, coordinating sales and shipping, or meeting with vendors

Operate a workshop from an attached garage on the same property as the home

Use a space in your home regularly to store inventory or products for an agribusiness

Can you claim home office expenses?

Yes—if your home office meets the IRS’s regular and exclusive use criteria for your farming business.

To qualify, you must:

Use a specific area of your home exclusively and regularly for business

For example, a dedicated office where you prepare crop schedules or manage livestock health records qualifies for the home office deduction.

But your home office doesn’t have to be a separate room in the house—you just need to use the space regularly and exclusively for business. Occasional use does not qualify.

For example, suppose you have a desk in a corner of your family room that you use regularly and exclusively to work on farm business. In that case, you can deduct home office expenses based on the square footage of that corner (more on calculating the deduction later). However, if you occasionally use your dining room table to do farm paperwork, you can’t claim your dining room because you also use it for personal use.

Be the principal place of business

This means you conduct essential management or administrative activities in your home, and you don’t have another fixed location for these tasks.

Who uses Form 8829?

You only use this tax form if you use the regular method for calculating the home office deduction. Under the regular method, you multiply your allowable expenses by the percentage of your home dedicated to business use.

For example, if your home office occupies 10% of your home’s square footage, you can deduct 10% of your mortgage interest, property taxes, utilities, etc.

You don’t need to file Form 8829 to use the simplified method for home office expenses. Under the simplified method, you don’t track each and every home-related business expense. Instead, your home office deduction is $5 per square foot of the portion of the home used for business, up to a maximum of 300 square feet.

For example, if your home office is 100 square feet, your home office deduction is $500. You simply enter this amount on Line 32 of Schedule F, Profit or Loss from Farming, or Line 30 of Schedule C, Profit or Loss from Business, for non-farming business operations.

Are there any drawbacks to either method?

If you choose the regular method and you ever decide to sell your home, that could affect the basis of your home and trigger depreciation recapture--i.e. you’ll have to pay back the tax deductions you’ve claimed. Choosing the regular method can also affect whether you qualify for the primary residence exclusion under section 121.

Under the simplified method, your depreciation is considered zero and claiming the home office deduction will not affect your home’s basis. For more about how home office deductions can affect the basis of your property, consult the IRS website.

How to complete IRS Form 8829

If you qualify for the home office deduction, here’s how to complete this tax form.

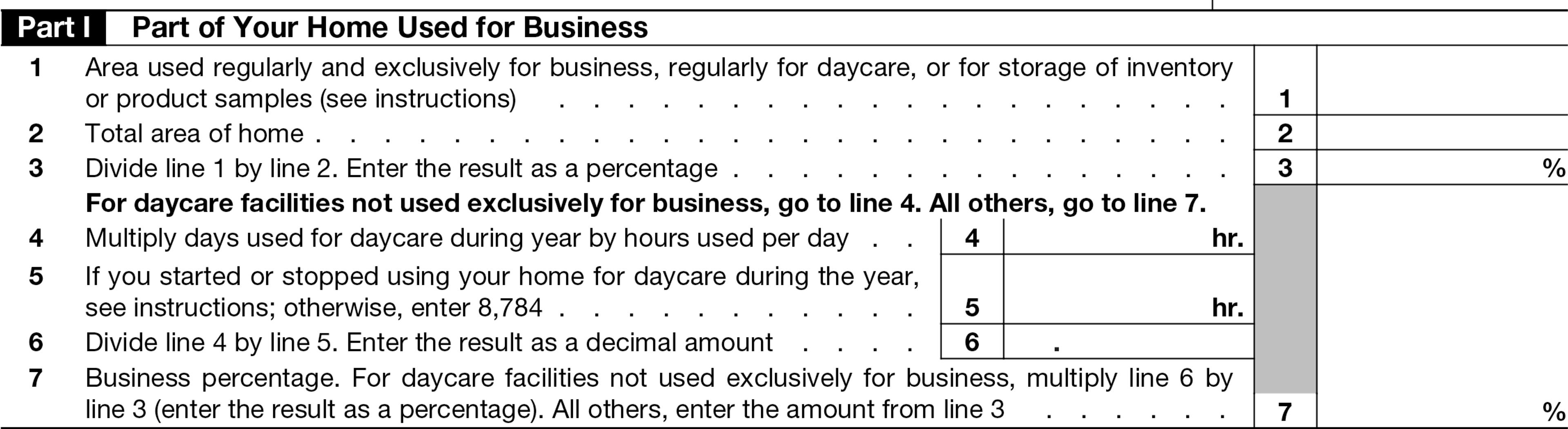

Part I – Part of Your Home Used for Business

In this section, you’ll provide details about the area of your home used regularly and exclusively for business versus the house’s total square footage.

Line 1-2: Enter the square footage of the area used exclusively for farm business and the total square footage of your home.

Line 3: Divide Line 1 by Line 2 to determine your business use percentage.

Lines 4-7 apply only to a home-based daycare facility.

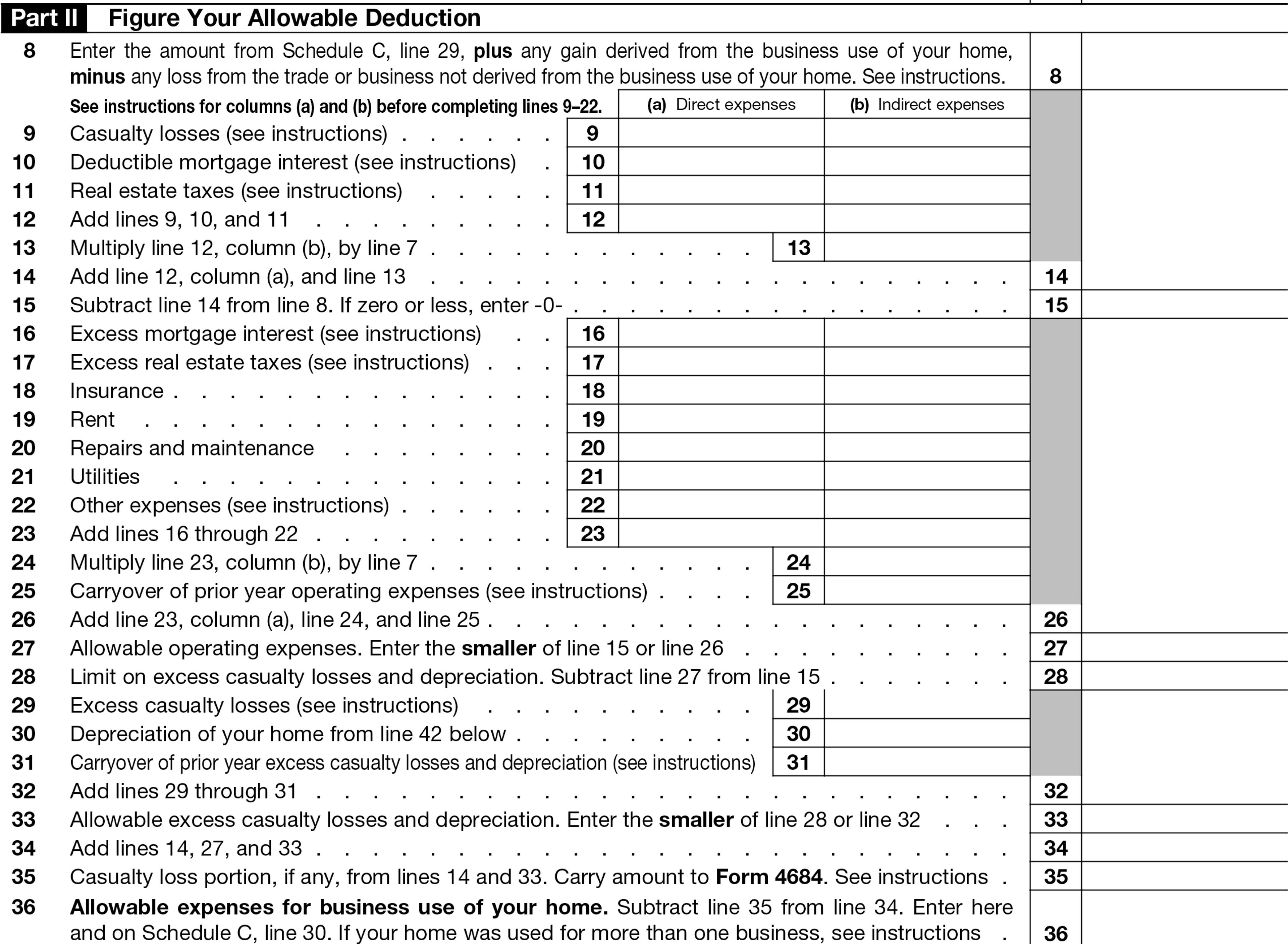

Part II – Figure Your Allowable Deduction

Line 8: Enter the gross income from your business minus any business expenses not related to the home (e.g., feed, seed, depreciation of equipment).

Lines 9-23: Enter direct and indirect expenses for your home office. Direct expenses apply solely to the home office, like repairs to a separate room designated for business use. These are 100% deductible. Indirect expenses apply to the entire home. These include costs like real estate taxes, mortgage interest, utilities, and homeowners insurance. You can only deduct the business percentage of indirect expenses.

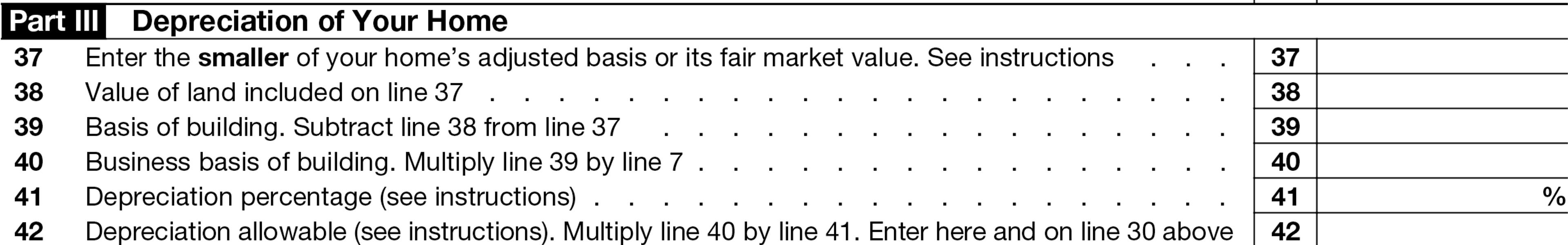

Part III – Depreciation of Your Home

In this section, you calculate depreciation on your home office. You need:

Your basis in the home (usually purchase price + improvements)

The value of the land included in your home’s basis

Use the tables in the IRS Form 8829 Instructions to calculate your depreciation percentage.

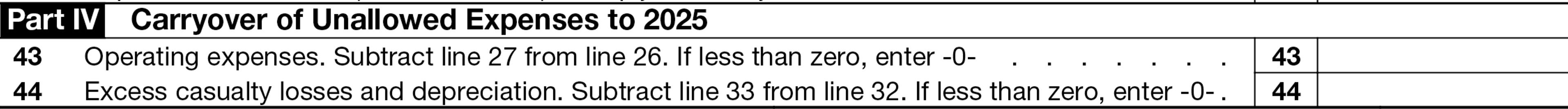

Part IV – Carryover of Unallowed Expenses

If your business income is too low to use the full deduction, you can carry all or a part of your home office deduction to the following year.

If you’re a sole proprietor, you’ll file Form 8829 alongside Schedule F or Schedule C.

What is the maximum write-off for a home office?

There is no strict dollar cap on the deduction using Form 8829, but your deduction can’t be more than your farm’s or agribusiness’s gross income. You can carry unused deductions to the next year if they exceed income limitations.

If you use the simplified method, the IRS caps your home office deduction at $1,500 (up to 300 square feet × $5 per square foot).

Is it worth claiming a home office on taxes?

Claiming the home office deduction can reduce your taxable income, and that’s a great benefit for smaller farms or part-time operations that operate on slim margins.

For example, say you’re a dairy farmer who uses 150 square feet of your home for a dedicated office. Using the simplified method, your allowable deduction would be $750 per year—potentially more if you use the regular method and write off a percentage of your actual expenses. Over several years, this could amount to thousands of dollars in tax savings.

Special Rules for Farmers

Farming operations tend to blur the line between home and business more than other small business owners. It’s common to maintain buildings like barns, silos, greenhouses, or processing areas on the same parcel as the home. However, these are typically separate structures and are not considered part of the home office for Form 8829.

Make sure you only claim the home office deduction for exclusive business use of your home. You can deduct structures like workshops or barns used for business separately as business property.

Make Form 8829 work for your farm business

Form 8829 allows farmers and agribusiness operators to deduct direct and indirect expenses for managing their operations from home. But it requires careful documenting of expenses, accurately measuring your home office, retaining records of any regular method deductions taken for the life of your home, and following IRS rules about exclusive and regular use.

While filling out the form is complex, the tax benefits can really add up if you’re running a small to mid-size operation with high home overhead and limited on-site infrastructure. A professional tax preparer can walk you through figuring out whether your home office qualifies and filling out the proper forms.

In the meantime, make sure you’re all of your other deductible expenses with Ambrook. Our accounting software is tailor-made for farming businesses, with features like Schedule F category tags, bill paying and invoicing, and automated financial reporting. Want to learn more? Start your 7 day free trial today.

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.